The Weekly Insight Podcast – The Golden Cross

This year has already been an interesting one from a sentiment perspective. We talked last week about the tug-of-war happening with expectations. Backwards looking indicators do not look good. Forward looking ones, much better. But the battle continues to rage as investors are looking for someone – anyone – to win this argument.

Sentiment is as much about human nature and psychology as it is about fundamental or technical components of the market. There is, unquestionably, a biological component to the fear and greed cycle, and it is always on display. And that cycle is almost always compounded by what the media has to say about the world (which is negative 17x more than it is positive!).

At Insight we’ve tried to battle that fear and greed cycle aggressively. But just being contrarian is not a solution to portfolio management. Take last year as an example. You read in these pages many times that we were not as negative on the markets as some of the “world is ending” crowd. But did that mean we hit the gas last year and got super aggressive? No! It was, in many ways, our defensive posture that lead to portfolios having such a good year (relatively speaking) in 2022.

So that brings us to 2023. Where is sentiment going? And what will that mean for markets in the short-, mid-, and long-term? Let’s take a look.

The Golden Cross

We’ve been introducing you to some technical measurements of the market this year. Last week we talked about the 200-day moving average and how it had proven to be a barrier to the market in recent rallies. We’re going to take it one step further this week.

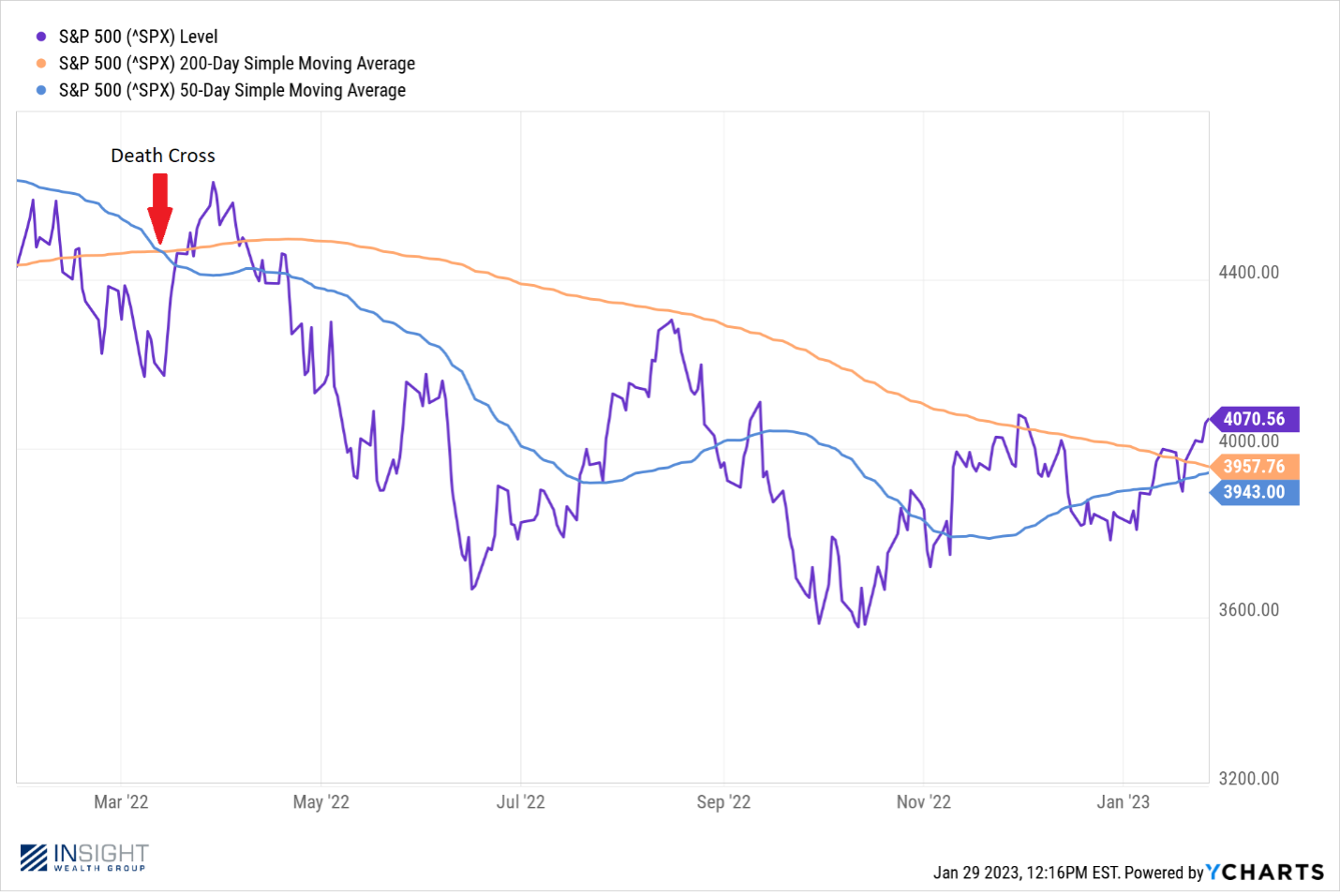

You’ve likely heard the phrase “The Death Cross” as it relates to the market. The Death Cross is the term used when the 50-day moving average dips below the 200-day moving average. Why is this considered such a horrible signal? Because it demonstrates that sentiment is moving from bullish to bearish territory. You can see what happened from the start of the last Death Cross below.

Past performance is not indicative of future results

The Death Cross happened on March 11, 2022. That was just a few trading days before the first Powell rate hike on March 15th. A little bit of optimism prevailed for a few days – until that peak of the market two weeks later on March 29th. Why was that the end? PCE Inflation was reported on March 30th and blew away any expectation that the rate hikes were going to be orderly.

What’s notable today, however, is the opposite of the Death Cross. Look at the very right side of the chart above. You will note that the 50-day and 200-day moving averages are about to cross again, but this time with the 50-day moving above the 200-day. That’s called the Golden Cross – and it indicates bullish sentiment.

