The Weekly Insight Podcast – Minutes, Hours, Days and Years

It was a quiet week on Wall Street last week. The President’s Day holiday started things out slow, and the remaining four trading days didn’t encompass a lot of new economic information to drive the markets forward or cause any consternation.

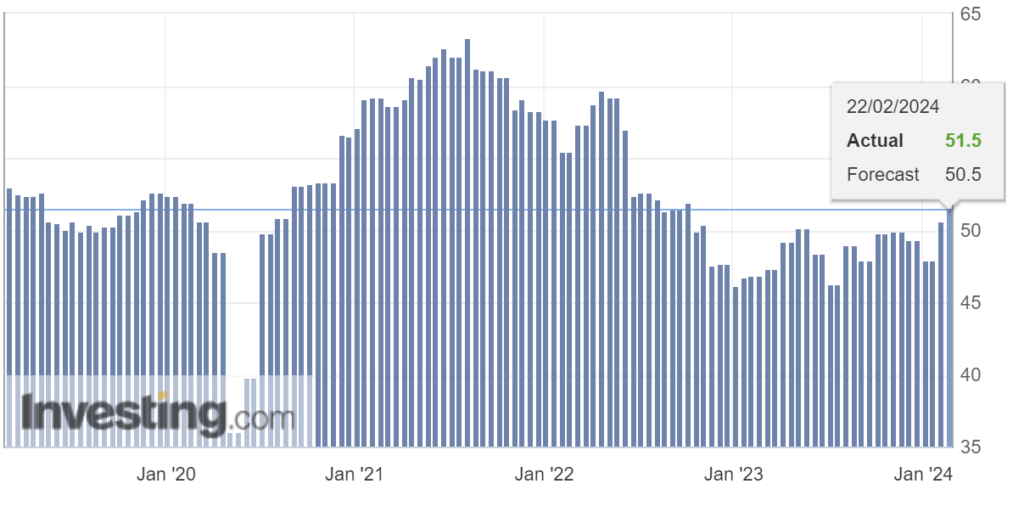

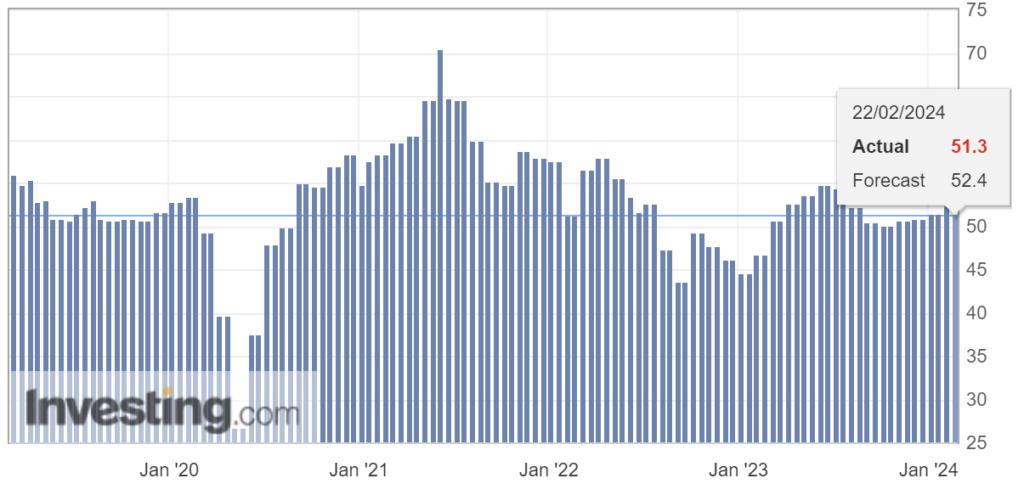

The most notable new data sets were what we saw on manufacturing and services PMI on Thursday. Both were positive (anything over 50 is “expansionary”) with manufacturing strengthening a bit more than expected and services lagging just a bit.

Manufacturing PMI:

Past performance is not indicative of future results.

Services PMI:

Past performance is not indicative of future results.

