The Weekly Insight Podcast – Goldilocks

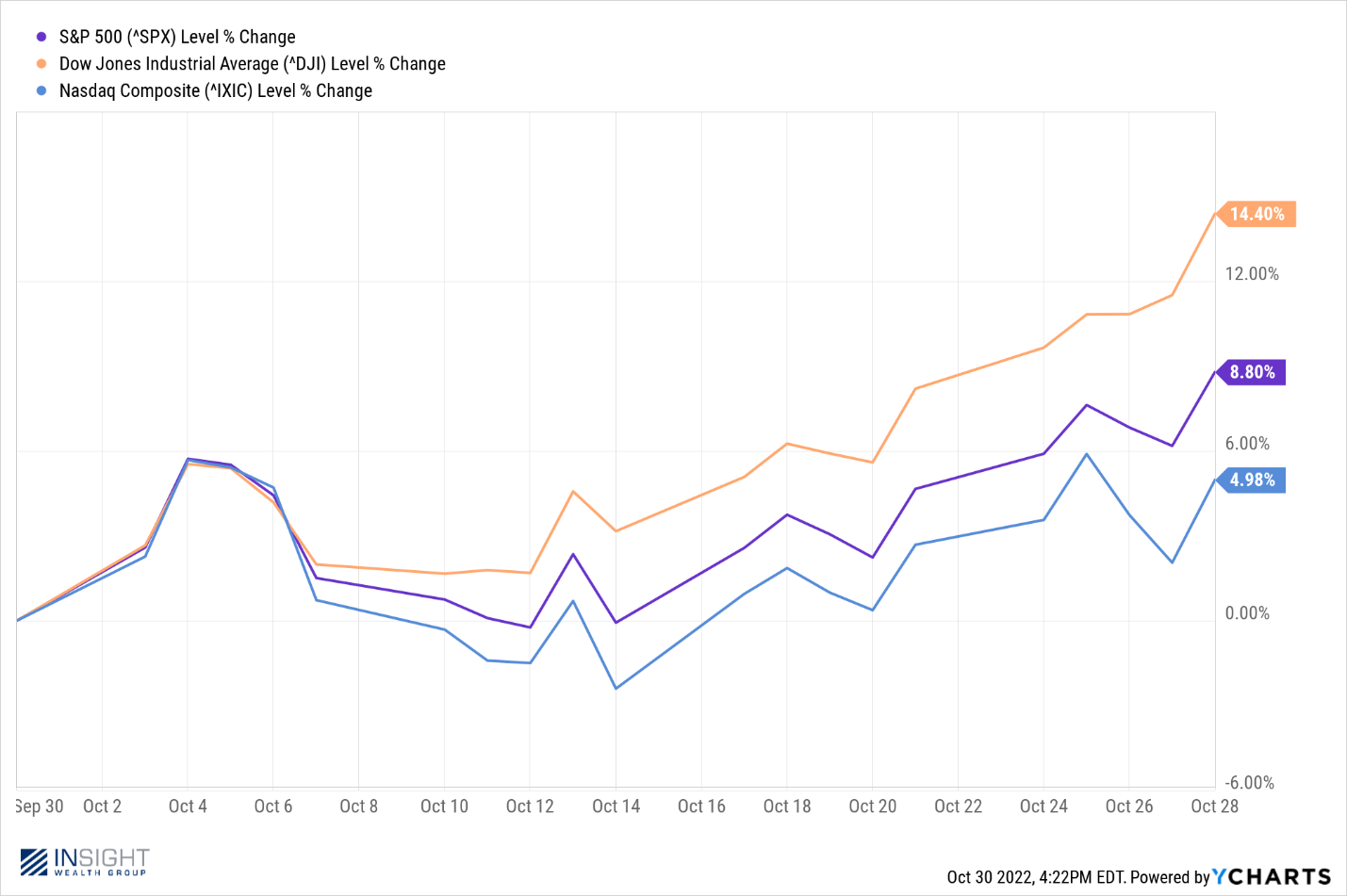

Happy Halloween! While we hope your evening is appropriately spooky, we would like to avoid that in the markets this week! Our good run continued last week, and the markets are now up substantively since the beginning of the quarter. In fact, if we don’t see a drop today, October may end as our best month of the year yet.

