The Weekly Insight Podcast – Politics and the Fed

Congress created the Federal Reserve in 1913 with a bill called “The Federal Reserve Act”. It was, unsurprisingly, a controversial bill, passing the Senate with just four Republican votes. But it was just the next in a long line of controversy around the U.S. banking system.

You may recall that Alexander Hamilton – made famous to this generation by the Lin-Manuel Miranda musical – started the first central bank, aptly named the First Bank of the United States. Hamilton wanted to bring order to the U.S. monetary system and create the ability to provide credit to both the private and public sectors. Others, like Thomas Jefferson, were strongly opposed to the idea, wanting a purely private system of banking.

Hamilton won that battle, but not for long. The charter, which was established in 1791 for a period of 20 years, failed to be renewed in 1811 and the U.S. was without a central bank.

That lasted until 1816, when the government realized it needed a better way to pay off the debts surrounding the War of 1812. Thus, the Second Bank of the United States (those guys were great with the creative names!) was chartered for 20 years. And much like the First, its charter failed to be extended in 1836 and the bank closed its doors.

Thus began an 80-year period without any sort of central banking system in the United States. Banks were not really regulated. There were no real tools for managing the economy. It was the definition of “laissez faire” – let people do as they choose.

It was economic troubles – specifically the Panic of 1907 – which led leaders back to the idea of a central bank. The bill which formed it had the following “Official Title”:

An Act To provide for the establishment of Federal reserve banks, to furnish an elastic currency, to afford means of rediscounting commercial paper, to establish a more effective supervision of banking in the United States, and for other purposes.

The most important amendment to the bill was made in 1977, when Section 2A: Monetary Policy Objectives was added. It stated:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates (emphasis added).

The very idea of a central bank has been controversial in the United States since the very founding of our country. Even today there are voices calling for the abolishment of the Fed.

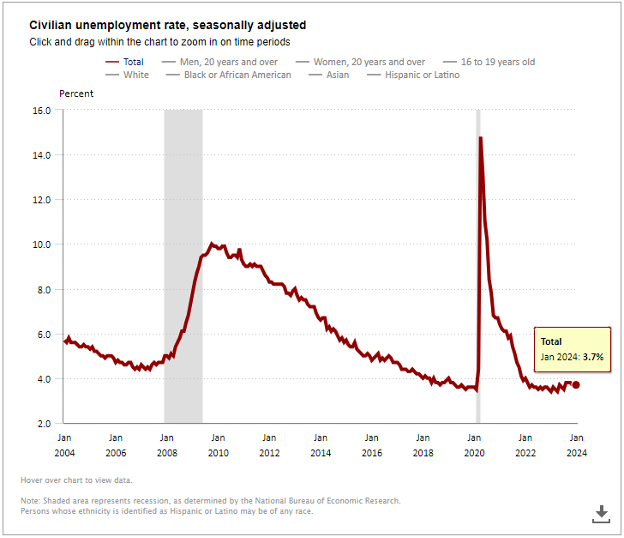

And so today we find ourselves in an interesting time. Whether we like it or not, Fed policy has worked so far. Remember the goals: maximum unemployment, stable prices, and moderate long-term interest rates.

We have maximum employment:

Past performance is not indicative of future results.

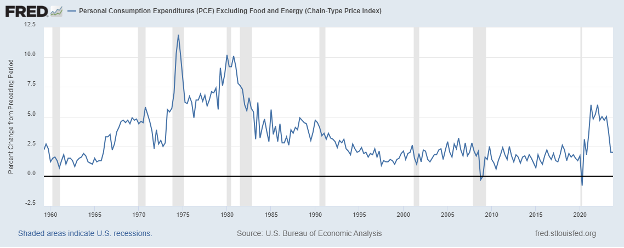

Core PCE has fallen to levels below the long-term historical average. Stable prices are returning:

Past performance is not indicative of future results.

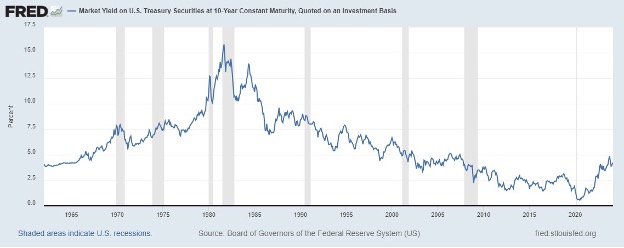

And, whether we want to admit it or not, we do have moderate long-term interest rates. The 10-year treasury yield, which closed last week at 4.24%, is 162 basis points below the average since 1960 of 5.86%.

Past performance is not indicative of future results.

Simply put, the system has worked. Could things be better? Of course they could. We’d all love to see a decade like we saw pre-pandemic when we say long-term stable growth with minuscule interest rates. But that was a goldilocks era. To get through the pandemic we’ve had and get to this point without seeing any long-term economic damage is stunningly good news. We doubt many would have predicted it four years ago when the pandemic was just kicking off.

And yet, even with all these successes, politics is heading straight for the Fed. And it may not be pretty. Why? One of the weirdest presidential elections of our time is about to collide with the Fed’s timing on cutting interest rates.

Politics and Rate Cut Timing

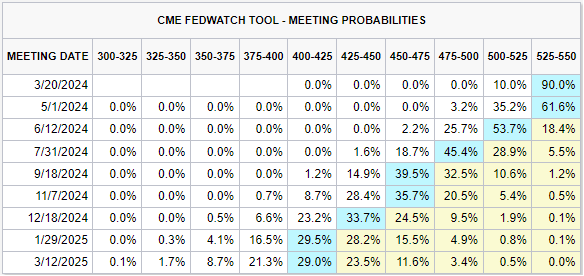

We’ve talked for weeks now about the differences between the Fed’s preferred path on rate cuts and the market’s belief of what they will do. As a refresher, the Fed announced in December they believed they would cut rates three times in 2024. The market had a different view. The consensus at the time was the Fed would start rate cuts in March and would cut a total of seven times in 2024.

The timing and number of cuts is important. If the Fed waits too long, or cuts too little, the odds of a recession increase dramatically. But data we’ve seen in recent weeks, including last week’s CPI data, continue to show a strong economy with inflation being a bit stickier than the Fed would want. If the Fed cuts rates quickly into too good of an economy, we’d likely see inflation raise its ugly head again.

And so, the market is now coming in line with the Fed. What was once seven expected cuts fell to six, and then to five. As of Sunday, the market is now expecting four rate cuts with the first not happening until June.

Past performance is not indicative of future results.

That’s good news for us as it relates to market volatility. The market has completely reset its expectations on rate cuts and the S&P 500 is still up nearly 5% for the year. We’ll take that.

But it also means rate cuts will likely begin right in the heart of a very messy presidential election. Former President Trump has already attacked Chairman Powell and Fed, accusing them of using rates as a political tool:

“I think he’s going to do something to probably help the Democrats, I think, if he lowers interest rates. It looks to me like he’s trying to lower interest rates for the sake of maybe getting people elected. I don’t know”.

Powell has been a fierce defender of the Fed’s independence. Does the likelihood that any cuts in the second half of 2024 will be seen as political force him to delay? We sure hope not, because the results could be quite damaging for the economy. Let’s hope they play it by the book and ignore any political pain or pressure from both sides of the aisle. That may be a challenging thing to accomplish this year.

Sincerely,

Insight Wealth Group