The Weekly Insight Podcast – Bond Bust

There’s been a story the financial services industry has been telling investors for many years. It’s one that’s meant to convey safety and confidence. It’s one that countless investors have bought into to build “secure retirements”. And it’s one that just hasn’t been true for a long, long time. It’s the story of bonds. And it can all be seen in one simple chart.

Past performance is not indicative of future results.

Over 20 years the ETF tracking the U.S. Aggregate Bond Index is down 8.10%. 20 years! Even at its peak, in 2020, the ETF averaged just over 1% per year for 17 years. Bonds haven’t worked for a long, long time. Equities have been the only game in town for the better part of a generation.

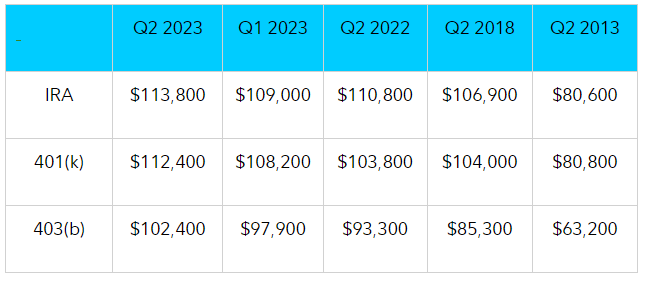

That hasn’t necessarily been horrible news. We’ve experienced a period of easy money that has generated unprecedented wealth in our country. One need only look at what cheap mortgage rates did to allow people to grow wealth in home equity. And it has had a significant impact on retirement savings. The growth in retirement plan balances over the last decade is substantial.

Source: Fidelity

Past performance is not indicative of future results.

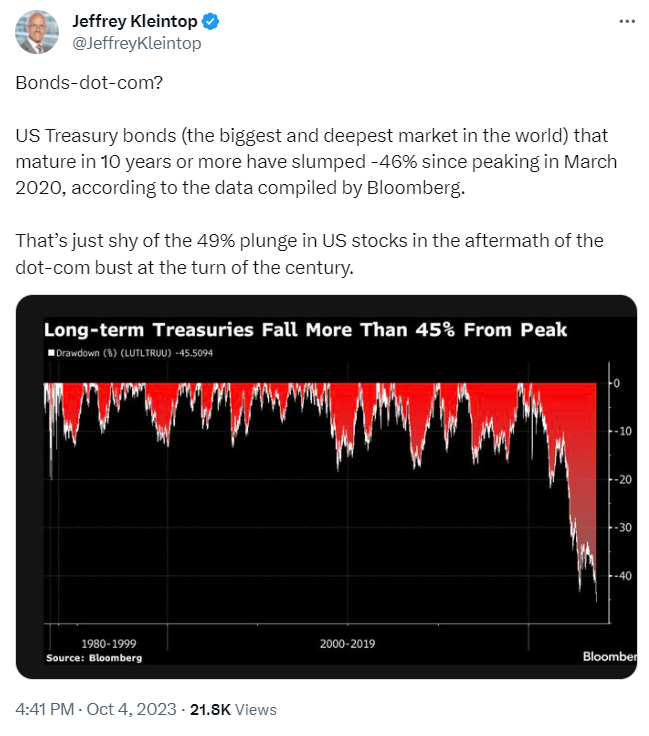

But the amount of wealth lost by retirees as they looked to “get more conservative” by switching into bonds is significant as well. And those losses are being magnified right now, especially last week. Charles Schwab strategist Jeffrey Kleintop noted as much in a Tweet (X?) last week:

