The Weekly Insight Podcast – The Math Doesn’t Lie

As we enter the home stretch of the Presidential campaign season, there will be a lot of barbs being thrown back and forth between the candidates. Abortion, illegal immigration, foreign policy, taxes…there are a lot of things the two candidates don’t agree on.

But there is one in which they are in absolute lock step: Social Security and Medicare. Let’s go directly to the quotes.

Biden at the 2024 State of the Union:

“If anyone here tried to cut Social Security or Medicare or raise the retirement age, I will stop them”.

Trump Statement on his campaign website:

“Under no circumstances should Republicans vote to cut a single penny from Medicare or Social Security”.

There it is. We have unanimity on something! Doesn’t that feel great?!?

The problem is…well…math. Both candidates are being entirely disingenuous with you about this issue. We can talk all day about how important it is to protect Social Security and Medicare. It is. But unless we can fix the math, both programs are destined for failure. As Claudia Gray once said, “Math doesn’t lie. Our emotions do”. And this is an issue packed with emotions.

So, let’s take the emotions out of it, and just look at the data and see what we can discover.

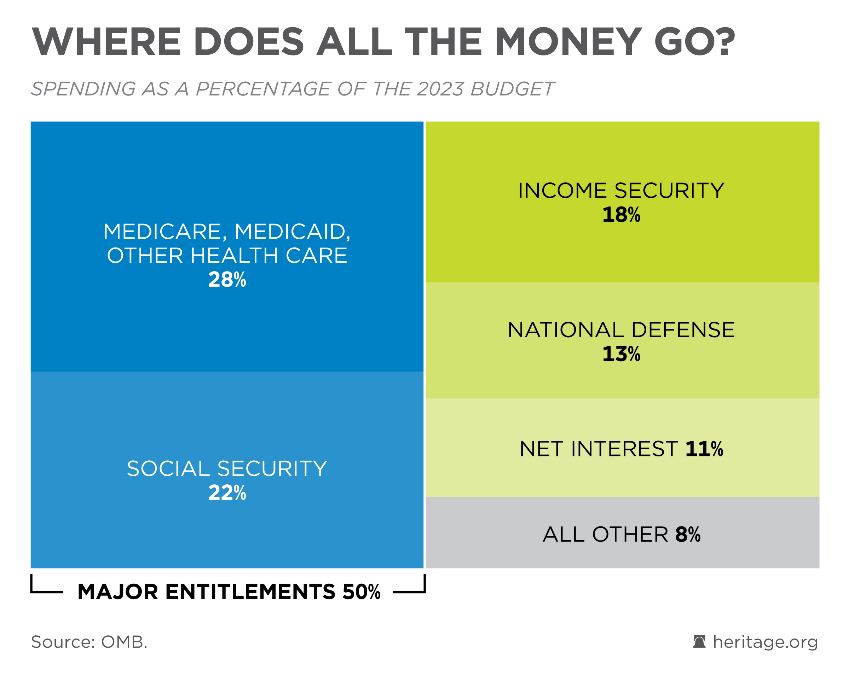

The first thing we need to look at is how much of the Federal Budget is made up of entitlements. The major entitlements are, obviously, Social Security and Medicare. They make up fully 50% of the Federal Budget as of 2023.

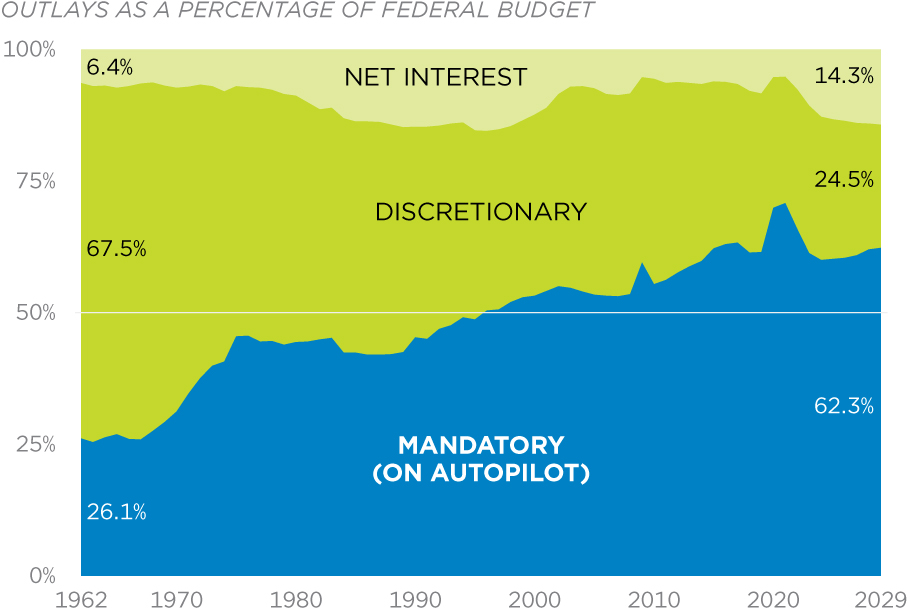

The term “entitlement” isn’t the best way to put things. Instead, let’s consider mandatory spending. These are things that, per law, Congress and the White House have no discretion about funding. The funds must be allocated every year. In 1962, that number was 26.1% of our budget. By 2029 it will be 62.3% of the budget. Add in interest payments on the debt and we’re now above 76% of the budget. Pretty hard to run a balanced budget when you can only control less than one quarter of the spending.

