Last year in these memos, there was a sense that the hits just kept coming. COVID, Ukraine, inflation, interest rates, interest rates, inflation. It was a drumbeat that lasted throughout the year and lead to a pretty pessimistic response from the market.

We don’t like subscribing some sort of magical significance to the turn of a calendar year. Other than clients asking “how did we do last year”, the dates on the calendar mean very little. In the end, we’re all concerned about the overall results in portfolios. But for whatever reason, the turn of the calendar last year was significant. The market peaked on the very first trading day of the year and never reached those levels again. And now, in 2023, the reverse has happened for the first two weeks. It’s been a nice change of pace even if there is no real statistical significance.

But there are reasons to be optimistic as we head into the new year. The wage data from last week was incredibly positive. This week all eyes were on the CPI report. Let’s look at that first this week.

CPI: Meeting Expectations

You’ve heard us talk for months about the expectations game for inflation. A bad number did not really matter if it was better than expectations. A good number didn’t count if it was worse than expectations.

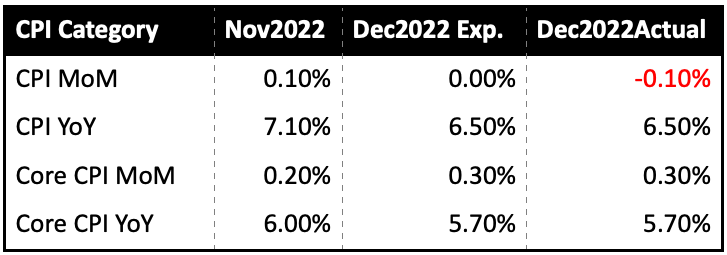

This week’s CPI report was perfectly in line with expectations. And that’s great news because the expectations were for a significant improvement on the inflation front.

Source: Department of Labor, Bureau of Labor Statistics

Past performance is not indicative of future results

There were no misses. And month-over-month CPI actually came in a bit better than expected. It was also the first time prices had dropped in the month-over-month in over a year. Core CPI had its lowest read since December 2021. Overall, CPI had its best read since October 2021. We are clearly on the path to improvement.

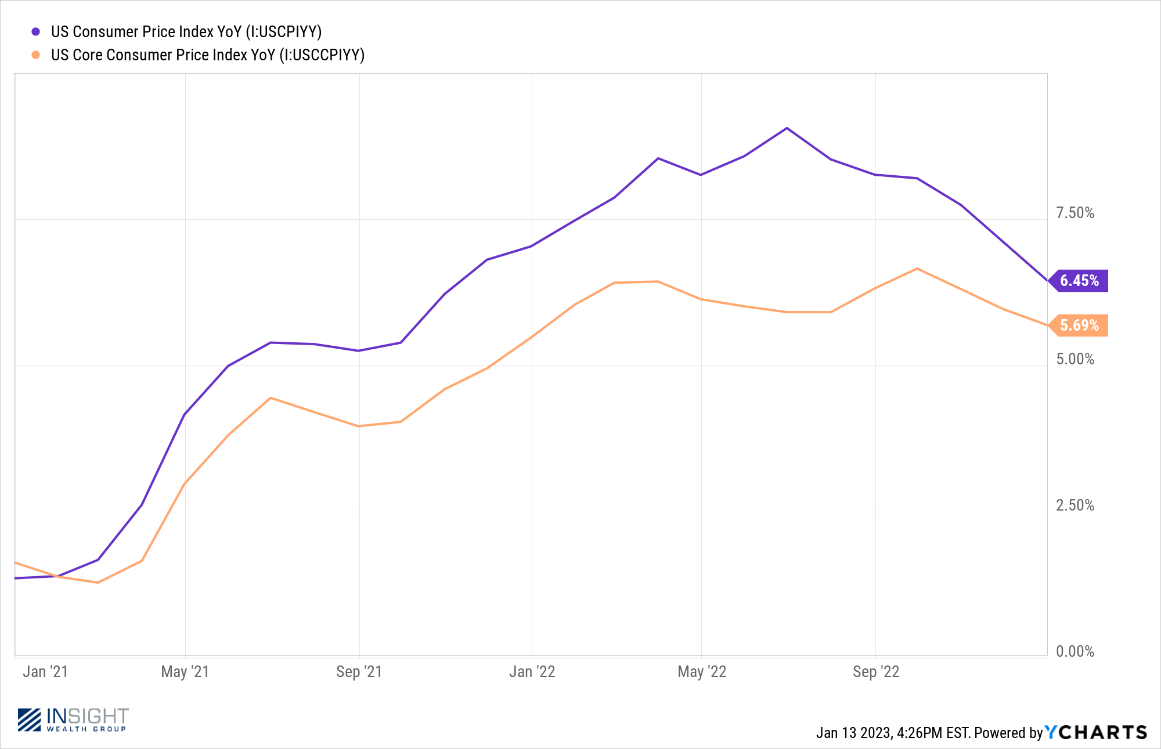

Past performance is not indicative of future results

But the real good news actually isn’t in those numbers, because in our opinion those numbers are significantly off base. You’ve heard us talk before about how CPI is calculated and the impact housing prices have in the calculation. The “Shelter” category makes up 30% of the overall CPI number and 40% of the Core CPI number. It is the largest contributor to both calculations.

And we would argue the data in it is just…flat…out…wrong.

We know it seems bold for little old Insight Wealth Group to say the Department of Labor data team doesn’t know what they’re talking about. But why not. We’ll say it. Why? Because in the latest CPI data, the BLS has the cost of shelter rising by 0.80% in December and 7.5% year-year-over-year.

