The Weekly Insight Podcast – It’s Time for a Tough Conversation

We’ve been writing this memo for more than four years now. Most of that time has been filled with difficult discussions about COVID, inflation, FOMC meetings, war in eastern Europe. The list goes on and it seems like this commentary has been as much about how to properly respond to crisis as anything else. That’s not the case today.

We’re on a great run right now. The market has recovered well from the 2022 correction. Inflation is coming under control. A recession – while eventually inevitable – is still not a concern. And, as we’ve discussed many times, election years tend to be good for portfolios. Things are stacking up nicely at this point.

It would be easy to take a victory lap, right? Woo-hoo! Things are great! Enjoy your week!

These are the moments, though, when it becomes important to look into the future and start addressing the next risk. What will affect portfolios not just this year, but for the next ten? And how do we prepare?

Some risks are unknowable. The prospects for global conflict, certainly higher today than they’ve been at any time since the end of the Cold War, are difficult to decipher. Will China take advantage of this moment and move on Taiwan? If Russia is successful in Ukraine, will they move further west? Does NATO involvement in Ukraine drive Putin to do something drastic? It’s all unknowable.

But the problems here at home are easier to understand. And the one we’d encourage you to focus on is a $34 trillion problem: the national debt.

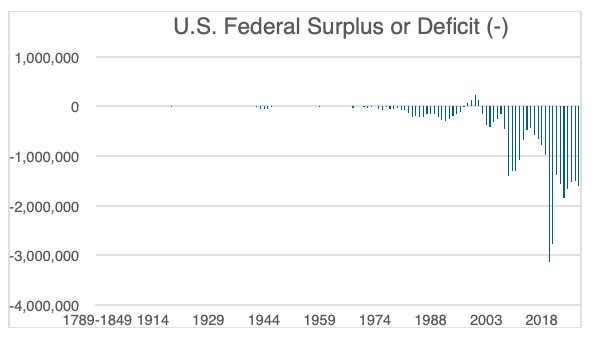

You know the story by now. The battle against COVID – more expensive than World War II on an inflation adjusted basis – drove the national debt to levels previously unseen. But is this really a COVID problem? Isn’t this just the way it’s always been when problems happen? Nope.

Source: https://www.whitehouse.gov/omb/budget/historical-tables/

Past performance is not indicative of future results (we hope!).

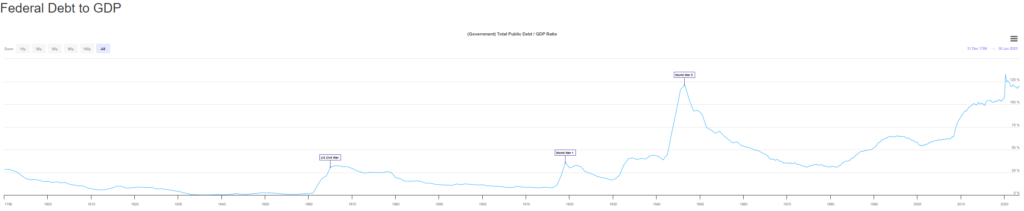

But, Insight, you’re not adjusting for inflation! You’re right. Let’s look at the problem on a basis which excludes inflation: debt as a percentage of GDP. Even then, we’ve only tipped these levels during the greatest armed conflict in human history.

Source: https://www.longtermtrends.net/us-debt-to-gdp/

Past performance is not indicative of future results.

The truth is, other than World War II, this is a new phenomenon. In fact, Washington worked hard during the post-war years, despite the military spending surrounding the Cold War, to gradually reduce our debt as a percent of GDP, getting it down to roughly 30% in 1980. That was the moment things changed.

The Reagan Administration – paired with a Democratic Congress – started spending money at a rate not previously seen in peacetime. The pace continued until Bill Clinton was elected President – and Republicans took control of Congress – when we briefly balanced the budget again.

