TL/DR: Our “Too Long/Didn’t Read” Section of the quarterly update is proving popular, so we’re going to keep it going. Here’s your 30-second version. Read on to get the meat of the story!

- 2019 Year in Review:

- 2019 proved to be a great year in portfolios. We review the changes made in portfolios and the impact that had on overall performance.

- What does 2020 have in store?

- What are our top indicators saying about a recession? We still have some runway before an eventual downturn.

- As was the case in 2019, Fed policy error and trade policy are the big policy issues that could impact the market negatively this year.

- The election year is upon us! The market is watching this closely and the outcome of the Democratic nomination process will be important to the market’s performance in the first half of the year.

- 2020 Portfolio Changes

- We made some changes early this year increase our international holdings as non-U.S. developed markets see steep discounts to the U.S. equity markets.

- Technology Update

- Orion is rolling out to clients. Keep an eye on your inbox!

- Financial Planning Topics

- How will the SECURE Act impact you and your financial plan?

- Don’t forget to review your current insurance coverages to ensure they are in line with your long-term goals.

What a year 2019 was! As the S&P closed the year just 0.29% off its all-time high, markets across the board enjoyed a very positive year. What a difference a year makes. You may recall this (we certainly do!), but 2018 was unique in that there was no asset class – except for cash – that closed the year in the black. 2019 made up for it as the broader markets had their best year in over two decades.

That’s not to say 2019 was a year without drama. The same old boogiemen that have riled the markets for the last several years raised a hand out of the grave this year as well, specifically interest rate policy from the federal reserve and trade policy with China. And – as we’ve discussed before in depth – the 10-year/3-month yield curve inverted for the first time since the Great Recession. These incidents led to two 6%+ corrections in the market and one nearly 5% correction. You might recall us saying this in the past, but historically markets have three 5% or more corrections each year. Last year was pretty spot-on in that regard.

This volatility – while it had little impact on the total return in portfolios – serves as an excellent reminder that policy from Washington and the Fed has a direct and substantial impact on the overall market. In an election year (more on that later!) this is an especially important thing to remember.

2019 Portfolio Update

A year like 2019 has the tendency to make asset managers complacent. We made it our priority to do the opposite. As you will see in the update below, we took the opportunity of strong returns in the market to continue buffering our portfolios from future volatility. The result was portfolios which ended the year with excellent returns but are also more conservatively positioned than we have been in the last several years. While the end of the bull isn’t happening tomorrow (see below), it’s never bad to get some hay in the barn while the sun is still shining.

Balanced Portfolio

Our Balanced Portfolio is the most conservative of our core portfolio strategies. The long-term goal of the portfolio is to be a 50/50 equity to fixed income strategy. However, in the middle of the year, after a very strong start in equities (nearly 2/3 of the stock market’s return happened by July 26th), we made the decision to reduce our equity exposure. As of the end of the year, the portfolio was roughly 40% equity and 60% fixed income. Despite this conservative positioning, the strategy ended the year up 16.77%.

Conservative Growth Portfolio

Our Conservative Growth Portfolio – the largest of our strategies – is designed to be more equity weighted and has traditionally held a 70/30 positioning. Much like the Balanced Portfolio, we made the decision in mid-July to contract our equity weighting in this strategy as well and ended the year roughly 58% equities and 42% fixed income. Again, the timing of the change worked to our advantage and the strategy ended the year up 19.63%.

Growth Portfolio

The newest of our portfolios, our Growth Portfolio is a heavily equity weighted strategy. While this certainly worked to its favor this year, its equity weighting leads it to have a higher level of risk than our other core strategies. But, yet again, we made the decision to pull back from our standard 90/10 weighting in the strategy and ended the year at roughly 81% equity and 19% fixed income. The strategy ended the year up 24.07%.

Enhanced Yield Portfolio

Our Enhanced Yield model is our strategy designed to generate cashflow through dividend yield and income distributions. At the end of 2019, the portfolio was generating a 6.92% distribution yield to clients’ accounts. As you may recall, we decided at the end of the first quarter of the year to take some winnings off the table and reallocate the portfolio to less expensive positions. While the yield was not affected, it did provide us substantial upside through the last ¾ of the year. In the end, the strategy ended the year up 19.31%. While our goal in this strategy is income, not total return, we couldn’t help but be pleased by the overall result.

