The Weekly Insight Podcast – No Cuts Coming

Editor’s Note: Your author will be travelling next week and will not be able to publish a Weekly Insight. We’ll return to our normal schedule on Monday, February 19th. If you need anything in the meantime, please don’t hesitate to contact our offices.

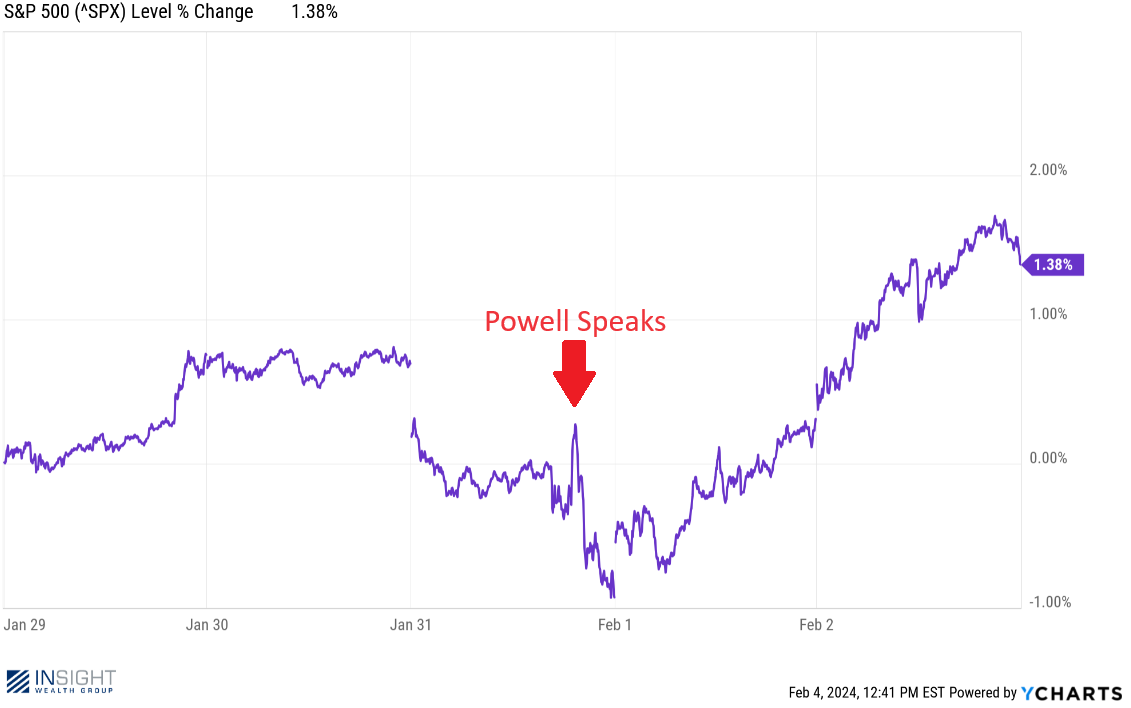

Fed Week has come and gone. And the results were initially as expected. Powell spoke and threw cold water on interest rate cuts. The market dropped dramatically as a result.

Past performance is not indicative of future results.

But then…we rallied! And ended the week up nearly 1.4%. But why? Let’s take a look at what happened.

Powell: No Rate Cuts in March

As we’ve discussed before, “Fed Meeting Day” (which is actually two days) culminates in two events: the release of the FOMC statement at 2:00PM EST and Chairman Powell’s press conference at 2:30PM EST.

The statement from the FOMC is a typically short release (1 – 2 pages) that is reviewed very closely for minute changes in the language. There were a few this month, but they all lead in the same direction: the FOMC was no closer to cutting rates than they were last month. To quote from the statement: “The Committee does not expect it will be appropriate to reduce the target range (interest rates) until it has gained greater confidence that inflation is moving sustainably toward 2 percent”.