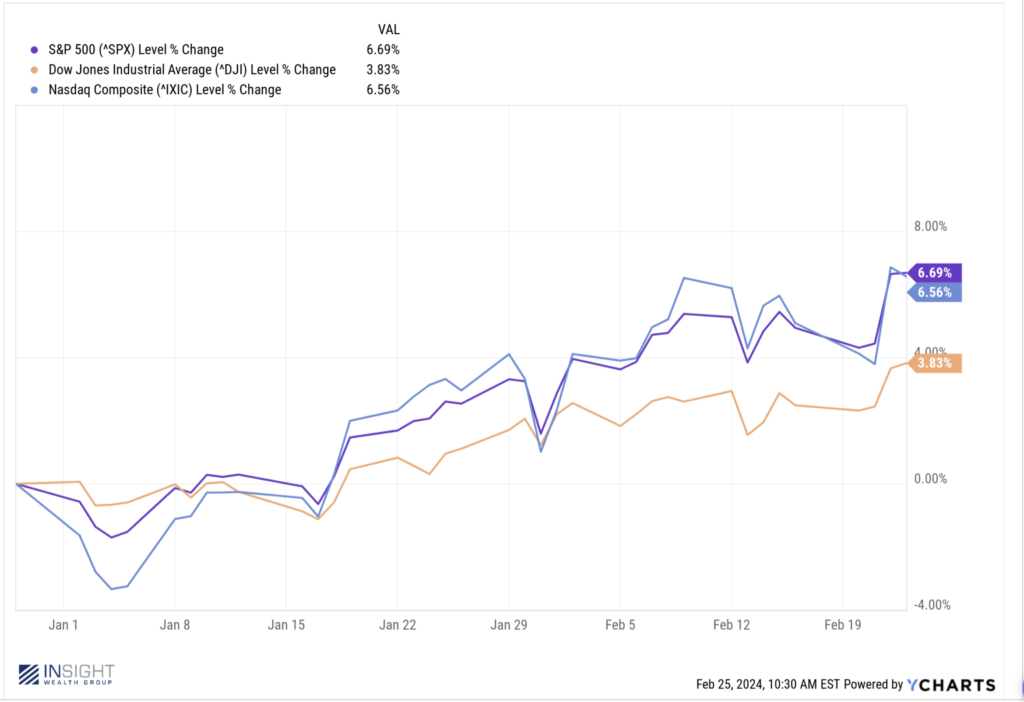

And so, the steady advance of U.S. equities continues as the major indices see themselves either close to or at all-time highs. Not a bad first two months of the year.

Past performance is not indicative of future results.

It wasn’t the economic data we got last week that moved any needles for the market. Instead, it was commentary from two of the biggest players in the game: Jerome Powell & Warren Buffett. We’ll let you decide who has had a bigger impact on markets in their careers – but no matter your opinion of the men, they’re important.

Powell’s comments weren’t really comments at all, but instead the release of the FOMC meeting minutes. We all know they’re horribly dry. But the minutes, when taken as an ongoing (albeit one-sided) conversation between the Fed and the market, can start to provide some guidance and insight about what is to come.

And that has been one of our biggest concerns as we started this year. The economic data has looked great. The fact that we’re in a Presidential election year historically bodes well for the market. It was the rate cut conversation that continued to be our big hold up with markets.

Powell & Company have been consistently more hawkish than expected and – like it or not – it has worked. We’ve talked in recent weeks about the market coming into this year expecting seven rate cuts (starting next month!) while the Fed was predicting three (starting much later…). But this story goes back much farther than that. Fully fourteen months ago we wrote a memo outlining our concerns that the market was getting ahead of itself on the idea that the Fed was going to cut rates in May…of 2023!

