The Weekly Insight Podcast – Are We There Yet?

It’s road-trip season across America. Moms and Dads across the country are packing up the family truckster with idyllic plans of making new family memories. And inevitably the question will come – for the 10th or 20th or 30th time – “Are we there yet?”.

The answer is inevitably “no” – but there is a strategy for how you answer the question. How old is the kid asking? Do they really understand the concept of how long an hour is? How far do you have to go? If you shorten the arrival time to make them feel better, it may work for a bit but will end in disappointment. If you stretch it to avoid disappointment, you may get a meltdown on the front end. It is a delicate parental dance.

And it is a dance Jerome Powell has been doing on interest rates for the better part of 15 months. He had his tap shoes on Wednesday as he broke down the Fed’s latest rate increase. Let’s look at what we learned.

Not Much of a Surprise

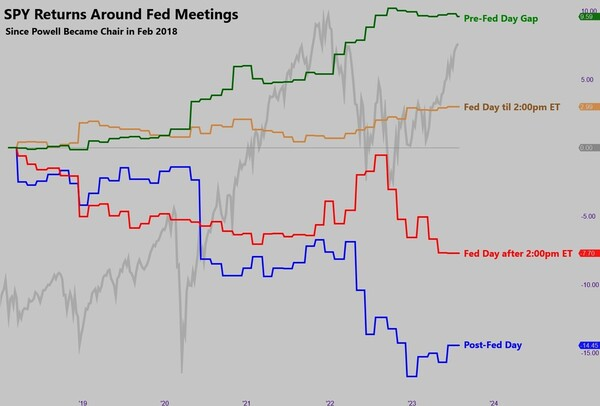

You have heard it from us before: Powell is a one-man wrecking crew when it comes to market performance on Fed Day. In fact, someone finally went out and proved it. See the chart below:

Source: Yahoo!Finance

Past performance is not indicative of future results.

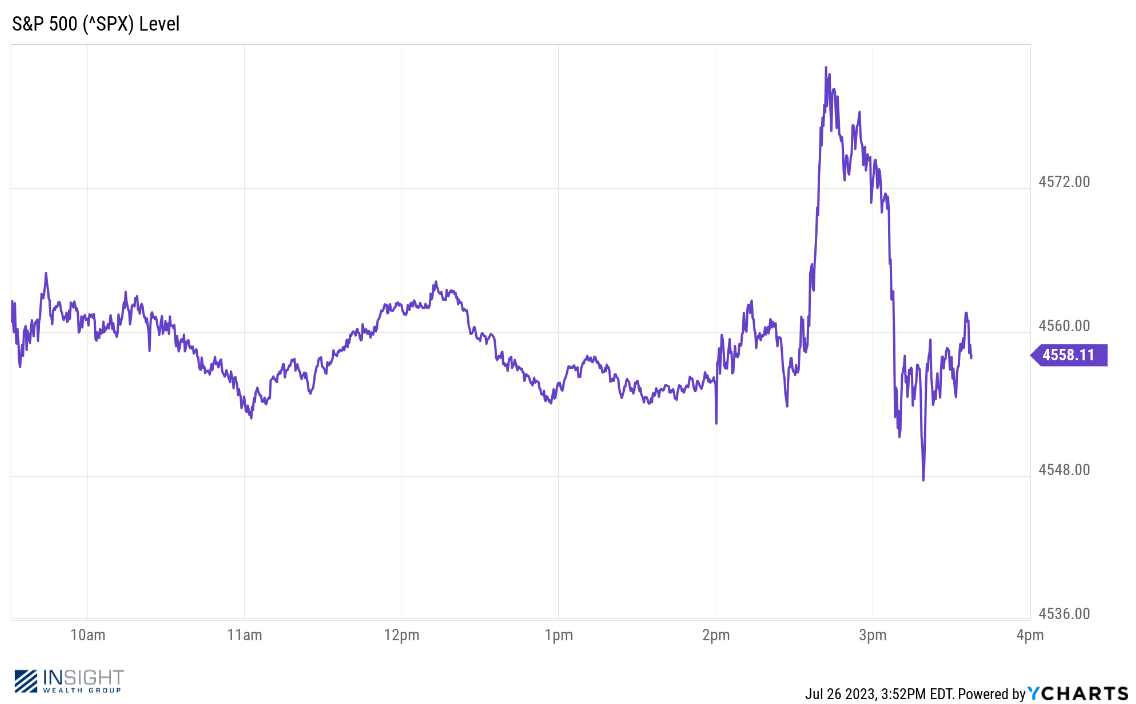

His podium skills have not improved in the last five years, and his drag on the market continued on Wednesday. Any guesses when his remarks concluded?

Past performance is not indicative of future results.