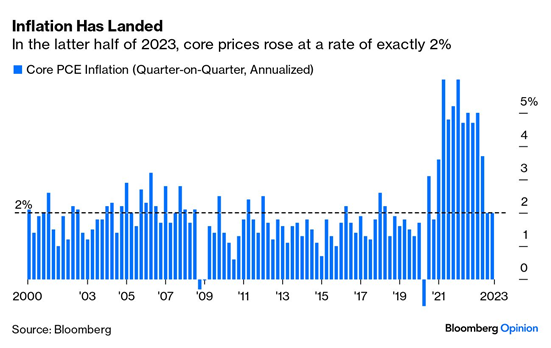

OK. That’s their opinion and they have more than 400 Ph.D. economists looking at this information. That’s more than we have at Insight! But what is the definition of “sustainably toward 2 percent”? When will we meet it? Because, as we noted last week, we’ve been at 2 percent Core PCE for the last six months!

Past performance is not indicative of future results.

But it was Powell’s comments in the press conference that made it clear we’re not getting rate cuts soon.

First, he addressed the idea of a March rate cut. You may recall in our memo “What if the Consensus is Wrong?” that just a few weeks ago the market was placing nearly 80% odds on a March rate cut and expecting 7 rate cuts before year end. Powell isn’t there:

“We’re going to be looking at this meeting by meeting. Based on the meeting today, I would tell you that I don’t think it’s likely that the Committee will reach a level of confidence by the time of the March meeting to identify March as a time to do that”.

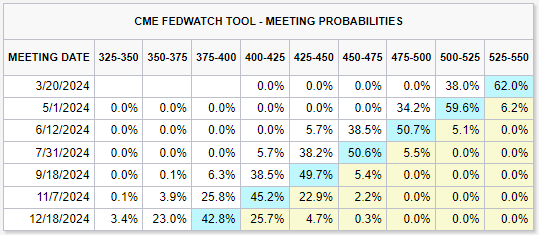

That couldn’t be clearer. Powell isn’t planning on March rate cuts. The market seems to have gotten on board with that idea. We now have a majority opinion (albeit just 62%) that the Fed will hold rates steady in March. But that hasn’t stopped the market from still concluding we’ll have six rate cuts this year.

Source: CME Group

Past performance is not indicative of future results.

Powell was, however, optimistic in his comments about both the state of the economy and the trajectory for inflation. That lead to one of the best questions of the press conference by Simon Rabinovich from The Economist. To paraphrase, he said that if six months of good inflation data wasn’t enough now, and eight months of good inflation data won’t be good enough in March, how much good data do we need for the Fed to be confident to cut rates.

Powell’s answer was indicative of what’s going on in the FOMC meetings. He said:

“…it’s not that we don’t have any confidence. We have growing confidence, but…it’s a highly consequential decision to start the process of dialing back on restriction. We want to get that right…we just want to make sure that we do get the job done in a sustainable way”.

A sustainable way. Powell just admitted the Fed’s real motivation. They’re more concerned about lowering rates and allowing inflation to creep back in than they are about keeping rates high and causing a recession. It’s the fear of repeating the 1970’s that we talked about last week.

So Why Is the Market Up?

If we are so disappointed in the path of the Fed – clearly the biggest driver of the market for the last 2+ years – why did the market recover so quickly and end the week on a high note? There are a few reasons for that which are worth noting.

1. The Market Still Doesn’t Believe Powell

We won’t belabor the point, but the chart above says it all. There is still over one-third of market participants that think we’ll see a cut in March despite the preponderance of comments against that view from Powell. And fully 93.8% of market participants think we’ll still see cuts starting in May.

From there, there is a lot of consensus about the path forward. Ninety-five percent of participants think we’ll see five or more rate cuts this year, with 69.2% believing we’ll see six or more. The market continues to refuse to reset their “consensus”. We hope they’re right – but need to consider what three or four rate cuts would mean for the market instead. Even at that level, we’d be happy.

