After all the crazy news over the last few weeks, it feels a little weird to write this opening statement: last week in the stock market almost felt normal! Other than the volatility caused on Tuesday by additional shocks in the oil markets (more on that in a bit), volatility through the week was the most benign we’ve seen in a while as federal, state and local governments all look forward to the Great Reopening. With that in mind – we are not going to write a lot just to give you a bunch to read. As there was less action in the markets and on the COVID-19 news front, thus there will be less for you to trudge through in this week’s memo!

Virus Update

Last week we discussed “beating the virus” being the most important piece in reopening the economy effectively. As we said last week: “we must be able to demonstrate to citizens that the risk is significantly reduced” before we are going to see a recovery in consumer confidence.

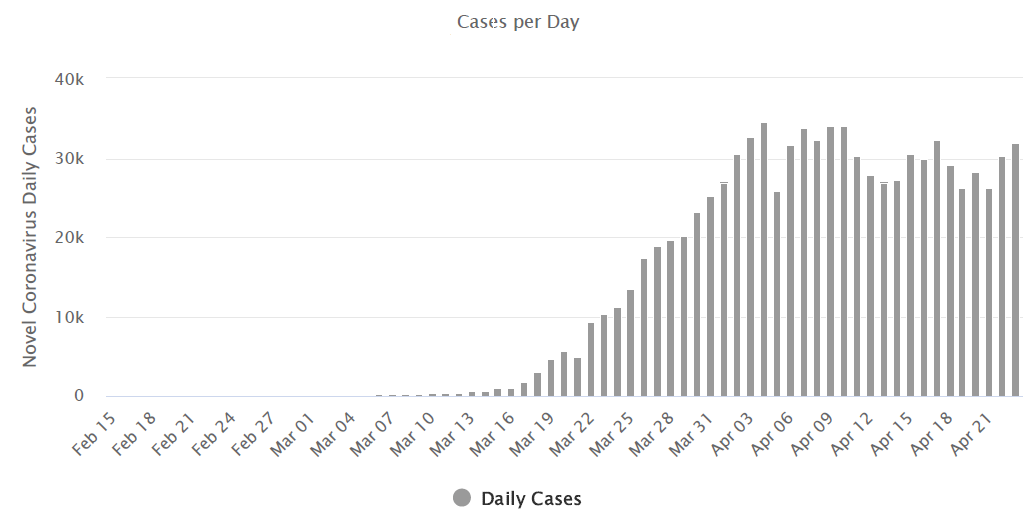

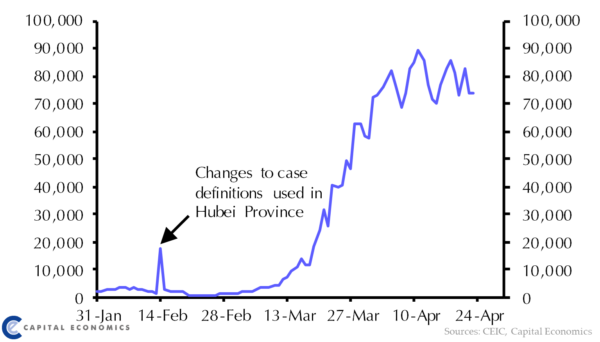

The good news is that we have seen the number of new cases per day peak over the last few weeks both in the United States and worldwide as you can see from the charts below:

United States Daily New Infections

Global Daily New Infections

But while the rate of new infections has stopped growing, it has yet to begin to shrink dramatically.

The Great Reopening

We are entering a new and very important phase of this process: ending the shutdown. As the data we just discussed on new infections shows, this process is not without risk. And, as we said last week, its success is vital to the recovery of both the U.S. and world economies.

As it was with locking down the economy, each state and nation will likely have their own approach. Some will work. Some will not. Spikes in infections and death rates caused by reopening could have significantly negative short-term impacts on the stock market.

We spent significant time last week going through China’s recovery process. We will not rehash all that data again this week, but it’s been a largely successful process and still – two months from the peak of infections – has yet to get the economy 100% back up to full steam. There have been fits and starts in their process. Businesses and regions have been reopened, only to be closed again shortly thereafter. We would anticipate the process to be similar here in the United States.

Hopefully, the successes and failures in some areas can be applied throughout the nation as we begin to understand what works and what does not. In Iowa last week, Governor Reynolds announced that she was ending the cessation of elective surgeries. Georgia opened a wide swath of industries including hair and nail salons, tattoo parlors (have to get that “I survived the Great Pandemic” tattoo!), and other industries. The stock market will be watching closely to see what impacts these decisions have on infection rates as we look to see how best to reopen the economy.

