One year. This memo is the one-year anniversary of the first “Weekly Insight” which was at the time titled “COVID-19 Sell-off” and was sent after it became clear cases of COVID-19 were spreading actively outside of China. At the time we wrote that memo, the markets were off just over 3%. The next week’s memo started with this statement: “Phew…that was a week, wasn’t it?”. And it certainly was. The market ended the week down 11.49%. As you all remember, it just got worse from there. The next four weeks were one of the most brutal periods in the history of the stock market as the world tried to understand exactly how this pandemic would impact the world economy.

There are a couple of things that stand out to us when we think back on that period. The first, and most important, is what amazing clients we have. Don’t get us wrong – we had no magic solution to COVID that the rest of the world did not have. But our clients avoided the one BIG mistake everyone makes in these periods: you did not panic. We have talked to you for years about the impacts of fear and greed on market performance. It takes more than just courage to stick something like that out. It takes logic, patience, and common sense. None of us were feeling too smart on March 23rd (when the market bottomed), but your willingness to be thoughtful has been rewarded.

The second thing that stands out is that it has only been one year! If you are like us, it feels more like a decade. But when you look back at all that has happened in the last 12 months it is remarkable. There is the bad, for certain, which is highlighted by the 500,000 COVID deaths in the United States (nearly 2.5 million worldwide). But despite what the naysayers would have you believe, there is also the good. The scientific community came together to develop vaccines in record time. Communities came together to support their own. Even the Federal government – who we at Insight often have issues with – delivered stimulus dollars in record time, essentially saving the U.S. and world economy.

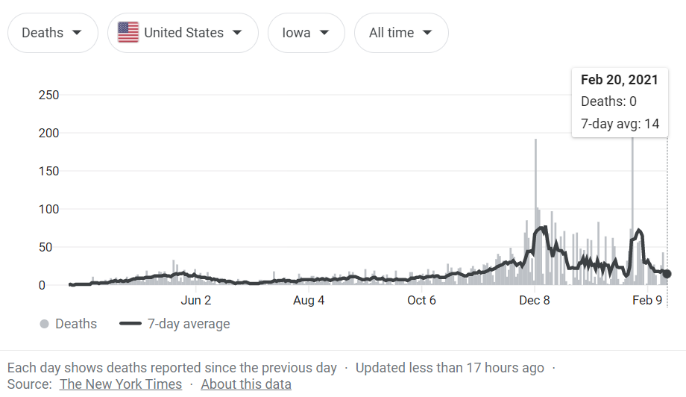

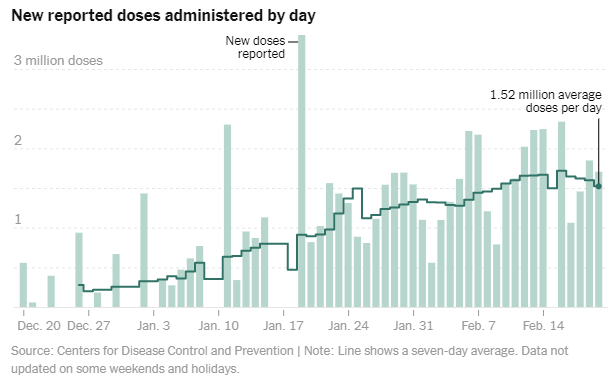

So, as we sit here one year later, there is reason to celebrate. Case counts across the United States are dropping. Vaccines are being distributed. We are making real progress to getting this behind us.

We are not past COVID yet. Vigilance – both from a healthcare perspective and an investment perspective – is going to be important. Just like we did not have a straight line from the first COVID death in China to the realization of the worldwide importance of the pandemic, we are not going to have a straight line to recovery. But the conversation is different one year later. Instead of worrying about how COVID will impact the markets, we are now focused on how to take advantage of the recovery.

Big Changes Happening in Portfolios

We have talked a lot in recent weeks about what will drive the market in 2021: COVID recovery, vaccine distribution, continued low interest rates, & government stimulus. We will not retread that ground this week (but would encourage you to look at past issues if you would like a recap). The consensus of our investment committee is this: yes, equity valuations are a bit stretched. But the growth of the economy in 2021, combined with high levels of cash on the sidelines, low interest rates, and funds coming from the government, will be a boon to equity markets this year.

