And just like that, we are through April. Somehow time seems to both fly and crawl during the Great Quarantine, doesn’t it? It is hard to believe this is the 11th weekly COVID update. And most of you/us have been locked down for at least six weeks.

The last week was a fairly benign week in the markets and in the fight against COVID-19. No negative oil prices, no new legislation, and fairly expected economic news. All in all, except for the continued lockdown, it seemed fairly…normal.

So, this week, we are going to take the opportunity to step away from the day-to-day news cycle and look a bit more long-term at what is – and what could in the future be – moving portfolios. Where are the opportunities? And what areas of the economy are we not interested in looking at? We have learned over the last 11 weeks that things can change in an instant – but let’s take a step away from the details and look at things from a 30,000-foot level this week.

Equity Markets

We have spent a lot of time over the last 8 years talking to you about how important valuations are in understanding whether equity markets are affordable. In the last several weeks, the conversation has turned from valuations to the broader economic challenge of understanding how the economy would stand back up as we enter the Great Reopening.

Understanding of broad economic issues is important, no doubt, in our analysis of how this market and economy will recover. It is a big justification for our messaging over the last few weeks that it is possible – if not likely – the market would go through another downward trend before we finally climb back out of this hole.

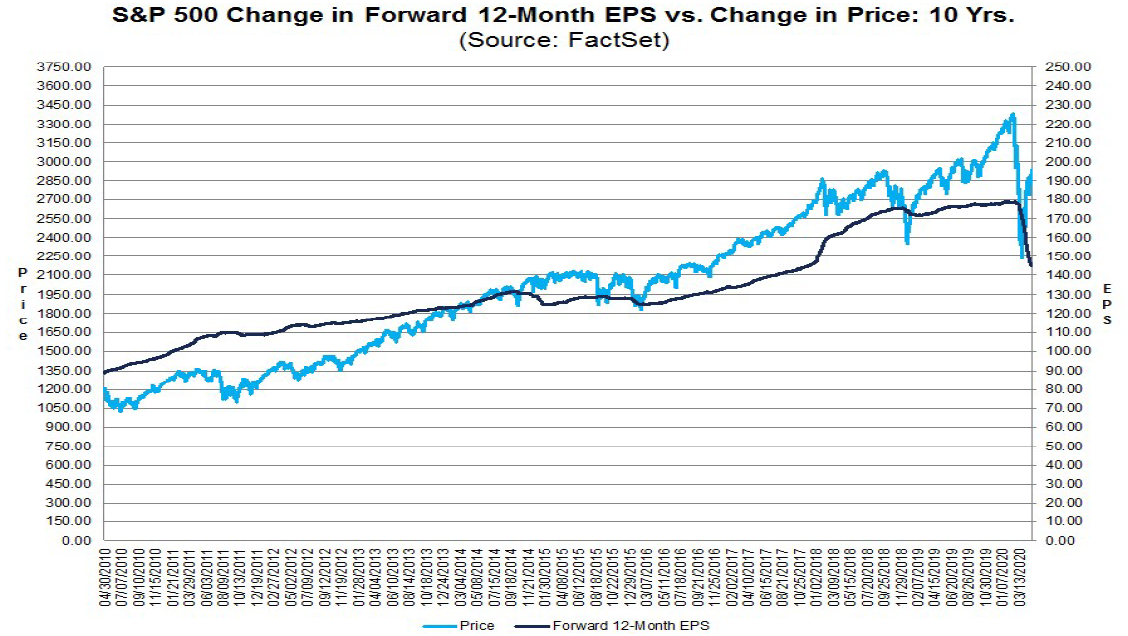

Now, however, we are starting to see some solid data on how companies are managing through this process. While many public companies have discontinued their earnings guidance for Q2, we can look through the Q1 data to begin to understand the valuation of the market today. Let’s look at what it says.

First, the good news. With 55% of S&P 500 companies reporting their earnings, 65% have reported earnings per share higher than analysts’ expectations and 65% have reported revenue higher than expectations. Simply put, analysts may have overestimated the damage caused by the lockdown in March. That is, no doubt, one of the reasons the market has reacted so positively and made April the best month in the market since 1987.

That said, while the results were not “really, really, really bad”, they were still “really bad”. Right now, the estimated earnings decline for the S&P 500 is -13.7%. If that ends up being the final number, it is the worst number since 2015.

