The Fourth of July is a special holiday. It may not be the first time a group of men and women tried to throw off the chains of tyranny, but it did signal the first time anyone did it successfully. The message was bold: “…all men are created equal. (And if you don’t believe us, come over here and we’ll show you!)”

The message – and the messengers – were not perfect 245 years ago. But they were far more perfect than anyone had tried to be at that point. And they truly did give up their “lives and sacred honor” to allow a new society to rise up that has been a beacon to the world of how free men and women can succeed.

People today still are not perfect – and neither is this country. The preamble of our Constitution said in 1787: “We the People, in order to form a more perfect Union…” Notice they did not claim to be forming a perfect Union – but a more perfect Union. And it remains our job today to continue to improve on the works of our great Founders.

So, as you celebrate this amazing holiday – one that has resulted in freedom for millions not just here but around the world – we hope you are able to cherish the fact that, while we may not be perfect, America has done some amazing things. And we still think she has more in the tank!

Short-Term Memory Loss

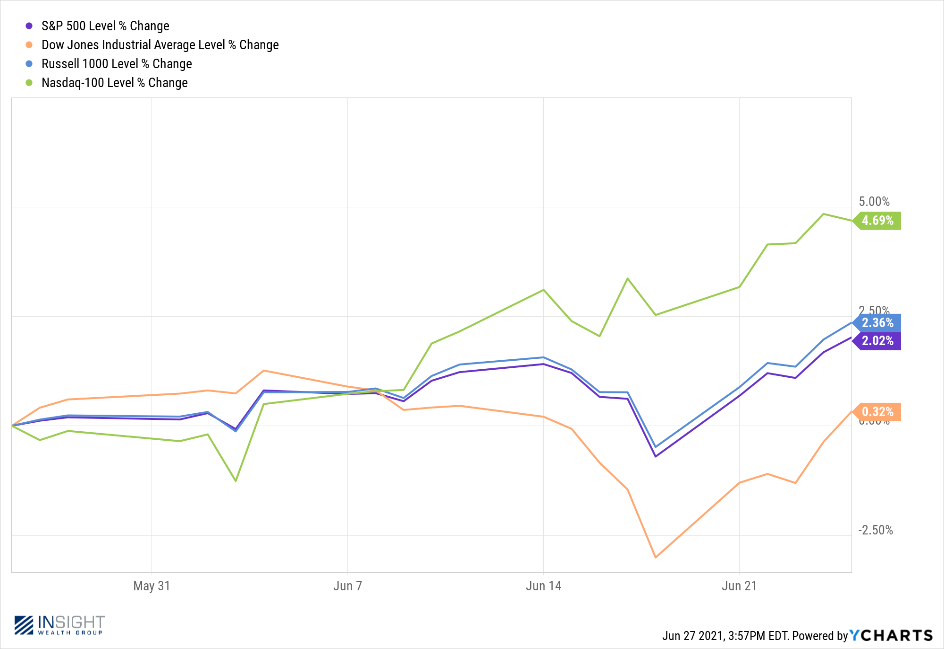

Anybody remember when the world was freaking out about inflation and the Federal Reserve raising rates? It was such a long, long time ago…oh…that’s right…it was a week ago. It seems the market has moved on. All major indices have turned positive for the quarter after a nice run last week.

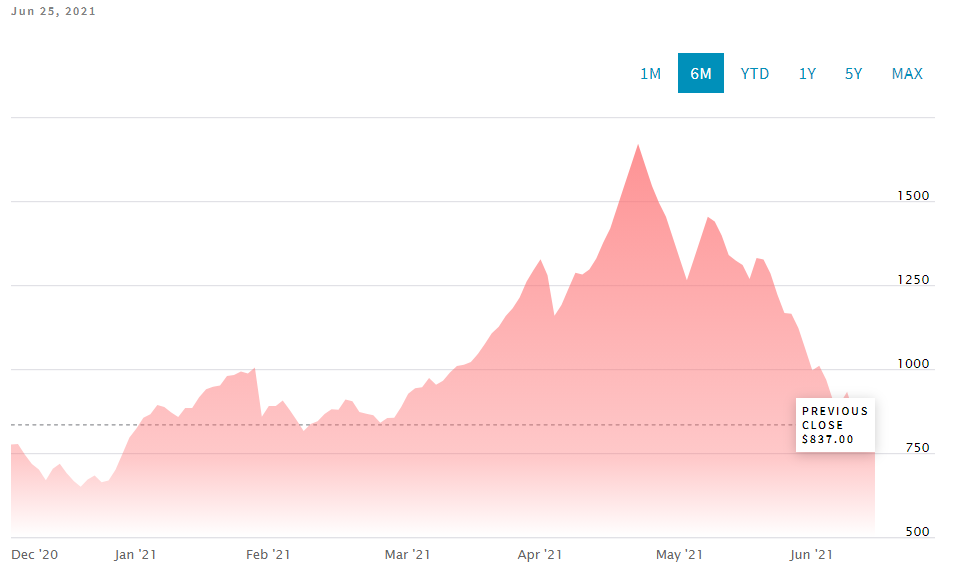

It did not hurt that everyone’s favorite inflation indicator – lumber prices – took another big stumble this week.