With that in mind, we have been working hard over the last week to make some substantial changes to our portfolios. They will impact our Balanced, Conservative Growth, Growth, Enhanced Yield and Dividend models. If you haven’t yet, you will begin seeing trade confirmations shortly.

We are not going to walk through every single trade in each model but wanted to give you a general overview of what is going on.

Rebalancing

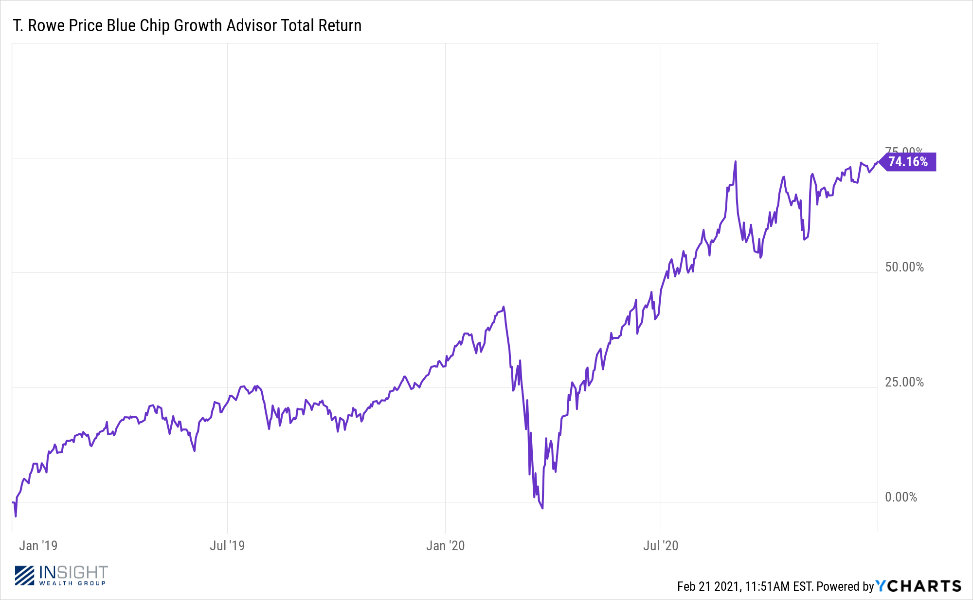

A key part of the changes is simply a rebalancing of models. Over time, as some positions outperform or underperform, they take on weightings above or below our targets. An excellent example of this is our exposure to large cap growth in our core portfolios which is achieved through our holding in the T. Rowe Price Blue Chip Growth fund (PABGX).

You have heard us say for a while that the big driver for the S&P in 2020 was six large tech names (Facebook, Amazon, Netflix, Microsoft, Apple, and Google: The FANMAGs). If you take those six names out of the S&P500, its performance drops by 50% for 2020. Thankfully, we had significant exposure to those names in our core portfolios via PABGX. As you can see, it has had a good two-year run.

Past performance is not indicative of future results.

But anytime a position is up 74%, you also know it has gotten out of compliance with our targets in the portfolio. And Big Tech has largely capped out its performance over the last few months. As other areas of the market look to provide additional opportunity (more on that later), we made the decision to trim PABGX back to our target weights.

This same rebalancing effect will be showing up in other positions in the models as well that have seen outsized growth – or which have smaller weights today because of the growth in some of these quickly growing positions. This will allow us to add some additional exposure to areas we like while also trimming some risk off the rapidly growing sectors in the portfolio.

Cost Containment

There are multiple components to a successful investment strategy. Often the exciting themes take precedent, but there are some workman like issues that are important “behind the scenes” drivers to overall performance.

One of the most important is expenses. And it is also one of the hardest to manage. Very often we want active managers who can take advantage of fluctuations in the market and the economy on your behalf. That costs money. But there are places in the portfolio where we can take a more passive approach to the model. Where this is possible – and we can engage ETFs or other low-cost options – it can result in significant savings to the investor.

We added a couple of ETFs to the portfolios last week to capitalize on a few areas where we think a passive approach can be useful at this time. The most important of these is our exposure to International Value where we replaced our active international value manager with the iShares MSCI EAFE Value ETF (EFV). We feel strongly international value is poised for a good year in 2021. If the broader complex is poised for success, we can pull away from the active manager and save significant cost.

