The Weekly Insight Podcast – So Close…and Yet So Far

Last week was Fed Meeting Week. But last week was not a normal Fed meeting. The circumstances surrounding it were unique. The commentary from elsewhere in Washington was important. And the result is still “TBD”. We would argue, however, that what happens over the next one to two weeks will have a dramatic impact on what the rest of this year looks like. Let’s take a look.

The Interest Rate Discussion

This is the issue the market has been obsessing about for a year now. As expected, the Fed raised rates by 0.25%. They also indicated that, while they may raise rates again, they may also look to pause as early as the next meeting.

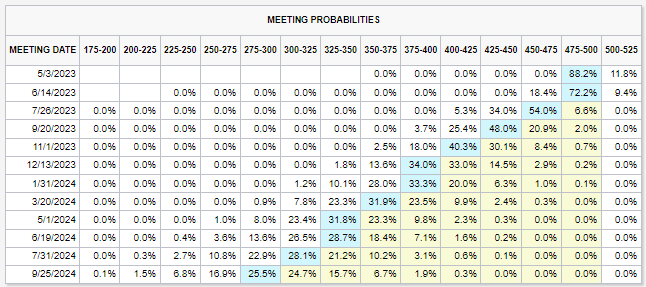

The market thinks the Fed is done. As the chart below shows, the current projection is that the Fed will leave rates at 4.75% – 5.00% during the next two meetings and will then begin to reduce rates starting in the July meeting.

Source: CME Group

Past performance is not indicative of future results.

That’s an interesting stance given Powell’s comments on Wednesday. He was asked in his press conference if these projections were accurate. His response?

“We published an SEP (Summary of Economic Projections) today…it shows that basically participants expect relatively slow growth, a gradual balancing of supply and demand, and labor market, with inflation moving down gradually. In that most likely case, if that happens, participants don’t see rate cuts this year. They just don’t…that’s not our baseline expectation”.

We’re going to guess most of you didn’t watch the press conference. If you did, however, you would have noted how this answer was delivered. It was forceful. Powell wanted the world to know they weren’t expecting to cut rates this year.

The market didn’t believe him.

That’s not without precedent. The Fed is horrible at predicting what the Fed is going to do! Just remember last year: in their December 2021 SEP, they predicted raising rates from 0.00% to 0.75%. Instead they rose to 4.25%.

But it was what Powell said later in the press conference that gave investors confidence in this call. He hit three points that are especially important: housing, jobs, and banks.

Housing

We’ve talked for months about the outsized – and incorrect – impact housing has had on the monthly inflation numbers. Yet again last month, housing inflation grew at 0.7%. If that’s true, why have home prices fallen at an unprecedented rate?

Our frustration has been (other than the stupid model the government uses!) that Powell & Co. have seemingly not noticed or cared about this clear inaccuracy. That changed this week. When asked about whether we were seeing disinflation, Powell dove right into the housing market:

“Housing services is really a matter of time passing. We continue to see the new leases being signed at much lower levels of inflation. So that’s 44 percent of the core PCE index, where you’ve got a story that’s ongoing”.

Finally! If the Fed believes housing inflation is falling, we’re talking about real disinflation.

