As longtime clients of Insight Wealth Group know, a core tenant of our strategies has been providing clients access to directly held real estate assets where appropriate in client portfolios. We have spent a lot of time in the last few months talking about the impact of COVID on the stock market and the economy – but this specific asset class deserves a memo of its own. The impacts of this virus on the real estate market are yet to be fully determined – and will undoubtedly vary based on asset class and geography – but understanding the path forward is important to our clients.

So today we are going to look at real estate in depth: what does the market look like over the next few months? What areas concern us? Where are the opportunities and when will they present themselves? Let’s dig in.

Current State of the Market

We quoted Jamie Dimon in a memo a few weeks ago regarding the economic impact of COVID and that quote is especially relevant to this conversation. Here it is again:

“In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that’s true here. Savings are up, incomes are up, home prices are up. So, you will see the effect of this recession; you’re just not going to see it right away because of all the stimulus.”

As readers of this memo know, the stimulus provided by both the government (fiscal stimulus) and the Federal Reserve (monetary stimulus) has been massive – more than $10 trillion dollars. That is the equivalent of nearly 50% of our 2019 GDP.

Stimulus programs have come in many forms, but the most important for today’s discussion are the loan forbearance and rent abatement programs in place. Essentially the government has protected tenants by ensuring they cannot be evicted and real estate owners by ensuring they cannot be foreclosed upon. This policy has made sense – for now. But it cannot go on forever. Eventually the tenants and owners are going to have to come to bear with the consequences of this recession.

In the meantime, these programs have largely held all real estate in limbo. But we can make some broad assumptions on some of the major asset classes:

Multi-Family

This is by far our largest exposure in client portfolios. Our exposure spans multiple geographic and demographic regions and includes both development (i.e. new construction) and operating (i.e. existing) projects.

Because of this diversity, it is impossible to say each project will be impacted by COVID similarly. The stage projects are in will matter. The manager will matter (a lot!). The location will matter. But what we can happily say today is we see no multi-family projects in our portfolio that cause us immediate concern.

Interestingly, we have seen rent payment levels remain very high at many of our projects across the country. As we have mentioned in past memos, current household income is actually higher during this crisis due to the federal and state stimulus programs and unemployment programs. On top of that, it is clear that renters are prioritizing rent payments with the capital they have available.

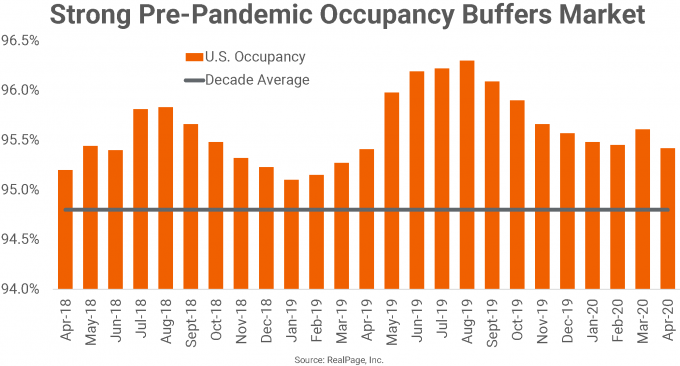

There is no question that the market prior to the pandemic has been assisting existing properties. Occupancy levels in multifamily were substantially higher going into this crisis than the 10-year average.

