The Weekly Insight Podcast – No One Cares

Let’s get this out of the way fast:

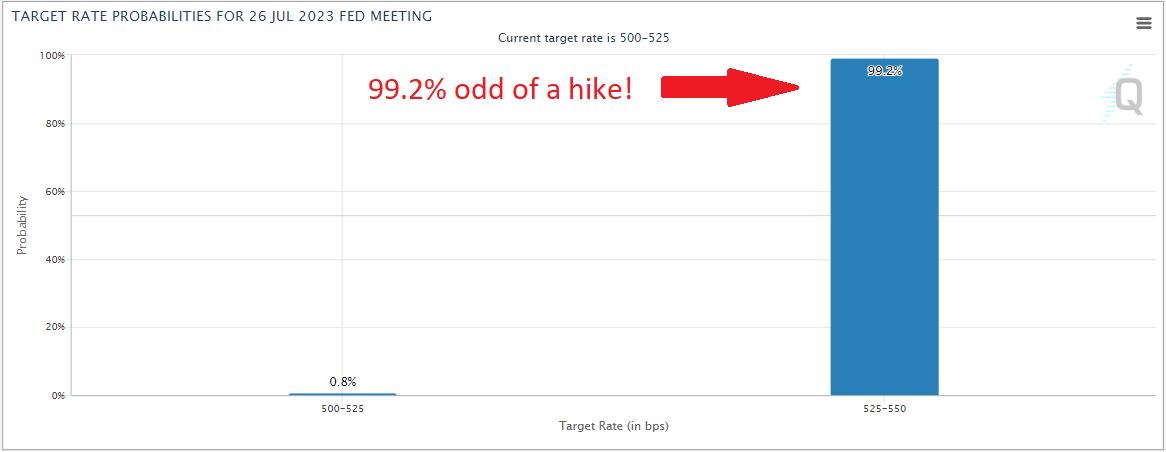

- This is Fed Week. On Wednesday, the Federal Open Market Committee (FOMC) will release their latest interest rate decision.

- During Fed Week, not much else matters. The entire focus of the market will be on Wednesday afternoon when Powell steps to the podium.

- The Fed is going to raise rates by 0.25%. There is simply no question at this point. Any other result would be a SHOCK to the markets.

