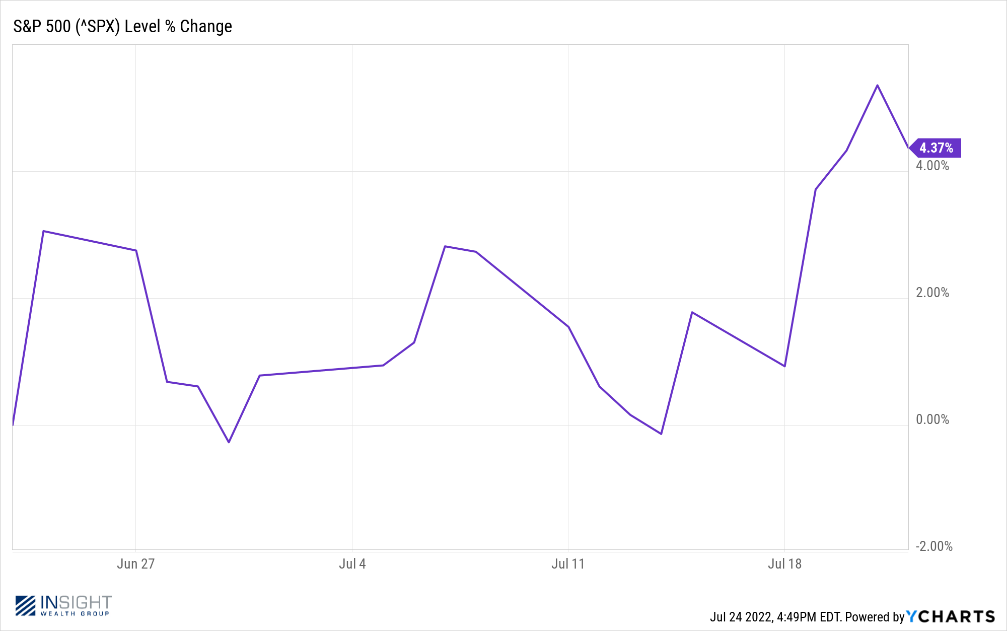

This is one of those “tweener” weeks for the Weekly Insight. Last week, we had the big inflation data and the start of the earnings season. Later this week, we get the big announcement from the Fed on interest rates. The market seems to be coming to an understanding of the current situation with interest rates and inflation, as the S&P 500 was up nicely last week is up 4.37% over the last month. We’d take that performance anytime – but especially during what can best be described as significant pessimism in the media and the public.

Past performance is not indicative of future results

The justification for the buoyancy in the market is, we believe, that the market is starting to believe some of the same things we’ve been saying to you: inflation is peaking, earnings – while weaker than we would love – are holding in well, and the path of the Fed is largely pre-ordained. Let’s look at each of these items as we wait for the Fed Chairman Powell’s pronouncement from the podium on Wednesday.

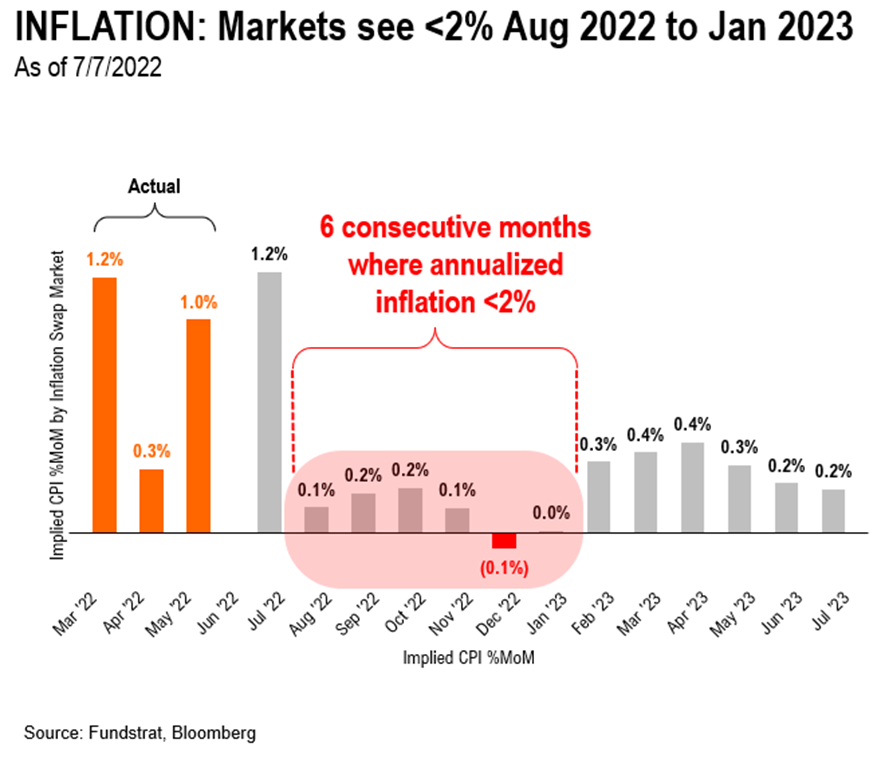

Inflation Is Peaking

We’ve talked a lot about this topic, so we won’t bore you to death with old data. The long and short of it is that Core CPI peaked in March and energy prices (the largest cause of non-Core inflation) have been moderating. You can see that simply by going to the gas pump. Last week we told you the average price for a gallon of gas in the U.S. was $4.54 a gallon. This week – according to AAA – it fell even further to $4.37. That’s down from a peak in June of over $5.00.

