We have spent a lot of time over the last 18 weeks writing memos about what is going wrong with the world. COVID-19, riots, looting, Presidential elections. You name it, 2020 has offered it. And we did not even provide any commentary on the “Murder Hornets” that have shown up in the Pacific Northwest! It seems 2020 has a goal of being a year to remember.

Surely a great deal of our job is to understand the “bad” in this world and do our best to defend against it in your portfolio. But that is not the only thing for which you rely on Insight Wealth Group. Another big part of our job is to understand the opportunities years like this provide. Our clients, wisely, hung in there through this process. The reward – in our opinion – are assets you can buy at tremendous prices and which can set up portfolios for years to come.

So, this week – we are sticking to the positive. No “daily new infection” rates, no discussion of jobless claims, etc. We will certainly get back to that in weeks to come – but let us talk today about the exciting things this tragic time has brought to the fore.

Equity Market Recovery

We all know the equity markets have recovered quickly since they bottomed on March 23rd. The recovery has been – quite simply – remarkable. That type of move would lead many to believe there is no more “juice” left in the market. There may be some truth to that, as fears of a Second Wave continue to cause concern amongst equity market analysts. But it is important to understand what is driving markets today because while the broader market has largely recovered its losses, once you lift the hood you see a much different story.

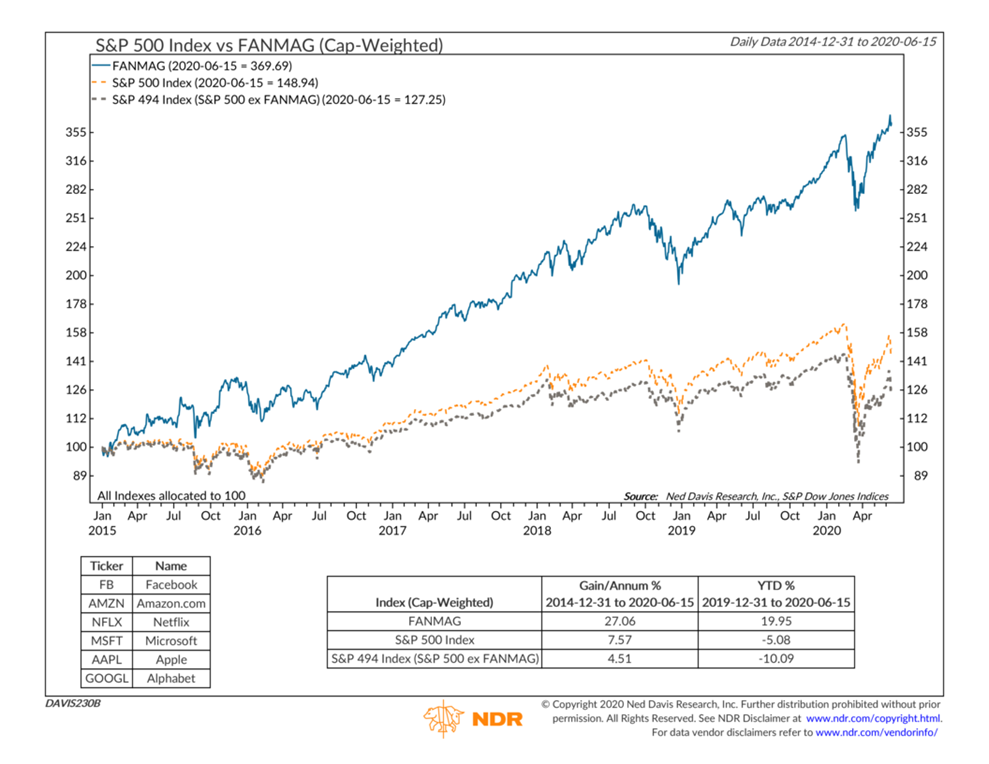

Longtime readers of ours will recognize the phrase “FAANGs”. It stands for Facebook, Amazon, Apple, Netflix, and Google. We are going to add one more to the mix today for this analysis: Microsoft. The new term: FANMAGs. What can we say…we love a good acronym.

As you have heard us say for years, the FAANGs – and the FANMAGs – have had an outsized impact on the overall market. Frankly, it has been a concern of ours for a long time. It started, broadly, with the IPO for Facebook in 2014 and has continued unabated since then. But the impact has never been clearer than in this recovery.

As the chart below shows, the FANMAGs have made up a massive piece of the stock market’s performance for a long time now. Without them, the performance of the S&P 500 over the last 5 ½ years drops by more than 3% and comes in at a well below normal 4.51% per year. But even more startling – through June 15th – the other 494 companies in the S&P 500 are still down 10.09% year-to-date.