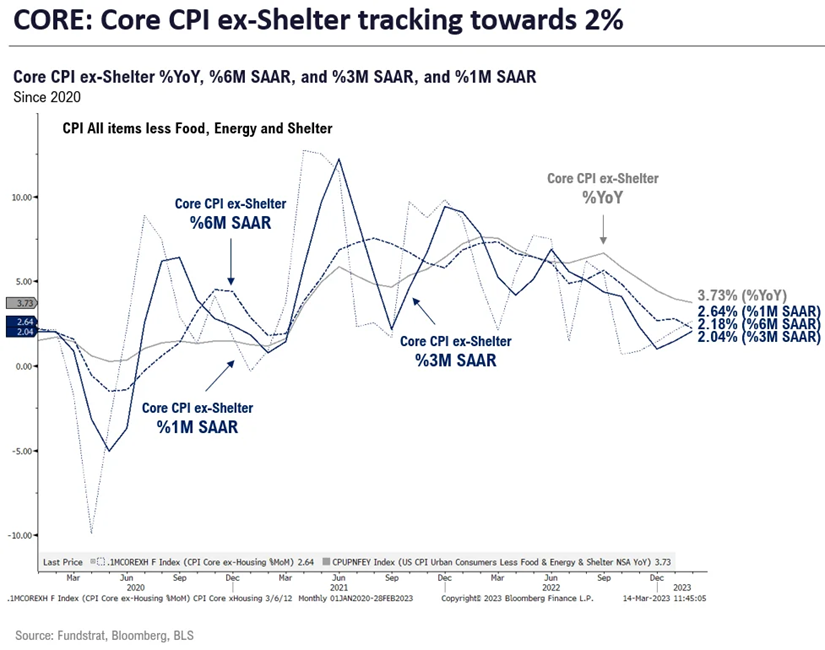

The chart below is a bit tough to read – but it explains exactly what’s happening. If we believe housing inflation is misstated and falling, the big question becomes what is happening with the rest of inflation. This chart looks at Core CPI with the housing sector removed. The short story – over the last six months, we’re averaging inflation just above the Fed’s goal of 2%. Over the last year, we’re at 3.73%. Those aren’t bad numbers.

Past performance is not indicative of future results.

Jobs

One of the Fed’s biggest worries has been the labor market. Too few workers and skyrocketing wages were a major reason for the inflation we’ve seen over the last 18 months. That’s why one sentence from the press conference was very important – and a further reason the market thinks the Fed is done:

“FOMC participants expect supply and demand conditions in the labor market to come into better balance over time, easing upward pressures on wages and prices.”

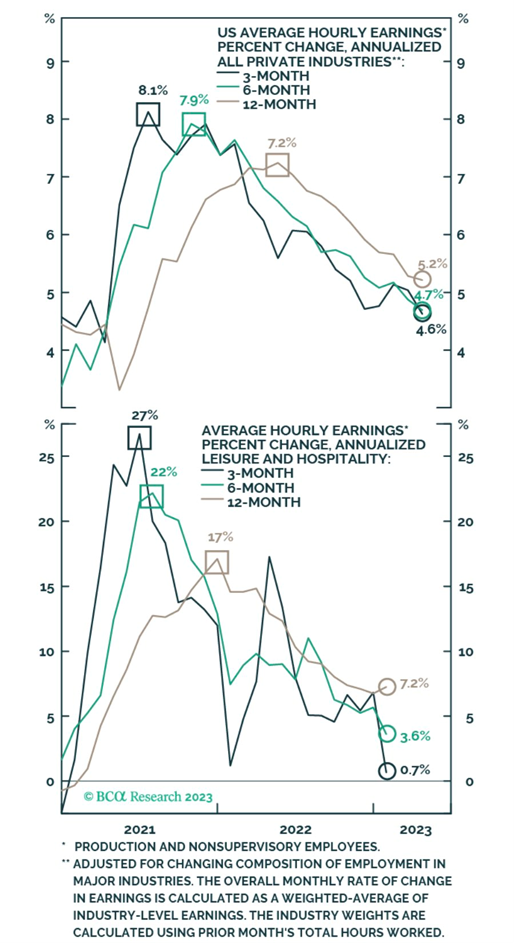

That’s the first time Powell has pivoted from wages being a problem to wages being a reason inflation will ease –and for good reason. The data shows wage growth has fallen dramatically over the last several months.

Past performance is not indicative of future results.

Banks

The banking situation is where things get messy. First, let’s be clear: Powell was emphatic that the bank failures we’ve seen were one-off situations and the banking system is fundamentally sound.

