The Weekly Insight Podcast – August Never Fails

In a review of old Weekly Insight Memos from years past, we noticed a trend in August. Some sort of variation along theme of “August is a quiet month in the markets”. The theory is that traders are getting the last of their vacation days before summer runs out and Washington is on the usual month-long break from legislation. That can lead to – as we have titled a memo before – the “August Lull”.

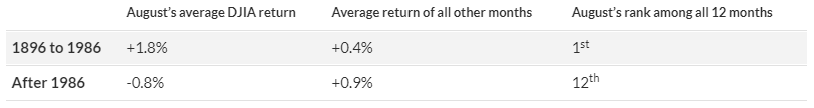

But that is not really a fair explanation of it. It is not so much a “lull” as it is “quiet underperformance”. It turns out, as pointed out in an article on MarketWatch this week, that August has had the worst performance of any month of the year since 1986. The strange thing? From 1896 to 1986 it was the best performing month!

Source: MarketWatch.com

Past performance is not indicative of future results.

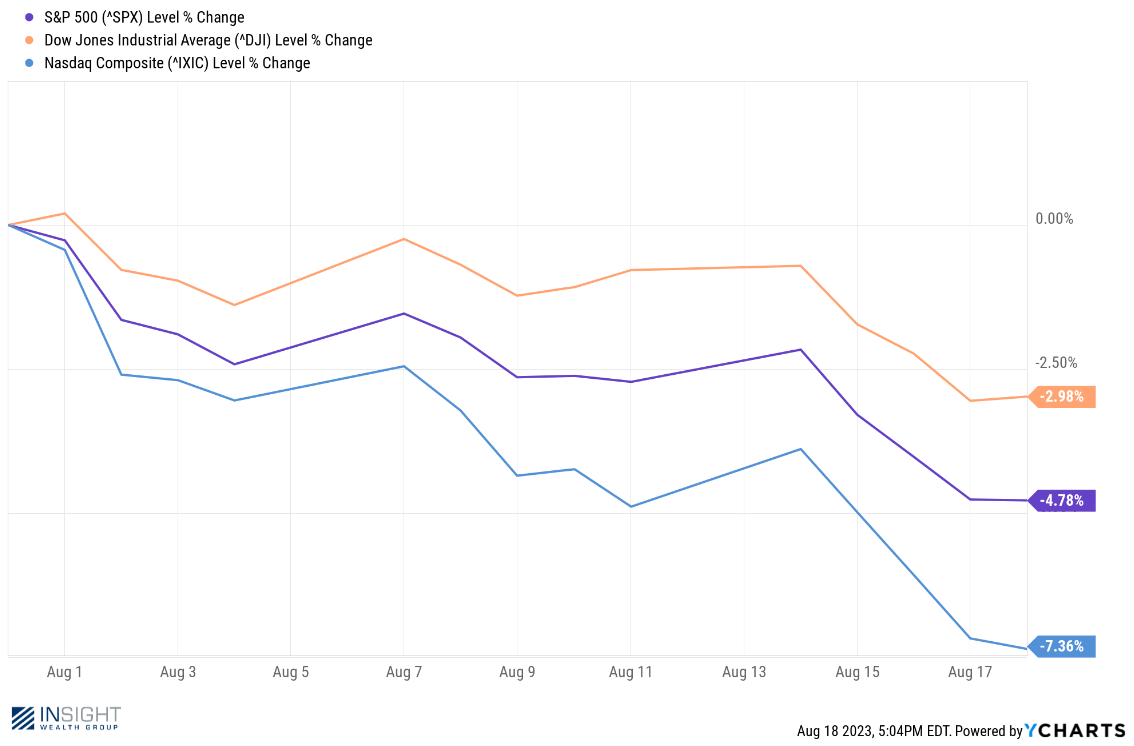

The why? Hard to tell. As Mark Hulbert, the author the MarketWatch story said, “the most likely explanation is that it’s just a random fluke”. Fluke or not, this August is shaping up much the same way as you can see by the chart below.

Past performance is not indicative of future results.