Opportunistic Muni Strategy

Last, but certainly not least, is our Opportunistic Muni Strategy. While some would consider an all muni-bond strategy a little “boring”, the returns in 2019 were anything but. The portfolio currently delivers a 3.41% tax-free dividend yield and ended 2019 up 11.83%.

2020 Outlook

If there is anything our experience has taught us, it is to not rest on our laurels. 2019 was a great year – which is exactly why we fret about what may be headed our way. We saw an article the other day titled “Experts Agree: No Recession in 2020!”. There is literally nothing that bothers us more than when all the so-called “experts” agree things are going to go well!

1 Model return numbers reflect the strategy as a whole and may not indicate actual returns in the client’s portfolio. Returns may differ based on contributions or distributions to/from accounts or deviations from the model based on custom allocations in the account. Assumptions assume a 1% a management fee (our maximum fee) on portfolio assets. Your fee will be lower if your managed portfolio balance is more than $1,000,000. Portfolio return figures are not audited, but are provided by Taiber Kosmala and Associates, a third-party consultant on portfolio strategies.

Accordingly, we’ve spent a substantial amount of time over the last several months checking and rechecking our research on the fundamentals of the market and economy, valuations, interest rate and trade policy, and more. Our conclusion? A recession isn’t imminent (in fact, it’s unlikely in 2020), but just because there isn’t a recession on the horizon doesn’t mean everything is “hunky dory”. Where 2019 was a year investors could ride the wave of overall market success, it’s our opinion 2020 will be one in which success is going to have to be earned. Let’s go through the data.

No Recession on the Horizon

Our four key U.S. recession indicators all remain constructive today. Those include monetary policy, U.S. corporate profits, the condition of the U.S. consumer, and current interest rates.

Monetary Policy

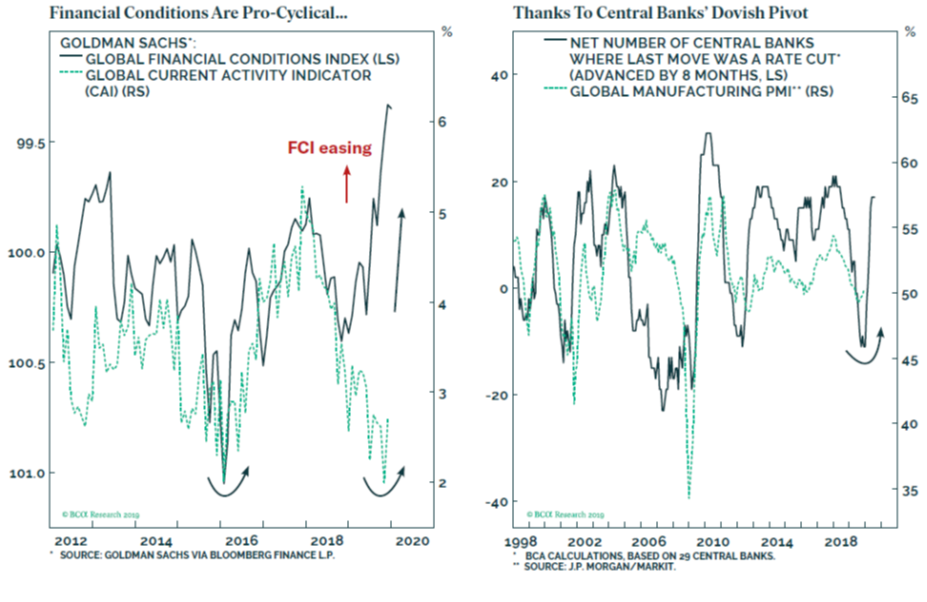

We all know that the Federal Reserve has been cutting rates for the last 18 months. But it’s not just happening here in the U.S. Global Central Banks have been joining in the liquidity push and it is having a positive impact on the global economic condition.