The problem, as we’ve discussed before, is how they calculate this number: owners equivalent rent. They call homeowners and ask them how much they could rent their home for. The result is a proxy for the cost for shelter. The problem with owners equivalent rent is there is actual data that exists on what rental prices are. Zillow (and many other outlets) collect this data and publish it monthly. What does Zillow’s data say? Rents dropped by 0.25% in December. That’s a 1.05% swing in something that makes up 40% of Core CPI.

Better yet, according to the Zillow data, rental prices actually peaked back in September and have been dropping since. CPI has instead been showing large gains in shelter prices. It is just…wrong.

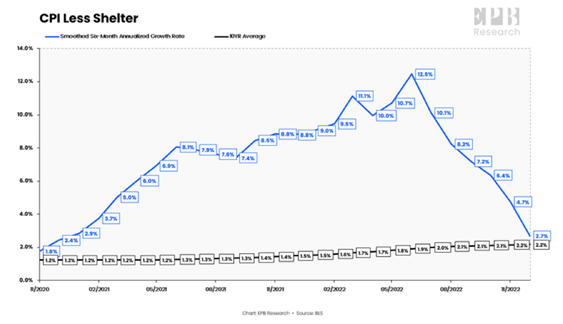

So what does CPI look like without the inaccurate shelter data? Not too shabby.

Source: EPB Research

Past performance is not indicative of future results

Eventually that housing number is going to correct. When it does, CPI will fall more rapidly than it is today. In the meantime, let’s hope the Fed understands where the data is wrong (they haven’t yet!) and takes it into account for the next meeting.

Are Falling Earnings a Sign of Doom?

Earnings season has started. And as with every earnings season we’ve ever talked about in these pages, the trend remains the same: analysts enter the season pessimistic and companies overperform their expectations.

For Q4, the question isn’t whether we’re going to have a great quarter of earnings (we aren’t), but whether or not things will be better than the worst case scenario. We know that over the last 10 years, actual earnings have exceeded estimates by 6.4%. Given the current estimate of the earnings decline (3.9% – down from 4.2% last week), that would mean we would actually have positive earnings for Q4.

But if you take a less optimistic approach, you could look at the last two quarters, which weren’t exactly fairytales. During Q2 and Q3, actual earnings exceeded expectations by 2.5% – meaning we’d end earnings season negative, but not catastrophic. All good news.

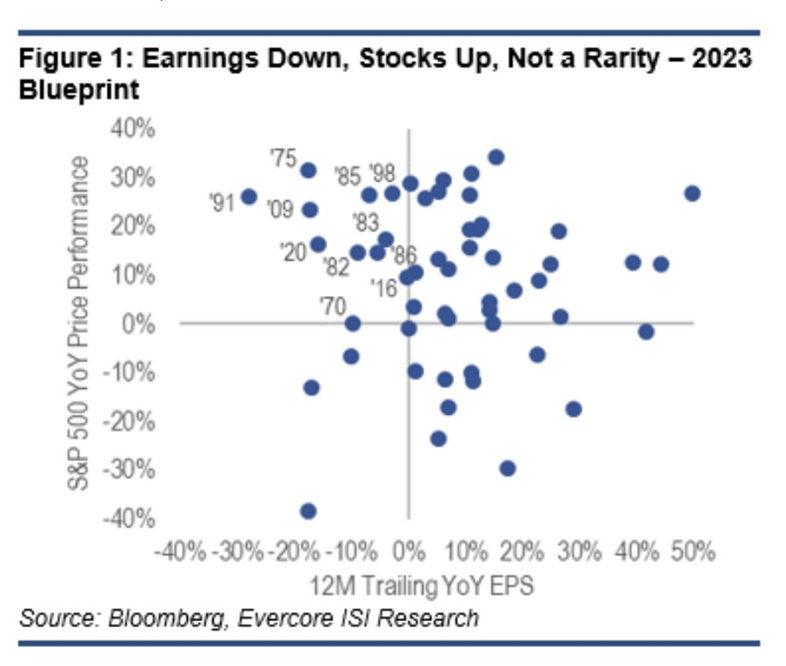

But that brings up another important point: if we have a down year (or quarter) for earnings, does that mean a bad year in the market? History says not at all. In fact, as the chart below shows, the market has been positive 11 of the last 14 times we’ve seen earnings fall year-over-year.

Past performance is not indicative of future results

But why? Why would falling earnings mean positive performance in the market? And, more importantly, why is the performance noted above so good in some of the worst market periods of the last 40+ years?

It’s pretty simple: the market is a forward looking tool. It has already priced in the downturn in earnings (that’s why we ended the year down nearly 20% in the S&P and more than 30% in the NASDAQ). It is now looking at next quarter, next year, etc. And if history is any indication, that may be good for the market this year.

Client Account Housekeeping

As we enter the new year, this is a time when our wonderful client operations team is working on “cleaning things up”. This year that process is particularly important as we know there is a transition coming up this fall as all TD Ameritrade accounts are assumed by Charles Schwab with the completion of their transaction.

One issue we’ve noted is there is a need in some accounts to update beneficiaries – especially in non-IRA accounts where beneficiaries are not required to open the account. Our team is going to be working through this process over the coming weeks, and it is possible you will be receiving a DocuSign packet in your email asking you to review and potentially update this information.

We all have changes happen in our lives. Marriages, deaths, divorces, etc. Sometimes one of the last things people think about in that process is updating their beneficiaries. If you think you need to change yours, please feel free to reach out to us and we’ll prioritize your changes in the process.

Sincerely,