The Weekly Insight Podcast – Earnings and Israel

There was a lot going on last week – both in the world and the markets. We got loads of useful economic and earnings data. And we also learned much more about what’s going on in Israel and the potential impacts of that conflict worldwide. The result was a market which was up and treasuries that were volatile. But a lot of capital still sits on the sidelines and investors wait for things to play out. Let’s dive right into some of the biggest news from the week.

Bank Earnings

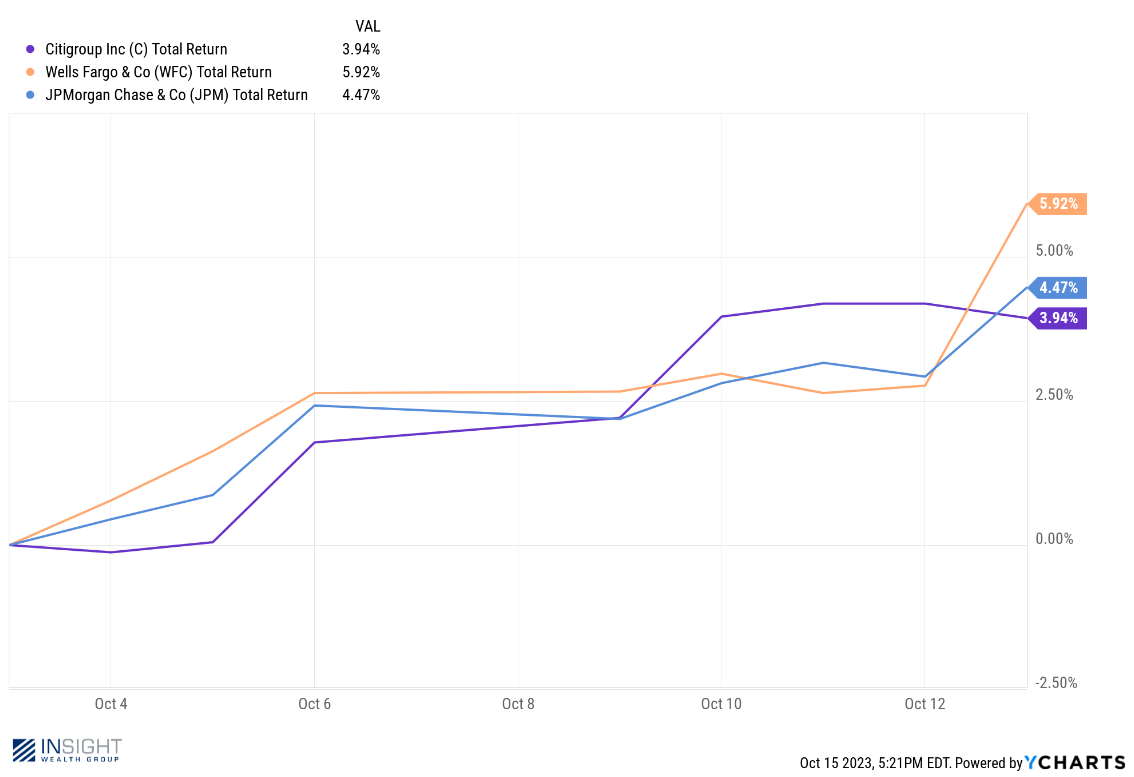

The big banks reported earnings this week and there was a lot of discussion about their reports. First and foremost, their earnings were quite good. Per the Wall Street Journal, JP Morgan, Wells Fargo, and Citigroup reported combined profits of $22 billion in the quarter. That was up more than 30% from the previous quarter. It turns out when you can write loans at higher interest rates there is a bit of money to be made!

But what else did we learn from the banks? They are, of course, on the front lines of the economic battle. What do they see today?

First, we must remember that these bankers have been promising us a recession for a long, long time now. It was over a year ago that JP Morgan CEO Jamie Dimon predicted a “financial hurricane” was headed our way. All their economists were promising a recession in late 2022/early 2023 which hasn’t arisen yet.

So, it shouldn’t be a surprise that Dimon is once again ringing the alarm bell. The quote everyone was talking about was his statement that “this may be the most dangerous time the world has seen in decades”. That’s spooky – until you realize he wasn’t talking about the economy, but instead the increasingly fraught issues happening on the world stage (more on that later!).