But when it came to the meeting last week – there really was not much surprise to be had. There were nearly 99% odds – according to CME Group – that the Fed was going to raise rates by 0.25% at the meeting. Everyone knew it was coming and the Fed delivered.

The questions coming out of the meeting, instead, were “what’s next?”. There were a few notable statements.

Powell & Co Were Surprised by the CPI Data in June

That’s right… they were not expecting CPI to drop as much as it did. That put them on their heels about what to do in the future – but was not enough to change the path for this meeting.

We now have two months until the next Fed meeting which means we will get two more CPI reads between now and then. But the likelihood of two more big surprises is very, very slim.

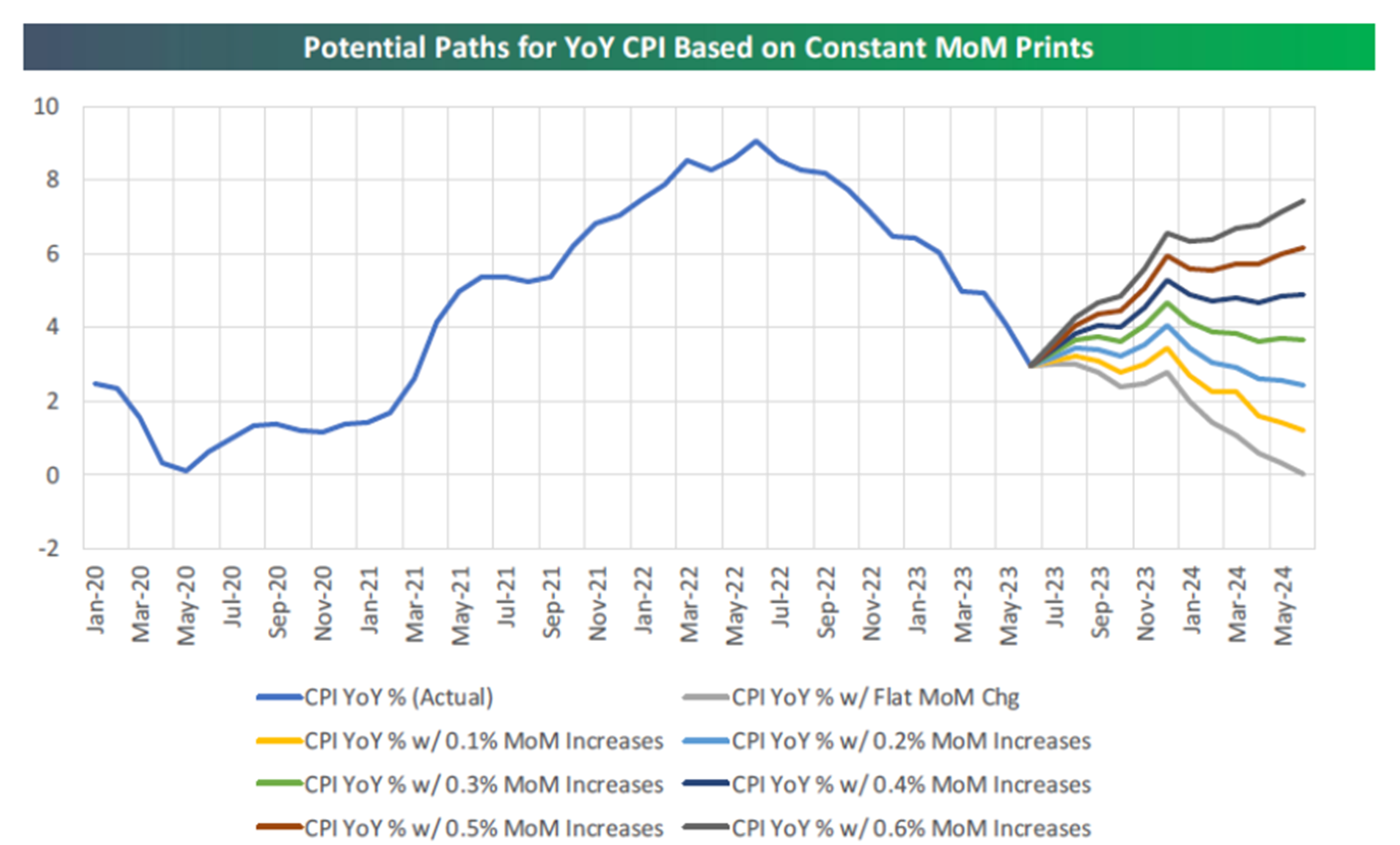

The data set that everyone focuses on regarding inflation is the “year-over-year” number. So last month we were comparing June 2023 with June 2022. June 2022 was – notably – the peak of inflation at 9%. Going forward we are not going to be measuring against a falling number. That means it is likely we will see year-over-year inflation rise in the coming months. The chart below looks at what various monthly inflation numbers would do to year-over-year inflation. We would have to see nearly flat inflation to continue marching down before the next Fed meeting. Possible? Yes. Likely? No.

