Roughly one year ago, we wrote a memo titled “Great Expectations”. The gist of the memo – as we dove headlong into earnings season after one of the worst economic quarters in history – was things in Q2 were bad. The expectation, however, was that they were looking up. Unemployment was falling, manufacturing and service sector PMI were improving, and retail sales were starting to rise. The worst of the pandemic, people hoped, was behind us. And now the great recovery could begin.

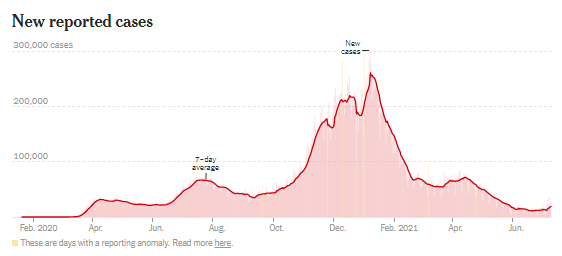

Part of that was true. The 2nd quarter was by far the most troubling of the pandemic financially. The economy was starting to recover. And the market recovery was in full swing. But we were far from past the worst of the pandemic. Cases would not actually peak until January – when vaccine doses started being distributed.

Source: New York Times

As we enter the heart of Q2 2021 earnings season this week, there is another set of “great expectations” that must be monitored. If the country lives up to those expectations, the path forward for the economy and the market could be strong. If not, more landmines may be littered in our path. These are the issues the Insight Investment Committee is paying attention to on your behalf.

The Delta Variant

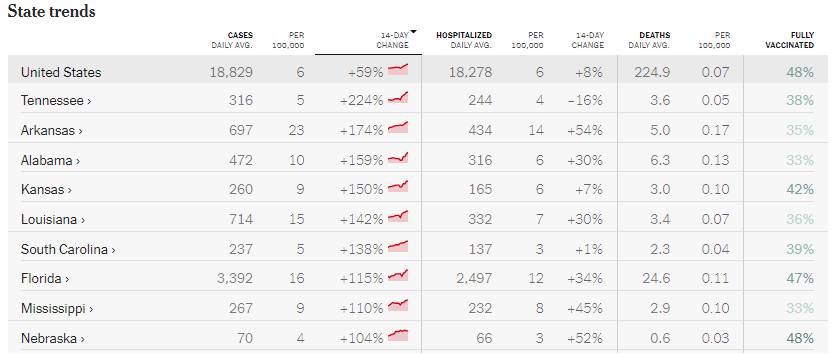

If you look at the very far right-hand side of the chart above, you will see a slight curl upwards in COVID cases in the U.S. By all accounts, this is the famed “Delta Variant” – a variation on the COVID vaccine that originated in India and is significantly more contagious than the original virus.

We are certainly not here to play the “vaccine debate” game. People are going to make whatever decision they believe is best for them. But it is time to have an honest conversation about the impact this may have on portfolios.

The math is pretty simple. The Delta Variant is spreading most aggressively in states that have the lowest vaccine rates. While there is some data to show the vaccine is not as effective against the Delta Variant as the core virus, it still provides significant protection, especially against severe disease.

You will recall us saying, time and again, that we have “three pillars” for market success this year:

- Emergency funding from Congress

- Continued zero interest rate policy from the Federal Reserve

- Continued reduction in the spread of COVID-19

The first two of these pillars are largely secured for this year. The third – while still in substantively good shape – may become more of a question in coming weeks.

Let’s be honest – the vaccine debate is largely over. People who want it have gotten it. People who don’t, won’t. And so, the goal of 70% vaccination is likely a pipe dream. Maybe opinions will change over time. We doubt it. But the thing to watch now on the virus front is how policy makers respond to the current situation.

What will happen with schools in the fall if the Delta Variant continues to spread? In the U.K., the highest prevalence of new cases is in children between the ages of 5 to 12. Will this mean school closures, keeping parents out of the workforce longer (or again)?

Will masking and social distancing make a comeback, forcing the closure (or limitation) of retails spaces, restaurants, etc.?

All of this is unknown today. But it is an issue the market – and we – will be watching closely in the weeks to come.

The Biden Tax Plan

There was an article this week touting the failing of President Biden’s tax plan in Congress. According to the author, the proposal was dying a slow and ignominious death. That kind of thinking may be a problem for the market.

The prevailing idea right now on Wall Street is that yes, the Democrats will raise taxes. But it is not going to be that bad. That sentiment is built into the pricing of the market today. In a sense, it has become a fourth “Pillar” in our path to success this year. But not necessarily because we believe strongly in it, but because if it is not true, the market may panic.

We know this: the Democrats plan to increase taxes via a vote on a reconciliation bill later this year. A reconciliation vote only needs 50 votes (+ Vice President Harris) in the Senate to pass – so they have the votes. The question will be exactly what is in the bill.

The worst-case scenario could be laid out as early as later this month as the House takes up its version of the reconciliation bill. The Pelosi-led version of this bill will likely include everything but the kitchen sink. Raising corporate taxes, raising income taxes on high earners, eliminating the capital gains rate for high earners, eliminating the step-up in basis for heirs, etc., etc. It could be a financial planner’s nightmare – and an estate attorney’s dream.

The real question is what they will be able to pass in the Senate. Senators like Kyrsten Sinema (D-AZ) and Joe Manchin (D-WV) have been clear they are not going to bend to every wish the House sends over. They will let Biden raise taxes, but they will also draw lines in the sand. Which ones become hills worth dying on is still TBD. If they are more amenable than the market suspects, it could make for an interesting end to the year.

Earnings and Economy

So far, we have talked about a virus we cannot control and politicians we cannot predict. Bluntly, those are the things that keep us up at night. Because when you get into our wheelhouse – hard data – things look pretty solid. We spent significant time a few weeks ago talking about the expectations for Q2 earnings – so we won’t beat that one into the ground again this week. Simply put, things are looking positive. We will know a lot more later this week when the banks start to release their data.

The first month of a new quarter is also full of economic data that we will be watching closely. Right now, the news is positive. Manufacturing PMI for June came in just shy of the expectation – and still well into the positive – at 60.6. Non-manufacturing PMI (services) came in at 60.1. June non-farm payrolls were much better than expected, growing by 850,000 jobs in the U.S. Even with that number, unemployment rose, which may be an indication more people are out looking for work.

This week we start to get into the heart of it. Core Consumers Price Index (inflation) comes out on Tuesday. PPI – which measures inflation for producers – comes out on Wednesday. And retail sales numbers come out on Friday. Then, over the next two weeks we see data on building permits, home sales, consumer confidence, and GDP. Oh – and we get another Fed meeting on July 28th.

If we can keep the virus under control – and Congress doesn’t knock down our new Fourth Pillar – this is shaping up to be a good month in the market. Now we need the numbers to back it up.

Sincerely,