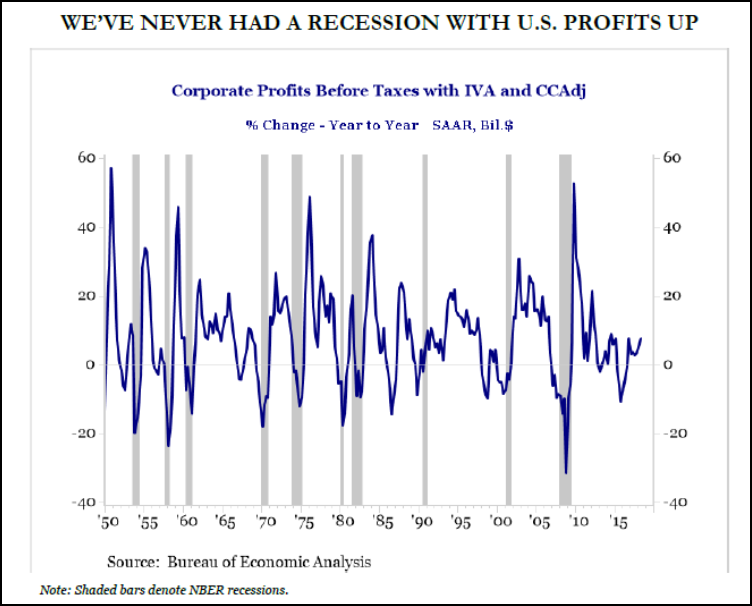

U.S. Corporate Profits

This seems like an obvious point – but we have never had a recession when U.S. corporate profits were up. That is where we find ourselves today.

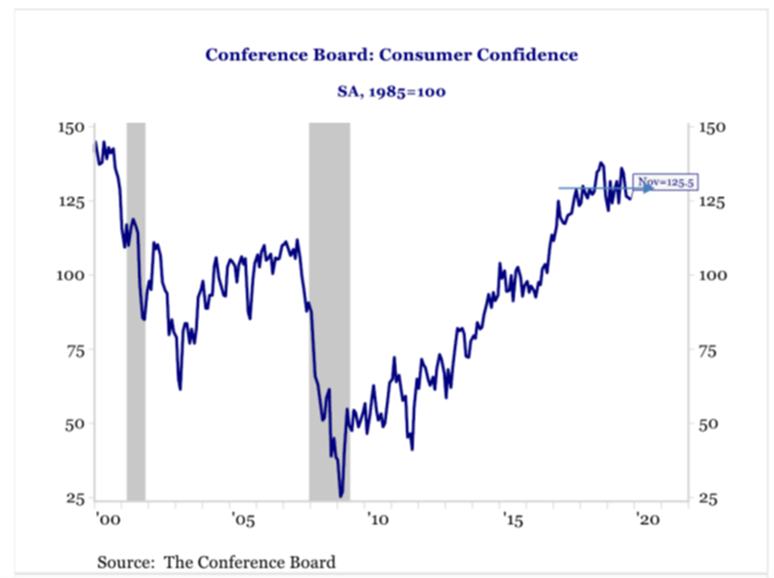

Condition of the U.S. Consumer

There is so much talk in economic circles about the condition of the manufacturing sector in the U.S. and around the world. While it’s an important measure for sure – it is a much smaller piece of the U.S. economic pie than ever before. Instead, it is important to remember that over 70% of the U.S. economy is made up of consumer spending. As such, the position of the U.S. consumer is vital to understanding where our economy is going. And right now, consumers are feeling pretty good about things.

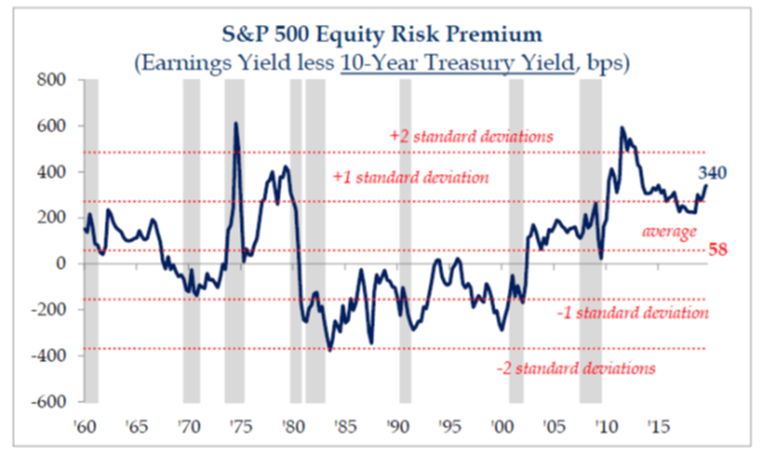

Interest Rates

We’ve discussed this a lot over the last several years – but low interest rates mean there is a premium given to equity returns. Essentially, if investors can’t generate a return out of “safer” fixed income assets, it makes sense to invest in equities to generate return. The risk premium given to equities today vs. treasuries is among the best we’ve seen over the last 60 years.

