Last week was Spring Break for many – especially those here in the Midwest. Families travelled far and wide as they looked for a little relaxation. In a not uncommon occurrence, a friend of ours was skiing last week and had a bit of an accident. While waiting for a diagnosis on the their knee, they described it as feeling “loose”. It was an unsettling feeling for them. It’s also how we would describe this market right now.

There is so much going on – and a substantial number of unknowns – that things feel unstable for investors. The inflation battle continues. A Fed meeting is on the horizon. Bank failures lead the headlines. A former President is calling for protests in the streets upon his likely indictment. The head of a nuclear superpower has been charged as a war criminal. Pick your poison. We guarantee there is something you can find to feel scared and/or pessimistic about. You wouldn’t be human if you weren’t.

When we founded our firm eleven years ago last week, there were a few basic assumptions we made about how we wanted to do business. There is one important one that rings out in times like these: understand that we can’t “see around corners”. We have no omniscient powers that allow us to see the future. So instead, we have to manage risk to ensure the bottom doesn’t fall out underneath us.

We started these memos to communicate to clients during the beginning of the pandemic. No one wanted to see us face-to-face back then and we had to get the word out about what was going on. When we wrote our memo three years ago this week, it was one of the most stressful moments in the pandemic. Governments had started shutting down businesses. Schools were closing. Congress and the Trump administration were in the midst of agreeing on the first round of stimulus.

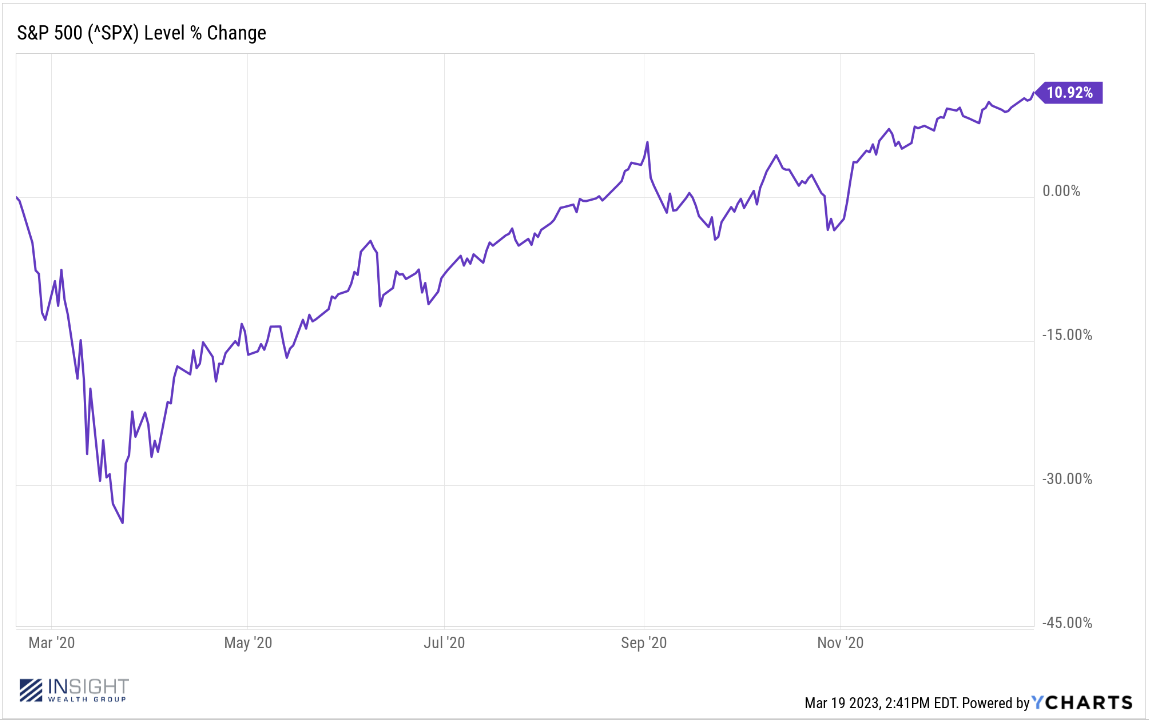

But it was also three years ago this week that the market bottomed from the COVID scare.