Past performance is not indicative of future results

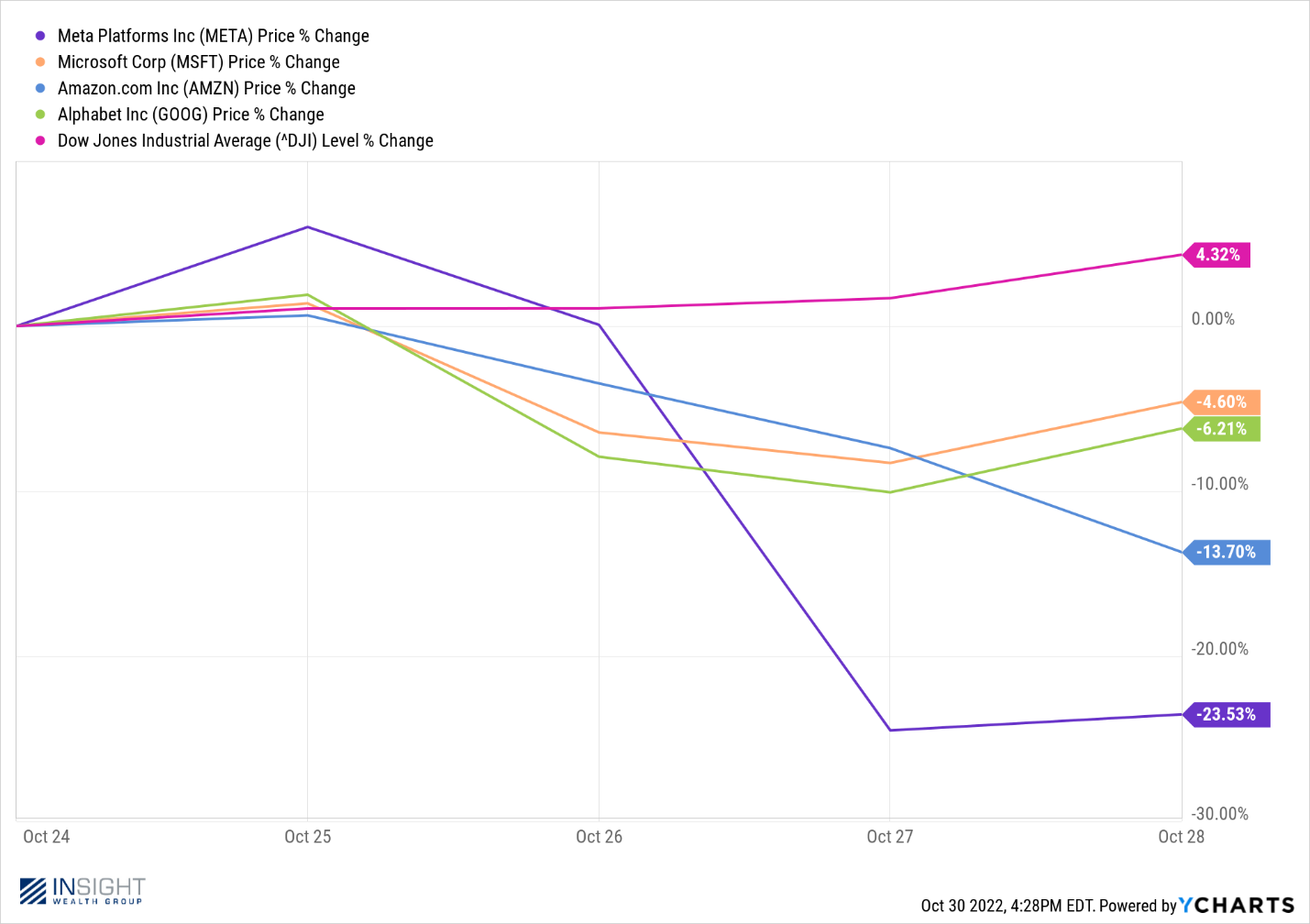

You will notice the wide disparity between the Dow and the NASDAQ. That is directly linked to the bloodbath in tech stocks this month. There was a massive spread last week between some of the biggest tech names that reported earnings and the Dow last week.

Past performance is not indicative of future results

The “why” is simple: the largest tech companies have been valued for the last several years not on their earnings, but instead on investors belief in their ability to grow exponentially.

