Somehow, for the last four months, the market and the economy have given us something to talk about every single week. When we started preparing this weekly market commentary, the plan was to continue them through the COVID-19 crisis and then get back to our normal course of business. Normal, however, seems to have changed in the last few months. As such, we are going to continue these weekly communications indefinitely. Some will be longer, some will be shorter, but our intent will always be the same: to make sure you have a good understanding of what the Insight Team is thinking as we work to manage your personal and business finances.

If one thing has proven true during the last four months, it’s that transparency and forthrightness has value. You are going to get it from us in these pages.

So, going forward, this will no longer be called our “COVID-19 Update Memo” – but instead “The Weekly Insight” (quite the play on words, huh?). If you are getting sick of us taking up space in your inbox, do not hesitate to let our office know and we can remove you from the distribution list for this memo. However, if you feel like this has some value, we would encourage you to share it with those who might also find it helpful.

Last week was one of those weeks which humble you as a student of the financial markets. First, the protests surrounding the murder of George Floyd were rocking the country. That should impact equity markets, right? Wrong. Then, what many expected would be a horrible May jobs report was supposed to come out on Friday. 7.5 million lost jobs were expected. The result? 2.5 million job gains!

The lesson from this is an important one both for us and our clients. We cannot possibly tell you what is going to happen in the next trading day, week, or month. The airwaves are clogged with people who will tell you, but the truth is they are all full of…ahem…gibberish.

Instead, our job – and yours if we are being frank – is to understand the big picture items which move markets, accept the trends they create and be willing to ride that wave until the next one comes along. Some waves are great (i.e. 2012 – 2019), some not some much (i.e. pretty much anything and everything that has happened in 2020!).

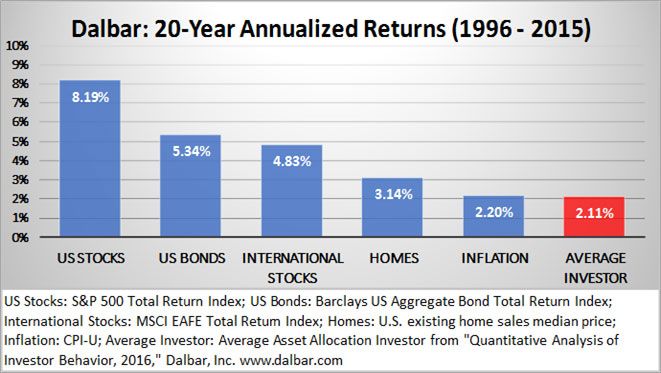

You have heard us talk a lot in the past about the emotions that guide investment decisions by so many investors – both individuals and institutions. One study our long-time clients may remember us citing is the Dalbar Study of Investor Behavior. This is an ongoing study that has been run over the last 25 years and measures the results of the market vs. the results of actual investors. The results are astounding.

Past Performance is not indicative of future results

That is shocking data. Not only does the average investor underperform the U.S. stock market and bond market. They underperform inflation! The average U.S. investor would quite literally not get much worse returns if they stuck their money in a box and buried it in the backyard.

Dalbar has spent a lot of time trying to understand this phenomenon. But the answer they found 25 years ago continues to be the same answer they find today. The average investor buys at the wrong time (i.e. GREED) and sells at the wrong time (i.e. FEAR). We can only imagine the same thing happened in March for countless investors across the country.

We are certainly not emotionally immune to the fear and greed cycle any more than you. As you may recall, we did a fairly sizable rebalance of portfolios less than two weeks ago – right before unrest erupted in cities across the country. We can promise you, as we watched cities wracked with both justified protest and violence, we were wondering if we had just screwed up by initiating that action. But, instead of letting fear take over and working to reverse those trades first thing last Monday, we instead went back to the big picture fundamentals. Thank God we did, because we would have missed out on a tremendous week in the markets.

So, what are the big picture items that are moving the market today? There are four in our mind: Interest rate policy, fiscal and monetary stimulus, employment, and the market looking forward. Let’s take a lap through each.

Interest Rate Policy

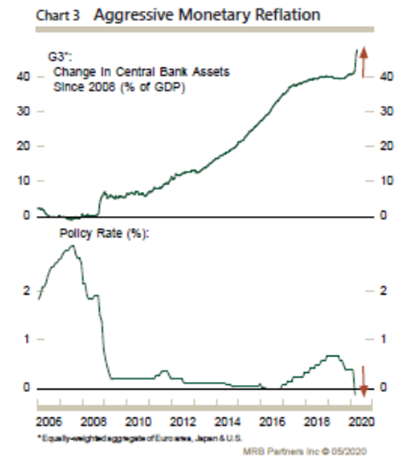

No one can doubt that central banks across the world have taken COVID-19 seriously. And none more than the U.S. Federal Reserve. Interest rates are basically at zero again. Reserve requirements have been lifted. The balance sheet is has expanded nearly 3x more rapidly than it did in 2008. They are not messing around.

