The Weekly Insight Podcast – The Red Dragon

Before we start this week’s memo, it is important to remember what a special, and tragic, place this day holds for our Nation. It seems almost impossible that it was 22 years ago that a group of terrorists perpetrated an act of war on our country that is rivaled only by the sneak attack on Pearl Harbor almost 60 years prior.

The last 23 years have seen a Nation rally together in a way many of us have never experienced. It has seen war. And it has seen that national unity evaporate into a maelstrom of he-said/she-said politics. But the sacrifice of those lost on 9/11 and the years after must never be forgotten as they represent the best of this country. God bless them and their families.

It is with that backdrop that we are going to dive into international affairs today. We have established by now that your author is a bit of a nerd when it comes to these. sues. So, it likely will not surprise you that on our family’s summer vacation this year we included a stop in Bretton Woods, New Hampshire so the kids could learn about the Bretton Woods Accords that were signed there in the waning days of World War II.

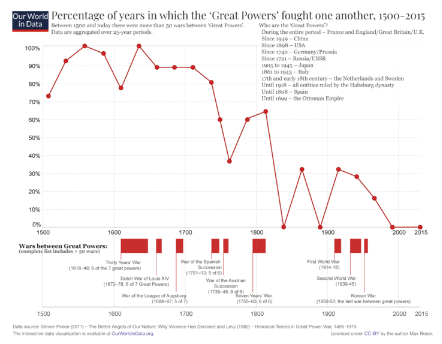

The Bretton Woods Accords put the world on a path towards globalization that led to the greatest global economic expansion in…well…ever. It led to furthering international trade, massive reductions in extreme poverty worldwide, and peace unlike the world had seen for centuries. The level of conflict between the “big boys” on the world stage was almost never lower.

Past performance is not indicative of future results.

But the last several years have seen a reversal of this trend. The politics of the age – combined with the COVID pandemic – have seen countries looking inward again and placing less value on the global relationships that carried us through the back half of the 20th Century.

It is with this backdrop that the relationship between the current “big boys” – the United States and China – should be examined. And while we are not here to be alarmist and raise the specter of armed conflict, the economic interactions of these two countries over the coming decades will undoubtedly author the story of global economic activity.

It seems like over the last few weeks that story is coming more and more to light. Just last week, it was reported that China has banned government workers from using iPhones. This is, no doubt, a retaliatory action to the U.S. sanctions on Huawei.

At first blush, it is not a huge problem for Apple. Yes, China is Apple’s third largest market and accounts for 18% of its sales. But the current ban would only impact 5% of Apple’s China sales – or 0.90% of Apple’s sales worldwide. But the fear is the government employee ban may be just the start of China’s efforts to push consumers into Chinese products instead. And it caused Apple’s stock to be off 6.40% at the end of the week.

And then there was Chairman Xi’s decision to not take part in the annual G20 summit in India this weekend. While no official justification for this decision has been provided by the Chinese government, the gist of it seems to be he is drawing a line between the “West” and “The Rest”.

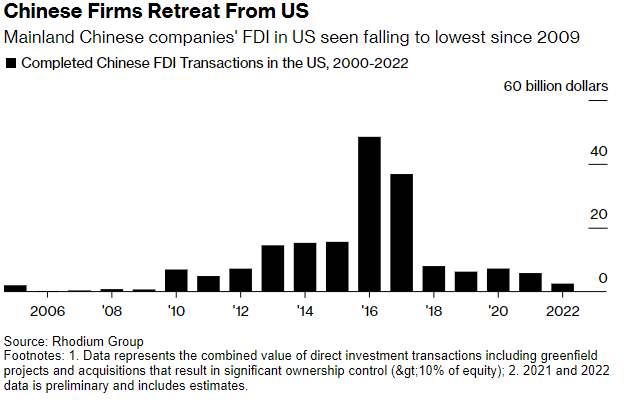

All of this comes at a time when the U.S. and China have been widening their separation economically. It was a process that started under President Trump with his “trade war” with China and has continued under the Biden Administration. The examples are stark.

