It’s that time of the quarter: data dump time. The market is inundated with information in the first 45 days of a quarter. Earnings data, economic data, etc. There is a lot to go through and digest. But it also has a big impact on what happens during the back half of the quarter. So, today, we are going to walk through some of the big picture items to which we are paying attention today.

Earnings

The earnings season kicked off in dramatic fashion last week with the Big Banks. The bank data is always important because banks are a signal of where and how people are spending their money. So, while the fact that JP Morgan, Wells Fargo, and others crushed their expectations is great, it is their internal data that is particularly interesting.

For example, JP Morgan reported that Q2 credit card spending exceeded pre-COVID levels, but card balances remained low – a sign of strong household financial health. Citigroup concurred, putting their credit card spending +6% from pre-COVID levels. Additionally, both JP Morgan and Wells Fargo extended more home mortgages in Q2 than they did in Q1 – which was a record quarter for this area.

We now have Q2 data from 41 of the S&P500 companies (8.2%). 90.2% of those companies have beaten their earnings per share estimates (which were already significantly elevated). That is the best number since Q3 2020 and the best revenue beats number since before 2019.

As we have said a few times before – while this growth is to be expected coming off the worst quarter of 2020 – we really love the longer-term outlook. If this rate of earnings growth persists for the rest of the earnings season, analysts are expecting earnings to be 14.57% higher than Q2 2019 – a year before the pandemic.

Inflation

Inflation continues to be the buzz word. There is no question we have inflation. The real question around inflation (how high will it go, and does it really matter) are what the whole market is trying to figure out.

Federal Reserve Chairman Jerome Powell testified in front of Congress on Wednesday and was pretty blasé about it. He admitted inflation had “surged notably and is likely to remain elevated in the coming months”. But he also remained confident that the rise in inflation is “transitory” and will be offset as conditions normalize.

Inflation can be a tricky subject. Core CPI, the Fed’s calculation, came in at 5.4% for June, higher than analysts’ expectations of 5.0% and last month’s reading of 4.9%. The Fed calculates inflation using a metric that does not include things like food and fuel, because those prices can be volatile. Yet those are also the things that cause everyday Americans to feel the inflationary pressures.

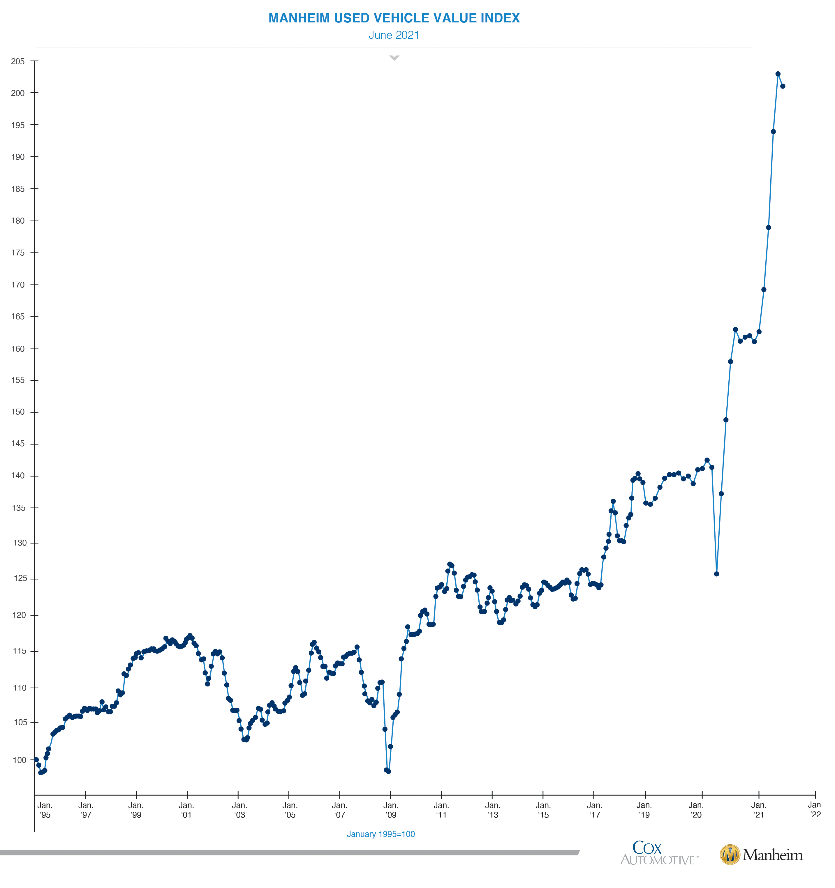

We have spent the last few weeks talking about inflationary pressures that actually impact you. The two we have focused on a lot are wood prices and used automobiles. It is worth checking on them again because they are both showing a significant reversion to the mean. If that sticks, it could be a sign that this inflation really is transitory.

Right now, the price of lumber has dropped nearly 2/3 and the September 2021 contract is trading just above where it was 11 months ago.

And while used car wholesale prices are still well above their historical norm, they have also started to retreat.

