Well…there are a few things going on this week, huh? This is one of those times when world events will certainly take center stage and the numbers – what really drives the market over the long-term – takes a bit of a backseat. It seems like we’ve been writing some version of “once we get past the political mess…” for a while now, but we haven’t yet been able to climb out of that hole as a nation.

We pray for our nation that this week goes smoothly and without violence. That’s important for the markets, of course, but much more important for the health of our democracy. But in the end we always know that world events are outside of our control. Investors – and the market – are always reacting to outside stimulus. 9/11. The Great Recession. COVID-19. That’s just the last 20 years. You have been through many more than that in your lifetime. And you will go through many more over the rest of your time on Earth.

So, while we will always take these events into our calculations on what to do with portfolios, we also must be brave enough to pull ourselves away from the constant disaster click-bait and bring the focus back to what moves markets over the long-term. And that will always be math. So, this week, we are going to avoid the political muck and focus on what is happening in portfolios right now.

Earnings

It’s earnings season again. After all the speculation and bloviating, we get to see how companies we own in portfolios performed over the last three months. Performance, however, is always relative. As we have said many times before, you can have very bad performance that is considered a win – or very good performance that is considered a loss – if it exceeds or underperforms the expectations of the “analysts”.

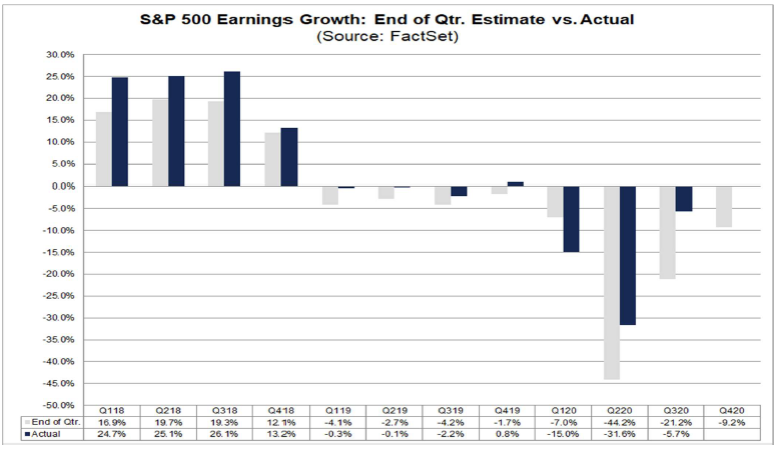

Take the chart below. As you will see, the grey bars are the analysts’ expectations for earnings growth and the blue bars are the actual earnings growth of the S&P 500 for the last 12 quarters. In every quarter but one – Q1 2020 – the analysts have underestimated the performance of the index. So, while the analysts are expecting a 6.8% decline in earnings for Q4 2020 vs. Q4 2019, if the market continues to outperform expectations as it has, it is very possible we see year-over-year earnings growth.

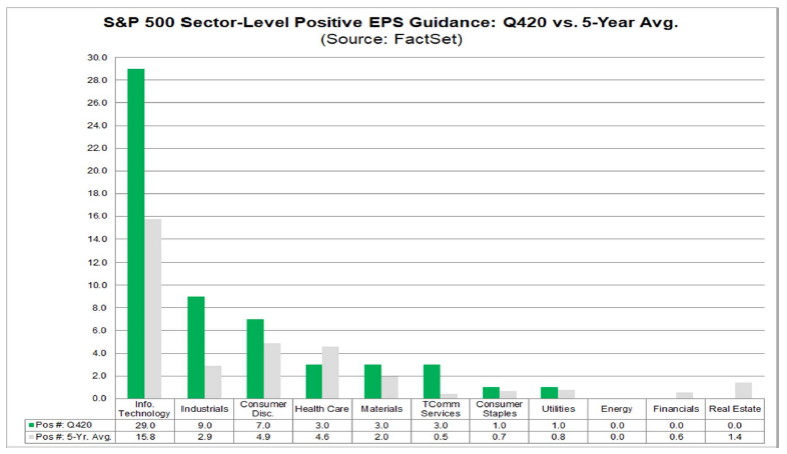

Maybe this is the one of the very few times analysts actually have it right. That’s possible. But it’s also noticeable that – when looking at companies that have provided earnings guidance for Q4 – we have a record number of companies issuing positive earnings guidance. And that applies to almost every sector.

