The Weekly Insight Podcast – Stumbling Blocks: Student Debt

Market Update – Banks & Inflation

The market rebounded this week as the fear of a banking crisis eased. The news didn’t quite reach the “all clear” standard (that would have taken the Biden Administration raising the FDIC insurance limit), but flows out of banks – especially small banks – eased this week as consumers seemed to wrap their head around the idea that the issues at hand have remained isolated and not become part of a broader contagion.

We did see several articles this week talking about the idea of “practical” insolvency of banks (as opposed to “literal”). The authors have a point: due to rising interest rates, long-dated debt values have suffered substantially. That is a paper loss…until it isn’t. A run on a bank (much like Silicon Valley) forces the bank to sell that long-dated paper and realize a significant loss. That could be problematic for many banks – especially smaller banks – across the country.

But it’s important to remember what the Fed has already done in this regard. Quickly after the failure of Silicon Valley and Signature Banks, they announced the “Bank Term Lending Fund” (BTLF). This program is very specifically designed for the problems which sank these two banks. It allows banks to borrow money from the Fed to cover withdrawals instead of having to sell their underperforming securities. Banks now have a readily available source of liquidity if a run were to take place.

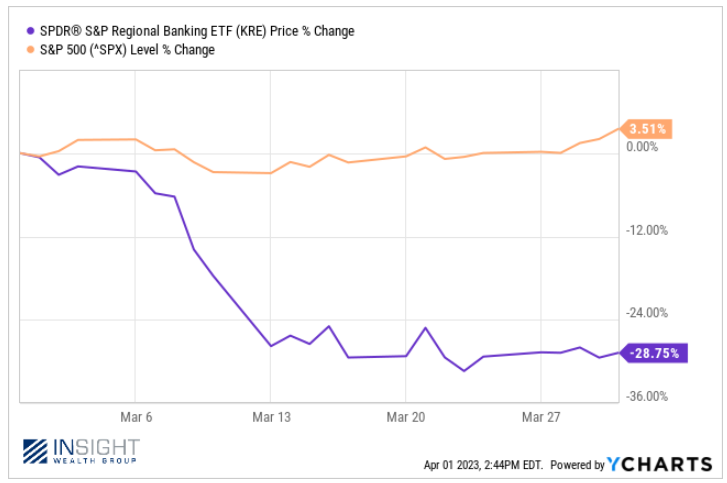

Is the problem gone? Probably not. In a week when the S&P was up 3.5%, the regional bank ETF (which is down 25% year-to-date), was flat. Certainly not a sign of continued weakness, but also not a sign of strong confidence for the future. This will be an item we’ll have to continue to watch.

Past performance is not indicative of future results.

While the banks had a negligible impact on the markets this week, the focus turned back to inflation and the overall economy. And yet again, the news was good, if not flashy.

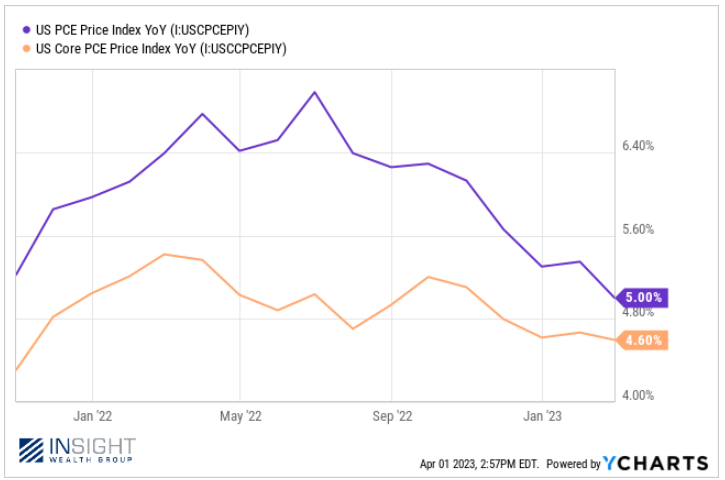

You’ll recall our comments on PCE vs. CPI over the last year. The debate remains open, but the Fed continues to call PCE their main measure of inflation (even if they haven’t been acting that way in recent months). February’s PCE data came out on Friday and the numbers were better than expected. Core PCE dropped to 4.6% (vs. 4.7% expected) and PCE dropped to 5.0% (vs. 5.1% expected). Those are the best numbers we’ve seen since October of 2021.

Past performance is not indicative of future results.

Nearly as important as the numbers themselves is what consumers are expecting for future inflation. We’ve heard Chairman Powell talk about this many times: if market participants expect inflation to climb, they change their habits. Producers stockpile goods and increase their prices. Consumers may stockpile cash. Keeping inflation expectations from getting out of hand is just as important as keeping inflation itself in check.