Past performance is not indicative of future results

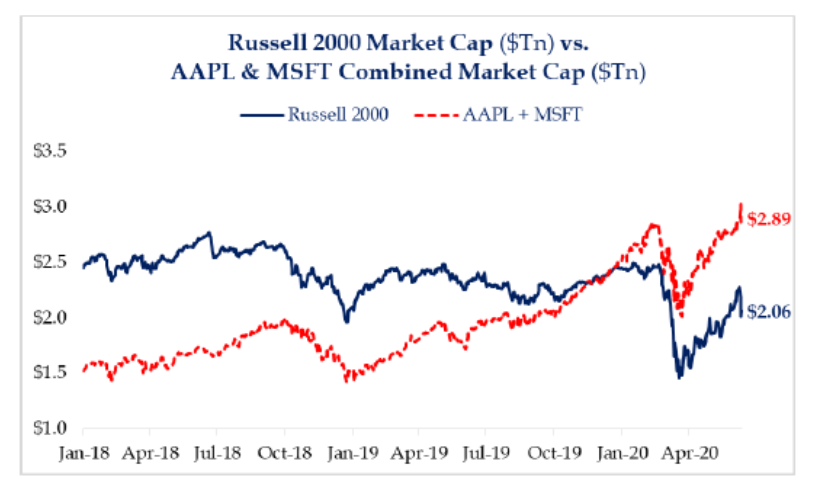

Even more startling, when you look at the market cap of just two companies – Apple and Microsoft – they now have a significantly larger market cap ($2.89 trillion) than the entire Russell 2000 Index ($2.06 trillion)

Past performance is not indicative of future results

So, Insight, you promised us positive news this week, you say? Here it is: When the so-called experts talk about the market being overheated, or all the opportunities in this market being gone, remember they are only talking about six companies! There is still substantial room for growth in the rest of the market – especially in small-cap, mid-cap, and international stocks. We added to those positions a few weeks ago and continue to believe they can be a catalyst for growth going forward – even if we do have a few more hiccups.

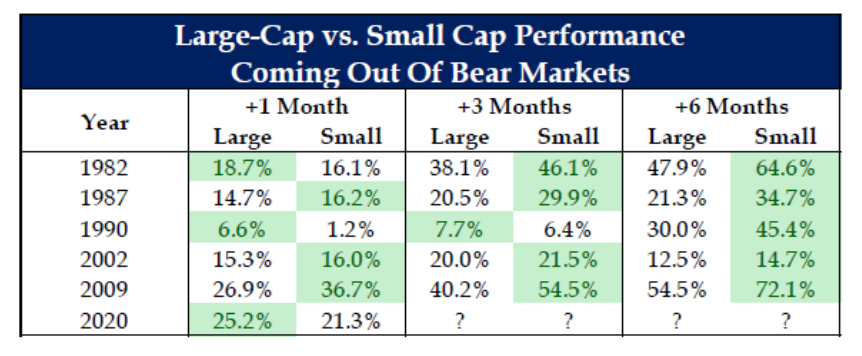

As you can see from the chart below comparing large-cap and small-cap stocks, large-cap has historically led the charge out of a bear market. But it is the small-cap (and we would argue mid-cap) that may start slower but end up outperforming over the next 3-month and 6-month periods.

Past performance is not indicative of future results

Fixed Income Opportunities

We have spent a lot of time in these pages talking about fixed income, but largely that discussion has centered on individual bonds (i.e. our structured note offerings) we believe have good qualities in times like these. We have not spent a lot of time discussing the broader bond market in depth.

This week we are going to do that, and we are going to specifically talk about the High Yield Bond sector. For those of you unfamiliar, High Yield Bonds are bonds that have a higher yield than investment grade bonds. As such, they have what is considered to be a higher rate of defaults and thus are deemed to be “riskier” than buying the bond of a well-capitalized company.

While that is true, how you buy high yield – like any other asset class – will determine your level of success. What we are seeing today is very similar to what we saw back in 2015/2016. High yield “spreads” (i.e. the excess yield you get from buying a high yield bond today vs. the historical average) remain substantially higher than normal (1.6% higher to be precise). That is caused by the surge in expected defaults – which undoubtedly may happen. But, compared to other crisis, it does not take into account the work the Federal Reserve is beginning to do buying corporate debt.

As such, there is an opening here. That opening is certainly not without risk, but the risk is largely already priced into the market. Much like when we started buying mortgage backed securities coming out of the 2008 Financial Crisis, doing the same with high yield debt – in conjunction with an extremely well qualified manager – could yield significant potential.

The chart below is very hard to read – but we wanted you to see it as it impacts our thinking significantly – both in our existing holdings and as we look for additional tools. What it says is this: when high yield spreads cross 800 basis points (left chart) or 900 basis points (right chart) the opportunity over the coming 1 – 5 years is, frankly, staggeringly good. The 1-year average return lands between 25.5% and 34.7%. The 5-year average return lands between 13.6% and 15.3%. Per year. In bonds!

