The Weekly Insight Podcast – Embrace the Good

You probably noticed a bit of a pessimistic bent to the memo last week as we focused on the Fed’s intransigence on inflation and interest rates. There is no question that we are…confused…about the path they are taking us down. The inherent risk from being too hawkish on interest rates is obvious (a recession), so you will forgive us for being a bit testy.

But there is another side to this coin that was readily apparent last week and needs to be highlighted: the U.S. economy is in remarkably decent shape considering all we have been through. As we wait another 10 days to hear the sermon from Pastor Powell, we thought it might be helpful to remember the position we are currently in.

Inflation

We know…the inflation data might not matter much to the Fed when they make their decision next week. Their ability to find bad news in good data is astounding. But for the people it is affecting? The inflation data we got last week is tremendously good news.

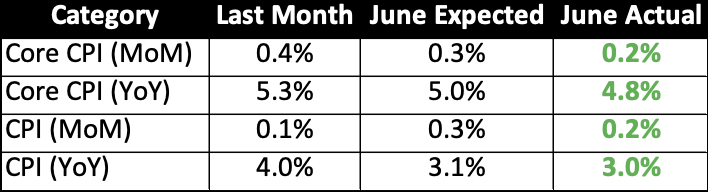

CPI data came in on Wednesday and it exceeded expectations in both core and all items CPI.

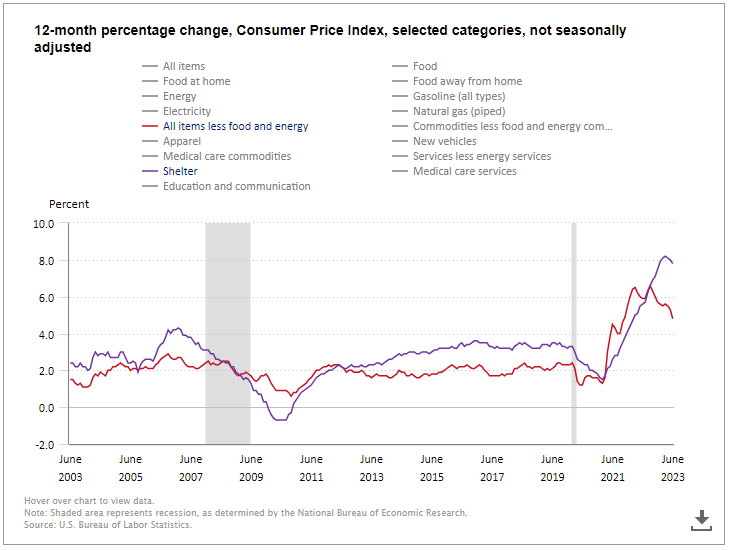

Source: U.S. Bureau of Labor Statistics

Both Core and All-Items have fallen dramatically from their peaks. Three percent total inflation is an excellent number (and below the historical average of 3.6%). But Core’s slower decline continues to be the concern of the Fed. And we continue to be concerned by the lack of reality in the Core statistics.

You have heard it from us a million times by now – but their calculation for shelter (which makes up 42% of Core CPI) is just…wrong. While it is finally edging down (a bit), the idea that shelter today is 7.8% more expensive than it was one year ago does not line up with reality. As this data set continues to improve, the Core numbers will drop dramatically.

Past performance is not indicative of future results.

