Before we start this week’s memo, just a brief side note. We understand this is a difficult and trying time for many. Lives have been lost, jobs are imperiled, and social distancing just…well…sucks. But as hard or as frustrating as it might be, we have no choice but to trust our federal, state and local leaders when they tell us the absolute best thing to do is stay isolated in an effort to slow the spread of this disease.

But throughout all of that – Insight Wealth Group isn’t going anywhere. We may not always be able to work from our offices (we currently still are – but they are closed to visitors), but our phone will always be answered, and emails returned until this crisis has passed. So please – please – take care of yourselves and know that we will be here to support you through this process in whatever way you need. Even if you’re just looking for someone to talk to when you get bored with Netflix! Just give us a call!

This is also a great point to remind you what this crisis is not. This is a healthcare crisis. It is a jobs crisis. It is an economic crisis. But it is not a crisis of our financial institutions. Banks have nearly 2x the liquidity they had going into 2008. We do not believe there is a risk today of the financial system collapsing. The reforms taken after 2008 have made the system better prepared to take on a situation like this. If we can weather this (hopefully short) storm, the rebound should be swift.

Alright — let’s get to it. In this week’s memo we’re going to go through the following:

- Update on COVID-19 spread and its impact on the market and economy

- A discussion of how China has fared coming out of the worst of the disease and how that might be a roadmap for the world economy

- The key points that we are watching for buy signals

- Financial planning ideas that may be wise in today’s environment

COVID-19 Roundup

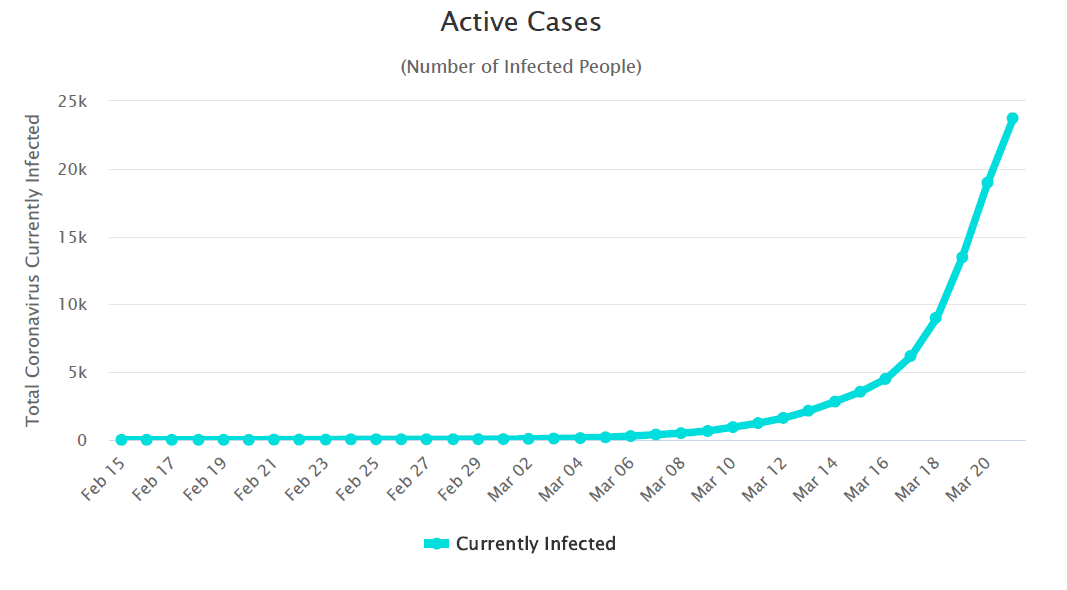

Last week was the week the market has been fearing as it relates to COVID-19. Two significant events collided to – frankly – scare the dickens out of the economy. First, we are now starting to see a significant increase in cases of the disease. Known cases in the United States are 7.38X the number they were one week ago. We have officially entered the “epidemic spread” era in the USA.

Second, we have now entered the “forced” social distancing era. Governments at the federal, state and local level have all acted to close schools and businesses, cancel events, etc. While each locality is different – the general concept is the same. Keep people home and away from other people. While this makes sense for the viability of our healthcare system, it is certainly not good for the economy.

We are seeing on the state level the same scenario playing out we’ve seen amongst nations for the last few weeks. Some areas are getting on top of social distancing quickly, despite a relatively low number of cases. For example, here in Iowa, while we haven’t gone on “lockdown” yet, schools are closed, restaurants are offering only take out, etc. Many, many businesses are shut down or “working remotely”. Today there are an estimated 105 cases of COVID-19 or roughly 0.000028 cases for every 100,000 citizens.

New York, on the other hand is a different story. Nearly half of all COVID-19 cases in America is in New York State. Finally, on Friday, the Governor of New York State shut the state down. Today they have 0.00063 cases per 100,000 residents, or roughly 22.5X as many cases on a population weighted basis.