Instead, JP Morgan announced that it had changed its base case for the economy from “mild recession” to a “soft landing”. They are now predicting economic growth all the way through 2024. CitiGroup and Wells Fargo seem to be on the same bandwagon.

The truth? We won’t know it until we see it. But the economy continues to show resilience and the banks are loving it. And they’ve all seen a nice bump off their bottom at the beginning of the month.

Past performance is not indicative of future results.

Is the Earnings Recession Over?

Earnings season has just started. Only thirty-two of the five hundred companies in the S&P 500 have reported thus far. Next week sees another fifty-two, so we’ll be at roughly 17% reporting. We still have a long way to go.

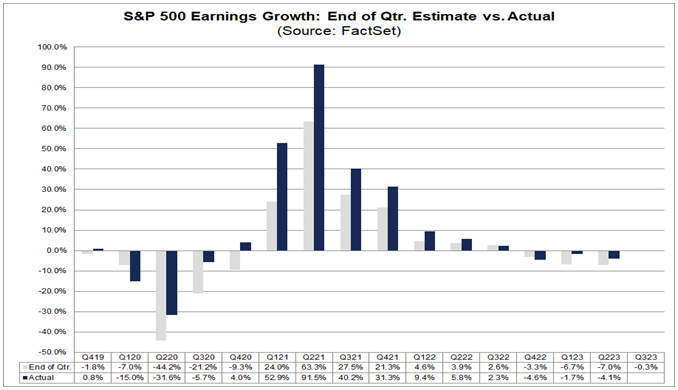

But we can look at and understand trends. We know that the current analyst estimate for S&P 500 earnings is 0.4% growth (already up substantially from the estimate on 9/30 of -0.3%). That would make Q3 the first quarter to see year-over-year growth since Q3 2022. The previous three quarters have seen declines.

But we also know – as we’ve discussed in the past – that analyst estimates tend to be very conservative. Over the last 10 years, earnings have exceeded estimates in 37 of 40 quarters. The only three times they haven’t were Q1 2020 (COVID!!) and Q3 and Q4 of 2022 (inflation!). In that period, actual earnings have exceeded estimates by 6.6% on average.

Past performance is not indicative of future results.

We won’t know for a few weeks, but right now the earnings recession looks to be over.

Israeli/Palestinian War Update

When we wrote last week’s memo, the Hamas’ attack on Israel had just happened and we didn’t yet know what to make of it from an economic perspective. Our initial economic take was some version of “let’s see what it does to the price of oil”.

And, unsurprisingly, prices of oil have gone up. Price of West Texas Intermediate Crude (WTI) rose from just under $82 a barrel to just shy of $88 a barrel on Friday. A move? Yes. A dramatic one? Not really. Oil prices are still below their high in late September.

Source: Google.com

Past performance is not indicative of future results.

Oil will continue to be the main economic driver of the impact felt by this conflict in the United States. And that all depends on how far the war expands. In its current state – a battle in Gaza between Hamas and Israel – the impact inside our boarders will be minimal. But the bigger question is what happens if the conflict expands.

There are a lot of threats bouncing back and forth across the airwaves. Hamas, Hezbollah, Iran, Syria, etc. But the question is how far these nations/groups will go. Since 1973, they have been very happy to arm Palestinians, but that was the extent of it. Will broader war break out? Will Iran and Israel finally enter the ring? Which side will the Saudis pick?

A war between Israel and Iran would almost certainly mean Iran attempting to close the Strait of Hormuz. That 90-mile-wide stretch of ocean may be the most important in the world. Why? Nearly 30% of the world’s oil production flows through the Strait every single day.

The U.S. doesn’t need Middle East oil anymore. In fact, we’re the world’s biggest oil producer again and produce more oil than we consume. We are, yet again, a net exporter of oil. But that doesn’t matter if 30% of the world’s oil supply gets bottled up in the Persian Gulf. There is a reason we have one aircraft carrier off the coast of Israel (USS Gerald R. Ford) and one steaming that way now (USS Dwight D. Eisenhower).

We can have all the economic growth and soft landings and positive earnings we want. But a battle in the Persian Gulf would be very impactful despite all the good news. Let’s hope calmer heads prevail. We’ll be watching closely.

Sincerely,