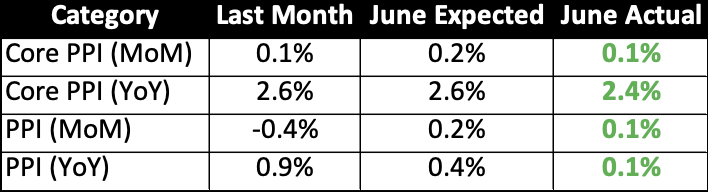

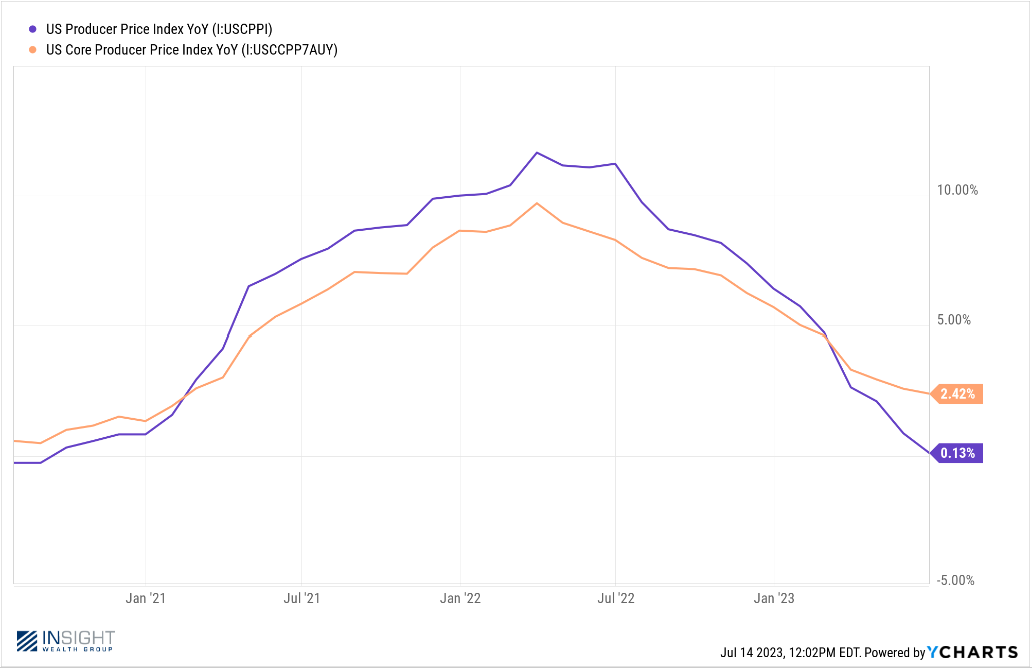

But it was not just CPI that showed positive results last week when it comes to inflation. The PPI data (Producers Price Index) also came in better than expected.

PPI is a leading indicator for CPI, so the data over the last several months should be extremely good news.

Past performance is not indicative of future results.

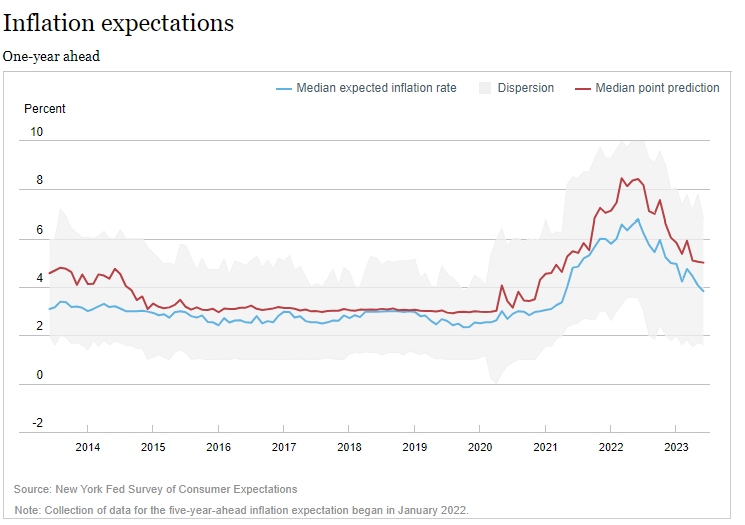

And consumers are taking notice. One of the concerns the Fed frequently cites is the anchoring of “consumers expectations for inflation”. The theory is that as people accept that inflation is a foregone conclusion, prices will be raised on products in anticipation of that inflation.

That is not where consumers are right now. According to the New York Federal Reserve, consumer expectations on inflation are coming in at 3.8% over the next year, the lowest number we have seen since April of 2021.

Past performance is not indicative of future results.