Source: CME Group

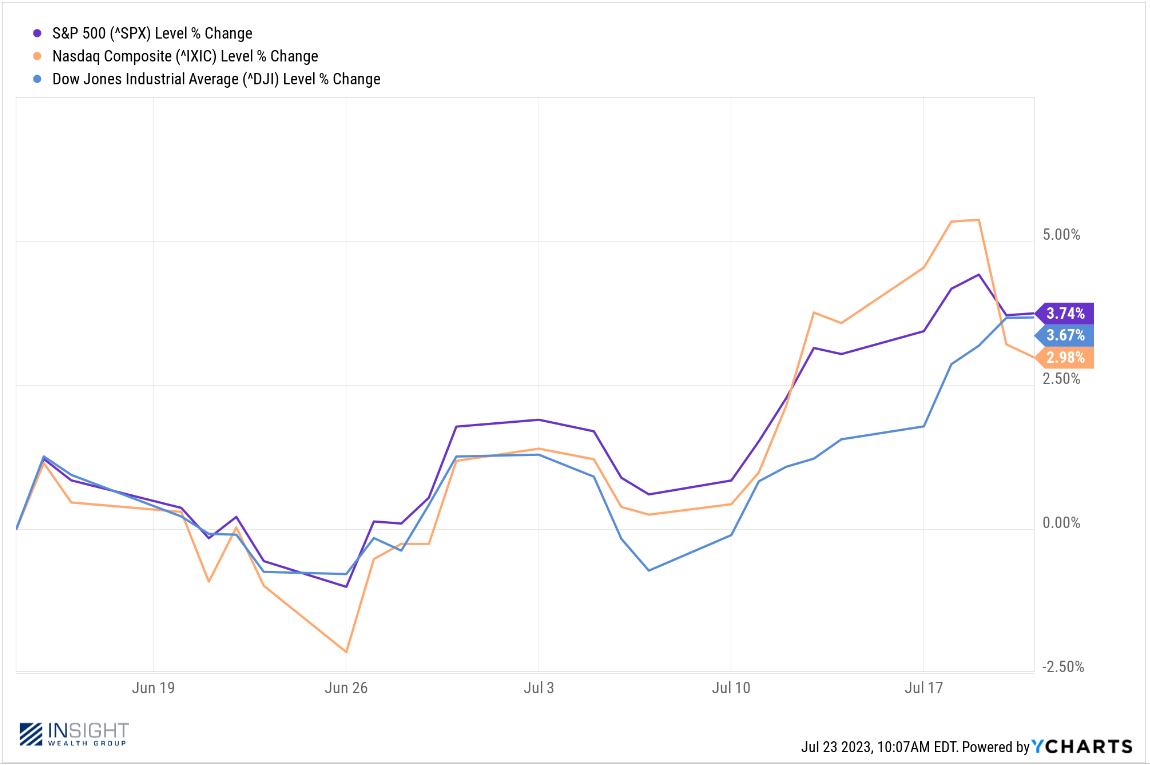

And yet, it seems…no one cares. We would argue the June Fed meeting was one of the most frustrating and confounding of any since rate hikes started in March of 2022. And no one cares. The market has been up strongly since the meeting. The roughly 3% pace over the last 40 days equates to a 28% annualized return. That is not a little move. The market looked at what the Fed said and came to a conclusion: no one cares.

Past performance is not indicative of future results.

But why? Why doesn’t anyone care that the Fed is set on continuing rate increases in the face of rapidly falling inflation? What happened to the cries of “RECESSION!”?

Economists Are Starting to Hedge Their Bets

Last week in these pages we discussed “embracing the good”. It was a reminder that – despite all the reasons to prepare for the worst – there is a lot of strength in the underlying economy. It turns out, we were not the only ones thinking that way.

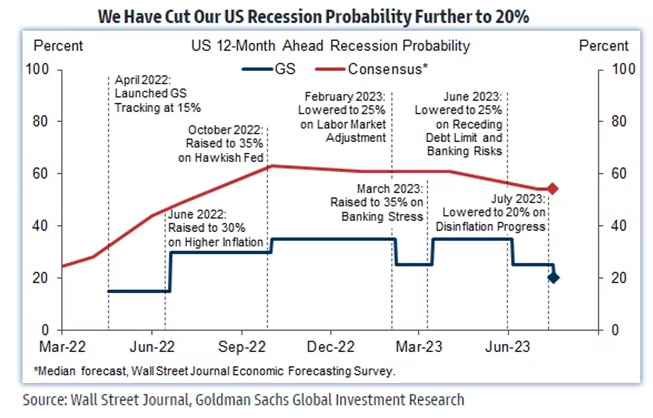

Goldman Sachs released their “Recession Forecast” on Wednesday. In it, they reduced the odds of a recession in the U.S. to 20%. That was the lowest their odds have been since the Fed started raising rates in March of 2022.

Past performance is not indicative of future results.

The main justification for their optimistic view? The Fed can cut rates just on the basis of lowering inflation instead of being forced to cut rates because of a recession. The simpler way of putting this? There is enough juice in the economy to last through these last few rate hikes. When you combine that with Goldman’s (and the Fed’s) expectation that the Fed will lower rates by 200 basis points in the next 2-3 years, they think we are going to get the ever elusive “soft landing”.

But, as the chart above shows, Goldman has been an outlier throughout this process. Even their peak odds of a recession (35%) were far below the broader expectation of economists. The word on Wall Street this week was that a number of those pessimistic forecasters were starting to change their mind as well. That started generating headlines like this:

The lede from the article as telling:

“Some of the forecasters who were first out of the box to predict a US recession are starting to hedge their bets as inflation ebbs and the economy remains resilient”.

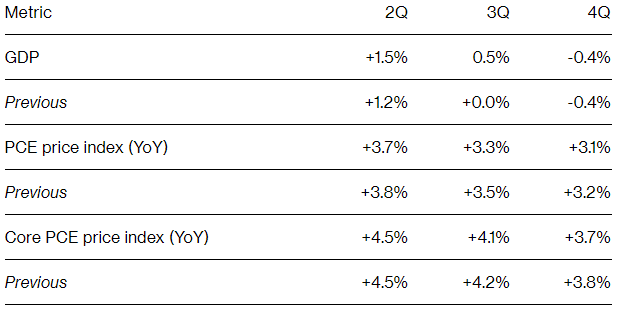

In the latest Bloomberg survey of economists, everything was just a bit more optimistic than last time. Expectations for GDP were up. Expectations for inflation were down. We’ll take it.

Source: Bloomberg

Past performance is not indicative of future results.