We must admit to ourselves that, as additional testing comes online, it increases the likelihood of finding more and more cases of the disease. It is likely that the disease is already widespread throughout our population, but relatively minor cases are going – and have gone – undiagnosed and unreported. More tests would then mean more positive results and could – in the short-term – cause known infection rates to skyrocket.

Stock Market Roundup

The battle in the stock market last week switched to a new gear as the market began to grapple with the impact of the economy “shutting down” for an indeterminate period. We tend to put the first drafts of these memos together on Sunday. Last week was no different and the memo was ready to go around noon last Sunday. The next five hours necessitated a complete rewrite as the Fed announced they were slashing rates and state and local governments aggressively started to close things on Sunday afternoon.

The Fed announcement was a disaster. Something that should have injected confidence into the market as they were making clear liquidity would be available instead signaled to the market that “all hell is breaking loose”. We try to stay away from bombastic statements in these commentaries, but the Fed under Jerome Powell has done a horrible job of messaging to the world its plans. That lack of clarity and purpose by the Fed has made even gift-wrapped good news into disasters.

This was no different as the market ran for the hills on Monday. The S&P500 ended the day down 11.98% as investors scrambled for safety. The rest of the week produced some wild volatility (nothing new these days) but seemed poised on Friday to end the week above the low we saw on Monday. As of 2:05PM CDT on Friday, the market was 8 points above the Monday close. But then New York Governor Andrew Cuomo announced the lockdown of New York State and the market tanked. One could argue the announcement could have waited 55 minutes – and Cuomo likely knew the impact it would have on the stock market – but it is what it is. The market ended the day down a little more than 4% and down 3.4% from Monday’s close.

Economy Roundup

This is the tough one. Anyone who tells you they know with certainty the impact of “social distancing” on the economy is, frankly, full of it. We really appreciated this quote from Warren Buffett talking about interest rates this week, because it lays out well the experts’ inability to predict the future:

“My circle of competence doesn’t include the ability to predict interest rates a day from now, or a year from now, or five years now. Can I function without knowing that? It’s the same way as predicting what business is going to do, what the stock market’s going to do. I can’t do any of those things. But that doesn’t mean I can’t do well investing over time.”

Simply put, no one can predict the day to day swings or the impact this will have on our economy. Our goal, instead, is to understand the big picture, valuations and pricing and trust that those data points will – in the long term – benefit us.

In terms of real economic data – we don’t have much. Or at least not much recent enough to assess the impact of what last week’s rapid shutdown of the economy means. Nearly every economic report last week was focused on February numbers or Q4 numbers. The only two that are in any way relevant were the weekly jobless claims for the week ending 3/14 (281,000 – or roughly 61,000 more than expected) and the Philly Fed’s manufacturing index which came in with a -12.7 mark for March. This is a “sentiment” index, meaning a negative number indicated manufacturers believe demand will decrease. Not a surprise.

This week we’re going to begin to see some real data. Purchasing managers data (PMI) is coming out on Tuesday morning and will give a good idea of how manufacturing sentiment is looking around the country. Consumer sentiment data for March comes out on Friday, giving us the same data except from the consumers standpoint.

The big report, though, is the weekly jobless claims data coming out on Thursday morning. We are seeing huge numbers of jobless claims expected (Goldman Sachs is predicting 2.5 million). Simply put – we don’t have any idea what the real number is at this point. It could be dramatically more than that – or dramatically less. Our economy has never seen this sort of rapid forced decoupling of productivity. But we would anticipate a number above the Goldman estimate would be very bad for the stock market at the end of the week.

Additionally, GDP predictions have been…wild. They vary widely across various economists and companies. While our GDP estimations have been substantially more conservative than most, the reality is, since no one truly knows the impact of the recent changes in our society, no one can accurately predict what GDP is going to do. That picture will become clearer as we see more solid data on how employers and consumers are reacting.

The big question for the economy this week is one of fiscal policy. The world – and the stock market – has been waiting to see what Congress and the White House are going to do for fiscal stimulus. Most would argue that central banks have done just about everything they could at this point. There is no question about liquidity in the marketplace. The question, instead, is about cash in homes. Are people going to have money to spend as we struggle through this process.

We have seen numbers anywhere between $1.2 trillion and $4.0 trillion estimated for this stimulus package. To put it in perspective, the entirety of our GDP growth last year was just over $560 billion. Washington is discussing putting as much as seven times that amount into the economy. That would be significant.

Sadly, it doesn’t seem Washington can get the bill out the door. Every moment they spend debating this process is an opportunity lost at this point. We would harken you back to September 2008 when the Republican House nixed the first bailout bill of the fiscal crisis. That mistake by Congress nearly sunk the economy. They can’t afford to make that mistake again.