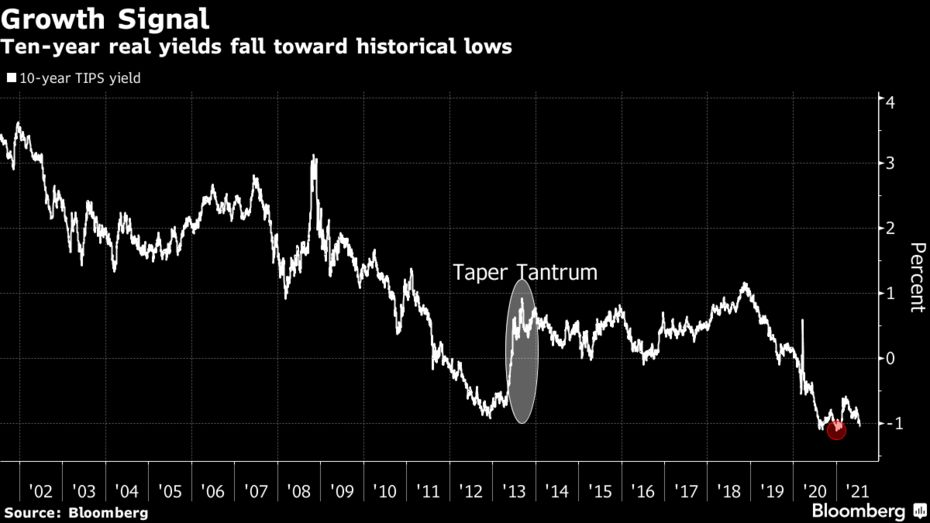

Despite the fears of inflation, bond yields are diving lower – and bond traders are confused. TD Ameritrade’s head of rates strategy Priya Misra twice recommended in the past few months that rates were going to spike. Twice she was wrong and had to pull away from the recommendation. As she told Bloomberg this week, “It’s a weird market”. With 10-year TIPS trading at a yield below -1%, she’s not wrong.

Jobs

One of the better signs this week was the jobless claims data. The labor market has continued to confound policy makers and economists. The question is clear – what will it take to get people off their couch when they are sitting in a very strong financial position right now?

We are not sure – but the data this week may suggest it’s starting to happen. Initial jobless claims came in at 360,000, well below analysts’ expectations and at their lowest levels since the pandemic started. More importantly, the same is true for continuing jobless claims. That number, 3,241,000, was also the lowest since the pandemic started and 126,000 lower than expectations. This is one to watch, but it looks like people are starting to get back in the workforce.

COVID: Delta Variant

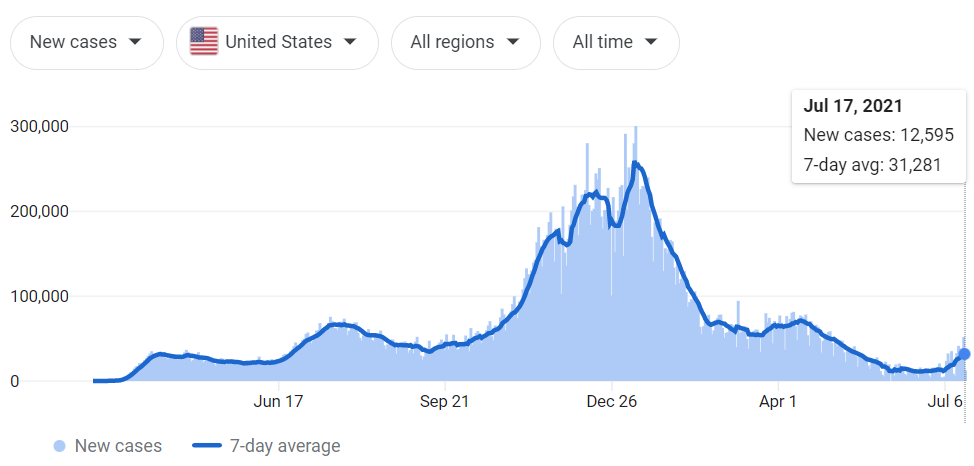

Someone asked us last week if we were “doom and gloomers” after they read our comments on the Delta Variant. Regular readers of this memo know we have been pretty darn optimistic for the last six months or so – but that person may have been sensing our rising blood pressure. We are definitely not ready to call the game, but we do think this variant (and policy makers’ response to it) is worth watching closely as we move to the end of summer and another school year.

As you likely saw, the mask debate started again this week when Los Angeles implemented a new mask mandate for all indoor activities. Our biggest fear at this point? It’s not a full shutdown like we saw in Q2 of last year. The government is likely past that. But if they start closing schools again? That could have a significant impact on economic growth as more parents are forced to stay out of (or leave again) the labor force. Again – it’s not panic time. But we need to pay attention.

With that in mind, while the spike in cases certainly is not at early 2021 levels yet, it is significant. In mid-June we had a seven-day average of roughly 11,000 new COVID cases per day. As of yesterday, the seven-day average was 31,281 – nearly 3x higher. Like we said – something to keep our eye on.

We’ll wrap it up there this week. Lots more to see in the coming weeks – especially as we eagerly anticipate more earnings news, housing data, and Q2 GDP.

We hope this finds you well!

Sincerely,