“Our banking system is sound and resilient, with strong capital and liquidity”.

We agree. But that doesn’t mean there aren’t issues ahead which cause concern.

First, there’s the impact on inflation and interest rate increases. The following quote from Powell lays it out well:

“We believe, however, that events in the banking system over the past two weeks are likely to result in tighter credit conditions for households and businesses, which would in turn affect economic outcomes…As a result, we no longer state that we anticipate that ongoing rate increases will be appropriate to quell inflation.”

What he’s saying here is this: this banking problem may be enough to slow down the economy so we won’t be forced to raise rates anymore.

More simply put: these problems over the last few weeks increase the odds of a recession. Why? Because the banks being impacted have a huge impact on economic growth in this country.

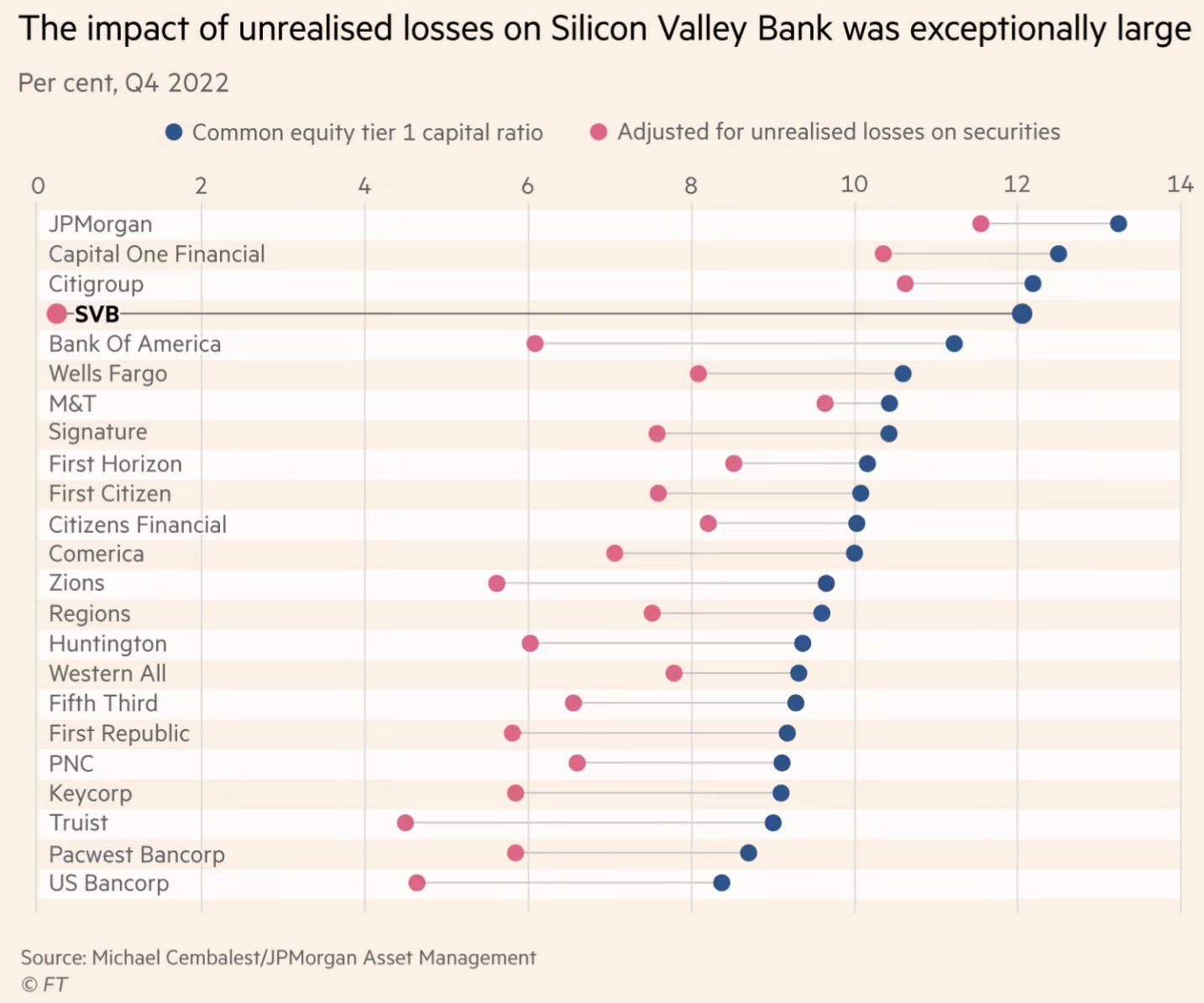

This isn’t a question of bank failures. The new lending program put together by the Fed and the Treasury department have negated that concern. This new program will allow banks the ability to borrow capital to offset their unrealized losses on their investment portfolio. That was the whole problem for Silicon Valley Bank. If this new program was in place at the time of their failure, they would not have failed.