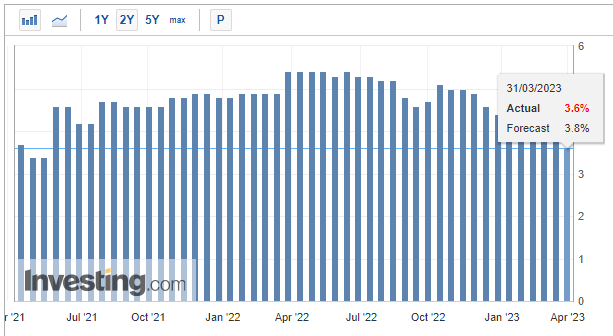

The University of Michigan does a monthly survey on these expectations. And the news on Friday was good. Respondents are now expecting inflation over the next 12 months to come in at 3.6%. That is the lowest number we’ve seen since May of 2021.

Past performance is not indicative of future results.

All of this leads to a majority opinion that Fed is done raising rates. While the expectation is now that they will hold at these levels through the end of the summer, a drop to 4.25% – 4.50% (down 0.50% from our current level) is expected by the end of the year. We’re moving in the right direction.

A Stumbling Block: Student Debt Wave Incoming

Part of our job is to think about what risks exist in the future. There is good news out there. Inflation is coming under control. The Fed will be done raising rates soon (if not already). And it doesn’t seem banks are going to start falling like dominos.

If those things are true, what are the future risks we should be concerned about? There’s one we’d like to highlight this week: student debt.

There is a valid conversation to be had about the cost of an education in America today and the availability of credit. The impact to the middle class over the long term has been…difficult. But that’s not the conversation for today.

Instead, we’re worried about what is lurking around the corner. Because, over the last three years, the vast majority of student debt payments have been put on hold. Borrowers haven’t had to make their payments. That’s about to change.

The Biden Administration announced that they were calling an end to the emergency declaration around the COVID-19 pandemic in May. That means loan payments are going to have to start up again. There is some fluidity around the “when” – but it will be no later than August 30th.

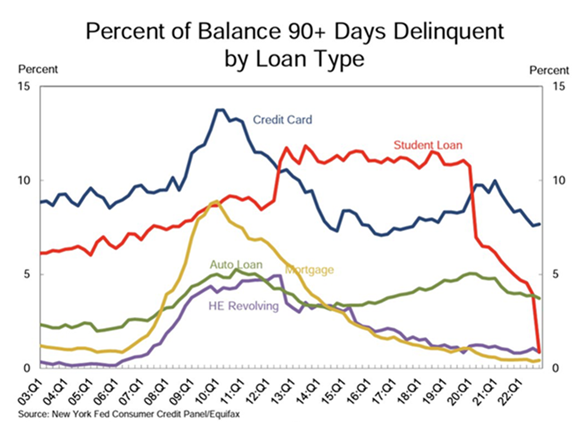

This will be a big change for a lot of Americans. You likely remember this chart we’ve shown many times about loan delinquencies today.

Past performance is not indicative of future results.

That chart is particularly good news. But it’s been undoubtedly helped by the fact that no payments were due on student loans.

The amount of student loan debt in forbearance is massive. Currently there is $1.75 trillion due in student loans held by 43 million borrowers. The average balance is just shy of $29,000 per borrower. And the average monthly payment is roughly $300 per month.

$300 per month for 43 million borrowers comes to $12.9 billion per month is student loan payments. That’s $154,800,000,000 over the next year that won’t be going to buy new shoes, or TVs, or dinners out, or vacations over the next twelve months. Or, roughly, 0.67% of GDP.

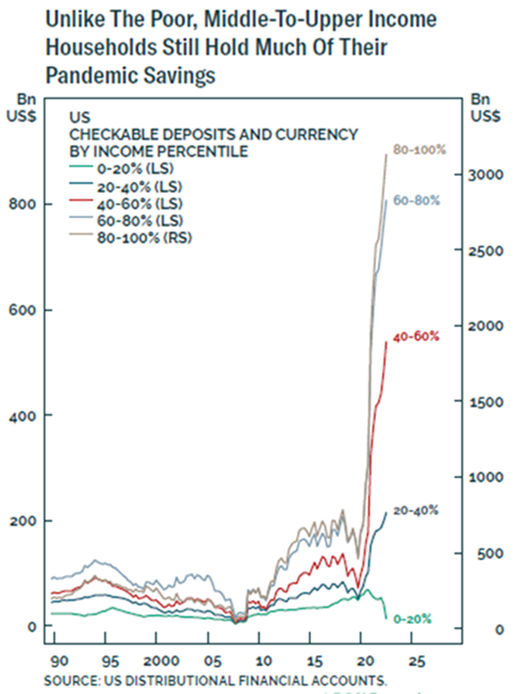

We’ve talked a lot about the cash consumers have in their bank accounts today. It’s an unreal number: nearly $5 trillion in checkable deposits and another nearly $5 trillion in money market accounts. That’s great news.

Past performance is not indicative of future results.

But if we assume the vast majority of student loan debt is held by those in the middle three quintiles of income earners, these new payments will chew it up quickly. There’s roughly $1.6 trillion held by that group in cash. One year of student loan payments will reduce that number by 10%.

This story isn’t finished yet. President Biden’s student loan forgiveness program is still going through the courts and will be decided sometime this summer. It’s still possible another extension gets handed out on forbearance. And there is certainly still enough cash in the system to soak up these payments initially. But it’s something that bears watching in the months and years to come.

Sincerely,