The news out of Washington Sunday was a mixed bag. Per Treasury Secretary Mnuchin, the bill should be completed as early as today. So far, that has not happened. As is usual, it seems politics is still in play in Congress. Now is not the time for partisanship. Sadly, it seems the American people understand this, but their leaders may not. We hope this changes quickly.

While Congress drags its feet on fiscal policy, the central banks around the world have not been shy on monetary policy. As we noted at the start – liquidity is not an issue. And the Fed and other central banks continue to make sure this remains true. The Fed has injected massive amounts of liquidity in the system. For example, in March of 2009 they purchased $162 billion in bonds onto their balance sheet. Just last week they purchased $307 billion. And then, just this morning, they announced asset purchases – with no limit! – to support markets. Tie that in with more than $800 billion in support in Europe and there is no shortage of cash in the system.

What Does China Mean for Us Today?

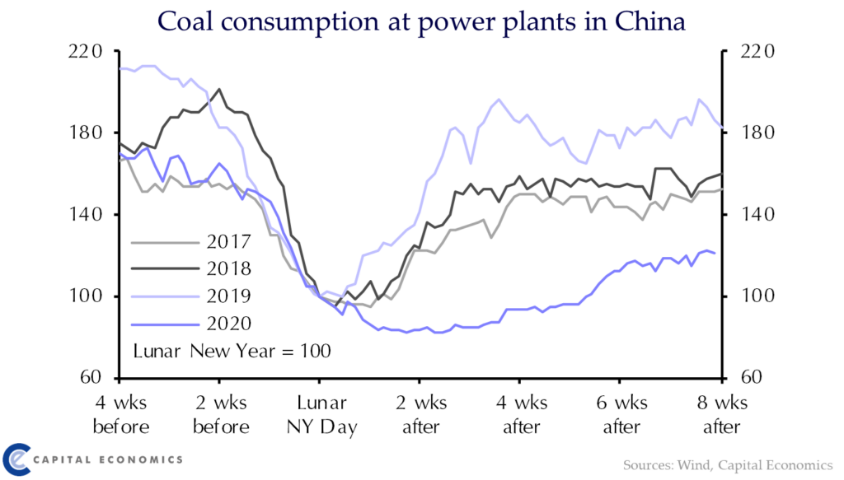

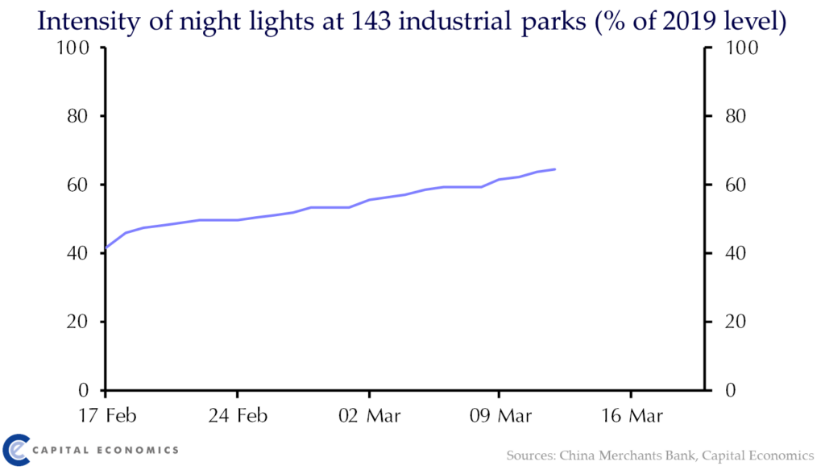

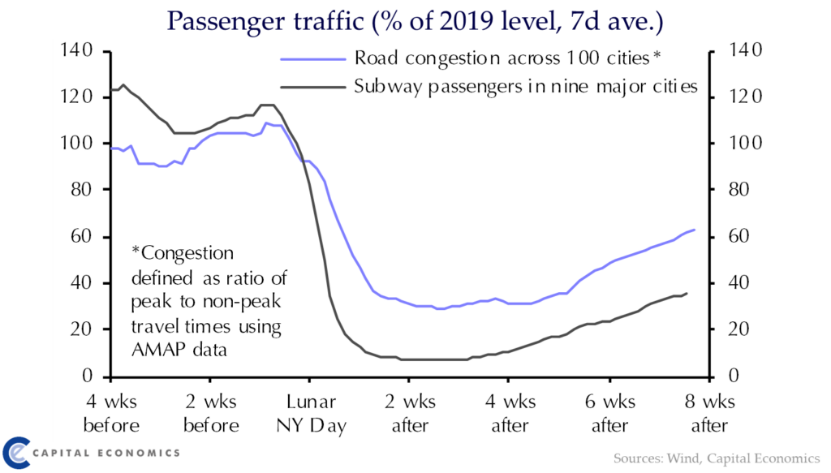

While we have relatively little U.S. economic data, we can look to China as an example of how this looks on the other side of a lock down. Frankly, the news is good. As China has gotten past the spread of the disease and begun to reopen their economy, we’ve seen solid growth in data points we can trust.