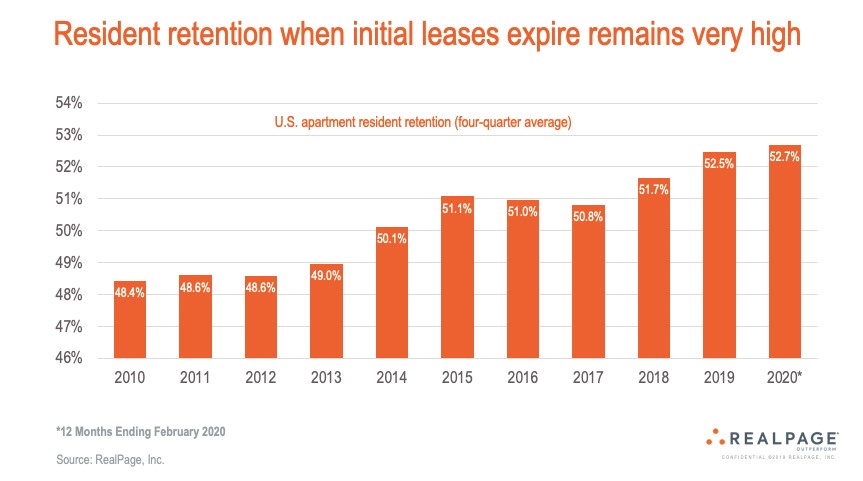

In addition, the uncertainty of pandemic has led to a much higher retention of existing tenants across the industry. Simply put, given the unsettled nature of the world, people are much happier to “stay put” than to take on the risk and added expense of moving.

But, alas, not all things are wonderful in the pandemic. There is no question the economic circumstances are impacting what sponsors can charge for rents in this environment. We do not have final numbers yet for Q2, but we would expect the growth rate of existing unit pricing to flatten out substantially over the coming year.

The big question for this part of the industry will be what happens next? What happens when stimulus checks run out? What happens if unemployment jumps again. We are very pleased with our existing portfolio – and believe we are positioned to weather a storm. But caution is warranted. That is why many of our sponsors have begun accruing cash in case they need it. Interestingly, one of our main sponsors told us they implemented this policy based on modeling a 2008-type scenario – but it has proven to be much better than expected. Still, we appreciate sponsors being cautious at this time.

Retail

We have a limited number of retail properties in our portfolio today, but it remains something to which we pay close attention. There can be no doubt if you have been to a mall lately that the retail industry is struggling with COVID. Shoppers are much more comfortable staying home and buying off Amazon than they are going into a store. Restaurants – which can also fit in this asset class – have been doubly harmed.

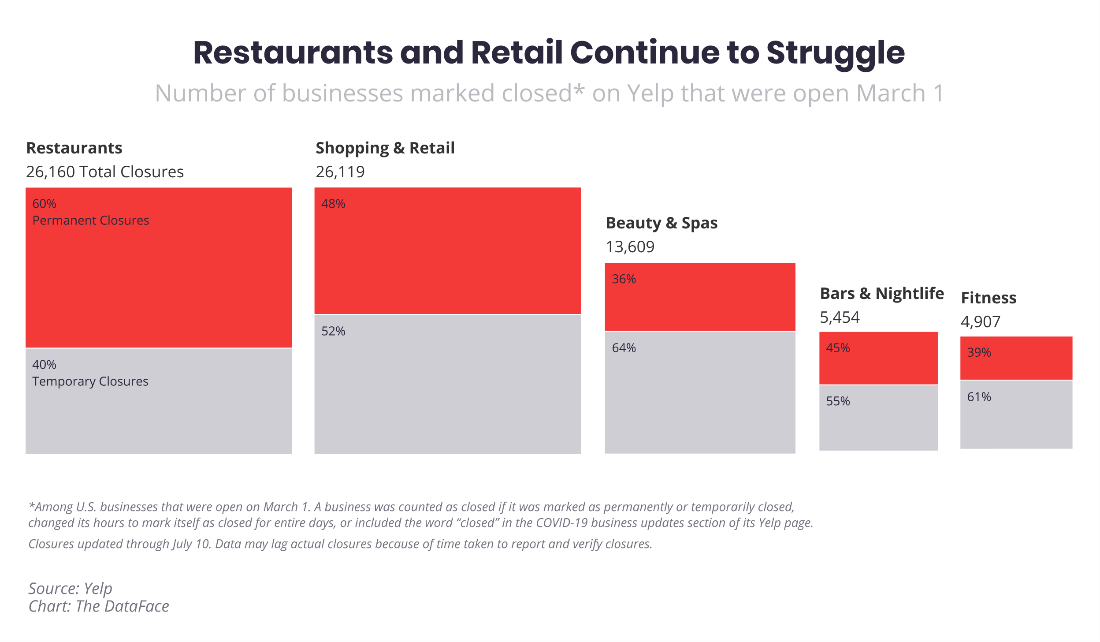

Of all four, this is the asset class which causes us the most concern. We’re all aware of the “big name” bankruptcies (i.e. Lord & Taylor a few weeks ago). But it is the mom & pop stores that have suffered the most through this process. As you can see from this data from the Yelp.com website, 60% of restaurants which are closed on Yelp are now saying they are closed “permanently”, as are 48% of retail businesses.