Earnings season really kicked off late last week with the big banks. The results were largely positive. JP Morgan, Citigroup, and PNC Financial (all holdings in our Insight Dividend model) posted significant earnings surprises of 44.5%, 54.9% and 24.8% respectively. Only Wells Fargo among the big banks (also a Dividend model holding) had a negative surprise of -7.9%.

We will be watching this earnings season closely as we try to divine some guidance for the next 12 months. You will be hearing more from us on this topic over the next few weeks.

Energy Sector

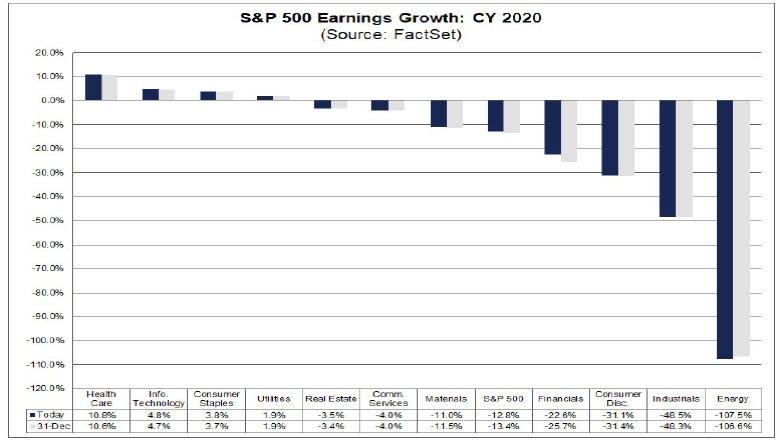

You have heard us hammer this issue home several times now, but it is notable as we get some additional data from the end of the year. Energy got pounded – more than any other sector – in 2020.

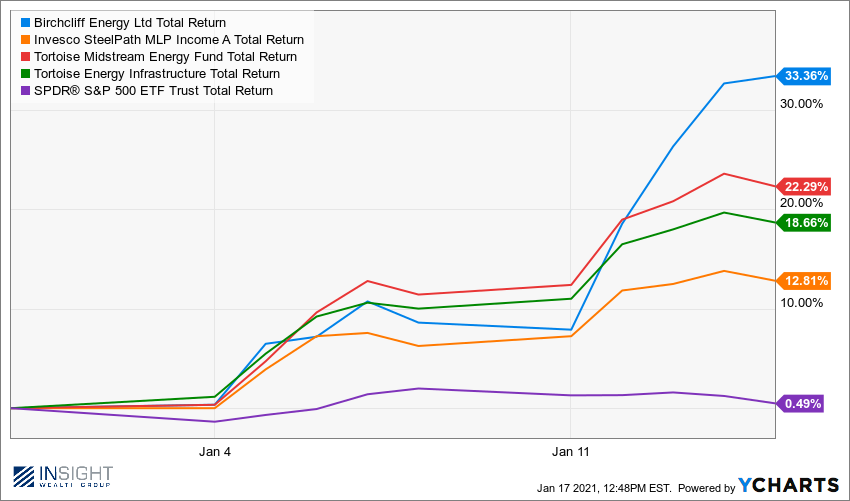

But as we head into the new year, energy has been on a bit of a tear. You can see below our top energy holdings vs. the market year-to-date.

