The Weekly Insight Podcast – A Position to Proceed Carefully

Editor’s Note: There will be no Weekly Insight or Weekly Insight Podcast the week of October 2nd. We’ll be back in action on Monday, October 9th!

Well…we did our best. You’ll note the last several editions of the Weekly Insight have said little or nothing about the Federal Reserve or Jerome Powell or inflation or interest rates. We’re as sick of talking about it as you are of reading about it!

But last week was Fed Week and – as usual – what the Fed said and did was the biggest story in the markets. And the impact of their comments over the coming months will continue to drive results. So, it’s time to dig back in to “Fed Speak” and see what we can discover.

S.E.P. Time

Four times each year – in March, June, September, and December – the Fed releases the Statement of Economic Projections (SEP) after their meeting. The SEP is famous for the “dot plot” which market participants scour for insights into what is going to happen with interest rates.

We’ll get to the “dot plot” in a second. There is plenty of other meat in the SEP worth looking at first. That comes directly from the first page of the report where they show their “median” outlook in comparison with the report they presented the previous quarter.

Past performance is not indicative of future results.

There weren’t a lot of wild swings in the data, but there are a few things to note:

- Their baseline for GDP is the most dramatic change – with 2023 GDP more than doubling to 2.1% and 2024 rising to 1.5%. The Fed is more bullish on the economy.

- Their unemployment expectations dropped as well. Not only do they expect sub-4% unemployment in 2023, but the peak of unemployment dropped to 4.1%. That’s well below the long-term average of 5.71% we’ve seen since World War II.

- They’re anticipating Core PCE (their preferred inflation measurement) to drop further this year than they previously anticipated. The estimates are down to 3.7% from 3.9%.

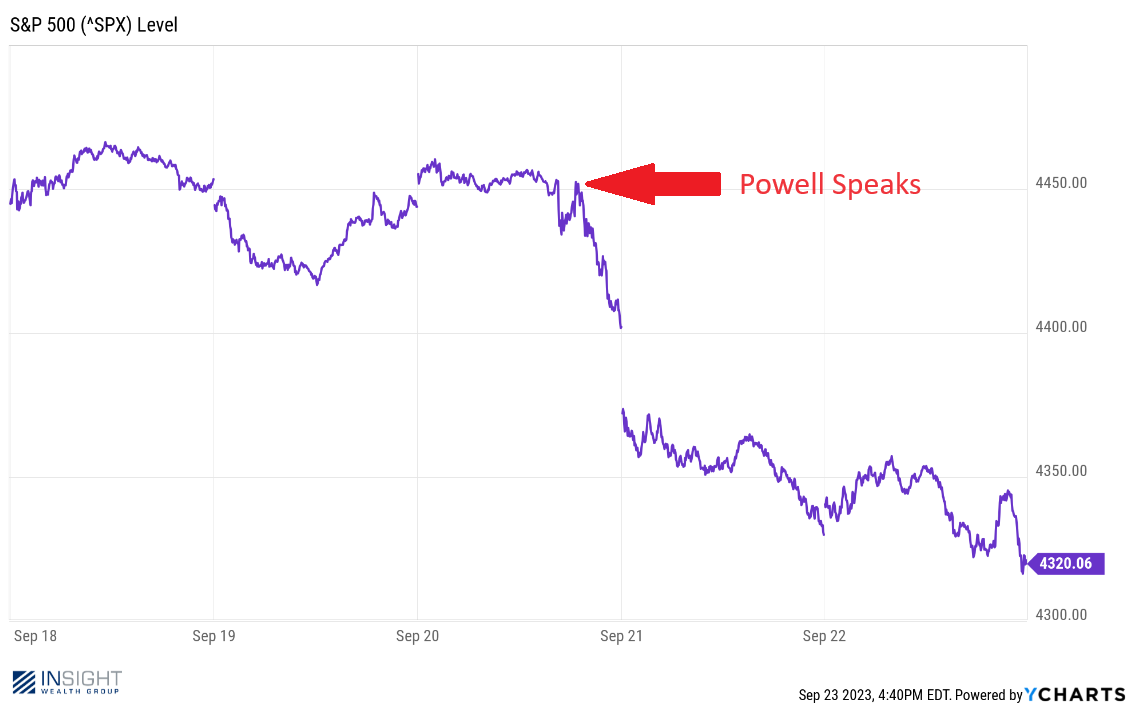

GDP up. Unemployment down. Inflation dropping quicker than expected. By any measurement that is all GOOD news! So, what happened? Why did we get the normal – pessimistic – post-Powell market reaction?