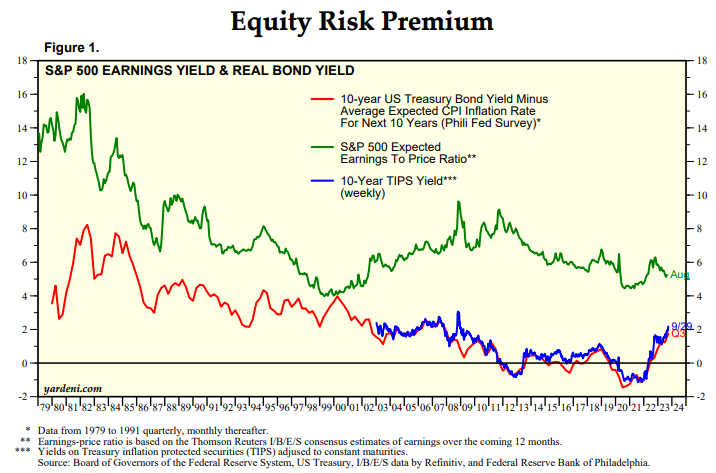

This also has an impact on equities. One of the things we look at regularly is the “equity risk premium” (ERP). The ERP is a measurement of equity earnings minus the 10-year treasury yield. That number skyrocketed after 2008 when we got into the period of “easy money”. Low interest rates and profitable companies meant there was a lot more value in equities than investors could find in bonds. You were being paid very well for the risk of equities.

Today? That spread is narrowing rapidly. There is still a premium for equities – unlike during the dot-com bubble when the spread went to zero. But it’s narrowing quickly.

Source: Yardeni Research

Past performance is not indicative of future results.

Here’s the problem with markets, though. Once a trend starts, the assumption becomes that it’s going to continue unabated…forever. Easy money from 2008 to 2021? No one thought it would ever end. Higher interest rates from the Fed today? Same.

But that’s never actually true. And while we can’t tell you when rates are going to come back down, they undoubtedly will. And when that happens? The value of 10-year treasuries yielding 4.78% (Friday’s close) will skyrocket. Bond investments may look dicey in the short term, but long-term the potential upside is significant. That’s why our clients will continue to see us play in this space in portfolios.

World Events Still Matter

The U.S. is the “Hulk” of economies. U.S. consumer spending, all by itself, is larger than the GDP of any other country in the world. Our GDP per capita is 56% higher than the next highest ranked G20 country (Germany). Our GDP in 2023 (expected to be nearly $27 trillion) is the same size as the #3 – #11 ranked countries…combined.

So, it shouldn’t be surprising that we tend to get wrapped up in what is happening inside our borders. But this weekend, we got an excellent reminder that what is happening outside our borders is equally important. Our global economy is so interconnected that an event halfway around the world can ripple to our shores very quickly.

That brings us to the Hamas attack on Israel. Will it impact our economy directly? Not really. In 2021, we exported just $12.8 billion in goods to Israel and imported just $18.7 billion. That’s a blip to our economy.

But the impact on the region may be massive. Israel was getting close to a peace deal with the Saudis. That is going to get backburnered immediately. Hamas is a proxy for Iran, so that will also ramp up tensions between Tehran and the world. And all of this will impact the region’s #1 export: oil.

Oil futures peaked in September at $94/barrel. By Friday that number had fallen more than 13% to $81.28. Demand was fading and supply increasing. An article on OilPrice.com Friday deemed the idea that we would get to $100 oil “firmly out of reach”.

That was good news for our ongoing battle against inflation. You’ll recall that “all-items” inflation has risen over the last two months (from 3% to 3.7%) almost entirely on the back of rising oil prices. CPI expectations for this week’s report (coming out on Thursday) have that number retreating to 3.6% on the back of falling oil prices. $80 oil would accelerate that process.

But wars in the Middle East have a funny way of driving up oil prices. The current thinking is this won’t have much of an immediate impact since Israel is not a significant oil producer. But how will Israel respond? It’s hard to imagine they won’t hold Iran at least partially responsible for the now more than 700 Israeli citizens who were killed in the attacks. And will the other Arab countries in the Middle East pick a side?

As of the writing of this memo, oil futures are up, but not dramatically. This is going to be a big one to watch in the coming days and weeks. Rising oil means rising inflation. Rising inflation means higher interest rates for longer. We may be the “Hulk”, but these things can – and do – impact our economy.

Sincerely,