So – if the world isn’t going to end tomorrow – what is keeping our Investment Committee up at night. And, more importantly, why wouldn’t we shift our portfolios entirely to equities?

Central Bank Error

It must be stated that the Federal Reserve has not been an analyst’s best friend for a long time now. We’ve joked in past issues of this communication about how bad the Fed is at predicting their own policy initiatives. In fact, the market does a better job of predicting what the Fed will do than the Fed itself. Which is why we have a hard time trusting in the information coming out of Federal Reserve meetings.

Current Fed policy today is known to have two key points:

- They are holding off on any additional rate changes through the end of 2020.

- They are currently reviewing their “dual mandate” and are now saying they may be willing to tolerate inflation above 2%.

Theoretically, the market loves this strategy. The problem is, the Fed is very bad at keeping it’s promises when it comes to long-term policy. Any change in either of these strategies this year could be met by problems in the equity markets.

Trade Policy Concerns

The announcement of a “Phase 1” deal between the U.S. and China has allayed the markets concerns for the time being. But there are still substantial tariffs on Chinese products entering the United States and the “on again/off again” nature of these negotiations has, in the past, led to 5%+ declines in equity markets.

It seems today the Chinese have decided they’re going to play ball with President Trump at least/until the November elections. They are essentially hedging their bets that he may be reelected. However, if his chances for reelection tumble, or if President Trump decides to use U.S./China trade policy as a lever in the election, all bets may be off. A significant escalation in rhetoric could be bad for equities.

The Election

The biggest unknown for 2020 is the fall Presidential Election. We’re much too far out to begin providing any sort of commentary on what might happen – but the picture is going to begin tightening up quite a bit in the first quarter. As of the writing of this memo, the Iowa Caucus is less than a week away. The narrowing of the Democratic field is going to provide a better understanding of the battle that will be underway this fall.

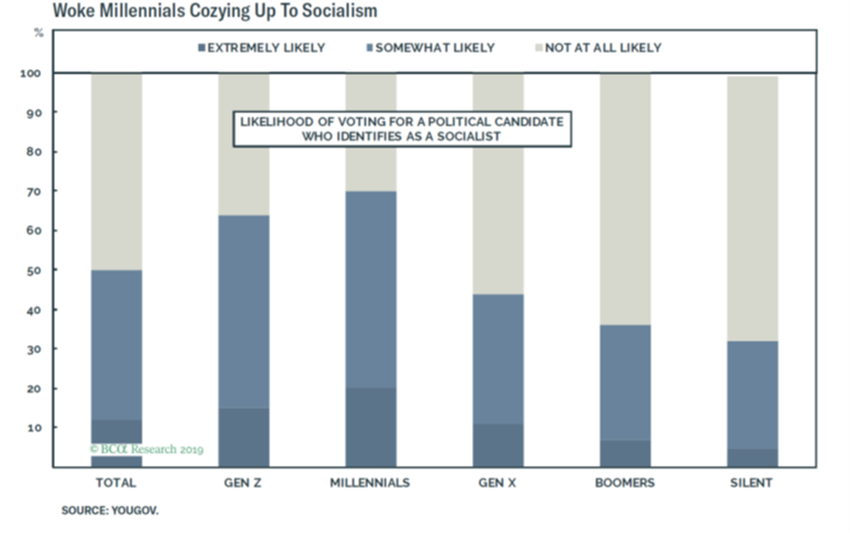

What do we know so far? The contest in the Democratic Party seems to be one of moderation vs. socialism. While it seems extreme to even be writing that sentence with the word “socialism” in it, the truth is we are seeing polling support it. In fact, as you can from the chart below, nearly 50% of voters in the United States say they are either “Extremely Likely” or “Somewhat Likely” to vote for a political candidate that identifies as a “Socialist”. Interestingly, when you look at Millennials and Gen Z, those numbers are substantially higher.