That’s a critical point because it reminds us that markets are forward looking. By three years ago today, the market was already down over 30%. That was before the worst of the jobs reports, or the results of the economy shutting down were known, or kids were sent home from schools.

Past performance is not indicative of future results.

In our memo three years ago this week, we wrote the following:

As you know from previous memos, we believe that, while this is a painful process, it also presents significant opportunities. Prices today are well below their “fair market value”. That’s before you even take the FAANGs out of the mix. Small-cap, mid-cap, and international stocks offer even more significant discounts.

The difficulty is understanding when to buy. There is no perfect answer. And, as we’ve said before, there is no doubt we will be wrong on timing. But that doesn’t mean we can sit on our hands. We have slowly been working dry powder in portfolios into the market. This strategy may not work perfectly in the short-term, but we are confident the long- term benefits will be substantial.

We had no way of knowing that the day that memo went out would be the bottom of the market. No one did. But we did know that valuations made sense and we had faith in the underpinnings of capitalism. Our investors stuck with us through that time and the last three years – despite the pain of the inflationary period we’ve been through, has been positive.

So, what does that mean for us today? Let’s take a look.

A Banking Crisis or a Bank-Specific Problem?

Let’s be clear: the last two weeks have exposed problems in the banking sector. Despite the fact that regulators have taken a much firmer stance on capitalization, two very large banks (Silicon Valley and Signature) have failed and two others had to be bailed out (First Republic and Credit Suisse). That is leading many to have flashbacks to late 2007 and early 2008.

But there is a big difference between where we are today and where we were in 2008. First, credit quality is significantly better than it was then. Banks have not been giving out the sub-prime debt that caused problems 15 years ago. And borrowers have been smarter as well. That’s why defaults are at historically low levels.

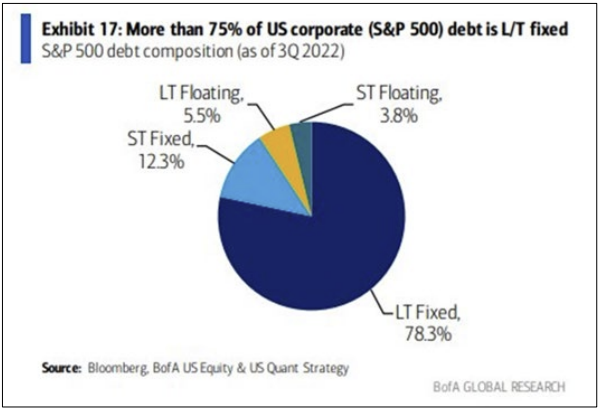

Corporations are acting much differently as well. Back in 2007, 54% of corporate debt was floating rate. Which meant that, when rates were rising dramatically, corporations were on the wrong side of the trade. Today, just 9.8% of S&P 500 corporate debt is floating rate.

Past performance is not indicative of future results.

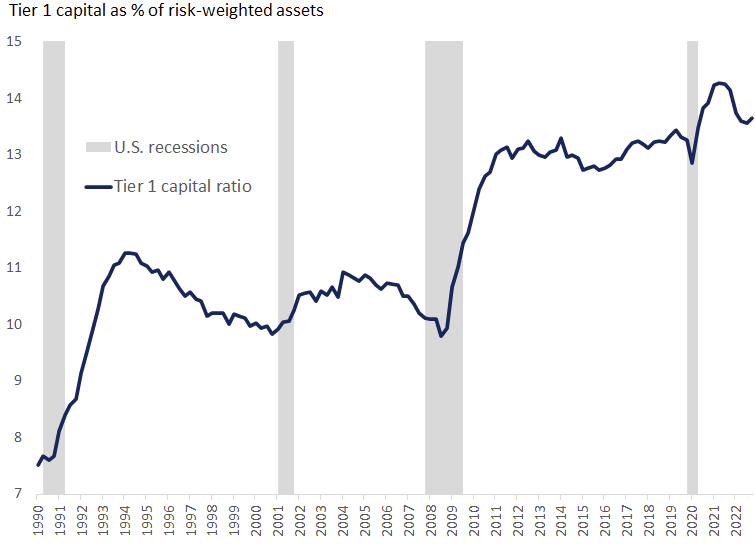

Secondly, banks are much better capitalized than they were heading into 2008. We are often eager to complain about government overreach, but the Dodd-Frank banking regulations made sure the big banks were well positioned for this environment. Today, they’re even better capitalized than when we entered the pandemic.