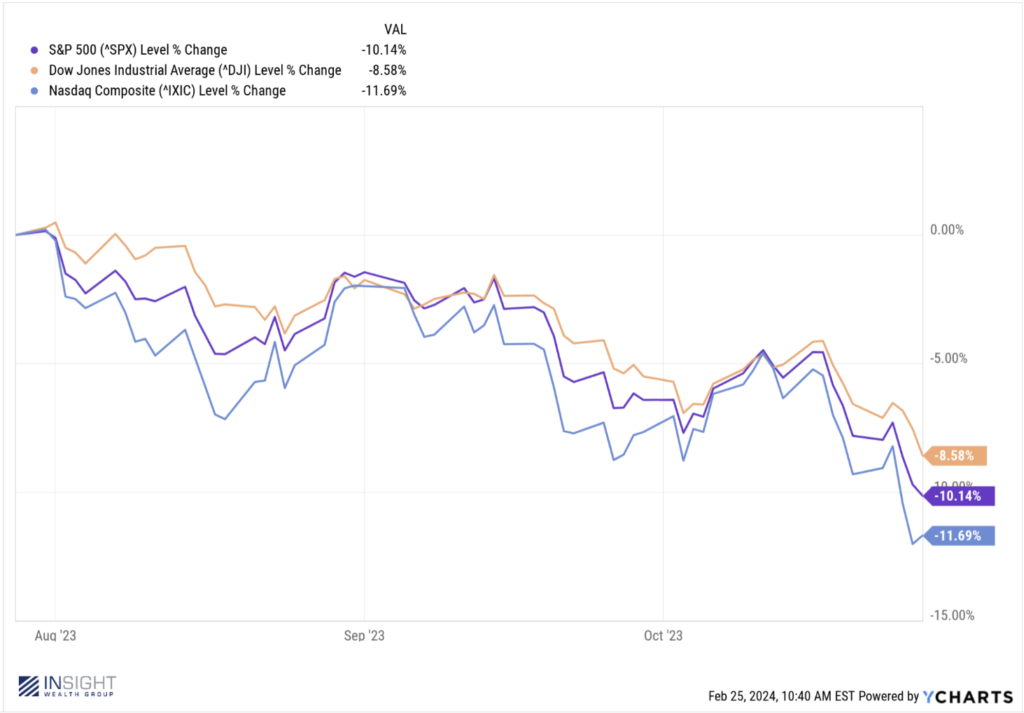

When those cuts didn’t materialize, and it became clear this process would take much longer than expected, equity markets suffered a substantial sell-off. While 2023 was an excellent full year in the markets, it didn’t seem too fun when markets were down 10% over three months leading into the fall.

Past performance is not indicative of future results.

And so, here we are, fourteen months later debating when cuts are going to begin. Powell and the FOMC were clear in the minutes: they’re done raising rates, but they’re in no rush to cut. Take this statement:

“In discussing the policy outlook, participants judged that the policy rate was likely at its peak for this tightening cycle. They pointed to the decline in inflation seen during 2023 and to growing sighs of demand and supply coming into better balance in products and labor markets as infirming that view. Participants generally noted they did not expect it would be appropriate to reduce the target range for the federal funds rate until they had gained greater confidence that inflation was moving sustainable toward 2 percent”. (emphasis added)

So that gets us to how the market has responded. Our concern has always been the gap between the market’s expectations for cuts and the Fed’s. Would confirmation of a slower and smaller rate cut this year cause a downturn like we saw last year? We can now say with some level of confidence that the answer is no.

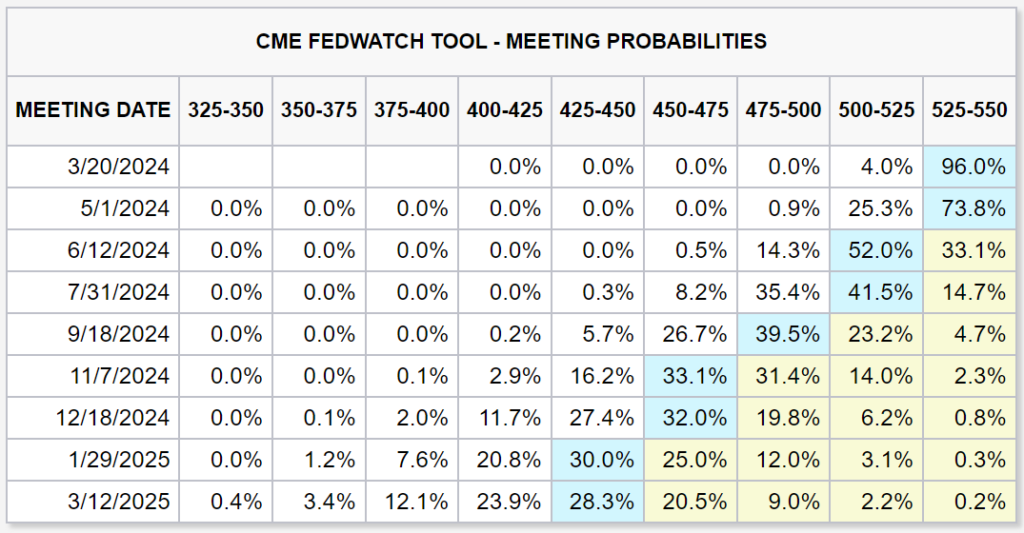

Why? Well, the market was up notably last week after the report. And the expectations markets are putting on rate cuts have now lined up exactly with the Fed. We’ve officially revised the probabilities from seven rate cuts to three rate cuts with the market up throughout that time. That’s good news. Our fears have proven to be unfounded.

Past performance is not indicative of future results.

Which brings us to Warren Buffett. Regular readers of this memo know we – like most people in our space – reserve a certain level of admiration for Mr. Buffett. What he’s been able to do with Berkshire Hathaway over the last 60 years is nothing short of remarkable. The sheer number of times we’ve used his “be fearful when others are greedy and greedy when others are fearful” quote to remind you of our philosophies is a testament to his staying power.

On Saturday he released his annual shareholder letter. This one started on an understandably somber note as he eulogized his longtime partner, Charlie Munger. But as he got into the heart of things, it was pure Buffett. More than anything, however, it proved an excellent reminder that the things we worry about (i.e. what will the market’s reaction be to the Fed minutes?!?) really don’t matter in the long run.