For example, coal consumption at power plants has begun to rise:

And more work is being done at night at industrial parks:

And passenger traffic – both on the roads and on subways – has begun to climb back towards previous levels:

Simply put, the Chinese economy is starting to go back to work. And their stock market was keeping pace. In fact, their market was up more than 10% during February until the global impact of Coronavirus began to play havoc with it once again.

How predictive will this be of a U.S. recovery? It’s hard to say. The containment of the virus, the length of the shutdown and the impact of government stimulus will play a role in determining our exit path.

Buy Signals

As you know from previous memos, we believe that, while this is a painful process, it also presents significant opportunities. Prices today are well below their “fair market value”. The S&P500 is trading at a 14.62X multiple of forward earnings. That’s before you even take the FAANGs out of the mix. Small-cap, mid-cap, and international stocks offer even more significant discounts.

The difficulty is understanding when to buy. There is no perfect answer. And, as we’ve said before, there is no doubt we will be wrong on timing. But that doesn’t mean we can sit on our hands. We have slowly been working dry powder in portfolios into the market. This strategy may not work perfectly in the short-term, but we are confident the long-term benefits will be substantial.

What we have not done – yet – is go “whole hog” into the market. In our opinion, there are two key points at which we can begin to understand what the bottom of this market looks like: the release (and market reaction to) the fiscal stimulus plan from Washington; and the moment we get to “net negative new infections” from COVID-19 domestically.

As stated above, step one may be answered soon. We hope that is true. The trickier one is “net negative new infections”. The projections on that number vary wildly. There are very smart and well-meaning doctors, scientists, and statisticians on both sides of this debate. Some think we’ll be there soon. Others think it could be weeks or months. We don’t know the answer but will be watching it closely. And, while waiting for that signal may mean we miss “the bottom”, we also think it will remove a lot of the potential volatility out of the marketplace and reduce our total risk.

In the meantime, it is important to point out that we are closely monitoring liquidity needs for clients who have regular monthly distributions. We do have areas in our managed portfolios where we have bonds and income focused investments where we can generate cashflow without forcing our hands to sell things when we might not want to. That has been and will continue to be an important piece of our analysis and overall strategy.

We will watch and see – and always reserve the right to change our thinking on this matter – but how we deploy capital during this time is the most important question. We promise it is one we’re taking very, very seriously.

Financial Planning Ideas

In times like these, it’s sometimes hard to think past the immediate problem we’re facing. But often, by sitting back and analyzing the bigger picture, we can start to see opportunities in areas beneath the surface. We wanted to throw out a couple of areas that might make sense to discuss at home or with your advisor:

- Roth Conversions: Many of you have a plan to do Roth Conversions from your IRA accounts. Now might be an excellent time to speed up that process. With market valuations as depressed as they are, you can get substantially more securities out of an IRA and let the recovery happen – tax free – in your Roth. If you had planned to do a year-end conversion, talk to your advisor now to discuss whether to move that process up.

- Retirement Contributions: If Roth conversions make sense today, so too do contributions to retirement accounts. Your dollar is going to go much farther in your IRA, 401k or 529 contribution given these pricing levels. Obviously, it is important to consider your need for liquidity before making these decisions, but it is something to keep in mind.

- Refinancing: We sent a brief piece out on this a few weeks ago. Interestingly, rates have gone up dramatically since that time (3.625% is the quote on a 30-year home mortgage this morning). That said, we would encourage you to watch rates closely as the Fed pushes more and more liquidity into the marketplace. This has the potential to be a “once in a lifetime” opportunity to lock in long-term debt – both for your home or your business.

- Disaster Recovery Programs: It is important you pay attention to the opportunities being made available by the government as we go through this process. Some of the programs will be simple to participate in (i.e. checks sent to taxpayers, tax deadlines delayed), but others will be more complicated. For example, if you are a business owner, you can now apply for a COVID-19 disaster recovery loan from the SBA. These loans – of up to $2 million – have a 30-year amortization and an interest rate of 3.75%. You may not know you’re going to need the money today. But if there is a chance you may, taking a loan out today to ensure you have liquidity as your business goes through this process may make sense.

We’ll continue to update you on programs that may be worth a look. But please make sure you’re paying attention as well and forward us things you think we might have missed. There’s going to be a lot of opportunities out there for folks in the know.

Finally, as a reminder, our offices are closed to visitors, but are open and operating. If you need anything, or have any questions, please don’t hesitate to let us know. We’ll continue reaching out as necessary.

We’re all going to get through this together. In the meantime, stay home and stay healthy!

Sincerely,