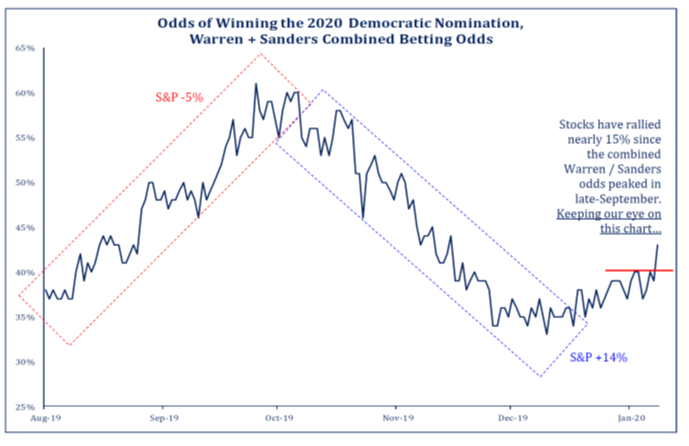

The market has taken notice. It’s interesting that stocks rallied nearly 15% after the odds of either Bernie Sanders or Elizabeth Warren winning the nomination began dropping in October. Since their odds of success bottomed out in December, we’re seeing a substantial uptick in their support and the most recent Iowa Poll (historically the best poll at predicting the Iowa Caucus) had Sanders (20%) and Warren (17%) leading the pack. More moderate candidates Buttigieg (16%) and Biden (15%) were close behind. This will be something to watch over the coming weeks.

Recent Portfolio Changes

While each of the items we noted above are things to watch, the final impacts are unknowable at this time. We must deal with things we can quantify and use them to position your portfolio accordingly.

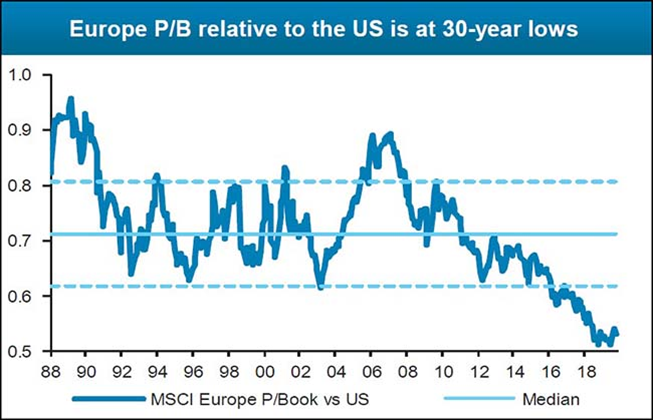

For the past several years, we have been substantially overweight in each of our three Core Models (Balanced, Conservative Growth and Growth) to U.S. equities. That bias has paid off because during that time period, U.S. equities have vastly outperformed those overseas.

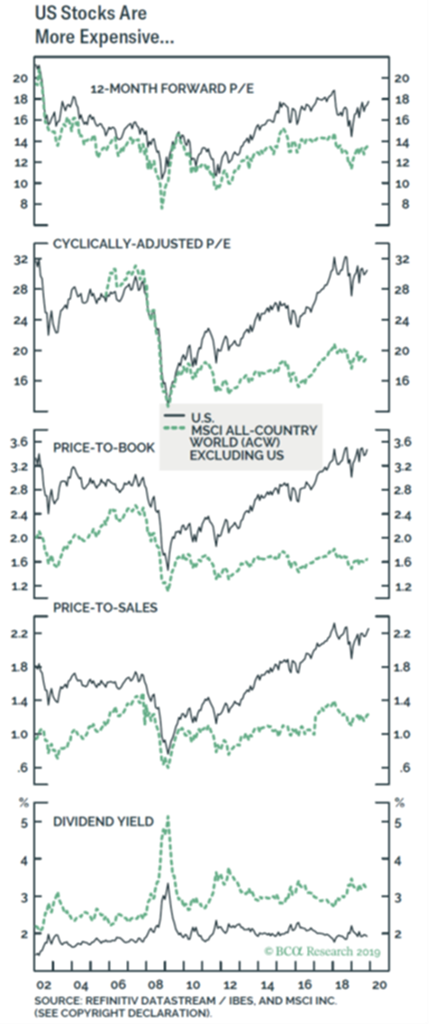

It is our opinion that the imbalance has gotten to such a point that a change is warranted. As you can see from the charts on the right, the U.S. is more expensive than the rest of the world in nearly every way you can measure the “cost” of a market.