The current market expectation for inflation is stunning when you look at it. July may still not be a good report – but once we get to August, expectations fall off a cliff.

Past performance is not indicative of future results

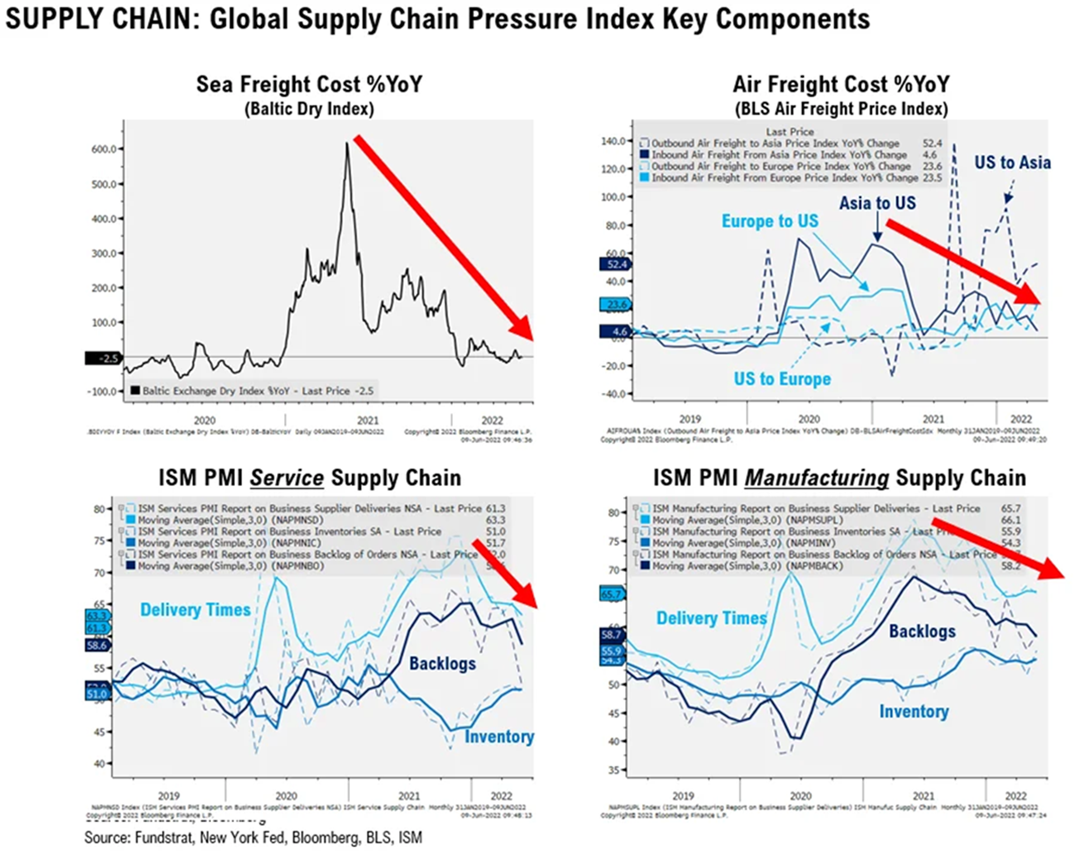

Why? Outside of energy, the biggest issue has been supply chain constraints. Those are easing across the board. Inventories are up and shipping costs are down (a sign of less stress on the system). The system is healing itself, even if gradually.

Past performance is not indicative of future results.