Buffett is known for his bluntness and honesty in these letters. There was a good bit of both this year. For example, he bluntly reminded investors that the sheer size of Berkshire Hathaway is now its biggest enemy:

“There remain only a handful of companies in this country capable of truly moving the needle at Berkshire, and they have been endlessly picked over by us and by others. Some we can value; some we can’t. And, if we can, they have to be attractively priced. Outside the U.S., there are essentially no candidates that are meaningful options for capital deployment at Berkshire. All in all, we have no possibility of eye-popping performance”.

How many CEOs do you know that will tell their investors the game is up? The thing Berkshire was for so long known for – big acquisitions of attractive businesses – is no longer available to them because they have sized themselves out of the market.

That could be considered a problem when Mr. Buffet’s company is sitting on more than $160 billion in cash. Yes, they can get a more attractive rate on that cash today than they could three years ago. But that’s still a lot of money not working for investors.

But that also leads to what Mr. Buffett reminds us of is the “Not-So-Secret Weapon” at Berkshire Hathaway: their ability to respond (and deploy cash) when markets struggle. Here he yet again gives us an excellent lesson in investor behavior:

“Occasionally, markets and/or the economy will cause stocks and bonds of some large and fundamentally good businesses to be strikingly mispriced. Indeed, markets can – and will – unpredictably seize up or even vanish as they did for four months in 1914 and for a few days in 2001. If you believe that American investors are now more stable than in the past, think back to September of 2008. Speed of communication and the wonders of technology facilitate instant worldwide paralysis…such instant panics won’t happen often, but they will happen”.

It wouldn’t surprise us if Berkshire’s stock is off early this week as investors say, “Warren doesn’t have any ability to deploy his cash!”. That’s the short-term thinking that Buffett is referencing. Good businesses, with good managers and fortress balance sheets, will do well over the long term. But we all must have the patience to see it play out.

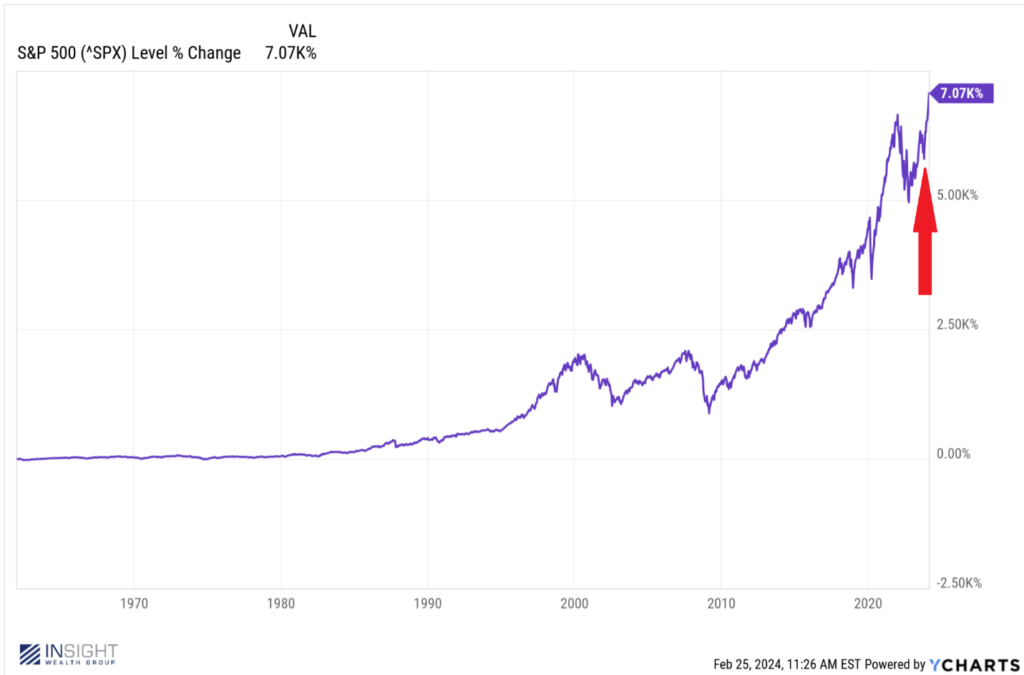

So, while folks like us are worrying about hour-to-hour or day-to-day debate about things like FOMC minutes, you need to think about these things like Warren Buffett. Investing is a lifetime game and fluctuations – even last year’s 10% decline – are just bumps in the road. We’ll leave you with this chart showing last year’s 10% decline as it relates to Berkshire Hathaway’s 62-year history. It’s an important perspective.

Past performance is not indicative of future results.

Sincerely,