Past performance is not indicative of future results.

The issue, then, is consumers confidence in banks. And banks confidence that consumers won’t suck their money out of their institution. This is primarily a problem for the non- “Too Big to Fail” (TBTF) banks.

There are five “TBTF” banks – defined as banks with more than $250 billion in assets. When concerned about the banking system, consumers often move their funds from non-TBTF banks into the big boys, convinced there is safety in size.

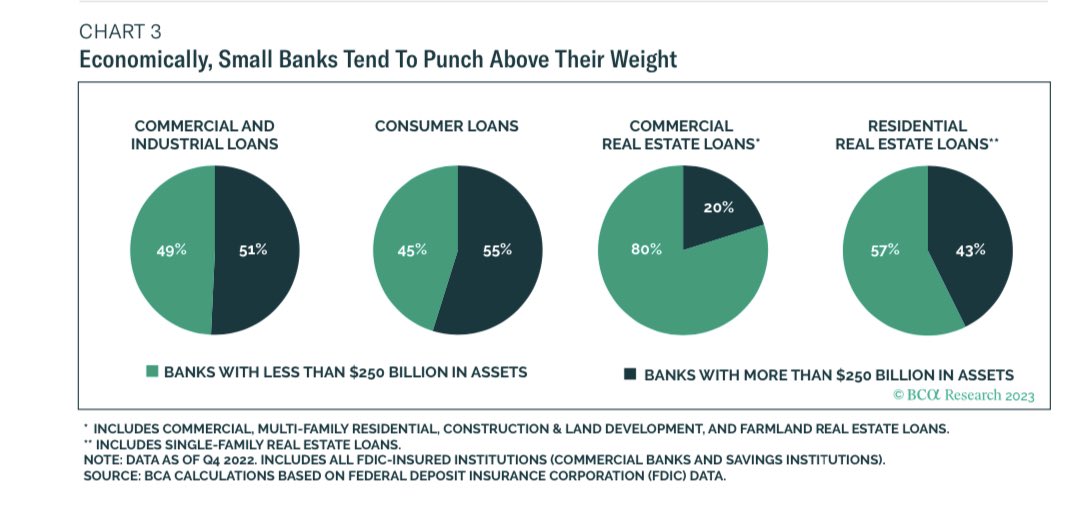

The problem is, while those banks are huge, the small banks tend to have a larger impact on economic growth. They are the banks that make the majority of commercial real estate loans and residential real estate loans. And they make nearly half of all commercial and consumer loans.

Past performance is not indicative of future results.

This is exactly what Powell is talking about when he mentions “tighter credit conditions”. If these small and mid-sized banks aren’t confident in their deposits, they’re much less likely to underwrite that loan for the purchase of a new building or new equipment which will allow a business to expand and add more jobs, growing the economy. If they stop lending, the economy comes screeching to a halt very quickly.