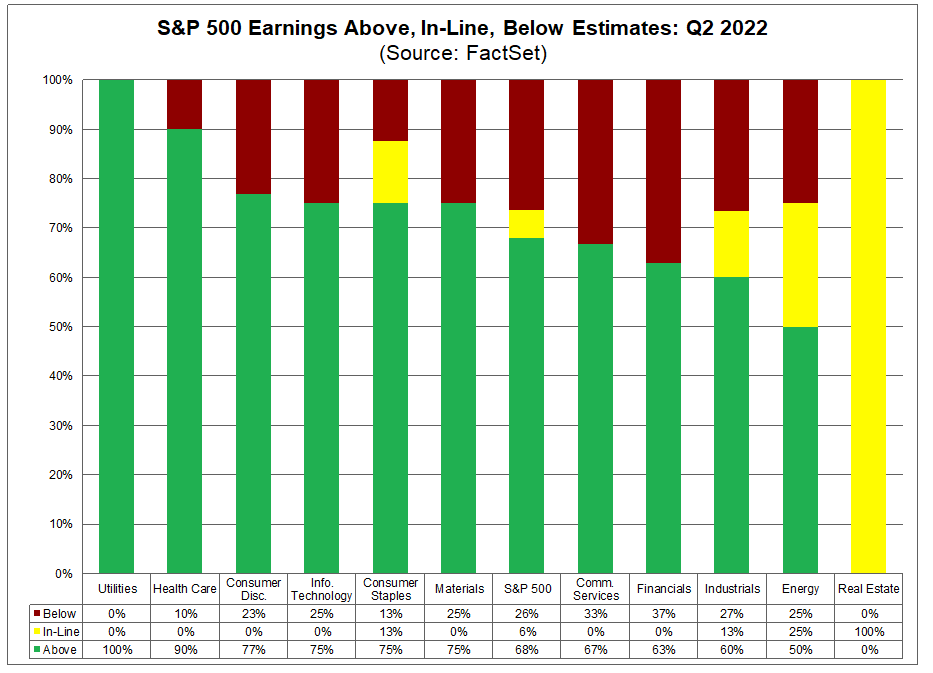

Earnings Are Solid (But Weaker Than We Would Love)

We came into the Q2 earnings season with significant downgrades in expectations from analysts. We’ve discussed in these pages before how that is typical but was more aggressive this quarter than normal. We now find ourselves with 21% of the S&P 500 companies reporting, and the results are positive. Fully 68% of companies have beaten their earnings expectation so far. The result is the earnings growth rate for the quarter has now risen to 4.8% for the quarter, up from 4.0% at the end of June.

Past performance is not indicative of future results

Once we piece all of this together, we see that analysts are still expecting 9.8% earnings growth for fiscal year 2022, which is higher than we saw at the beginning of the year. All at a time when the market is down nearly 17% and is currently trading at a forward P/E of 16.7, well below the five-year average of 18.6 and the 10-year average of 17.

The Path of the Fed

You’ll recall that expectations of what the Fed would do in June swung wildly after the May inflation data came out. At that time, we had just three trading days between the inflation data and the Fed pronouncement, and the Fed made clear (through anonymous sources) what they would be doing.

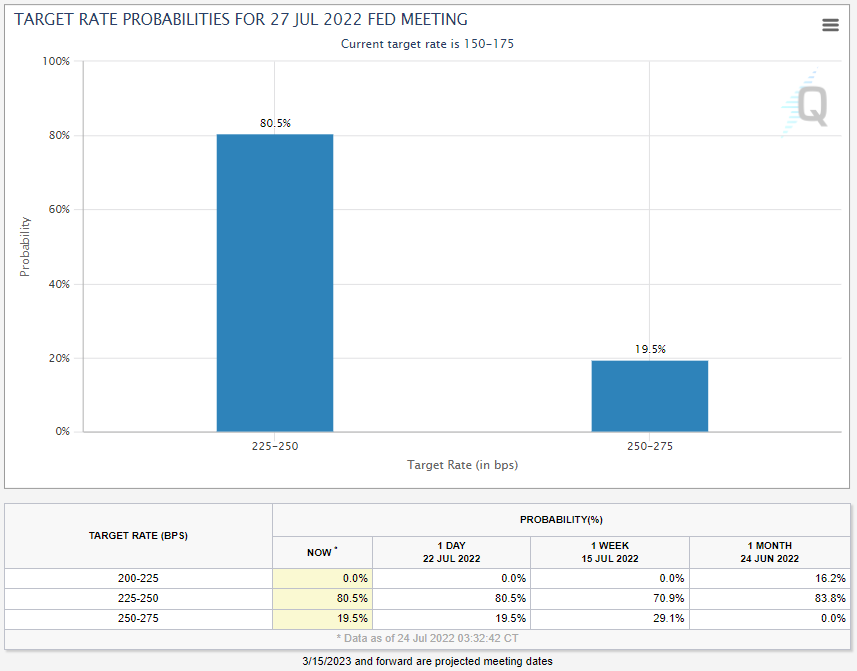

This month is different. There is a nearly two-week gap between the inflation data and the Fed release. The anonymous sources have largely been quiet. Despite a little volatility in the expectations after the inflation data came out, the market has settled into a fairly agreed upon position of the Fed’s actions: another 75-basis point increase. (You’ll note this is almost exactly where the market was 1-month ago as well.)

Source: CME Group; Past performance is not indicative of future results

There is one hiccup we should keep an eye on as Chairman Powell makes his announcement on Wednesday: there is not a Fed meeting in August. After the announcement Wednesday, we won’t hear from the Fed (officially) until September 21st. While they technically can do an “inter-meeting” rate hike, it’s nearly unheard of. Whatever the Fed announces Wednesday is going to stick for nearly two months.

There’s good news and bad news in that. The good is the market won’t have to deal with that drama for a while. The stage will be set, and they can act accordingly. Theoretically, if the inflation expectations we shared above are accurate, the next Fed meeting will come with a much better situation at hand.

But could that break also cause the Fed to be more aggressive? It’s hard to say, but we’d venture a guess that’s what the nearly 20% of people expecting a 100-basis point increase are thinking about. It’s something to watch.

In the meantime, we’re getting close to a significant buying opportunity. We’re not there yet, but once inflation peaks, the justification for a market down nearly 20% goes away very quickly. That’s the inflection point. We’re watching anxiously.

Sincerely,