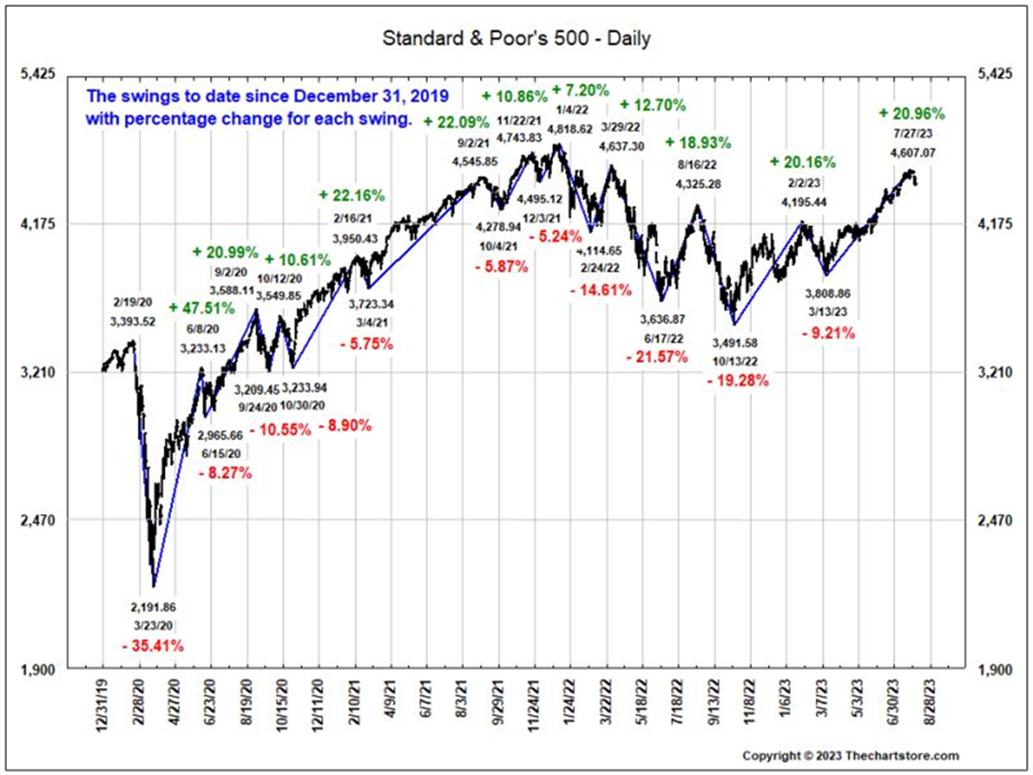

A chart like this can induce a measure of panic in investors. We do not see that today. In fact, what we see instead is a “breather” happening. And it is a pretty normal occurrence. Take, for example, the chart below. It maps out each of the major moves in the market going back to the pandemic. What you can see from each of the bull expansions that happened from March of 2020 through today is a strong stretch of equity returns followed by a “breather” that let a little air out of the tank.

The stretch from the bottom of the market through today has seen exactly that. We got a 20% run up in the market from October 2022 through February 2023 and then the market pulled back 9% in response to the mini “banking crisis” we had this spring. Now we have had another 20% run followed by a roughly 5% pull back currently. That mirrors closely the results in the market from mid-2020 through the end of 2021.

Past performance is not indicative of future results.

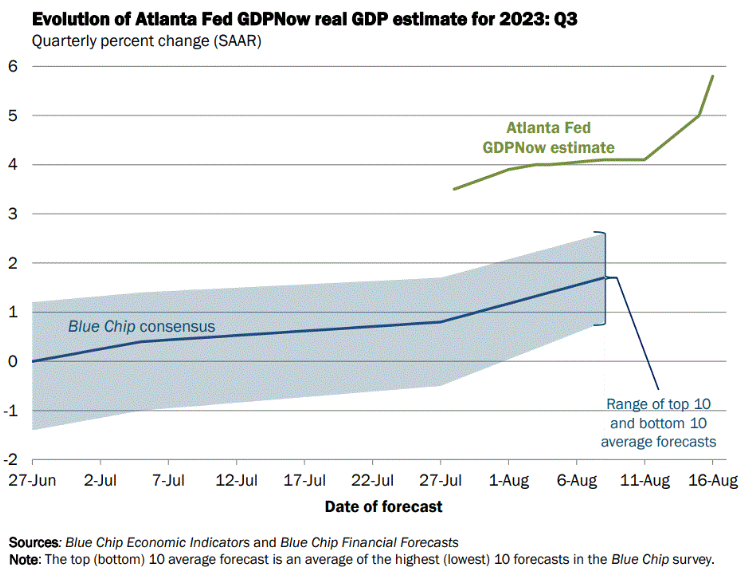

So, what might lead us to believe this is break and not a broader issue? The same reason we have continued to be confident for months: the economy is outpacing anyone’s expectations.

We told you a few weeks ago that Goldman Sachs lowered their recession odds to 20%. Last week Bank of America publicly stated they had missed the call and a recession was not happening anytime soon. The mood is starting to shift. And it is being reflected in what we see from the Atlanta Fed’s GDPNow forecast (note that GDPNow has been substantively more accurate this year than economists!).

Past performance is not indicative of future results.