Source: EPB

Past performance is not indicative of future results.

That does not guarantee a rate hike in September. But it does mean the market needs to prepare itself for more hikes between now and the end of the year.

Powell & Co. Are Optimistic About the Economy

Powell was explicit in his comments:

“So, the staff now has a noticeable slowdown in growth starting later this year in the forecast, but given the resilience of the economy recently, they are no longer forecasting a recession”.

That is a substantial change (that lines up nicely with our comments about other economists last week). They have been predicting a recession since last November. That change may give Powell a bit more rope to raise rates if the economy is ticking along.

That’s a great sentiment. But we must be careful about just hoping for the best. If the Fed takes too much advantage of this moment – and pushes rates too hard – we could put a recession back in the driver’s seat very, very quickly.

The QT Secret

You may remember the phrase “quantitative tightening”. The Fed’s been talking about it for a long time. The idea is simple. The Fed has a very big balance sheet from all the assets they bought during the pandemic to shore up the economy. To shrink their balance sheet – and cool the economy – they would allow assets to “burn off” their balance sheet as they matured. If, for instance, they owned a bond that matured, they would not redeploy the cash into the economy.

They have been going through the QT process for more than a year now, in line with their process of raising interest rates. Or so we thought.

It became clear in Powell’s press conference that they stopped QT in February due to concerns about the bank failures we were seeing at the time (SVB, etc.). That makes sense – but the problem is now they must turn it back on. It is just another thing the market was not expecting that now must be factored into what opportunities look like for the next several months.

So…Are We There Yet?

Unlike the dad in the family truckster, we do not have a map. What we know is we are getting close.

There is a strong consensus in the marketplace today that Wednesday’s hike was the last rate hike in the cycle and that we will stay at our current 5.25% – 5.50% range until the Fed stops dropping rates in the middle of next year.

The other camp (a 33% probability according to CME Group) thinks we will get one more hike – likely in November of this year – before we are done.

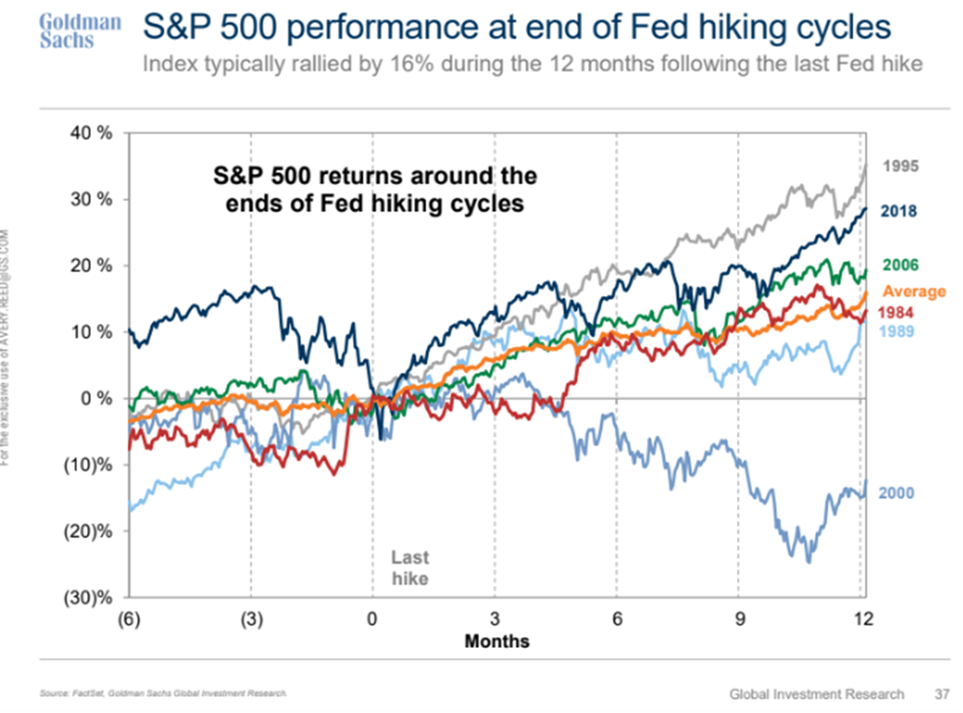

What we do know is historically the market has performed quite well at the end of a rate hike cycle. The average return for the 12-month period following a rate hike is more than 16%. We hope that clock started last Wednesday. But given the last 15 months, that is a hard call to make.

Past performance is not indicative of future results.

Sincerely,