Consumers Are Happy

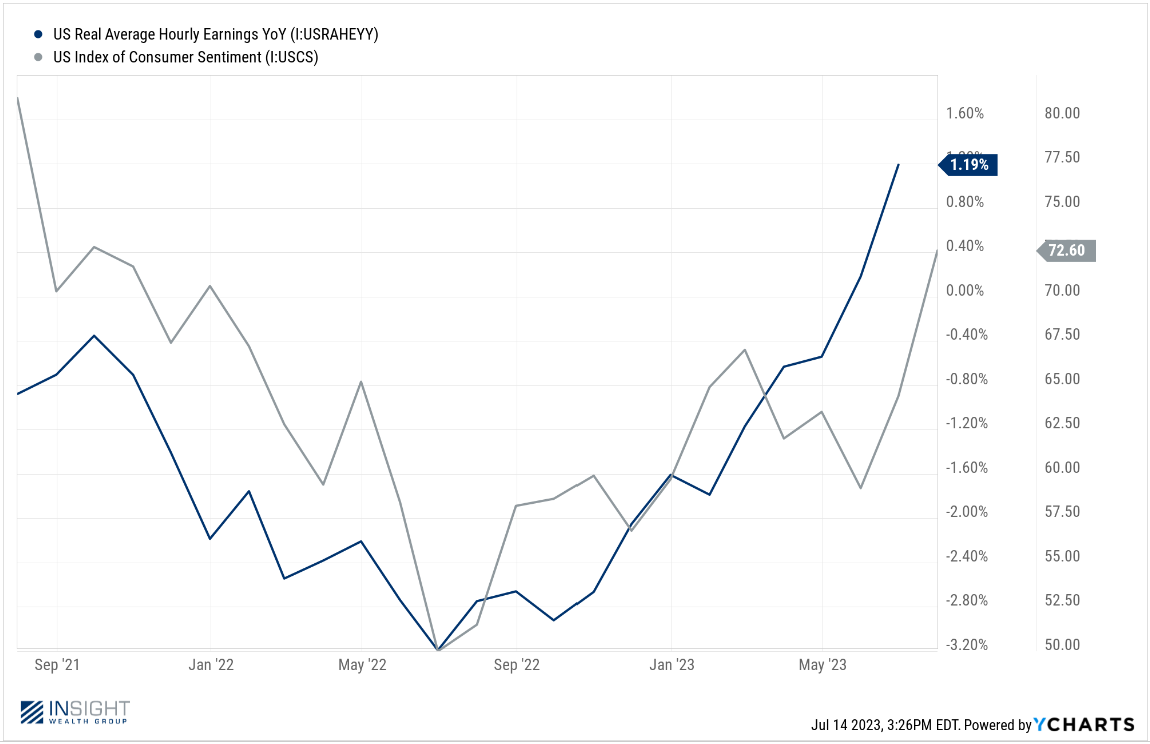

It should not be a surprise, given the data above, that consumers are feeling rather good right now. Consumer sentiment right now is the best it has been since September 2021. With inflation coming down, “real earnings” – i.e., how far the consumer’s paycheck goes – are rising. It is not a coincidence there is a direct correlation between the two.

It certainly helps that the consumer continues to be in a healthy position as well. We have discussed this before, but it bears noting again: for as much criticism as the American consumer receives, they did a fantastic job of right-sizing their debt-to-equity situation in the pandemic.