Past performance is not indicative of future results

High yield spreads maxed out earlier this year at more than 900 bps and remain extremely elevated despite the surge in equity markets. We have had the pleasure of working with well-seasoned high yield management groups who understand these dynamics. Because of that, we added to our high yield positions in our last rebalance and are actively looking for more opportunities.

Federal Policy Response

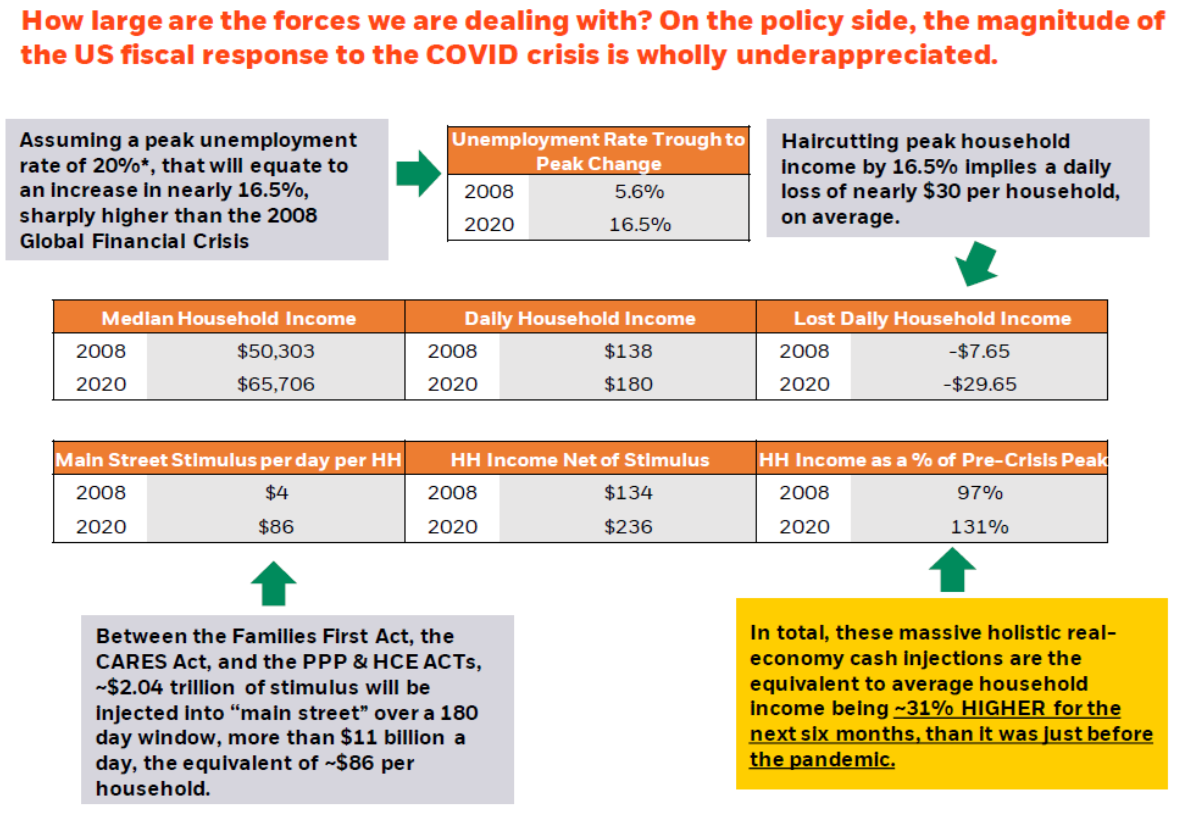

We have talked a lot about the policy response from Congress and the Fed in these pages. But we saw the chart below this week and – in our effort to look at the positive forces we are seeing in the world today – thought it was extremely compelling.

The chart compares the policy response during the 2008 crisis with the COVID-19 crisis and its impact on daily household incomes in the United States. Using the projected 16.5% unemployment rates for FY 2020, it is calculated that the loss in daily household income is $29.65 per day (assuming the median household income of $65,706). The fiscal stimulus alone (that coming from Congress) equates to an $86/day/household bump meaning daily household income will be 31% higher in 2020 than it was pre-crisis.

Obviously, this will not hit every household the same. But when we consider that consumer spending is the fuel that drives this economy, it is a very good sign.

Happy (Belated) Fathers’ Day!

While there are many dads at Insight – this is not even really about the dads. Instead it is about family. As some of us were sitting at a Fathers’ Day dinner over the weekend, we were discussing the impact of COVID on our society. As we were all commiserating, a very enlightened comment was made: While the health and economic impacts are scary, we cannot forget the cultural impact. And, while it has not all been good, this crisis has resulted in families spending more time together than we have seen in decades. That is undoubtedly good news!

We are incredibly grateful for the time we have been able to spend with our kids, spouses, and parents through this process. We hope you have been able to do the same. That time is invaluable, and we may never have a time quite like this again.

Sincerely,