Source: Nasdaq

We have been on the “transitory inflation” and “dovish Fed” trains for a while now, so this isn’t a huge surprise to our readers. But we also get really frustrated by the all or nothing nature of the messaging in the media. Over the last month it has been “RUN! The inflation monster is coming!” Probably not. But just because lumber prices are falling does not mean inflation is over either. It is important to note that the historical average price for lumber is roughly $400/ 1,000 board feet. We are still more than double that number. Navigating the next several months will continue to require a deft touch.

Q2 Earnings Season

As hard as it is to believe, shortly after folks return from the holiday, earnings season will be kicking off again. And we are excited for this one.

We have talked in the past about “base case” growth. As you will recall, earnings are often looked at as a comparable to the same quarter one year ago. When that quarter was particularly bad – earnings can often look very good in comparison. Or vice versa.

That’s good news for Q2 2021, because Q2 2020 was one ugly duckling. It was the worst period of the COVID economic crisis. And the expectation right now is we are going to get a very nice bounce.

But while any kind of growth is a good thing, we are much bigger fans of real, long-term growth, than a bounce off the bottom. Guess what? We are seeing that as well. A comparison of Q2 expectations to the Q2 results from 2019 shows earnings growth of more than 7.9%. That is a significant rate of growth.

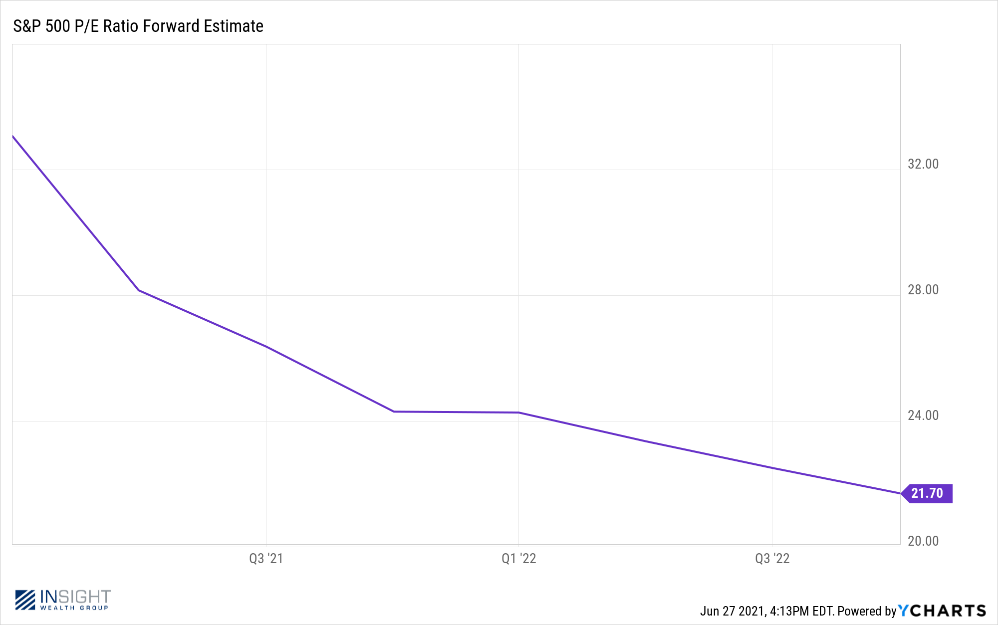

Earnings growth is one of the two big solves to one of the biggest issues plaguing the market today: how expensive it is. The P/E ratio for the market has been climbing since the bottom of the market last March. There are two ways to fix that problem: lower the price of the market (P) or raise the Earnings (E). Estimates right now show that if earnings growth keeps up with expectations, the market is pricing in a future P/E of 21.7X. That’s a little expensive, but not nearly as bad as the 25X or more we have seen in previous quarters. And it is much more closely in line with the historical average (in times of near zero inflation) of roughly 18.5X.

It’s Almost FAIR TIME!

That’s right – the greatest Fair in the land is coming back from a COVID break. The Iowa State Fair is back in 2021 and with it – so is Insight FairFest! Invitations will be going out shortly – but please put Saturday, August 14th from 11:00 a.m. – 2:00 p.m. on your calendar. We are looking forward to hosting you and your families again this year. It’s going to be nice see everyone together again!

Holiday Hours

Just a quick heads up that the markets are closed next Monday, July 5th, to celebrate Independence Day. Our offices – both Insight Wealth Group and InsightCPA – will be closed as well. We hope you can enjoy the time with your family and look forward to connecting with each of you after the holiday!

Sincerely,