What Happened with Oil (Again!)?

Yet again, oil prices were a headline item this week and lead to the worst of our weekly volatility. And this time it was for something we would bet most of you never even knew was possible: oil prices went negative on Tuesday, at one point reaching a price of negative $37/barrel. Essentially, holders of oil were paying people to take the oil off their hands.

Before we talk about what this means, let us first talk about how the heck it even happens. While there is no doubt a glut of oil and significant drop in demand caused by the worldwide lockdown, it is important to look beyond the “Oil Goes Negative!” news reports and understand the market infrastructure issues that caused Tuesday’s shock.

Admittedly, none of us at Insight are commodity traders (nor do we want to be!), so we are not experts in the day-to-day action of the oil markets. But what we do know is that the oil market runs on forward monthly contracts just like we see with grain markets so often discussed here in Iowa. What that means is people will buy or sell the commodity for delivery in a certain month. Tuesday was the last day of pricing for the May oil contracts with the market switching to June delivery on Wednesday. That meant people holding May contracts were trying desperately to get out of them, causing the run on oil prices.

It should be noted that the June contract ended last week at $16.75/barrel. Not a great price — but on par with where we saw May pricing before it all fell apart on Tuesday.

So – a big part of what we saw in oil pricing was simply a function of the mechanics of the commodity markets. But the bigger part is the uncertainty we have on oil demand as we try to understand how quickly and how well this economy will recover.

The good news out of the swings in oil prices has been it has firmed up, significantly, natural gas prices. As producers are capping oil wells, that is also taking production of “associated” natural gas offline and will be – we believe – good for natural gas producers.

Market Recap

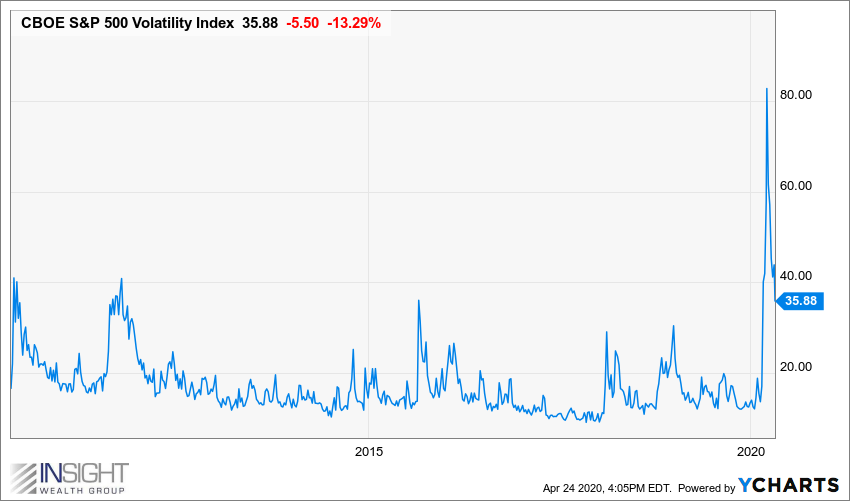

As noted, other than the swings caused by oil prices, last week was significantly less volatile than what we have become accustomed to over the last few months. However, the market opened the week down and stayed down through the end of trading on Friday (with the DJIA off 1.97%).

We now find ourselves one month out from the bottom of the market in March. Portfolios have reacted well over that time, with our core models being up anywhere from 20 – 26% (individual results will, of course, vary). That said, we remain cautious (and underweight equities) and are prepared to strike if (or more likely when) we see another leg down in this environment.

While volatility remains substantially elevated from “normal”, we have seen a precipitous decline from the peaks in March. That would indicate a slower rise – or fall – in the market from these levels. That said, do not discount the ability of “bad news” to rapidly change this picture.

We will, of course, continue to monitor the situation and will communicate quickly when we make the decision to increase our equity weighting in portfolios.

Government Stimulus

Lastly, our team at Insight CPA recently drafted a piece discussing the various stimulus programs and their associated tax consequences. If you have any interest in taking a look, you can view the article at this link: https://insightwealthgroup.com/covid-taxes-and-stimulus-making-sense-of-available-programs/.

As always, we stand ready to assist you in any way you need. While we continue to work remotely, our entire team is operational, and we are continuing to work normal business hours. Please do not hesitate to reach out. We are really looking forward to the day we can start seeing you all again face-to-face!!

Stay healthy!