Past Performance is not indicative of future results

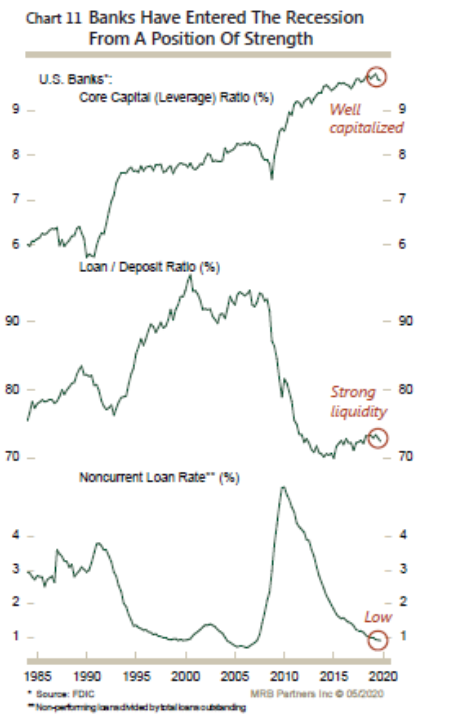

That solves the biggest problem we had in 2008 – the question of liquidity. We do not have that today. In fact, banks entered this crisis from a position of strength unseen in earlier financial crisis periods.

Past Performance is not indicative of future results

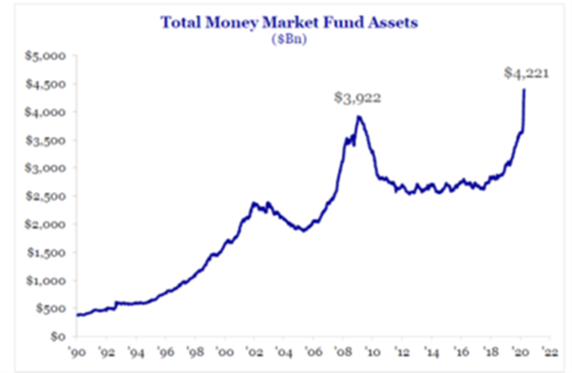

Which leaves us with two insights. First – equity markets love interest rate environments like this. And that is good news for the future. As much as we have seen a spike in equity market valuations, the market reaction has been largely happening in very few names and there is still a tremendous amount of money on the sidelines. Money market fund assets today are higher than they were even at the worst of 2008.

Past Performance is not indicative of future results

Second, the bond market continues to be an unresolved issue and some area of it may remain that way for some time. Ironically, the area with the most perceived “safety” may end up being the area where we must be the most cautious.

There will be – however – some very nice opportunities. For example, we have talked to you extensively about our positions in “structured notes”. These notes – at least the ones we use – typically have their interest rate calculated on the spread between the 30-year treasury and the 2-year treasury. That spread has skyrocketed since this began – going from 0.12% to 0.90% since the start of the year. That is an area of the bond market which may make our clients very happy in the coming months.

Fiscal Policy

We’ve talked about this before – but as we lean toward the next big COVID-19 support package from Congress – expected to be worth well more than $1 trillion – we can’t ignore the impact this has on a crisis like the one we’re facing.

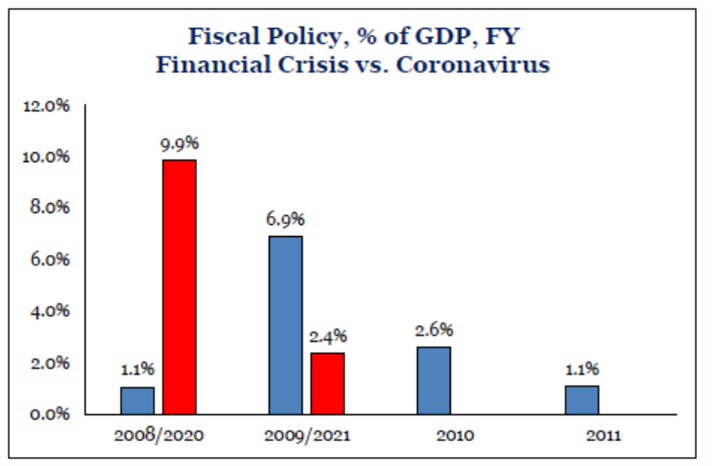

First, the speed with which Congress has authorized fiscal spending is unprecedented. As you can see from the chart below, they have stepped on the gas much more quickly than they did in 2008.

Past Performance is not indicative of future results

But it is the size of the response that continues to stand out to us. If you combine the fiscal policy from Congress ($3 trillion+) with the bond buying from the Federal Reserve ($6 trillion+), you get to – roughly – $10 trillion dollars thrown at the existing problem.

