We’ve seen it all, economically, in the last 20 months. Shut the economy down? Check. Unprecedented government stimulus? Check. Massive economic recovery? Check. Inflation? Check. They are, quite literally, going to write textbooks about this period. There will be things historians look back on and say, “Wow. That was genius.” And things they look at and say, “Man, those people were idiots.” The problem is – in the moment – it’s really hard to discern which is which.

The latest hot take by the national media is about “The Great Resignation” and the ways our labor economy is changing in front of our eyes. Some see it as a catastrophe. Some see it as a boon to the economy. To be blunt, we don’t know what it is, yet. But it’s happening. And it’s impacting inflation. So, it’s worth taking a dive into so all of us can at least understand the facts as they’re happening today.

COVID Burnout or COVID Comfort?

We know everyone is burnt out on COVID. Parents forced to school their children at home. Elderly who were locked inside for months on end, fearing exposure to the virus. Kids who didn’t get to see their friends for – in some cases – well over a year. It hasn’t been a fun time.

That’s certainly been true for workers of all stripes, but it’s been especially true for service workers. The service economy was flipped upside down by the pandemic. Businesses were either closed by mandatory government shutdowns or by the simple fact that no one was traveling or eating out.

Thankfully, as we’ve said before, there was significant government support available to help these workers – and their employers – through the pandemic. But the support also created an interesting divide. Those who were working saw their value in the workplace increase. Workers were hard to come by so employees were getting more hours. Often many more hours. For example, your author talked to the manager of a local convenience store last week. He was scheduled for 76 hours for the week. The good news – he’s making the most money he has in his life. The bad? He’s burnt out.

Then there is the other side. For those who found themselves unemployed, that is certainly a stressful event. In many cases these are people that have no safety net. They live paycheck to paycheck and that fear doesn’t go away just because the government is coming with checks. But they were big checks. In many cases, the unemployed were making substantively more by staying at home than they ever were by working.

Workers Emboldened

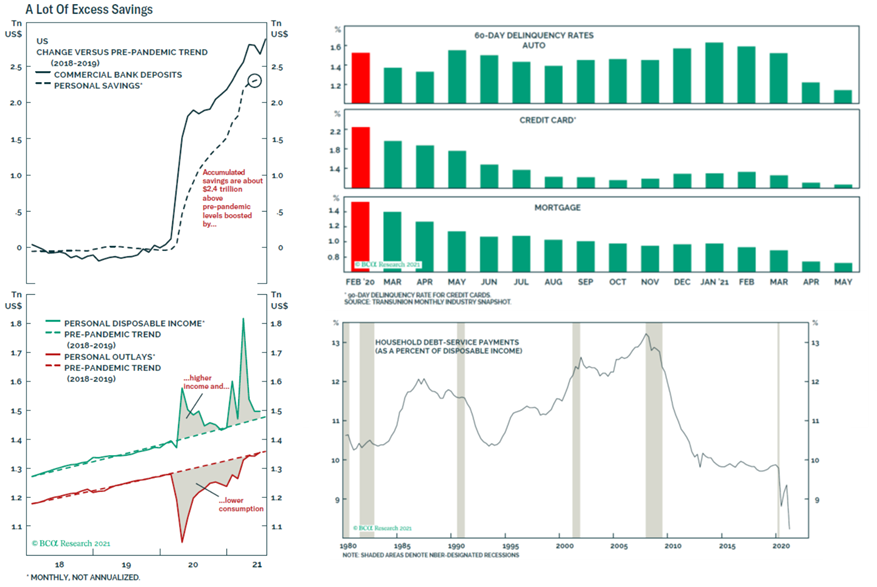

We’ve shared these charts before, but we’ll throw them up one more time for reference. Workers did well during COVID financially. In fact, the consumer is as healthy as they have been for a long, long time.

People aren’t dumb. They know their pocketbooks are fuller today than they have been in some time. And they also know they have leverage against their employers. There are more than 7 million unfilled jobs in the United States today. If they walk away from one job, the chances they’ll be able to find gainful employment are very, very good.

Which leads us to the talk about the “Great Resignation”. People are quitting jobs in unprecedented scale today. A record 4.27 million people quit their jobs in August alone. That follows 4.03 million quits in July, 3.87 million in June, 3.63 million in May, and 3.99 million in April. That’s nearly 20 million resignations in five months – or roughly 13.6% of the U.S. workforce. In the hospitality industry, one in every 14 workers quit their job in August alone.

Let’s be clear: workers aren’t quitting just because they want to sit at home and play Xbox (okay…some probably are…but that’s a small fraction). They’re quitting because they hold the cards today. And those cards are tied directly to wage increases.