The success or failure of retail space in the coming years is going to depend not on recovering that lost business – it will not come back quickly – but instead on repurposing their spaces for the “new normal”. That will mean shopping malls that become less shopping malls and more “communities”. Parking lots will become spaces for apartments and hotels. Big box retail stores will become fitness centers and grocery stores. This had already begun at one of our retail properties before COVID. It will likely accelerate in a post-COVID world.

Hospitality

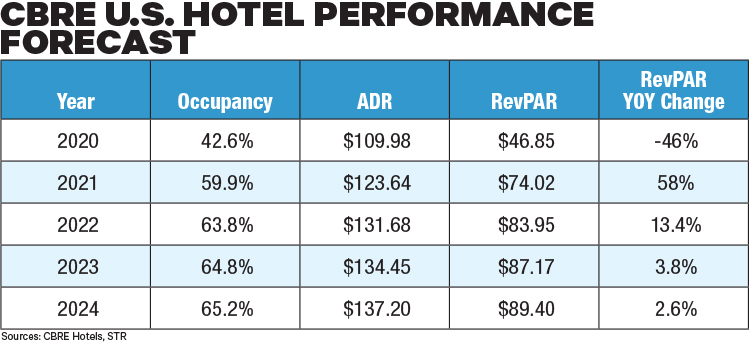

Hotels, much like restaurants have been hit hard and fast by COVID. Travel has ground to a halt around the country either by government edict or personal preference. There is simply no saying at this point when that will change. Recent data from CBRE shows they do not expect a full recovery until at least 2023.

This is an area of the market where we have limited exposure. Our only hotel properties are very small pieces of large funds, so we are comfortable we will not feel this impact across portfolios. It is an area, however, where there may be substantial opportunity coming out of this crisis and an area we will be watching closely.

Industrial

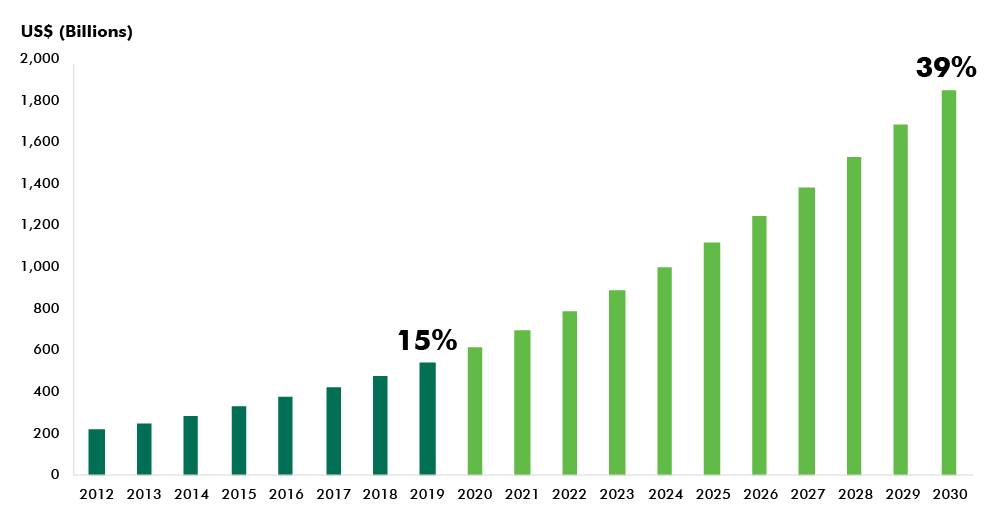

The industrial real estate market (think warehouses and Amazon fulfillment centers) is one where who your tenant is will greatly impact the success of your project. If you are renting to Amazon right now – there is no question you will continue to get paid. And the long-term trend continues to look good as E-Commerce penetration continues to grow (no doubt spurred on by the pandemic).