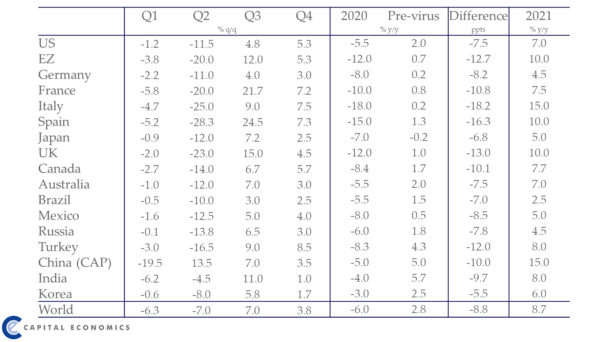

Next the question is how big is the problem? Current consensus GDP estimates put the problem, for all of 2020, at roughly minus 5.5% in the United States.

Past Performance is not indicative of future results

But let us take the pessimistic view. The worst decile for GDP predictions average at – today – a roughly 10% contraction in GDP. Our gross domestic product – prior to COVID – was roughly $21 trillion. A 10% loss in GDP would be a $2.1 trillion hole that needs to be filled. Between fiscal and monetary policy, we will have filled that hole. And then filled it nearly four more times. In fact, no other country has come even close to the kind of money thrown at this problem.

Throwing money at a problem is not always the right idea. But it does give the markets – and us – confidence we will have the liquidity and safety net necessary to get to the other side.

Employment

What can we even say about this week’s unemployment report? It was tremendously good news. It also showed just how bad the “experts” can be when it comes to forecasting news like this.

In the end, though, things have gotten so bad on the employment front that you do not need to have a huge surprise like this for the market to succeed. Instead it is about beating expectations – and this week’s report certainly did that. It will be important to continue to watch for success – or slips – on this front.

Market Looking Forward

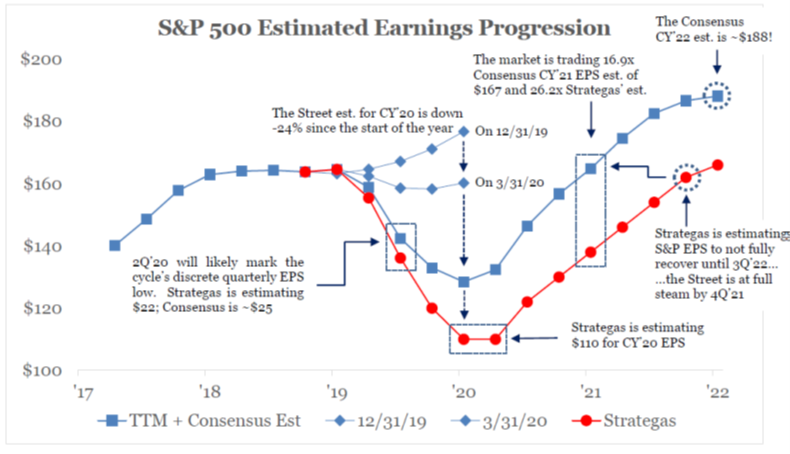

We must understand market sentiment as well as hard economic data to better understand how the market is reacting to any recession, let alone one caused by a nationwide pandemic. Just because you understand the sentiment does not mean you have to agree with it. In fact, it is fair to say we are not sold on either the red or blue lines from the chart below from Strategas. But the important one to note is the blue line as it is showing what the consensus estimates are for earnings over the next two years.

Past Performance is not indicative of future results

Right now, the market consensus is that earnings will drop 24% for 2020 overall. That is probably pretty close to accurate, although we will know a lot more after Q2 earnings hit in July.

But more importantly, the market is pricing in – right now – that by Q4 2021, we will have essentially fully recovered and be back to Q4 2019 earnings. For example, as Jamie Dimon mentioned this morning, banks are having to reserve more and bake in excess losses beyond what even they think may happen. As he said, this may lead to a “fairly rapid recovery”. The market realizes this is happening. If that continues to be the expectation you can expect this market will continue to motor along.

PPP Update

We mentioned in last week’s memo we were expecting some additional direction on PPP loans that businesses received at the start of the crisis. If you currently have one of these loans, please note that the Senate passed a House bill this week which extends the forgiveness period from 8 weeks to 24 weeks and lowers the amount that must be spent on payroll from 75% to 60%.

This should be very beneficial to companies who hold these loans. We would highly recommend checking with your banker and/or your CPA before processing a loan forgiveness application. As we stated in our memo last week, our team at Insight CPA has been helping dozens of companies with this process and stands ready to assist if you need help.

That’s all for this week. As always, we hope you are staying healthy and safe. It continues to be an honor to work with such a tremendous group of clients through this crisis and we look forward to continuing to serve you. If you need anything – please let us know!

Sincerely,