Source: Edward Jones

Past performance is not indicative of future results.

We’re then comfortable saying this is a bank specific problem, not a systemic one. That doesn’t mean these times of higher interest rates won’t cause more problems for other banks. Banks that haven’t managed their investment portfolio well may suffer, but there isn’t a risk of the banking system collapsing.

The Fed Weighs In

Wednesday is going to be a big day in this conversation as the Fed will publicly weigh in for the first time. This whole problem has happened in a unique time period in which the Fed does not allow public comments by Fed Governors for the 10 days leading up to a Fed meeting. Their silence leaves a lot of unanswered questions.

Public perception hasn’t changed much since we wrote our memo last week. The idea of a 50 basis point rate hike has disappeared, and the market is split between a 25 basis point hike (62% odds) and no hike at all (38% odds).

The European Central Bank (ECB) shocked markets when it raised rates by 50 basis points last week despite all of the news about banks. Their argument was that killing inflation was more important than easing financial conditions.

Will the Fed have the same approach? It was announced last week that inflation fell as much as expected in February – but the number still wasn’t great (5.5% for Core CPI and 6.0% for All-Items CPI).

But other data was quite good. PPI – the Producers Price Index – dropped much more than expected. The year-over-year number fell from 5.7% in January to 4.6% in February. And the month-over-month number was negative.

So the Fed now has a choice to make: stay aggressive to kill inflation for good, or slow down to benefit the economy. There are good arguments for both paths. And both paths have risks. It’s a crossroads we can’t predict (remember, we can’t see around corners!).

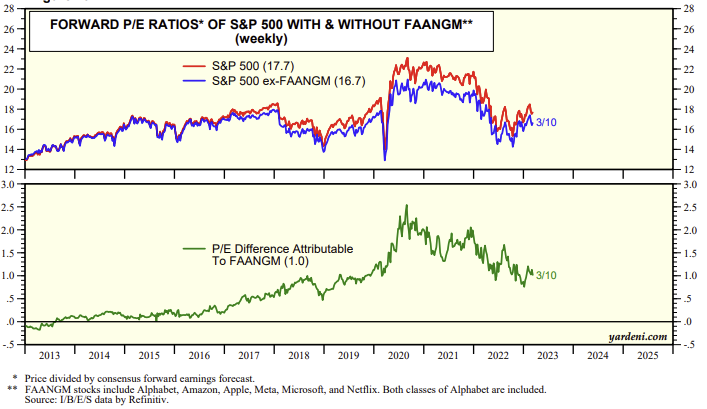

But we can come back to our thinking three years ago. Much like that time, while there is undoubtedly risk in the world (less today, we would argue), there is still opportunity. Valuations remain good in this market. If you remove the big-6 names (Facebook, Amazon, Apple, Netflix, Google, and Microsoft) from the S&P, it’s trading at roughly 16.7x earnings. That’s just a smidge higher than the long-term average of 16.5x and well below the 10-year average of 17.5x. The situation is much better for value stocks and mid-cap and small-cap equities.

Source: Yardini Research

Past performance is not indicative of future results.

Opportunities exist. Much like three years ago, we didn’t sit on our hands last week. We eased more capital into bank stocks in our Dividend strategy. The timing may not have been perfect, but we’re comfortable with the long-term outlook.

But it isn’t a time to be reckless. Things are “loose”, and we have to be flexible. This is a much less scary time than March 2020. Those who keep their heads will be able to capitalize.

Sincerely,