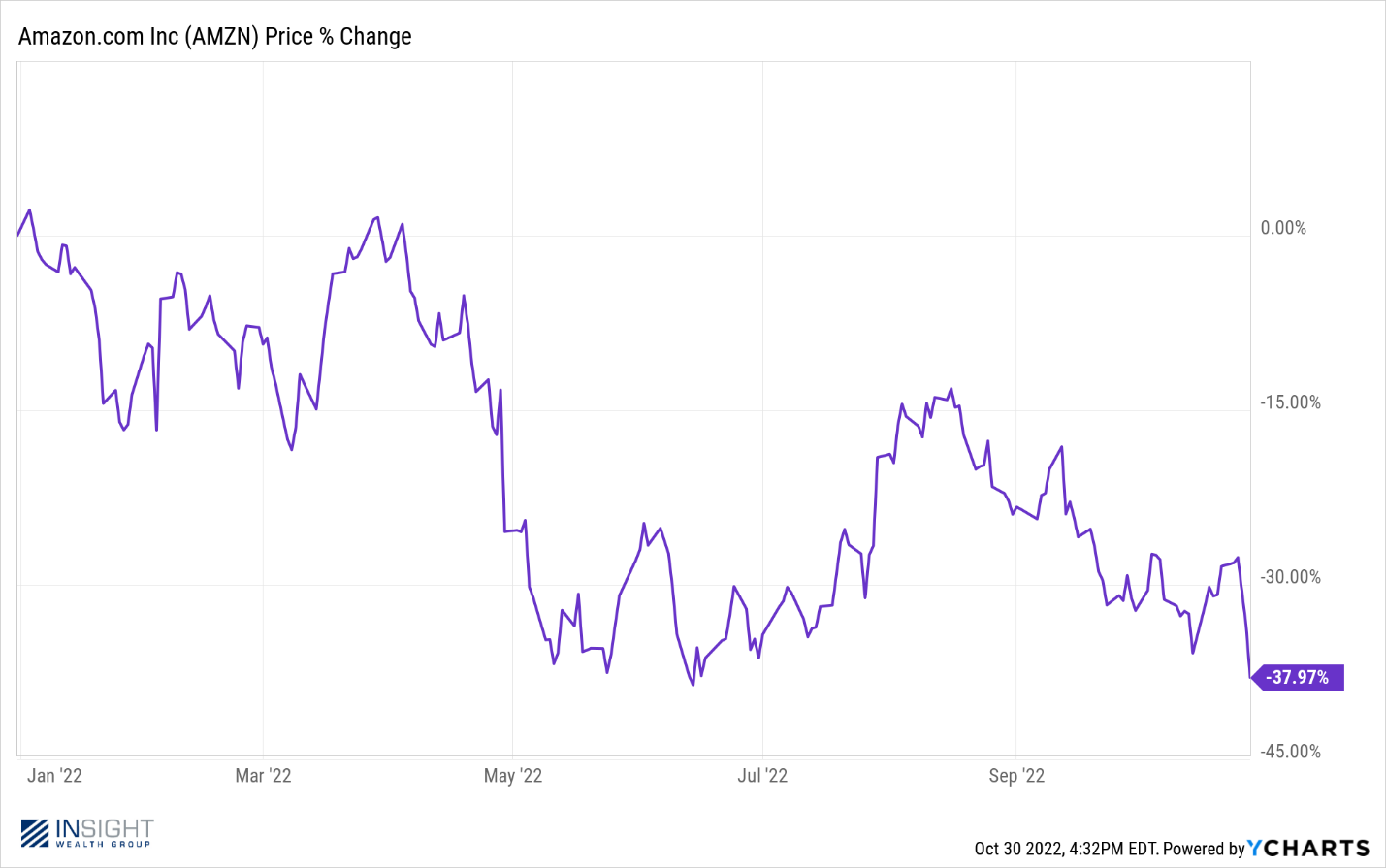

Amazon is an excellent example of this phenomenon. We all know it is a great – and profitable – company, but their earnings are starting to come back to earth. Q3 earnings came in down 34.6% from 2021. And Q4 earnings are expected to be down 70.4% from 2021 – despite the fact they are expected to be a positive $0.41/share.