Will it happen? Hard to tell right now. We’re close, but there are a few issues standing in the way.

Fed Week…Again

The first, of course, is the Fed. This is a big week for the market and the Fed as we have the first FOMC meeting of 2023. As we discussed last week, there is very little disagreement about what the Fed is going to do at this meeting. The current probabilities are 98.4% that they raise rates by 0.25%. The other 1.6%? That’s landing on no hike at all. There is no one that believes a 0.50% hike or more is going to happen this month.

But as we have said in the past, what they do this week is much less important that what they say. Do they given a sign the rate hikes are about to stop? Or do they leave the market without a timeline?

One could argue not providing a timeline for the end of hikes is exactly what the Fed wants to do. A great report from the Fed this week announcing it will all be over soon? That will undoubtedly send the market for a run and swing us through that Golden Cross. The problem is bullish markets are…inflationary. The Fed may want to keep a cap on that optimism for a few more months.

Do not be surprised if the takeaway from Wednesday’s meeting is more pessimistic than the pundits may be expecting. That could very well be the design. We’ll spend a lot of time next week going through the Fed’s announcement in these pages.

Will Washington Ruin a Good Thing?

I know it’s hard for anyone reading this to imagine that Washington, D.C. and our elected leaders might be an impediment to the economy. Shocking, right?

But here we stand, yet again, worrying about the debt ceiling. We actually passed the debt ceiling of $31.4 trillion on January 19th. Right now, the government is running off the cash in the bank account. That cash will run dry in June.

We’ve talked before about the consequences of the U.S. not paying its debts. It’s not a pretty picture. Right now we are the safe haven for foreign assets. If we prove their confidence to be ill-placed, it will have negative effects up and down the economy.

But wait…we have a few months before that is a problem, right? Why could that impact the Golden Cross? Because on Wednesday, the same day the Fed is coming out with their latest hike, President Biden and Speaker McCarthy are meeting to negotiate on the debt ceiling.

Both sides are locked in their world view. To Biden, it’s raise the debt ceiling with no other changes. The spending that caused this issue has already been approved and is not up for renegotiation. To McCarthy, this is an opportunity to get concessions on future spending.

The problem will not be solved on Wednesday. But if the word coming out of Washington is bad, it may slow our ascent to the Golden Cross.

We will be back next week with a lot to talk about. In the meantime, don’t hesitate to let us know if you have any questions.

Sincerely,