Overall, our cost containment strategies in this rebalance are going to reduce expense ratios in our accounts as follows:

- Balanced: -5.08%

- Conservative Growth: -10.74%

- Growth: -16.35%

It is important to note that the more equity exposure a model has, the more savings we are seeing. We continue to believe active management in fixed income is vital in this environment. Thus, our more conservative models (with more exposure to fixed income), will see less savings.

Big Themes

Our big themes for 2021 remain largely unchanged. We feel strongly that energy, international (both developed and emerging markets), mid-cap, and small-cap are all poised to outperform in the current environment. The changes in our allocations last week are capitalizing on these themes.

There are, however, some tweaks. Take for example our energy exposure in the Enhanced Yield model. We have talked repeatedly in these pages about the underperformance of energy in 2020 and our belief that 2021 will see a substantial recovery. We will not keep beating that into your head.

But the advent of the new Biden Administration means there are some new things to take into consideration. While traditional fossil fuels are going to be a driver of our energy economy for some time, there is no question this administration is going to drive an agenda focused on renewable fuels. As such, we are shifting away from our traditional energy fund into a new fund, the Tortoise Energy Infrastructure Fund (TYG) which has significant exposure to renewable energy. And it still delivers a solid yield of 5.51%. We are not walking away from traditional energy (in fact we are overweight it in all models), but we do think this will allow us access to the new policy direction coming out of Washington.

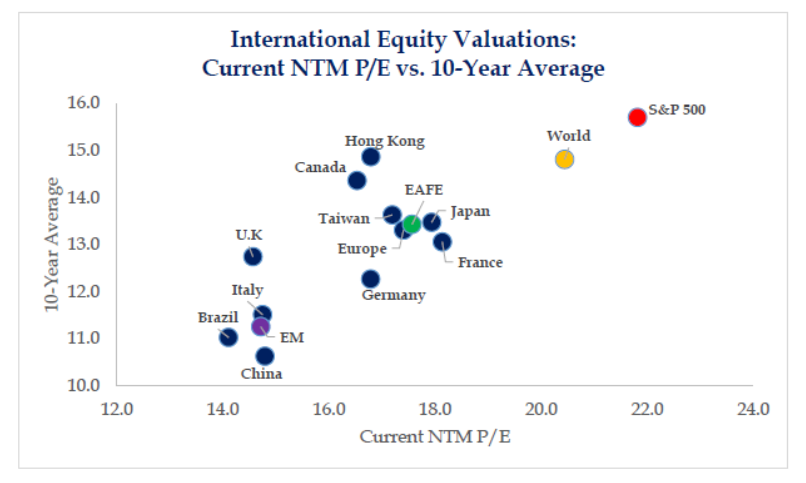

We talked above about our changes in our international strategies to reduce costs. It is also important to note that international continues to be a big focus in models. In fact, in our largest model (Conservative Growth), our international target is growing from 19.50% to 22%. There is a lot that goes into this conversation, including the weakening of the dollar, stronger earnings beats overseas in recent quarters, etc. But we believe this one chart explains it best: The U.S. stock market is the most expensive in the world.

Past performance is not indicative of future results.

This is not to say the U.S. cannot continue to outperform. As we have stated above, we believe it can. But we think international markets are poised for a breakout relative to the United States.

The Job is Never Done

As we look back at those first “COVID Memos” from a year ago, one final thing that stood out is the evolution of thinking surrounding the virus. There were very serious and smart scientists saying COVID may end up being a regional epidemic in the vein of SARs. We all know that did not happen.

In the same way, we are certain our theories and expectations for 2021 will not be entirely accurate. Vaccine distribution may lag. The virus may mutate. Governments may not deliver expected stimulus. Inflation may take off.

As is always the case, changes to our models will have to be made to respond. But as we look back at the past year, we are pleased with the results and are confident the changes made in the portfolios this week have reduced our risk in higher performing areas, cut our expenses, and given us exposure to areas we believe are poised to take advantage of the recovery.

As always, if you have any questions about these changes and how they are impacting your portfolio, please do not hesitate to let us know. We are happy to schedule an in-depth review.

Sincerely,