The Weekly Insight Podcast – Doom

Last week was the 82nd anniversary of the Japanese attack on Pearl Harbor. Their audacious attempt to crush America’s Pacific Fleet awakened a sleeping economic giant. In just four years, the United States and its allies created the most ferocious war machine ever created. And they also created the platform for long-term economic growth and prosperity the likes of which the world had never seen.

But the war brought us a new set of problems – highlighted by the weapon that ended the war – the atomic bomb. If you enjoyed this summer’s blockbuster movie Oppenheimer, you know the invention of nuclear weapons was both a peak of American ingenuity and a clarion call for the new risk the world now faced.

It was just two years later that Albert Einstein and a group of scientists concerned about the risks of nuclear weapons started the Bulletin of the Atomic Scientists. You probably haven’t heard of the group. But you’ve heard of their most famous product: The Doomsday Clock. It is held out to the world as a “scientific assessment” of how close the world is to Armageddon. Originally it was focused on nuclear Armageddon. They have since expanded it to include climate change and “disruptive technologies”.

The Bulletin is led by a board with credentials that are amazing. Nine Nobel laureates. Professors in mathematics, physics, chemistry, etc. from the world’s top universities. Top scientists from government and the corporate world. These people are no slouches.

And, according to them, the Doomsday Clock today is set at 90 seconds to midnight. That is worse than 1949 when the Soviets tested their first atomic bomb (3 minutes). It’s worse than when the U.S. introduced the hydrogen bomb (2 minutes). It’s a lot worse than 1962 – during the Cuban Missile Crisis – when the Doomsday Clock was set at seven minutes to midnight. In fact, according to these esteemed scientists, the world has never been closer to Armageddon than it is right now.

Really? This is the most dangerous time? Let’s look at a few things that have happened statistically between 1947 (the start of the Bulletin) and today.

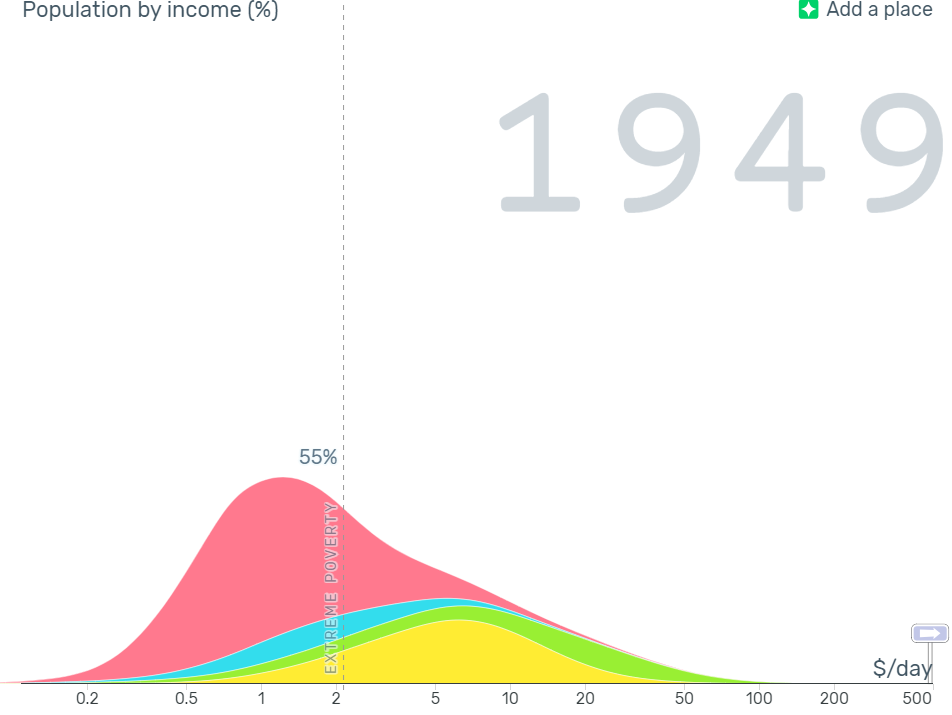

In 1947, 55% of the world’s population lived in “extreme poverty”.