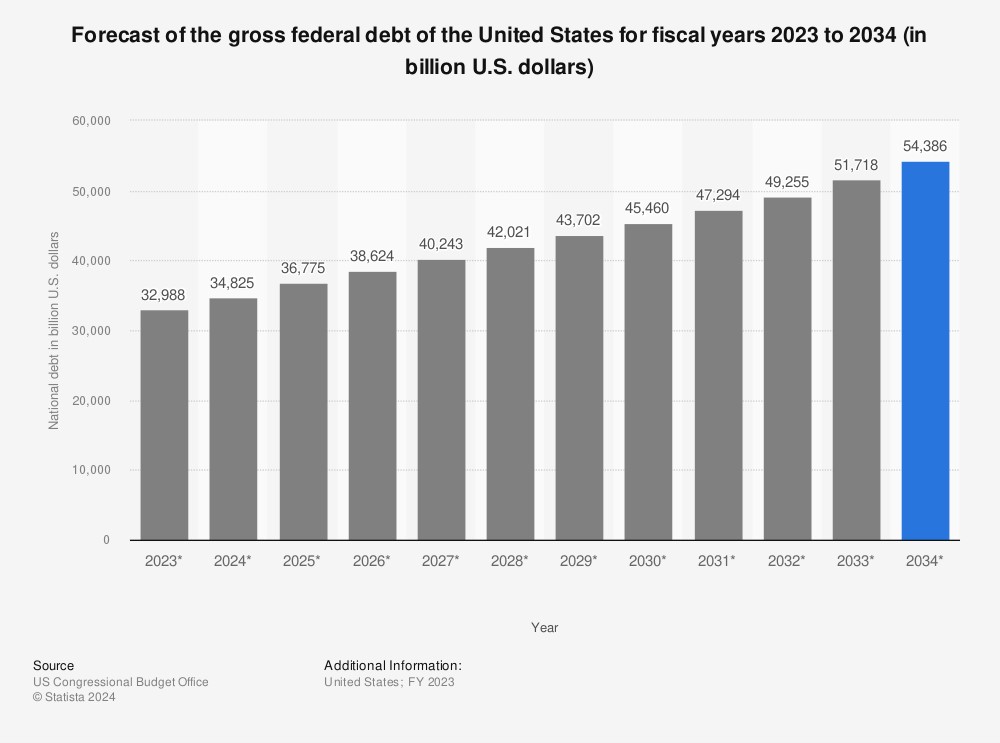

When the Bush Administration took control – again with Democrats in Congress – the 9/11 attacks and the recession in 2000 started the flames of new budget deficits. The Great Financial crisis threw gasoline on it. And no politician – Republican or Democrat – has provided more than lip service to our national debt since. That leads to projections like this about the future:

Past performance is not indicative of future results.

So, it’s a problem. And no one seems to be concerned about fixing it. Is this just our fate?

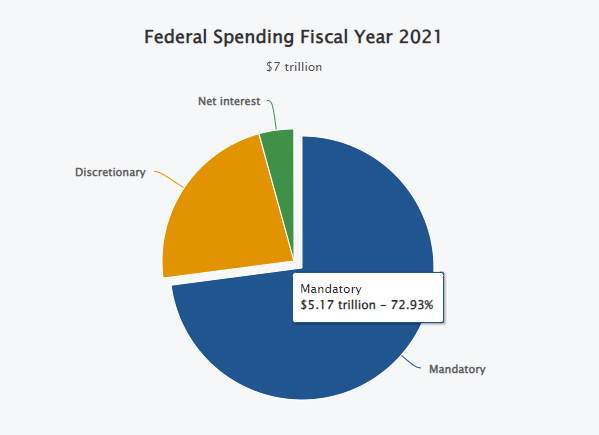

It doesn’t have to be. But some hard conversations are going to need to be had. The first is the simple realization that “mandatory spending” makes up a disproportionate amount of Federal spending. What is “mandatory spending”? It is spending mandated based on a previously passed law. Simply put, the debates we’re seeing happen in Congress really aren’t impacting the budget to the level we imagine when nearly 73% of the Federal budget is happening whether we like it or not.

Past performance is not indicative of future results.

Mandatory spending includes things like Social Security, Medicare programs, food stamps, welfare, and highway costs. In 2021, fully 80% of mandatory spending went to Social Security and Medicare. That means over 58% of the Federal budget is spent on these two programs. And that number is growing rapidly. If we don’t address those costs, there is no fixing our debt.

We can hear the complaints now: Insight wants the poor to suffer so we can reduce the debt! No. Not at all. It turns out there are several things that can be done right now with these programs which wouldn’t impact those who need the programs most but would cut costs dramatically.

For example, simply tying the cost-of-living adjustments (COLAs) for Social Security to CPI would save $430 billion per year. Or we could subject earnings greater than $250,000 to the payroll tax (which pays for Social Security). That would save $1.810 trillion per year. Or we could raise the payroll tax rate by 1%. That saves another $790 billion. Look at us! We just saved over $3 trillion per year.

But these aren’t conversations our leaders are willing to have with us today. Raise these issues and it’s “The GOP hates the poor!” or “The Democrats always want to raise taxes!”.

But this problem is spiraling. In our industry we love the power of compounding interest. But when it comes to debt, compounding interest is a nightmare. In 2023, it is expected that the U.S. Government will pay $875 billion in interest payments on the Federal debt. By 2034, that number is expected to nearly double to $1.62 trillion. When you consider the expected tax receipts in 2034 are $7.5 trillion, interest alone will make up nearly 22% of the government’s income. The problem just gets worse from there.

In the end, the government’s budget is much like your household’s: you can’t consistently spend more than you earn. The piper will eventually have to be paid. And the longer we put it off, the more painful it will be.

So, what are we recommending? A real, honest national conversation about the debt. It’s time to set aside our biases and address the issues as they are today. We’re all grownups. We should expect our leaders to act like grownups as well.

In the meantime, we’d encourage you to visit the website of the Committee for a Responsible Federal Budget. This bi-partisan organization is looking at the real issues surrounding the debt and how to fix it. They have a neat tool – the Debt Fixer – which helps to show exactly what changes you might support would mean for the budget. You can visit it here: https://www.crfb.org/debtfixer.

We have a long way to go. But it starts by having a real conversation. We look forward to hearing your thoughts on this issue of vital national importance.

Sincerely,