2. More Great Economic Data

Powell’s comments can’t change the raw data we’re seeing. And the raw data is good!

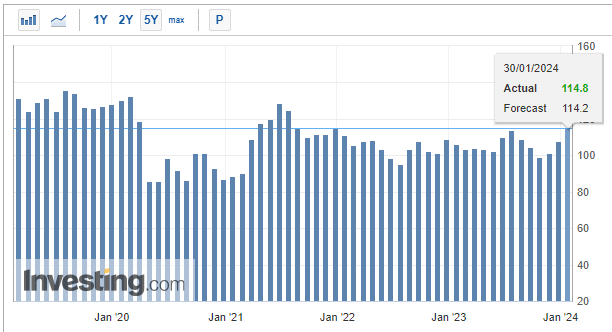

Consumer confidence numbers came out on Tuesday, and they were the best we’ve seen since before inflation became an issue.

Past performance is not indicative of future results.

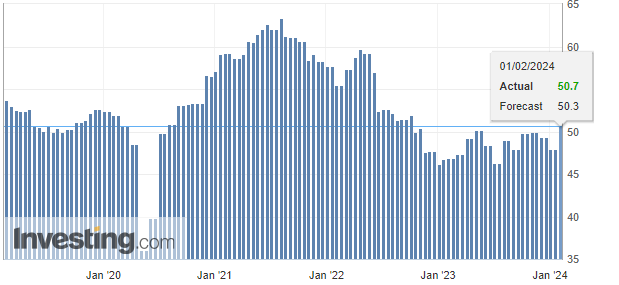

Manufacturing PMI came out and had us back in the “expansionary” range (above 50) for the first time since March of 2022.

Past performance is not indicative of future results.

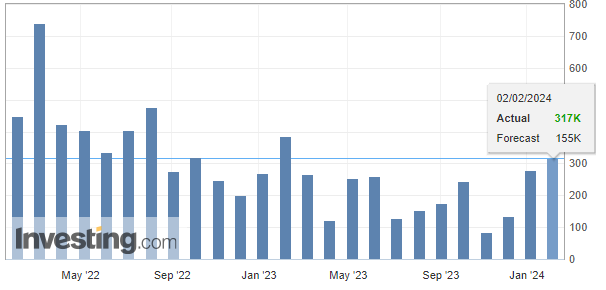

And then, on Friday, the jobs data blew expectations out of the water. The economy created 317,000 jobs last month, more than double the expectation.

Past performance is not indicative of future results.

This economy is still cooking. In fact, it may be cooking just a bit too much which keeps Powell & Company on their heels in fear of reigniting inflation.

3. Meta is a Dividend Stock?

You know by now that we’re concerned about the valuations of the Magnificent 7 tech stocks. Meta (formerly Facebook) is one of the more “reasonably priced” of the group, with a PE ratio of 31.87 (vs. the long-term market average of roughly 16.5).

In their earnings call last week, Meta announced a dividend of $0.50 per share for the quarter (theoretically $2.00 per year if they keep it up). At the share price prior to the call, which would be a dividend of 0.5% per year.

But that was the price before the call. Because the next day the price shot up $84 per share! That’s right, some investor out there paid $84 to access a $2/year dividend! That means they’d have to hold the stock for 42 years to justify the premium they paid.

Sometimes we just don’t get it. This is one of those times. That doesn’t seem to be justified to us. But it sure worked for Mark Zuckerberg. As the owner of 350 million META shares, the dividend will pay him an extra $700 million per year. And the $84/share jump in the price just grew his net worth by $30 billion. Not a bad day.

What’s Happening this Week?

With the Fed meeting behind us, and the economy on sure footing, this week is all about earnings. Over 100 S&P 500 companies report earnings this week. It will be nice to get back to talking about market fundamentals! We’ll give you an update in the next Weekly Insight.

Sincerely,