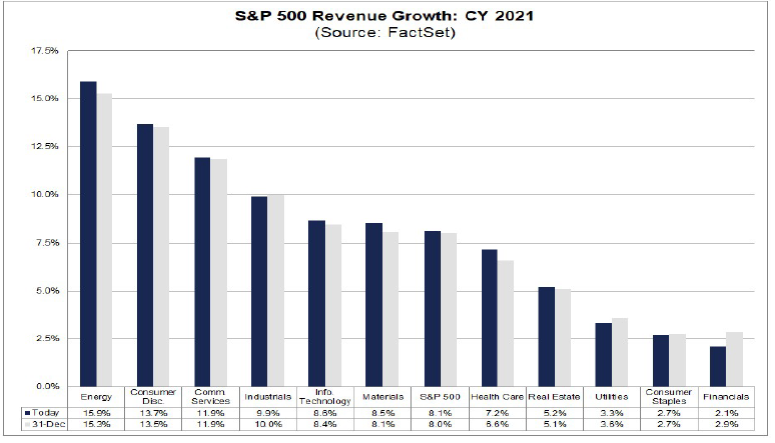

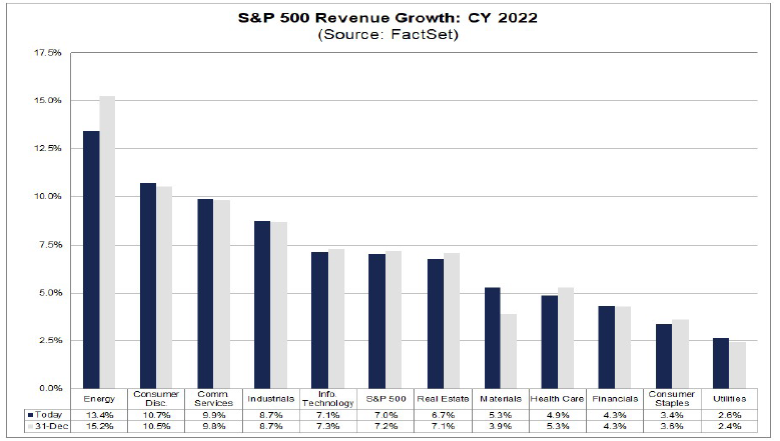

Why – when the Q4 numbers are expected to continue to be bad for energy – are these positions starting to accelerate? The market is finally figuring out that the next few years look very good for energy. As you can see from the two charts below, energy is expected to lead the pack in revenue growth for the next two calendar years.

Simply put – as the economy begins to recover from COVID-19 – energy has tremendous potential for portfolios. While it was certainly a drag on our portfolios in 2020, this is why we hung on.

Where is the Risk?

We have been talking for a while about all the things we anticipate driving the market as we move toward a COVID-19 recovery. But what are the things that can slow down the market as we move through 2021?

There are the obvious issues like continued political turmoil, slow vaccine delivery, etc. But in the end, it comes down to a simple set of numbers that are encompassed in this question: does the economic recovery match the expectations the market currently has?

Right now, the market is expecting the following:

- Q1 2021 earnings growth of 16.8%

- Q2 2021 earnings growth of 46.3%

- Calendar Year 2021 earnings growth of 22.5%

We have discussed the P/E ratio of the market many times in these pages. Today the P/E of the market remains in line with where it has been for the last several months, currently sitting at 22.4. As we have discussed before, this is moderately high by historical standards. But given the nominal yield in fixed income, a premium is usually given to equities. At this level, the S&P500 has an “earnings yield” of 4.46% which is substantially higher than anyone could expect to get in traditional fixed income markets.

So, the risk is simple: if the market underperforms the earnings expectations for 2021 laid out above, that means either the P/E of the market will have to jump, or the market will have to contract. As we stated earlier in this memo, these “earnings expectations” are historically conservative – but we will be watching closely for variability.

The Promise of America

We will wrap up this memo where we started. Much of what is happening in Washington and around the country right now is out of our – and your – control. But we would be remiss if we did not mention the beauty of this messy process. An author once described it this way: the history of man is essentially a tale of strong men ruling over the masses with threats of violence. Then, 244 years ago, we decided to try things a different way. Democracy is still a baby. And a relatively untested one at that.

Our way is not perfect. It’s messy. But we believe it is better than any other system mankind has figured out thus far. We hope and pray what we are going to see this week is the peaceful transfer of power we have been so admired for over the last two centuries. If that happens, we ought to remember just how remarkable that is – especially given the craziness of the last few months. What a testament to the system our Founders built for us!

Sincerely,