So, the exponential growth phase is over – but the valuation is still notably high. Right now, Amazon is trading at a price to earnings ratio of 92.70. The broader market is at 17.03. It is no wonder the stock is down nearly 38% year-to-date.

Past performance is not indicative of future results

Whether that “exponential growth” path can be reasserted has a lot to do with what we are going to hear from the Fed this week. If it does not, expect high quality, dividend paying companies to outperform the tech companies. That would be good for Insight portfolios.

Too Hot? Too Cold? Just Right?

Years ago, your author’s mother and aunt dressed the cousins up as the Berenstain Bears for Halloween. While we can only hope those embarrassing pictures have been lost to history, it is a great metaphor for Jerome “Papa Bear” Powell and the Fed meeting this week. Will Goldilocks (the market) be happy with the porridge? Will it be too hot? Too cold?

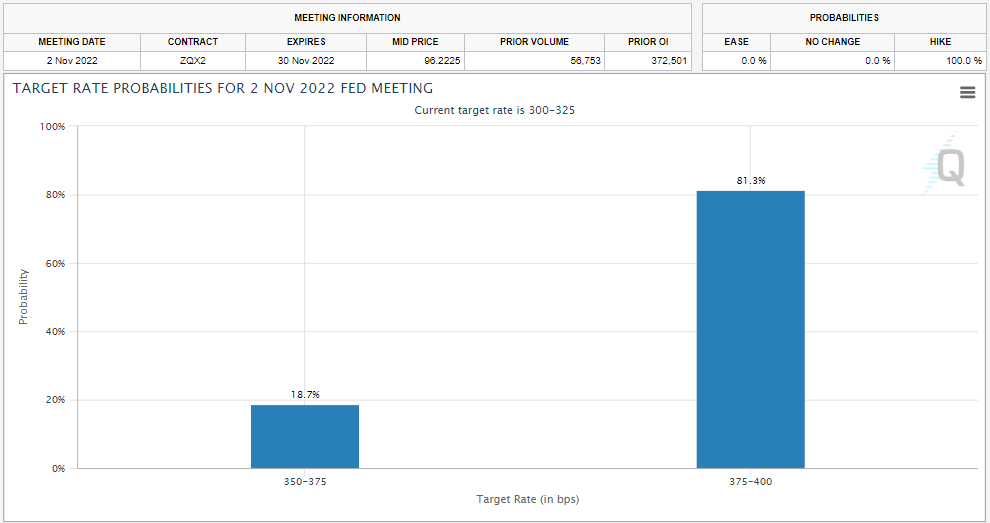

First, let’s look at what (we think) we know: the Fed is going to raise rates by seventy-five basis points this week. That’s what they said they would do last month. And it is also what the market assumes they are going to do. Even with the run up in the market, seventy-five basis points is already priced in.

Past performance is not indicative of future results

What really matters this week is not what the Fed does, but instead what Papa Bear says after the meeting. While we have said this before – and every Fed meeting has taken on an air of urgency this year – we think his comments this week are as important as any we have seen so far.