Source: Gapminder.org

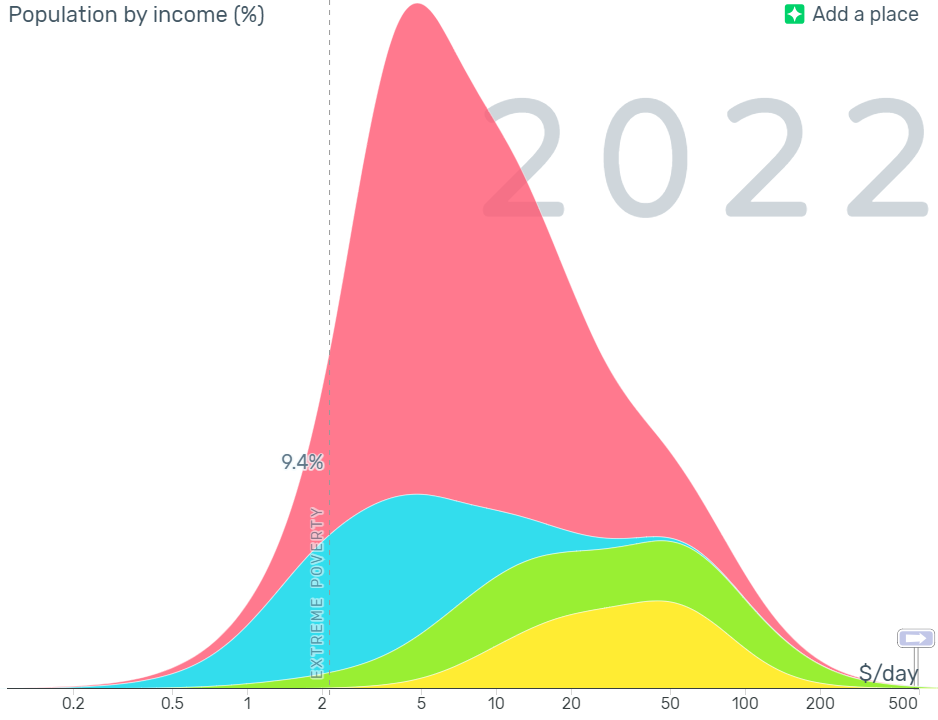

By 2022, that number was just 9.4%.

Source: Gapminder

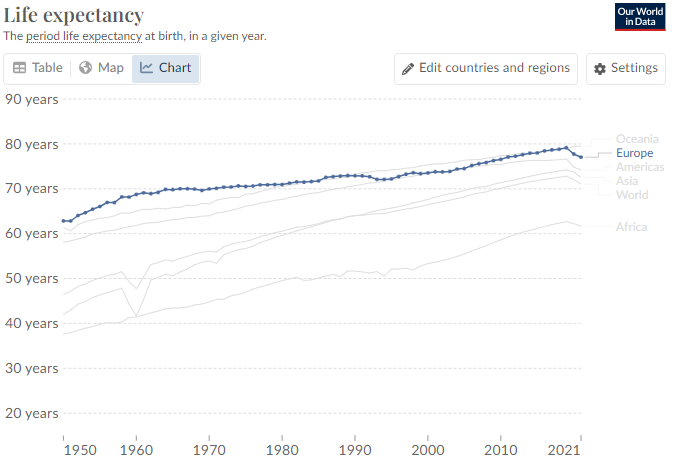

Life expectancy is another interesting statistic. Worldwide, life expectancy in 1950 was 46.5 years. Today it is – even after a drop from COVID – 71.0 years. People are living nearly 25 years longer today than they were when the Doomsday Clock came out.