U.S. E-commerce Penetration, % of Total Retail Sales Forecast

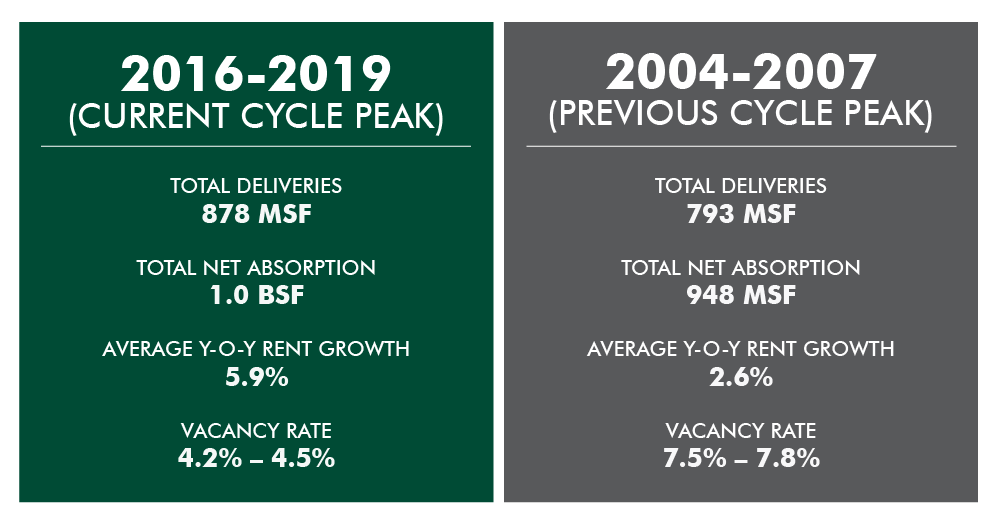

For those not lucky enough to have Amazon as a tenant, the market is taking a wait and see approach right now. Vacancies are very low and rental growth was very strong leading into this crisis as shown in the graphic below.

That will undoubtedly slow as we begin to pick the winners and losers from COVID, which will also slow the rate of development in the sector as owners and tenants look to see how necessary changes in inventory controls and supply chain diversification will impact them post- COVID.

Opportunities and Timing

Coming back to our Dimon quote at the start of this memo, the strange nature of this recession means we have not seen the “blood on the streets” previous crises – like 2008 – caused in the real estate market. Vacancies remain strong in areas like multifamily and industrial. Foreclosures have not happened yet. And the cost of capital is very, very low with current interest rate policies.

So, for those operators struggling right now, that means two things: First, the bank is not knocking at their door with a foreclosure notice. Second, they have the opportunity (if properly capitalized) to find extremely cheap debt to bridge the gap.

That does not mean the other shoe will not drop. It certainly will. But it does mean that transactions in the commercial real estate market have slowed dramatically – even while prices have remained largely the same. Our analysts are finding that deal activity in the space has dropped nearly 85%.

The impact for our current investors is this: virtually no exit or refinance events in 2020. While we had expected this to be a big year for several deals to “go full cycle”, we now anticipate that gets bumped back to 2021 or later as the market resets and gets comfortable doing deals again.

The same concept applies to finding and picking up opportunities – no matter the commercial real estate sector. There will be one-off, unique opportunities that we anticipate presenting themselves over the coming months. But the wholesale “let’s go shopping” approach is likely six months to a year away.

It is important to note we are seeing some very innovative operators looking for ways to transition existing real estate to a new purpose which we believe may show some promise. We have seen sponsors that are buying up big box retail stores for pennies on the dollar and converting them to storage. Or buying hotels and converting them to apartments. The storage opportunity looks particularly appealing as people have been buying toys at an aggressive pace during this period of increased income and are going to need somewhere to put them.

Another area of particular interest to us is buying real estate debt from lenders. We believe the debt will begin to show up at auctions before we see a wholesale foreclosure on properties. Why? Foreclosure is a long and painful process. Selling the debt is a much quicker way for banks to get rid of risk they don’t want – and a way for investors to buy up those opportunities cheaply. This is similar to what we saw work very well in portfolios that bought mortgage debt coming out of the 2008 financial crisis. We are studying these projects closely and looking for opportunities to pounce.

But in the meantime, the message right now is simply patience. The deals will come – of that there is no question. But the storm has not yet passed, and we do not yet have the full damage report.

As always, we would be happy to discuss this update with you – especially as it relates to your personal holdings in private real estate projects. If you have any questions, please do not hesitate to let us know!

Sincerely,