The discount is especially remarkable in developed countries – including Europe. As the chart below shows, Europe is trading at one of the steepest discounts we’ve seen in the last 30 years:

As such, the Investment Committee made the decision to bring our weighting in developed international positions up substantially after the end of the year. This includes positions in both Europe and Japan. This change brings us in-line with more traditional expectations for foreign weighting and is one we anticipate not only provides us potential upside but may protect your portfolio in the case of any broad-based market correction.

Technology Update

As you are no doubt aware, one of our major focuses as a firm has been the rollout of the Orion platform for portfolio reporting. We’re happy to announce that, by the time this memo reaches you, Orion access should have been provided to clients making up more than 90% of our assets under management. That is the easy part!

The next part of this process is appending all the historical information to each client’s data file. That effort will be ongoing throughout the year and we will keep you up to speed as more information becomes available.

If you have any questions – or any concerns – throughout this transition, please feel free to contact our office directly so we can address those issues with you personally.

Financial Planning Topics

Each quarter we highlight relevant financial planning topics that may be of interest to our clients. Not every quarter will a topic be relevant directly to you, but we hope this can serve as a catalyst for thoughts about your personal situation and may drive conversation in your regular meetings with your financial advisor.

The SECURE Act

The SECURE (Setting Every Community Up for Retirement Enhancement) Act came out of Congress and was signed by President Trump in late 2019. The SECURE Act implemented several changes to the way retirement plans (i.e. 401k plans) and retirement accounts (i.e. IRA accounts) work. The details of the bill are too many to enumerate here, but we thought we’d highlight a few important ones:

- Changes in RMD Age

- The SECURE Act changed the age at which retirement account holders were mandated to begin taking Required Minimum Distributions from 70 ½ to 72. It is important to note, however, that if you had already reached age 70 ½ by the time the bill became law, you are still required to use the old timeline.

- Elimination of the “Stretch IRA”

- Under previous law, non-spousal beneficiaries of an IRA were able to take distributions from the account over their lifetime. Under the SECURE Act, all assets must now be distributed over a period of no more than 10 years. This may have a substantial impact on estate plans that were set up to skip generations to stretch distributions over the longest time period possible.

- 529 Plans for Student Loan Debt

- The SECURE Act now allows holders of 529 accounts to use those funds (up to $10,000 annually) to repay qualified student loan debt. Previously this was not an approved use of 529 funds and would result in a tax penalty.

- Increasing Maximum IRA Contribution Age

- Under previous rules, investors were not allowed to contribute to an IRA account past age 70 ½ – whether they were still working or not. The SECURE Act eliminated this requirement. If you have earned income (and it is not above the maximum limits) you are still allowed to contribute to a traditional IRA or 401k (or similar) account.

As we said above, there are many provisions to this new law that may impact you personally. If you are at or nearing retirement age – or own a business – this is an item you should address with your advisor to ensure your plan matches up with the new rules.

Insurance Solicitations

Over the years we have spent a significant amount of time working with clients to review their insurance coverages. As you know, we view insurance as just that – insurance against a future risk. After much research and attention to this issue, we have a firm stance that insurance may not always benefit a client as an “investment”.

Too often, we have seen insurance products held by clients that were clearly not placed in their best interest. We would encourage you, if you have contracts that you believe deserve a review, to contact us and we will happily spend some time getting you an assessment of its future viability for your financial plan.

As always, we thank you for sticking around through all of our musings! It is an honor to serve you and your families and we stand ready to assist you in any way we can. If there are items in this communication you would like to discuss further, please don’t hesitate to contact your advisor directly at (515) 273-133.

Wishing you a wonderful 2020!

Sincerely,