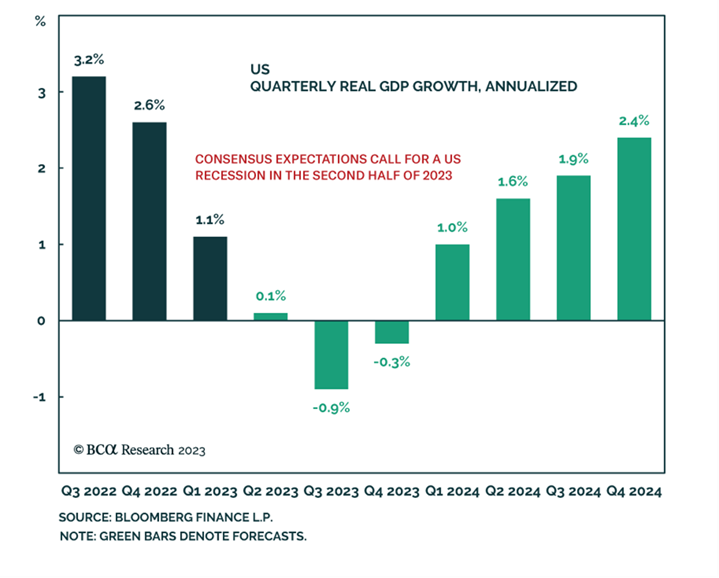

You read that right: GDPNow is currently forecasting nearly 6% GDP growth in Q3. That is an amazing number – especially on the back of the 2% number we saw in Q2. This number will evolve (and likely come down a bit), but it is important to remember what the world was saying just a few weeks ago. The chart below shows the consensus GDP expectation from economists just before the end of Q2. What a miss!

Past performance is not indicative of future results.

So where are the bogies? What are we worried about?

The first one is obvious – and we will not waste a lot of space here on it. Any time we see an economy expand this rapidly, it will have some inflationary effects. If we get to the end of Q3 (right about the time of the next Fed meeting) and are expecting 5%+ GDP growth, that will make it more likely the Fed will raise rates.

We are going to get a peak at their plans this week when Chairman Powell speaks at the Jackson Hole Conference. Regular readers will remember that his speech last year took the market to the woodshed. The S&P dropped 700 points (16%) over the next 8 weeks before things turned around in October. It will not be that dramatic this year – but it is worth watching and we will report back on it next week.

The other bogie to keep an eye on? China. The world’s second largest economy is…going through some things. Their reopening has not gone the way Chairman Xi hoped and the news is starting to pile up. The most notable example was the bankruptcy filing of Evergrande, one of the world’s largest real estate developers. They have lost over $80 billion in the last two years. Another Chinese real estate giant – Country Garden – announced last month that they have lost $7.6 billion so far this year.

We all know the Chinese economy is not as free or open as ours. But that is what makes these real estate collapses even more interesting. One of the few places where Chinese citizens can – and do – invest is in real estate. Protecting the real estate market is going to be important to Xi.

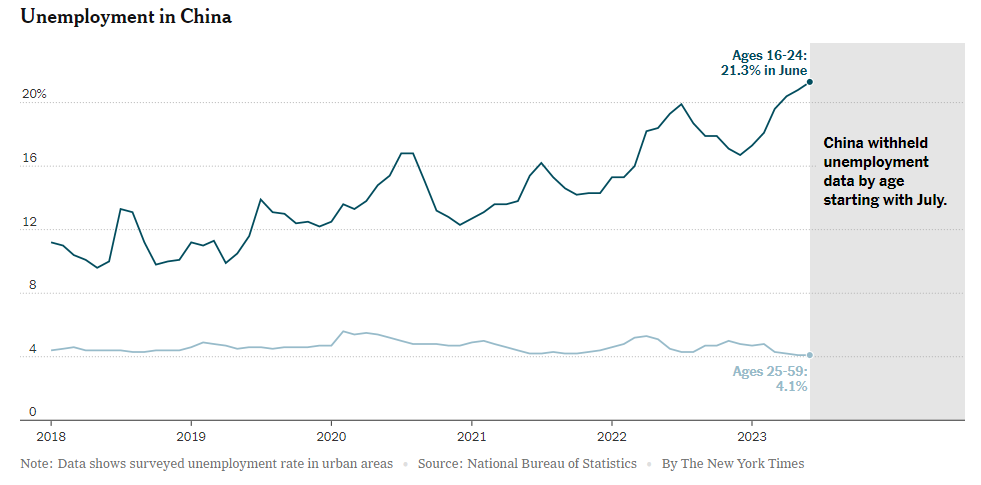

Which brings us to the next point. Chinese youth unemployment has been rising rapidly in the last several months. That is to be expected in a slowing economy. But here is where China shows it is still China. Last week they abruptly announced they would no longer be providing data on youth unemployment in the country.

Past performance is not indicative of future results.

That’s it. Just not going to provide that data anymore. Could you imagine if the United States Bureau of Labor Statistics just decided not to provide a data set anymore because the news was not good? There would be pundits screaming on TV and lawsuits filed in courts.

It is a good reminder that China is not us. They are not a free wheeling democratically run, market-based economy. They are a one-party system where one man – or a small group of men – make the rules whether you like them or not.

But any system like that is vulnerable in the end. And so, they will do what they must to maintain control. And we would guess that will be some stimulative input into the economy. It may not be “real”, but China’s economy will recover from this malaise if only because Xi says so.

And it is also a good reminder of just how good we have it over here. Are there things to worry about? Certainly. But things are chugging along pretty well right now.

Sincerely,