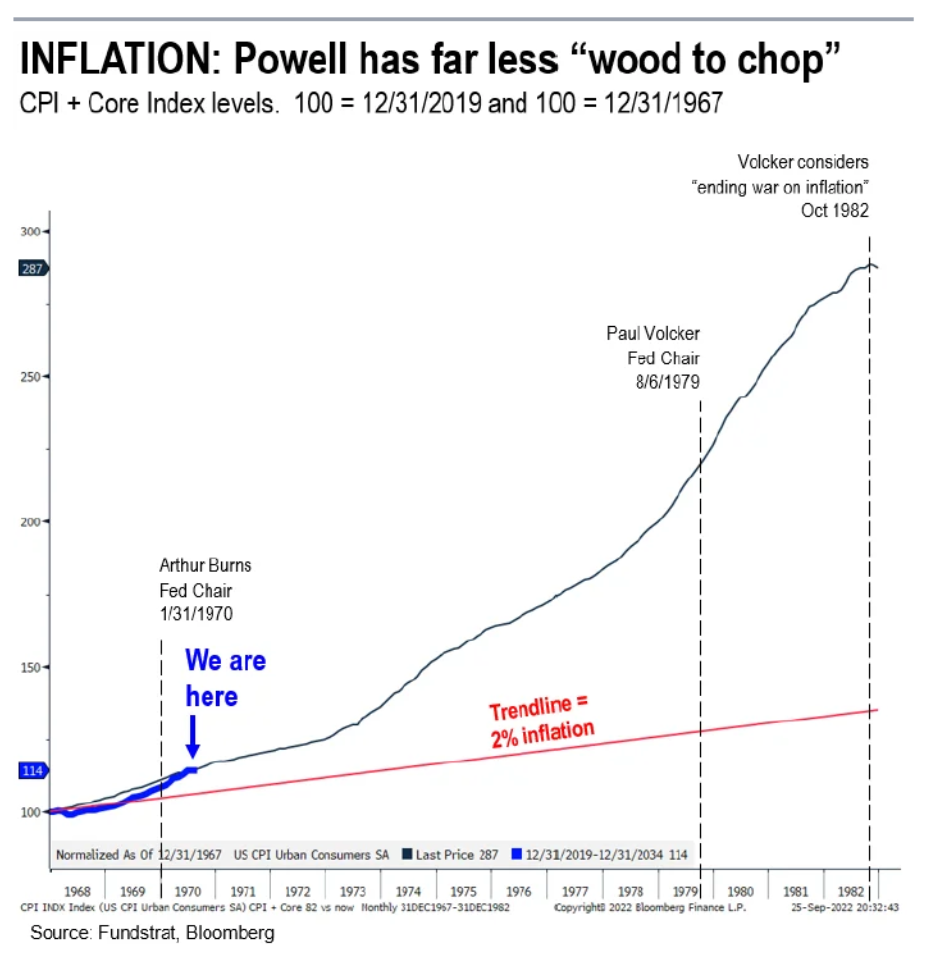

Why? Because we have reached a fork in the road. We know that Powell has taken an aggressive approach of late – including drawing direct comparisons between the current Fed path and that of Chairman Volcker in the early 1980s. But we must remember this is NOT the battle Volcker was fighting.

Past performance is not indicative of future results

And yet, with a 0.75% interest rate increase, the Fed will match Volcker for the fastest rise in rates in history.

As we have discussed for weeks, inflation is starting to correct. The fear right now is that the Fed is getting too far ahead of itself on interest rate policy. There is a longstanding belief that the economic effects of Fed policy take six to nine months to trickle through to the economy. If that is true, we are just now feeling the impact of the Fed’s March and May rate hikes! The economy still must swallow four 0.75% hikes.

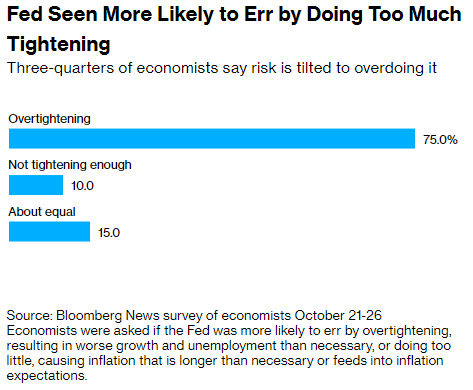

That’s why economists are starting to get nervous. The most recent Bloomberg survey of economists had a huge majority fearing the Fed is overtightening.

Past performance is not indicative of future results

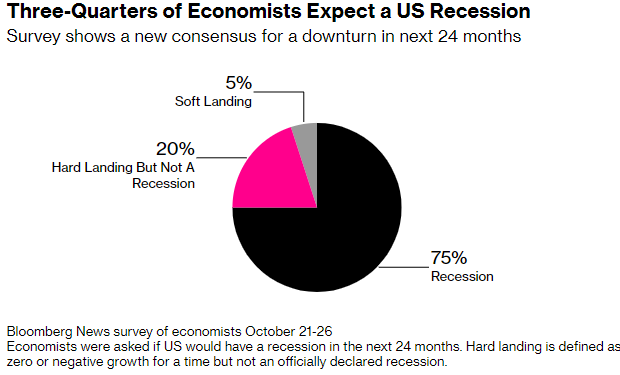

It is no surprise then, that the same economists are predicting a rough landing for the economy.

Past performance is not indicative of future results

So that brings us to Wednesday’s meeting. Will Powell continue his aggressive “inflation fighter” attitude? Or will he begin to message an easing of the rate hike process? The sustainability of the current rally depends on the latter.

Sincerely,