Which brings us to the confusion in Washington. Much has been discussed about raising the level of deposit insurance at banks. A move like this would stabilize deposits and reduce outflows from the non-TBTF banks that have such a dramatic impact on the economy. Powell danced around the issue a bit, but stated plainly that “depositors should assume that their deposits are safe.”

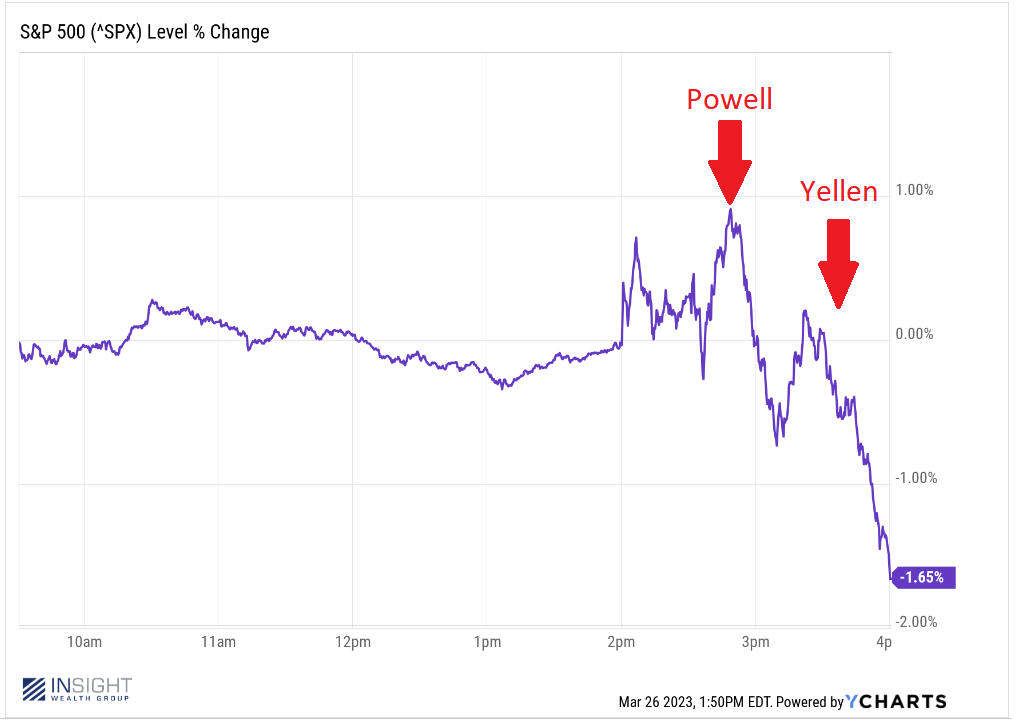

This was a big message to the market that there would be policy action to ensure this was true. The market popped when Powell said this. In fact, in terms of market performance, this was one of Powell’s best press conferences in a long time. The market loved what he said.

Then he stepped away from the podium. And his predecessor, and current Treasury Secretary, Janet Yellen took her turn in front of a different microphone at a Congressional hearing. And completely dismantled what he just said. According to her, there was no plan to protect depositors beyond the existing limit of $250,000. The market tanked.

Past performance is not indicative of future results.

Yellen quickly backtracked on her comments on Thursday. But the damage was done.

That leads us to this week. Will the Fed/Treasury do something to shore up consumers concerns about their deposits? Will deposits be insured at higher levels? Or will consumers move their money away from the regional banks and into the big boys?

If we get some level of confidence on deposits, this market may be poised for a run. Expect us to get more aggressive in portfolios.

But if it becomes clear these lenders are on their own and deposits will continue to flow out? Our recession odds just increased. We’ll look to get more defensive in portfolios.

This week matters – and may impact the direction of markets for the next several months. We’re on the cusp of getting over the proverbial hump, but we’re not there yet.

Sincerely,