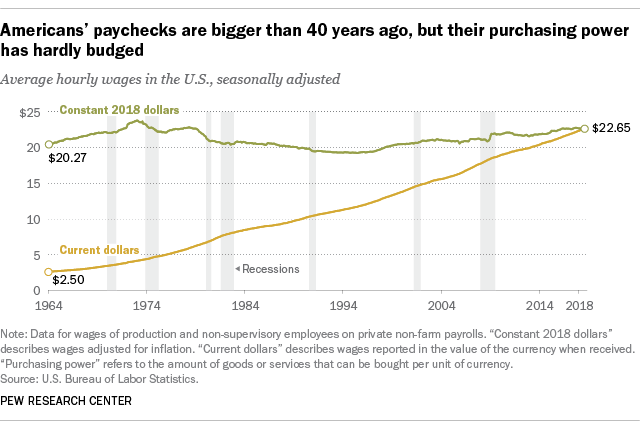

It’s the first time in a long-time workers have had this advantage. The chart below – from 2018 – shows that from 1964 to 2018, real wage growth was only 11.74% over 54 years. That’s 0.21% per year. Wage growth has just barely squeaked above the rise in inflation. More importantly, if you look closely, the numbers from the mid-1970s to 2018 went down.

Derek Thompson wrote and interesting piece in The Atlantic this week about this behavior (you can read it here). He notes that the rapid wage growth in the 60s and 70s was tied to a unique period for workers. As he points out:

“You may have heard the story that in the golden age of American labor, 20th-century workers stayed in one job for 40 years and retired with a gold watch. But that’s a total myth. The truth is people in the 1960s and ‘70s quit their jobs more often than they have in the past 20 years and the economy was better off for it.”

The wage growth chart above would seem to prove his point. This reshuffling of the labor market might be a good thing for the economy as we march along. But right now, it’s still a big question mark that has economists nervous.

Earnings Update

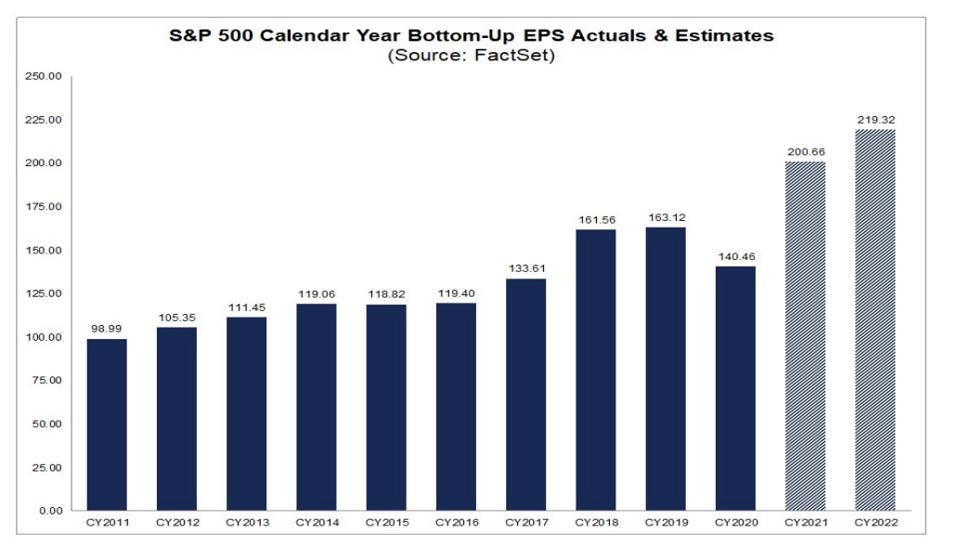

We previewed earnings season in these pages last week with our hope that earnings for Q3 would top 30% growth. It looks like we may have been right.

The first big week of earnings – when the big banks report their numbers – has come and gone and the results were very good. Bank of America beat expectations. JP Morgan beat expectations. Wells Fargo, CitiGroup, etc., etc., etc.

That’s good news for Insight investors as we continue to be overweight financials in several of our models. The sector makes up nearly 24% of our Insight Dividend model, 15% of our Growth model and 14% of our Conservative Growth model.

But it’s also good news for the overall market as the financials tend to be the canary in the coal mine. Earnings watchdog FactSet is now showing earnings growth projections for Q3 of 30% and projections of more than 20% for Q4. Their model for the full fiscal year is now showing earnings growth of more than 40%.

We would point out – as we have repeatedly over the last few quarters – that earnings growth is measured as growth over the same quarter one year ago. As someone once said, it’s hard to fall off the floor. One year ago was the floor. Looking at next years earnings expectations is going to be an important exercise over the coming months.

Right now, the expectation for 2022 remains strong with growth expected to continue at more than 9.3%. We barely doubled that number in five years from 2011 through 2016. While it won’t be 40%, it’s also nothing to sneeze at.

Until next week, we hope this finds you well! If you need anything, please don’t hesitate to give us a ring.

Sincerely,