Earnings Are Solid

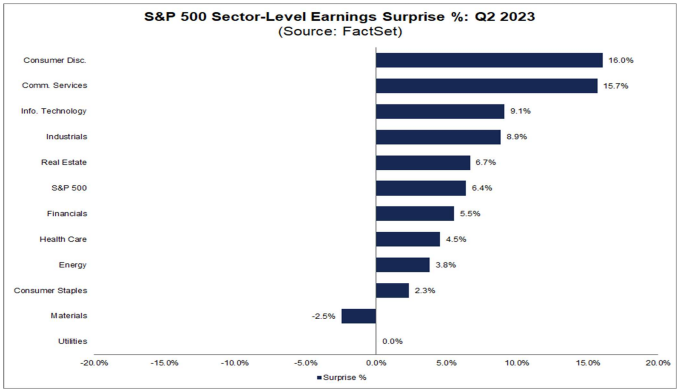

There are a million ways to measure a successful (or damaging) earnings season. We have talked a lot in these pages about earnings relative to the analysts’ expectations of earnings and how beating those expectations (even if they’re very, very bad) is better than missing them (even if they’re very, very good).

Everyone knows year-over-year earnings for Q2 are going to be below the earnings for Q2 of 2022. We are measuring the market against “peak post-COVID” in terms of consumer spending. It will mark the third straight quarter of lower earnings.

So, again, the key here is beating expectations. A great way to understand this is whether earnings are surprising to the upside or the downside. So far, the overwhelming answer is upside:

Past performance is not indicative of future results.

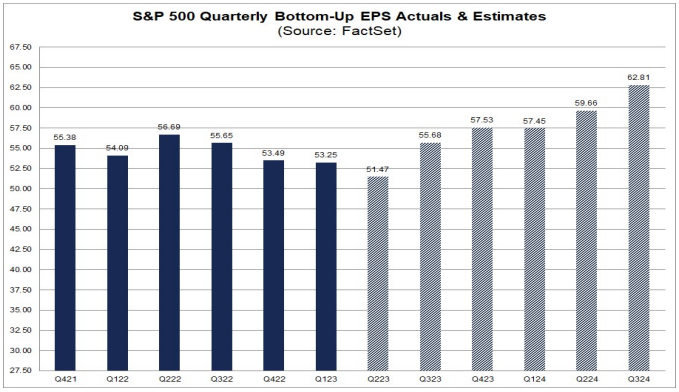

The better news right now, however, is it looks like we are getting to the end of this “earnings recession”. The current belief is this is the last down quarter for earnings and we will see a spike in Q3 followed by a good run over the next 12 months.

Past performance is not indicative of future results.

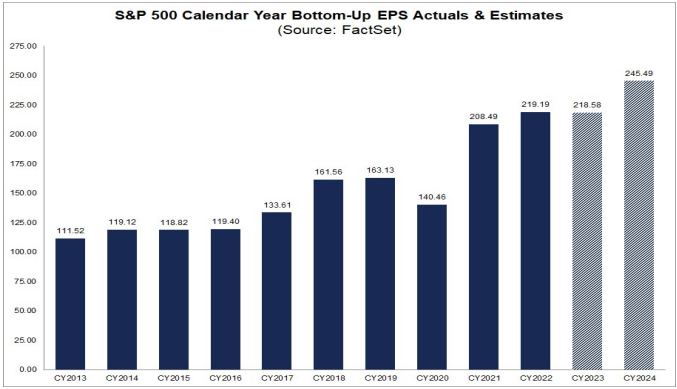

If those expectations prove to be accurate (they have historically tracked pretty well), that means next year sees a big jump in earnings per share for the S&P.

Past performance is not indicative of future results.

The 12.31% growth in earnings predicted for 2024 would be the biggest we have seen since the post COVID spike in 2021.

What Does This Mean for This Week?

We have established so far that the Fed’s going to raise rates this week, economists are getting more optimistic, and there is reason for optimism in the stock market. So, what does all that mean for this week? Nothing.

Where everyone has ignored the Fed for the last month, they are going to be the loudest voice in the room this week. A negative – or more hawkish – tone is certainly going to impact the market in the coming days, much as it did in the few days after the June meeting.

But this is the last Fed meeting until late September. If we can simply muddle through this one and get some good market and economic results in the meantime, it might be possible that a month from now no one cares what the Fed said this week. Much like what happened in June.

Sincerely,