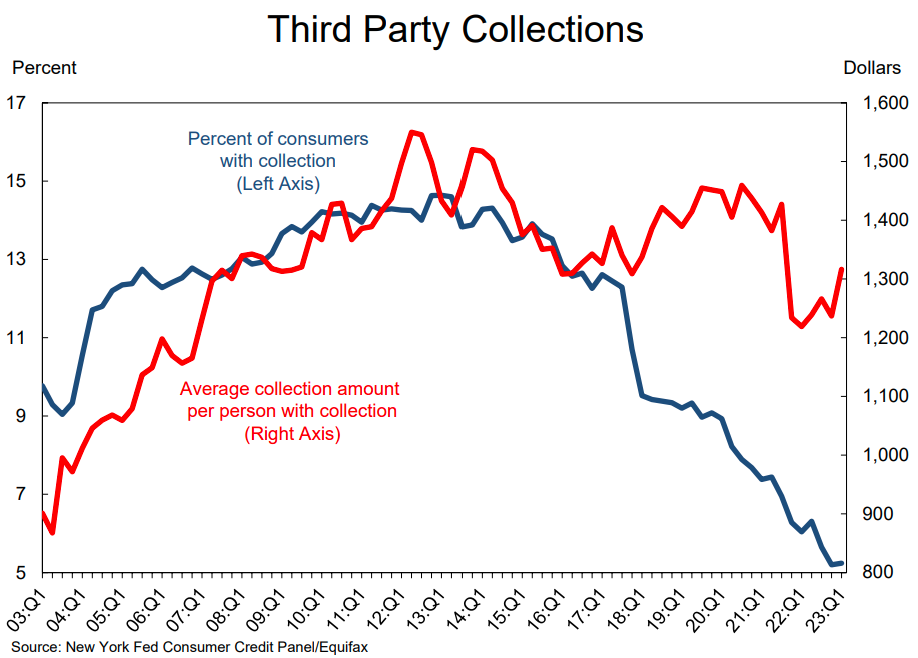

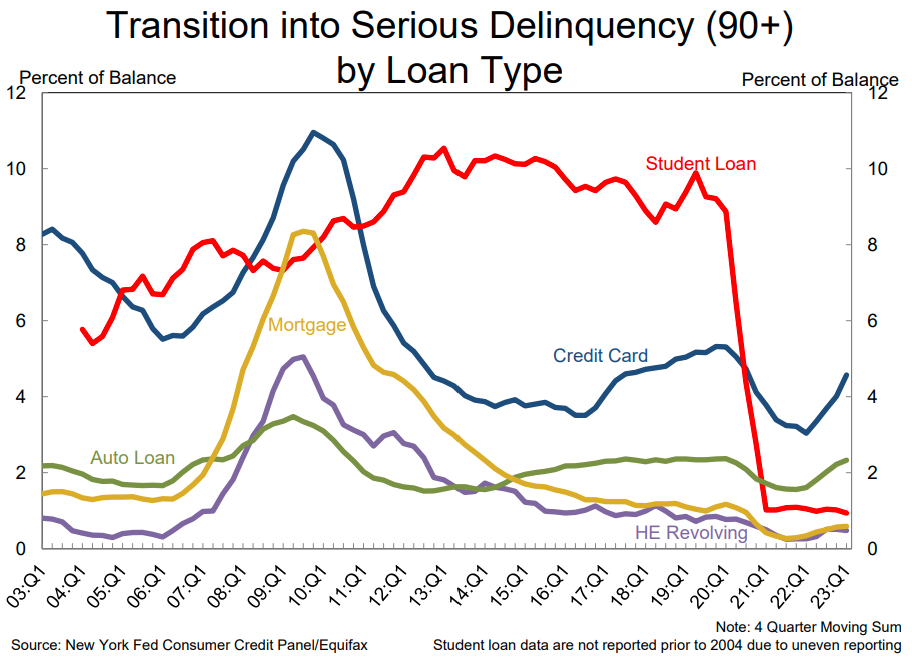

Even today, debt delinquencies are at the lowest levels we have seen in the last twenty years. And the percent of consumers who have some sort of debt in collection is also at twenty-year lows…by a long shot.

There are two big reasons for this healthy balance sheet right now. The first is the fact that consumers have not had to pay on student loan debt for the last two years. That’s allowed them to get the rest of their house in order while payments were abated.

The Supreme Court, however, just ruled against President Biden’s student loan forgiveness program. According to the ruling, payments are going to turn back on again in August. But the political gamesmanship continues as the Biden Administration just announced a new forgiveness program that will wipe out the debt for more than 800,000 borrowers who enrolled in “income-driven repayment plans”. This $39 billion program will undoubtedly be challenged as well in the courts – but it will delay the payments for a small portion of the more than forty-three million Americans that have student loans.

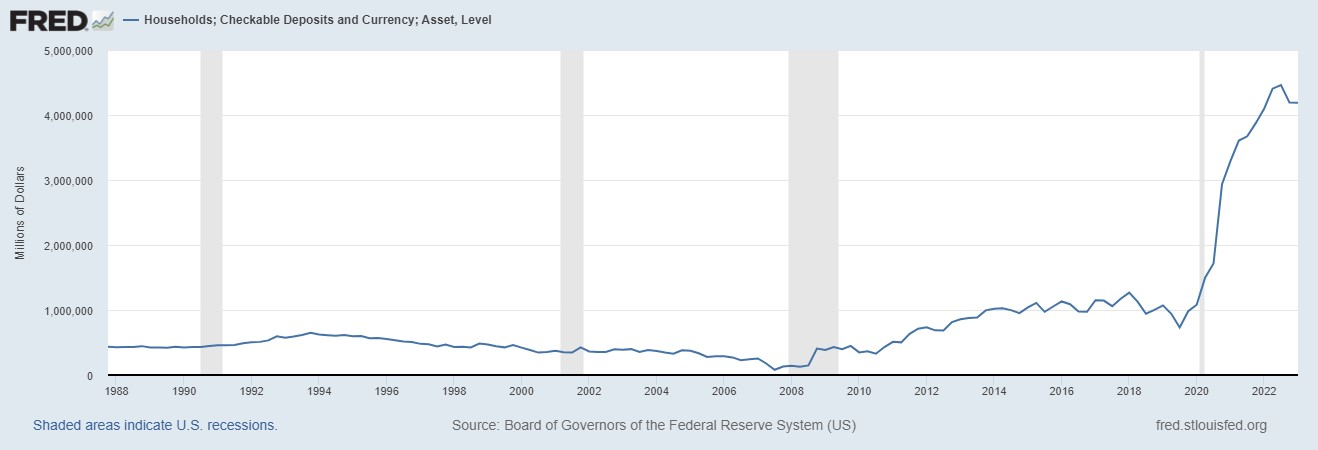

The other counterweight to the upcoming student loan payments is that consumers still have a lot of cash. And we mean a lot of cash. While the balances have come down some this year, they still stand at historic inflation adjusted highs.