Past performance is not indicative of future results.

Higher for Longer

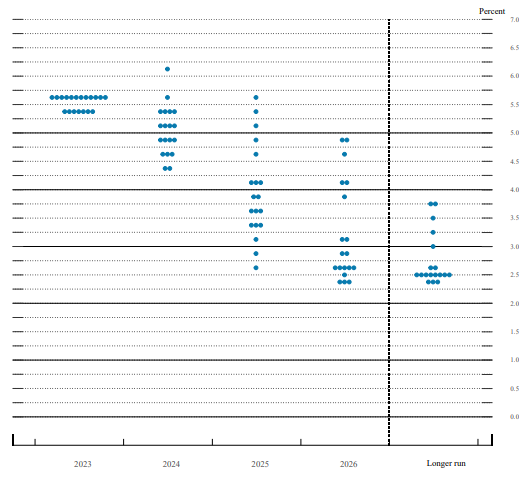

The Dot Plot is where all the trouble happened – both for Powell at the podium and for the market after he spoke. To better understand it, we first need to take a step back and look at what the Fed put out in June. You may recall us saying at the time that it was a surprising projection. There seemed to be a consensus and it was higher than we had seen before. All but three members were stacked between a terminal rate of 5.25% – 6.00% for 2023. And there was a sizeable group that anticipated rates getting below 4.6% by the end of 2024.

Past performance is not indicative of future results.

The problem with last week’s dot plot was two-fold:

- The market really, really hoped that the Fed would say they’re done raising rates. They didn’t. The majority opinion was they would raise rates one more time this year.

- The projections for next year aren’t as good as we saw in the June SEP. The median projection is a Federal Funds rate of 5.1% by the end of next year, 0.5% higher than we saw in June.

Past performance is not indicative of future results.

You’ll note that after every chart we must put “past performance is not indicative of future results”. It’s a silly trope, but there’s a team of lawyers out there somewhere that think it somehow protects us from liability! But in this case – it couldn’t be truer.

Past dot plots have been notoriously inaccurate. Remember the one from December 2021 which projected the Fed would raise rates to 0.75% in 2022. Ha! We wish. Instead, we got the quickest rise in interest rates in history.

We’d caution the market to take the same approach with this month’s data. Yes – they may raise rates one more time. In the end is it that big of a deal? Chairman Powell doesn’t think so. He said as much from the podium:

“I wouldn’t attribute huge importance to one hike in macroeconomic terms”.

He’s right. 0.25% higher or lower isn’t a huge swing when we’re already at 5.25% – 5.50%. It isn’t going to make or break things.

And when it comes to next year? We have zero confidence in their projections. You shouldn’t either.

A Position to Proceed Carefully

“Careful” was the watchword of the Powell press conference. He used some version of the word sixteen times in his comments. And he started with it right out of the gate with this:

“Looking ahead, we are in a position to proceed carefully in determining the extent of additional policy firming that may be appropriate”.

Most of the world saw the SEP and the Dot Plot and concluded last week’s meeting was a “hawkish pause”. Yes, we didn’t raise rates but there was an indication rates will keep rising and stay there for longer.

But what if Powell’s comments meant something else? He was asked later in the press conference if a “soft landing” was now the baseline expectation. Powell didn’t take the bait. A Fed chairman promising a soft landing would be unheard of. But he did note that the path to a soft landing has “widened apparently”.

And then he said it again:

“I also think, you know, this is why we’re in a position to move carefully again”.

“Fed Speak” is its own language. There is a constant back and forth between trying to deliver a message without trying to give away too much information. But this time we think it’s clear. Powell believes that the interest rate moves over the last 18 months, combined with the strength of the economy, put the Fed in a “position” of strength. A position that doesn’t force them to keep moving the interest rate needle. But instead allows they to “proceed cautiously”. They aren’t forced to raise rates. They can watch and see what happens in the economy and react to it, instead of trying to drive it.

That’s new. Until now the Fed has been trying to catch up. Now they have some room to breathe. Some room to be “careful”. The inflation battle may not be over, but we think Powell announced last Wednesday that we’re winning it.

Sincerely,