Source: OurWorldinData.org

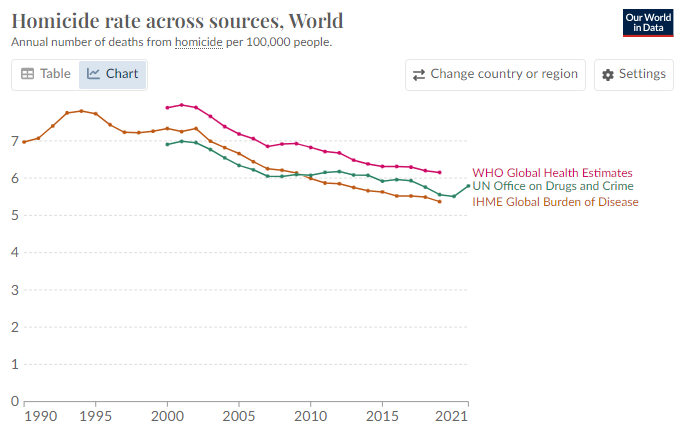

But surely the world is a more violent and scary place, right? Nope. Good homicide data is hard to come by prior to 2000, but in just the last 23 years the world homicide rate has fallen 20% no matter what data set you use.

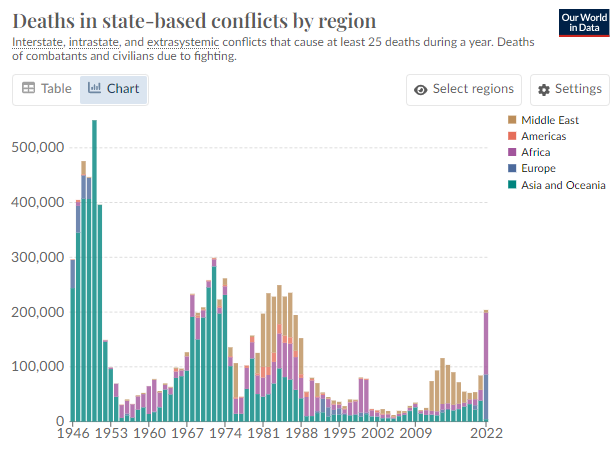

Even after a particularly war torn year in 2022 (thanks to both the Ukraine war and violence in Africa), the number of deaths from armed conflicts last year was less than half what it was in the late 1940s.

Source: OurWorldInData.org

So, what, in the safer and more prosperous world, does this have to do with investing? Why does any of this matter to your portfolio? One word: fear.

Even the smartest scientists in the world can succumb to fear. And by doing so, they lose perspective. When looking back and asking the question “Are we safer today than when the U.S. and the U.S.S.R. nearly started a global nuclear war?” we can gain a bit of perspective. Obviously, we are.

The same goes for the markets. We’ve been living with the specter of “recession” hanging over our heads ever since the Fed started raising rates in early 2022. Nearly every big brained economist in the world has been saying “a recession is coming in the next six months” for the last two years. And yet, it isn’t here.

Will it come? Of course. We have had a recession, on average, every 6.4 years since 1953. We’re always going to have a recession. And while we had one in 2020, that wasn’t really a classic recession. It was caused by a specific, non-economic reason: COVID. We haven’t had a true recession since 2008 – 2009, more than 14 years ago!

Which brings up our last point: the Great Recession of 2008 should not be our barometer for what the next recession might look like! It was not normal!

Are you ready for a wild statistic? The average recession in the United States since 1950 lasted ten months. The average market return during that time? POSITIVE 1%! Even in more recent times, the average market return of the last four recessions, dating back to 1990, was negative 8.8%. That math includes the 2008 recession when the market fell 40.67%.

Are we saying we should all be pollyannish? Or that we should ignore signs of economic struggle? Of course not. But we can’t paralyze ourselves with fear either. Imagine the market returns we would have missed if we had run for shelter over the past few years. Cautious optimism is an important trait in investors.

And the dirty little secret? The next recession, like all those before it, will be a tremendous opportunity to create wealth for those who stick it out.

Sincerely,