We hope this finds you safe and rested after a weekend of celebrating the 245th birthday of the greatest country on Earth!

While we were celebrating with fireworks and burgers, the rest of the world was still out there doing their thing. And in the case of OPEC, that thing may have a significant impact on portfolios – and the economic recovery – over the coming months. We are going to take some time this week to look at the energy economy, what happened at OPEC’s meeting over the weekend, and what the outlook for energy is for the rest of the year.

COVID & Oil

We all remember the onset of COVID last year. First, it was a weird story about a virus in a town in China we had never heard of. Then, it was a story about an infection raging around – but contained in – China. Then, it was Asia. Then, Italy. As the virus creeped closer and closer to the U.S., panic grew. But it was not until March when the “stuff” really hit the fan. And when it did, it hit fast.

The results of shutting down the economy were not surprising for the energy economy. People staying at home meant less travel, less commuting, less heating and cooling demand. The demand for energy collapsed.

But what does not get talked about much these days is what OPEC – and their non-OPEC allies, a group called “OPEC+” – were doing at this same time. In their meeting on March 5, 2020, leaders of OPEC tried to convince their members and OPEC+ allies to extend production cuts made at their previous meeting. They were seeing COVID repercussions on the horizon and wanted to adjust production to account for it. But their members and allies – led by Russia – could not come to an agreement. The resulting lack of an agreement meant, as the Russian Energy Minister told reporters, “Members could begin pumping as much as they like.”

This stunning lack of foresight resulted in a collapse of energy prices. Crude oil prices were down 8% over the next 24 hours and down over 54% during the month of March. It was a bloodbath.

Past performance is not indicative of future results.

Supply & Demand

We can sit here and debate metrics and trends all day long, but, in the end, supply and demand always wins out. That can be a very good thing, or a very bad thing. And for oil producers in 2020 – with a glut of supply and very little demand – it was a very, very bad thing.

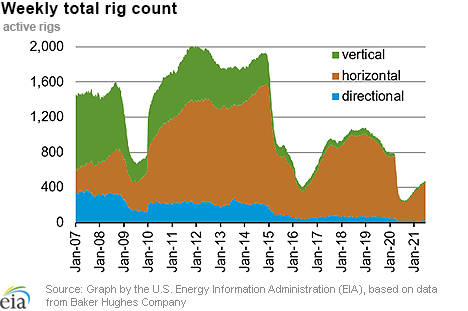

As expected, demand evaporated, and prices cratered. That means rigs were put on the sidelines and wells were not being drilled. OPEC and their allies finally came to the realization they were wrong and cut production. In the U.S., the number of active rigs cratered to levels not seen in decades.

Past performance is not indicative of future results.

Today, and over the last several months, the opposite has been happening. The lack of existing production – along with the increase in global economic activity – has meant a spike in prices. Oil prices have been consistently above $60 and natural gas prices are at summer levels not seen in nearly 20 years. For energy investors – which includes all our clients – it has been a very good run.

The question is what happens next. And the answer to that question once again runs through our friends at OPEC.

A Fallout at OPEC?

It turns out that running a global cartel is not exactly the easiest thing to do. Member interests are rarely aligned – especially when you include the non-member allies like Russia.

Now, when the prospect of cashing in on rising oil prices is on the horizon, the members are yet again fighting. The main area of disagreement is between Saudi Arabia (who wants to maintain production at current levels) and the United Arab Emirates (UAE) who would like to increase production. Over the weekend, the battle spilled out into the public when the cartel could not come to an agreement amidst a nasty battle between the two – normally friendly – countries.

The good news for energy investors is the spat means production will stay at its current levels for the time being. The market, which was planning on increased production, responded strongly over the weekend. Oil prices spiked above $80. We expect that will mean good things for our energy holdings this week.

For August and beyond? We will see what OPEC does. But even if they do increase production, that is not a switch that can be flipped overnight. As demand continues to grow – and supply remains constrained – we are confident this remains a strong environment for our holdings.

Sincerely,