Past performance is not indicative of future results

That, alone, is a strong reason to continue the path we have been going down with portfolios. The idea was reiterated by Warren Buffett this weekend in his annual meeting (held, of course, online) when he stated that, while he was not mass liquidating positions, he was letting cash accumulate and looking for opportunities in the marketplace.

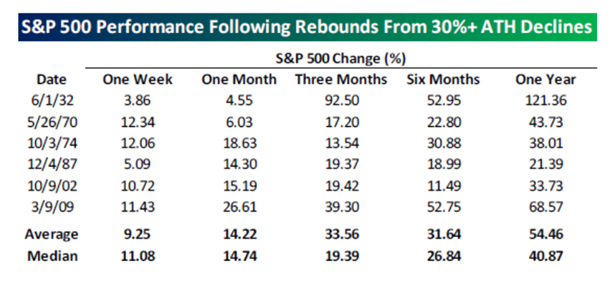

As the chart below shows, we firmly believe there will be opportunities in the near future.

As Buffett said on Saturday: “Never bet against America”. The result, at least in the equity markets, has never been good.

Fixed Income

You may remember the “old days” when everyone talked about fixed income as the “safe” alternative to the equities markets. That was based on something we have talked about some time ago in our quarterly memos called “Modern Portfolio Theory” and is the source of the “60/40” portfolio that so many financial advisors still use today. Sadly, Modern Portfolio theory is neither “Modern” (it was designed in the 1950s) nor particularly successful.

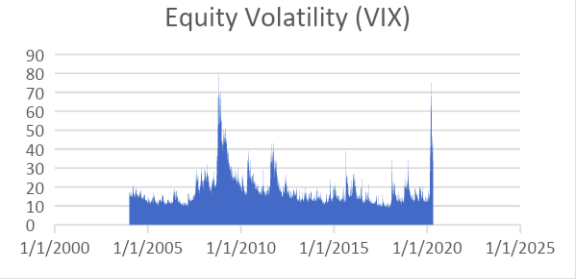

Part of the reason for that – which we learned in 2008 and saw extensively in the “COVID Crash” – is that volatility in the fixed income markets and volatility in the equity markets are not disconnected. We have discussed the VIX before – which is a measure of volatility in the equity markets. As you can see from the chart, volatility spiked to its highest level ever during March.

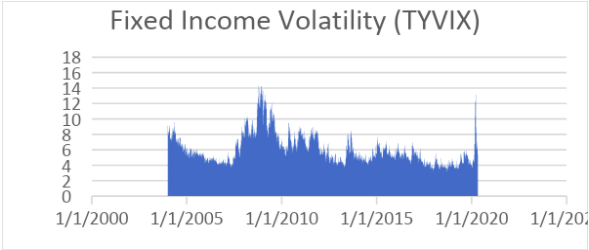

What we have not talked about – and we are guessing you have not seen from many people – is the fixed income cousin of the VIX: the TYVIX. It measures volatility in the fixed income markets and, while it did not quite set a record in March, it came very close.

Past performance is not indicative of future results

What we have not talked about – and we are guessing you have not seen from many people – is the fixed income cousin of the VIX: the TYVIX. It measures volatility in the fixed income markets and, while it did not quite set a record in March, it came very close.

Past performance is not indicative of future results

This is exactly why there was “no place to hide” when the market reacted to the economic shutdown in March.

Which brings us to our favorite bond topic: structured notes. We have talked about these before – but believe it is an excellent time to bring it up again. As you know, we have typically utilized a specific structure of bank note: the Levered Steepener. All the steepeners on our books tend to have very similar characteristics:

- Investment Grade Credits: we utilize only large banks that are well capitalized and you have heard of before

- Pay interest on a multiple of the 30-year CMS minus the 2-year CMS. CMS stands for “Constant Maturity Swap” which you can think of as a measurement of the 30-year Treasury Bond minus the 2-year Treasury Note.

- Typically have a “Coupon Barrier” linked to the equity markets. For example, if the equity markets drop 35% or more, the bond does not pay interest.

The structured note market is a very inefficient market, which means we can find very attractive opportunities, but there are also less buyers and sellers (these are most often small issuances and traded by institutions).

