The Weekly Insight Podcast – What Changes is Congress Making to Retirement Accounts?

It was a slow week in the market – both in terms of what we learned and the amount of trading that happened. Volume on the S&P 500 was down 6.2% from average so far this quarter. The market took a step back, the week down just over 3%. But it was mostly a week of folks covering their bets before the big action this week: a CPI read on Tuesday and the Fed’s latest announcement on interest rates on Wednesday.

Most of the data we received about the economy this week confirmed the story of the last thirty days: the economy is a bit stronger than the Fed would like, but inflation continues to fall:

- Global Composite PMI (November): It fell from 48.2 to 46.4 but came in above the expectation of 46.3.

- Services PMI (November): It fell from 47.8 to 46.2, but came in above the expectation of 46.1

- Core PPI (November): The year-over-year number fell from 6.8% to 6.2% but came in above the expectation of 5.9%.

- PPI (November): The year-over-year number fell from 8.1% to 7.4% but came in above the expectation of 7.2%.

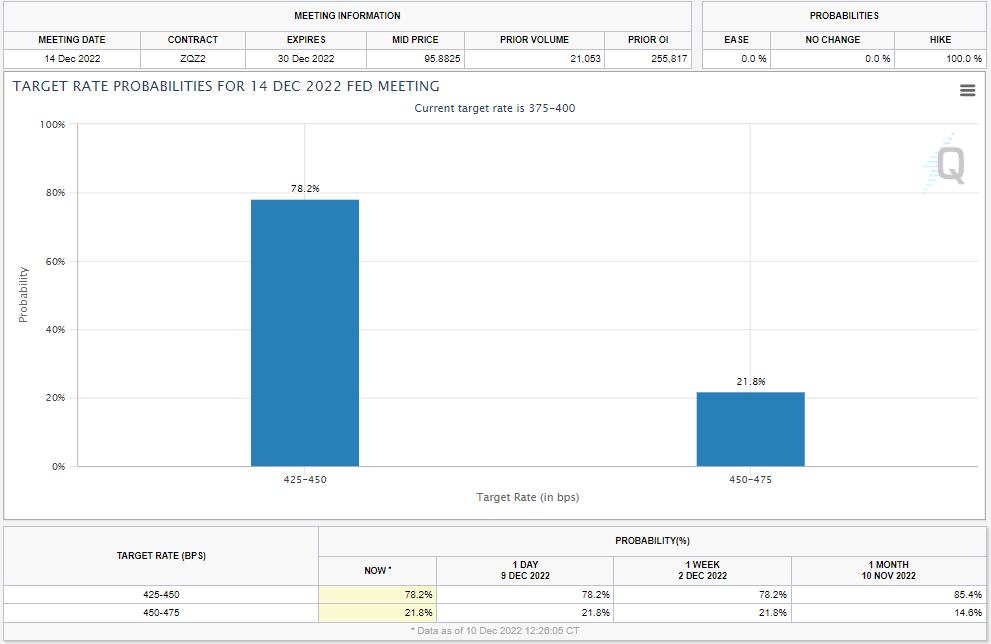

The assessment? Good, not great. But it did nothing to change the expectation for Wednesday’s Fed meeting. Before the week kicked off, there was a 78.2% chance of a 50-basis point hike in rates. At the end of the week? 78.2% chance. Sentiment did not move an inch.

Past performance is not indicative of future results

The one data point that stood out to us this week was the University of Michigan survey on inflation expectations. As you may recall, Chairman Powell has talked a lot about keeping consumers from pricing in higher long-term inflation expectations. His fear is the expectation of inflation becomes a self-fulfilling prophesy.

The expectation for Friday’s report was 4.9%. It came in at 4.6%. That is a remarkable number, because it ties for the lowest read we have seen on this data set since June 25, 2021, when it came in at 4.2%. And it is down dramatically from the 5.4% we saw in June of this year. That’s good news.

Secure 2.0

The last year has been full of Fed and inflation drama. That’s meant we have always had something to write about in these pages. But it has also gotten us away from one of the core reasons we started doing this in the first place: providing you with information that can inform your investment and financial planning decision making.

Given it was a quiet week in the markets, we thought we might venture back into the financial planning space because there are some important developments happening in Congress which may impact the way we save for retirement and beyond.

You may recall during the Trump Administration that Congress passed – and President Trump signed – a bill called the Secure Act. This bill did many things to address changes in saving for retirement. The most obvious change was raising the age for Required Minimum Distributions in retirement plans from 70.5 to 72.

The current Congress is hoping to pass an update to that bill – called Secure 2.0 – in the lame duck session before year end. It is a rare moment of bipartisanship on Capitol Hill. But it is also something investors must understand should it become law. Let’s look at some of the biggest changes it would make for retirement savings:

Automatic 401(k) Enrollment

One of the biggest problems with retirement plans today is that too many employees do not take advantage of them. Secure 2.0 would now require employers with 401(k) or 403(b) plans to automatically enroll all new, eligible employees into the plan at a contribution rate of 3%. It would also implement annual adjustments of 1% to the contribution rate until it reaches 10% of salary.

Bigger Catch-Up Contributions

Currently, employees over the age of 50 are allowed to make “catch-up” contributions to their plans of $5,000 per year – in addition to the current maximum contribution allowance. Secure 2.0 would raise that catch-up level to $10,000 per year. But there is a “catch”: all catch-up contributions will now be Roth – or post-tax – contributions. They will not lower your taxable income.

Student Loan Payments Become Match Eligible

One of the problems for savers today are their student loans. They must prioritize those payments over making contributions to their retirement plan. But by doing so, they lose the ability to take part in the employer match the retirement plan may offer. Secure 2.0 would make payments to student loans “matchable”, so employers could contribute to the retirement plan as if their student loan payments were a payment into the 401(k) plan.

Further Delays of RMDs

As noted above, the original Secure Act raised the Required Minimum Distribution age to 72. Secure 2.0 would raise that age even further to 75 – in steps. The age next year would bump to 73, in 2029 it would bump to 74, and it 2032, it would bump to 75.

Emergency Savings Accounts

The latest version of the bill in the Senate would allow employees to contribute up to 3% of their salary in an after-tax (Roth) emergency savings account. This account would be allowed to be invested a grow like the rest of the retirement plan but would be accessible without penalty if the employee needs to access the funds in an emergency. We do not yet know how they are going to regulate what “an emergency” is.

We are still a few steps away from having a finalized bill voted on in both the House and Senate. It is quite possible it does not happen before year end and the process must be restarted in the next Congress. But like all regulations around retirement planning, it will create opportunities – and potential landmines – for smart investors. We will be watching it closely and will keep you informed of what steps you may need to take in response.

This week is the last “big week” before the holidays kick off, and we find ourselves in 2023. We will be back next week with a detailed examination of the Fed’s Wednesday meeting, interest rate decision, and final Summary of Economic Expectations for the year. It should be a fun one!

Sincerely,