Earnings

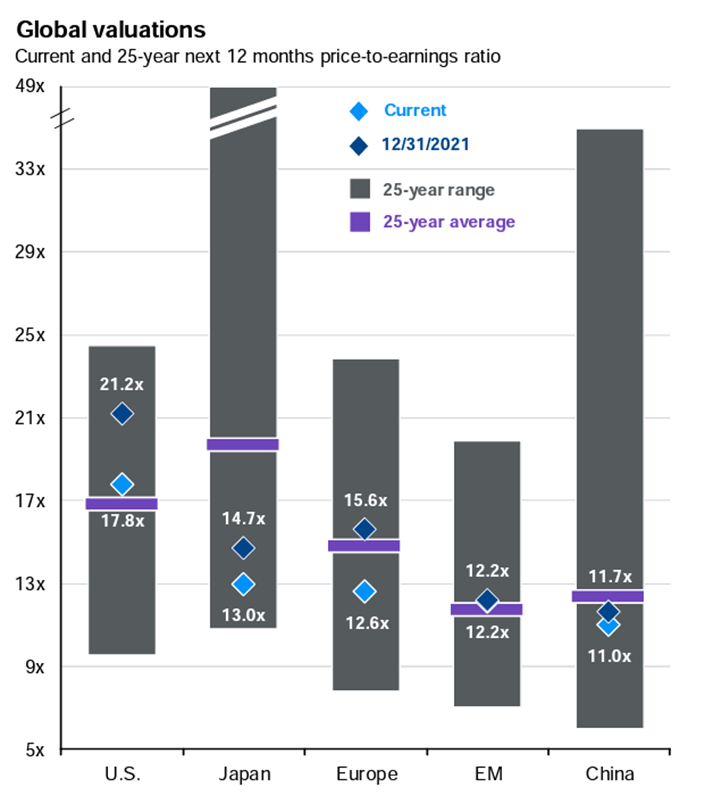

So, if inflation is falling, and the consumer is healthy, the next question becomes one of corporations and the markets. We always hear about asset bubbles, the next Black Swan, etc., etc. But the truth of the matter is that things look fairly healthy today. Just look at where valuations stand compared to historical averages and – even more importantly – one year ago. We have seen a significant shift back to more normalized valuations that will provide opportunities in the future.

Source: Hamilton Lane

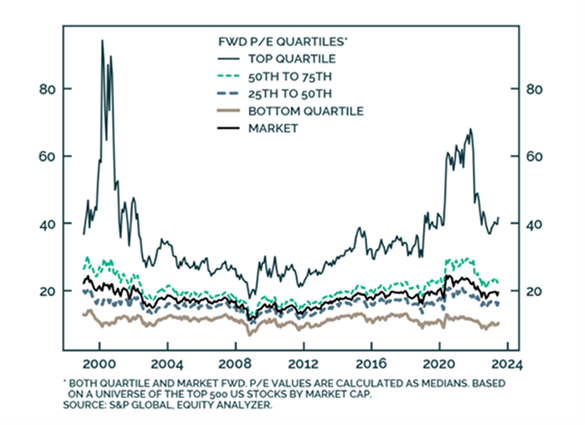

But if there is an asset bubble, it is undoubtedly in the mega-cap AI stocks right now. The forward P/E of the biggest names is light years higher than the rest of the market.

Source: FundStrat

If, in fact, the Fed does drive us off the cliff, that will bode well for a more defensive, value driven strategy in equities. As the chart below shows, value stocks outperform significantly in recessionary periods.

So, as grumpy as we might get spending our time monitoring the comings and goings of the Fed, the truth remains that things are not that bad right now. The economy is healthy. Consumers are healthy. The market is fairly valued. We can bear a bit of strain from the Fed. In fact, it may be this very optimism that is giving the Fed the confidence to be more aggressive about interest rates.

Sincerely,