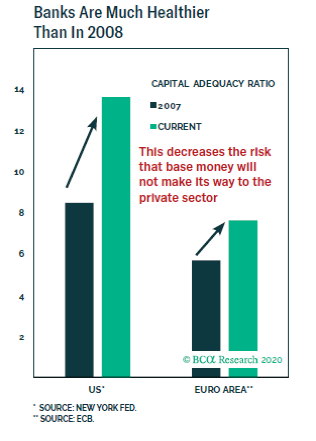

So, let’s talk about those three characteristics above and figure out how these bonds are looking today. First, are we concerned about the durability of the big banks? Simply put, no. Due to the regulatory environment that came out of the 2008 Financial Crisis, the big banks have better capital ratios than ever and will be able to withstand the current market shock. And, let’s be honest, even if they couldn’t, they would likely get support from the Fed to do so.

Past performance is not indicative of future results

Second, the variable interest rate. This is one of the main reasons we have chosen to use this structure over the last few years. As we all know, and the Fed Chairman made even more clear this week, the Federal Reserve and central banks around the world are committed to keeping interest rates artificially low as we work through this current situation. Lower for longer is the plan.

But we also know that, in recessionary environments when short-term rates are lowered and held there, the long-term rates typically rise more quickly than the short-term rate, thus widening the spread and increasing our interest rate paid on the bond. Simply put, these are a great hedge against a recessionary environment.

Additionally, this rising interest rate on this particular type of bond makes it more likely the banks will call our bonds since they can refinance this debt for lower short-term rates. Since many of these bonds have been bought at significant discounts to their par value in the secondary market this can mean a substantial capital gain when the bonds are called. We believe this will start happening over the coming months.

Finally, the “Coupon Barrier”. This is, for most clients, the scariest term on these bonds. Understandably so as the last thing you want to worry about in an economic crisis is a lack of income from your bond portfolio. But, like anything, it depends on how well the asset was bought. In our current portfolio of levered steepeners, we have 70 different bond issuances. The one bond closest to hitting its coupon barrier is linked to the Russell 2000 which would have to drop 30% from its current level (more than 45% from its high) before our interest would be impaired. Of our 70 levered steepener holdings, our average coverage is 58%.

All of this is a long way to say this is an area we feel strongly is recession resistant and presents opportunities today. We are actively seeking bonds in the secondary market and are finding some very attractive instruments. For instance, just last week we picked up a bond from a large U.S. bank that we were able to buy at a 10% discount to par and which pays an 8.88% current yield. If you are looking for opportunities to put money to work in this environment, we believe this may be a space that makes sense.

Illiquid Alternative Investments

As you well know, we have done significant work in this space for our high net worth investors. While it is a small portion of our overall client assets, it has been a valuable tool to keep in the tool chest.

The thing to remember about this space is, due to its illiquidity, the problems – and opportunities – tend to present themselves later than we see in the public markets. Right now, we have been keeping in very close touch with our managers to gauge any concerns they have in the portfolios. What we are seeing is heartening. While there will no doubt be issues to be worked through, managers are taking a much more proactive stance than we saw in 2008. We are seeing some sponsors hold distributions for this quarter to reserve cash while they watch what happens to rent payments and consumer behavior over the next 60-90 days. We will continue to aggressively pursue information on your behalf and communicate to you directly any news we hear.

Many of you have asked about opportunities in this space given the current environment. They will undoubtedly come. But we are not quite to the “blood in the streets” environment which will present those opportunities. We would anticipate we will see more of that as we get closer to 2021.

Federal Programs Update

As you are likely aware, PPP-2 was rolled out last week. We do not have an update yet on how many funds have gone out, but once again the program has a limited amount of capital. If you are a business owner that would be eligible for the program, we highly recommend you speak with your bank as quickly as possible before the funding for this program runs out.

Office Update

As we begin the process of the Great Reopening, we wanted to provide a quick update on our office situation. As you may have heard, the Governor of Iowa reopened a portion of the state (77 counties) on Friday, May 1st. Polk and Dallas Counties, where our offices are located, were not included in the reopening. The Governor has extended the lockdown until at least May 15th for our area.

As such, we will continue to operate our offices remotely until given guidance by state officials it is safe to bring our staff back together. When that happens, we will release guidance on client visits to the office, public events, etc. Sadly, we realized this week we are getting close to having to decide on our annual Dallas County Rodeo and Iowa State Fair events. While we have not made a decision yet, we promise if we cannot do them this year, we are going to make them even better next year!

As always, please stay safe and stay healthy. We hope you can enjoy some time with your loved ones during this extraordinary situation. If you need anything, our phones are always being answered and we look forward to catching up!

Sincerely,