The Weekly Insight Podcast – The Validity of the Public Debt

What had been a particularly good month of stock market returns turned quickly last week on the news that Fitch, one of three bond rating agencies (along with S&P and Moody’s), made the decision to downgrade the credit rating of the United States Government from AAA to AA. That unexpected decision led to a quick (but relatively shallow) downturn in equities that wiped away most of the gains of the last thirty days.

The ”full faith and credit” of the United States is something that is enshrined in our Constitution. The Fourteenth Amendment, in Section Four, clearly states:

“The validity of the public debt of the United States, authorized by law, including debts incurred for payment of pensions and bounties for services in suppressing insurrection or rebellion, shall not be questioned”.

The simple translation: the government is required by law to pay our bills. We cannot try to squirm out of them.

That clause, and our country’s track record of never missing a payment, has our debt some of the most treasured in the world. It has been as safe of a bet as one can make.

But now, for the second time in twelve years, that promise is being called into question. The last time, on August 5, 2011, it was S&P that downgraded the U.S. to an AA rating (they have maintained that rating since). The market’s reaction this time was much more muted. Equities were off over six percent the day of the S&P announcement. The Fitch announcement this week had the market off just over 2%.

The real questions for investors today, however, are twofold. First, why did Fitch decide to do this now? And second, what does it mean for you? Let’s take a look.

First…The Why

The nice thing about credit ratings is the provider provides a very straightforward report that lists the “key ratings drivers”. The reasons for the ratings downgrade are laid out in black and white.

And none of them are going to surprise you. In their summary, Fitch highlights “the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to…peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions”.

They go into much greater detail, of course (you can read the report here). But the long and short of it is this: our politicians have screwed this up and until they see some grown-ups take charge, they are concerned about a default. Our guess is our readers would agree.

They go on to note the risk of a recession in Q4 of this year or Q1 of next and highlight the rising interest rate environment led by the Fed.

The path back to a AAA rating, according to Fitch, is simple:

- Congress must address “rising mandatory spending” (i.e., Social Security default in a decade) or “fund such spending with additional revenues” (i.e., raise taxes); and

- “A sustained reversal of the trend deterioration in governance”

Simply put, elect grownups that will address our fiscal issues. Does anyone see that happening anytime soon? We don’t.

So, if two of the three major ratings agencies have downgraded the U.S. (one can only assume Moody’s will eventually follow along), and there is no clear path to a AAA return, what does that mean for you?

Second…Where the Rubber Hits the Road

The first obvious issue is a “chicken or the egg” problem. One of the fundamental issues causing this change today is the rising cost of interest payments on the Federal Debt. Fitch notes that the “interest-to revenue ratio is expected to reach 10% by 2025 due to the higher debt level as well as sustained higher interest rates”.

That means that 10% of Federal tax revenues will go to make interest payments on our debt (not pay down principal!). That is a staggering number. But you know what will make that number even worse? A AA credit rating.

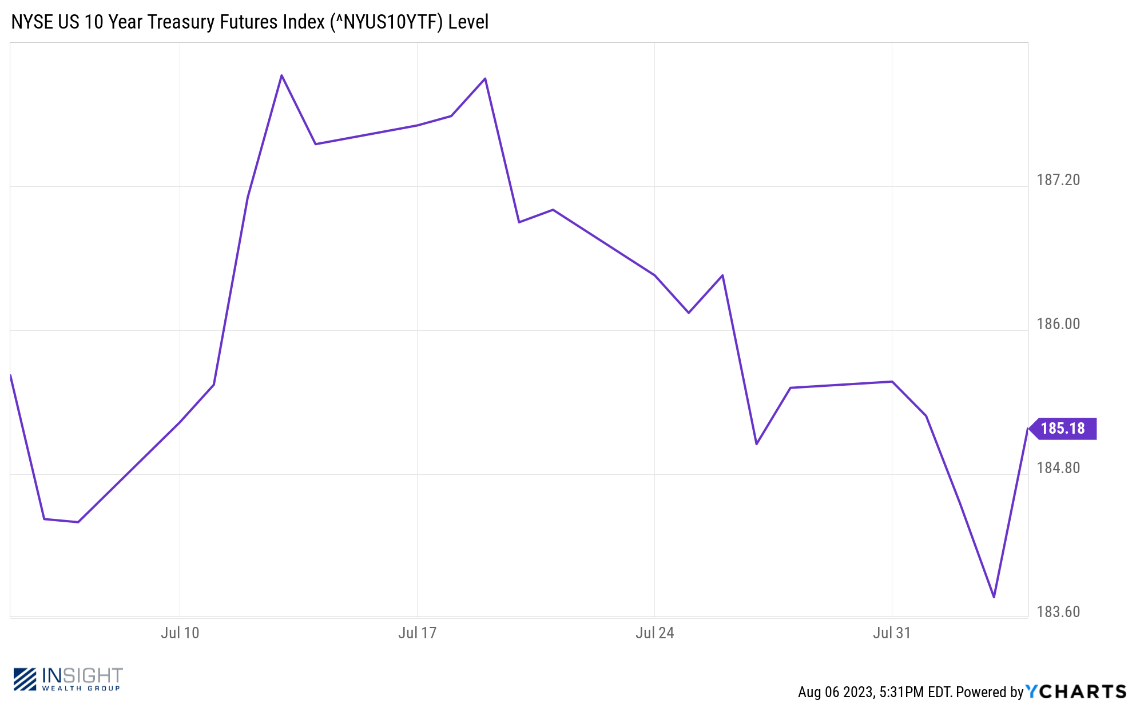

The lower a borrower’s credit rating, the higher the interest rate they will have to pay because they are judged to be a higher risk. That can be easily seen by what happened to 10-year Treasuries when Fitch announced the downgrade.

Past performance is not indicative of future results.

But that gets to the real-world impact for you: borrowing money is going to become more expensive. All lending in this country in some way, shape, or form, is tied to the U.S. government’s ability to pay its bills. Banks and other lending institutions place significant dollars in U.S. debt. If treasury rates go up, so will consumer rates.

That means mortgages, car loans, business loans, credit cards. It will be felt throughout the debt ecosystem.

But here’s where things get interesting. That acts much like the Fed’s interest rate policies. It taps the brakes just a little bit more on the economy. And it may serve as an excuse for the Fed to slow or stop their rate hiking process. We are not the only ones to think so. The odds of a “pause” at the September meeting went up from 80% last week to 87.5% after Fitch announced their downgrade.

And in the end, Fitch did not say the U.S. is going into a default. It said the likelihood is higher today than it was. The U.S. still ranks in the top dozen or so countries when it comes to the safety of our debt and the fact we are the world’s reserve currency still matters.

In the meantime, we may be able to make a little more money on cash parked in bonds. And the economy still looks strong. If only we could find a way to get a little sanity in Washington…

Sincerely,