For example, China is no longer investing in the United States – or at least not at levels we have seen since 2010. 2022 marked the smallest amount of Chinese investment in the U.S. since 2009.

Source: Bloomberg.com

Past performance is not indicative of future results.

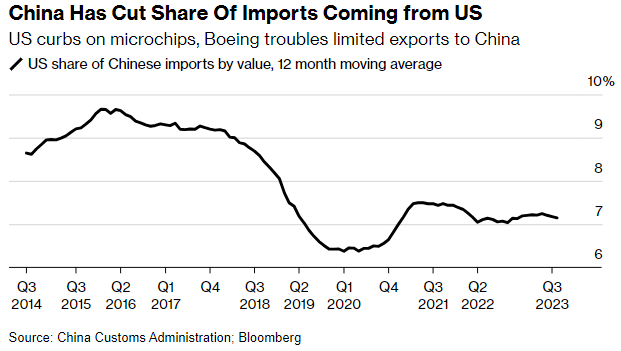

China has also substantively cut their imports from the United States. While the COVID dip was pandemic driven, the recovery has been anything but. You can see from the chart below that the trend was moving down prior to COVID and remains well below the numbers we saw as recently as 2018.

Past performance is not indicative of future results.

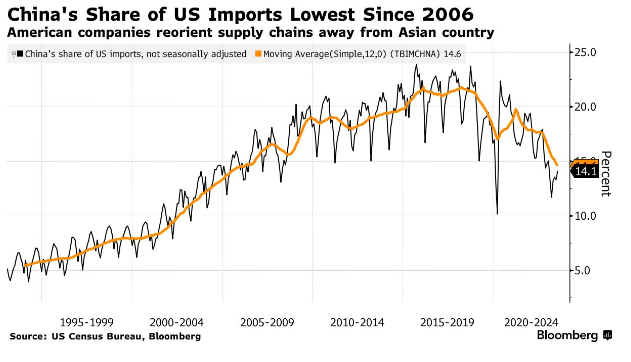

And it is not one-sided. U.S. imports from China are at their lowest levels since 2006 and down substantively from their 2018 peak.

Past performance is not indicative of future results.

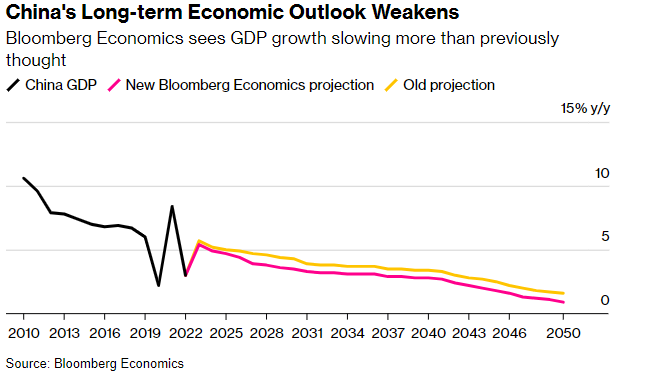

The time of greater and greater collaboration between the U.S. and China is over (for now at least). And it is not happening at a good time for Xi. China’s exit from COVID has not gone as planned. Their economy has not recovered as much, or as quickly, as the Chinese had hoped. And a recent Bloomberg analysis shows economic growth in China slowing dramatically over the coming decades. In fact, their analysis shows that the hopes of China’s economy overtaking the U.S. as the world’s largest may in fact never happen. That is a dramatic shift.

Past performance is not indicative of future results.

What that means for a one-party state run by an irreplaceable dictator is hard to tell. But when that one party state is the largest country by population and the second largest by economic output in the world, this is a shift that must be watched extremely carefully. If the decoupling of the United States and Chinese economies continues, it will impact people – and portfolios – around the world.

It is for that reason that, since COVID, Insight has held little direct exposure to China in our portfolios. Getting their economy back up to speed will be quite difficult without a partnership with the United States. And until cooperation is back on the table, it is unlikely we will be adding any China exposure to client accounts.

Sincerely,