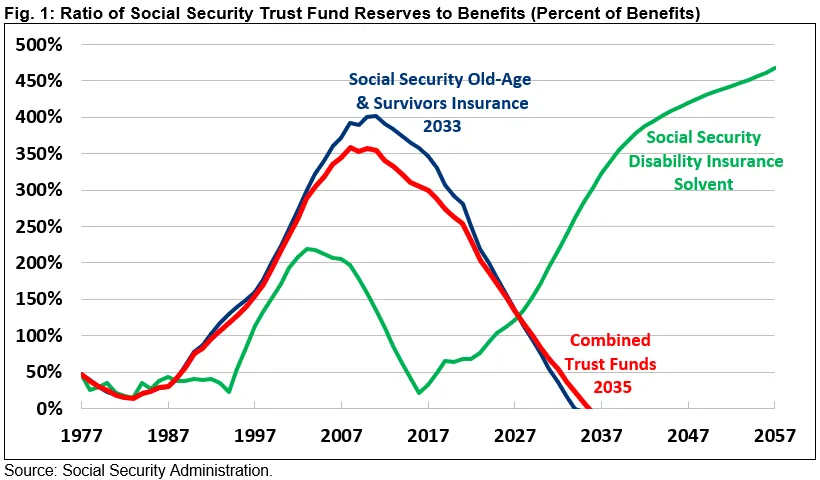

As the cost of these programs grows, we are not keeping up with the funding necessary to sustain them. Every year, the Trustees of the Social Security Trust Fund release a report. The latest edition came out in May and showed we have just nine years – 2033 – until the Trust Fund is out of money.

Medicare isn’t much better. It runs out of funds in 2036. That means a 58-year-old today – due full retirement in 2033 – will be impacted. And a 53-year-old today – due Medicare in 2036 – will be impacted.

But that doesn’t tell the whole picture. We need to think about how this might impact your financial plan. The math here is simple. Once the trust fund runs out of money, it will only be able to spend what it takes in on an annual basis. That means, in 2033, Social Security benefits for everyone will have to be cut by 21%. That means a typical couple retiring in 2033 will face a $17,400 cut in their annual benefits. And the cuts don’t stop there. Over the following 75 years, the cuts will have to grow to 31%. Social Security checks will be shrinking, not growing with inflation.

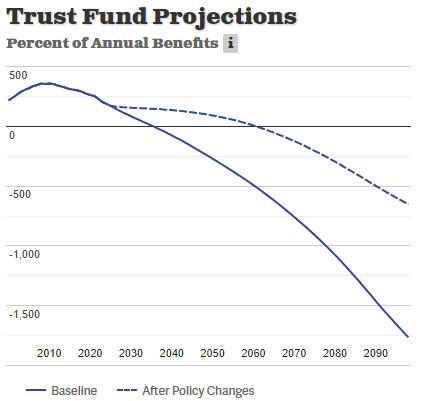

In the end it comes down to a simple answer: we either need more money in the system or fewer payments going out the door. We either raise taxes or cut benefits. There are gradients to this. We could raise payroll taxes for some earners and not others. Or we could cut benefits for some groups but not others. But it’s not a simple fix.

For example, you could fix 60% of the problem by subjecting all wages to payroll taxes. Currently only the first $168,600 of wages are subject to payroll taxes that fund Social Security. That would stretch the insolvency for Social Security all the way out to 2060. That sounds great, right? Just tax the rich. Fair enough but realize you’re now going to be pulling 13.3% of those wages out of the economy and putting them back into the government. That will mean fewer jobs created, less economic activity, etc., etc. It has an impact.

Source: Committee for a Responsible Federal Budget

Or we could fix 40% of the problem by raising the retirement age to 69 and then indexing it going forward to average longevity. This makes a lot of sense in the grand scheme of things. Social Security was created over 90 years ago and we’ve raised the retirement age by two whole years while life expectancy keeps rising. But telling people they’re going to have to work longer isn’t exactly a popular political ploy.

In the end, we know two things:

- Trump and Biden are lying to the American people on Social Security. So is pretty much every other politician. We can say we’re never going to touch it or change anything. But that simply won’t work. By doing nothing, they’re guaranteeing retirees are going to face significant income shortfalls just nine years from now.

- You need to reset your thinking on Social Security. Many of our financial plans already account for flexibility around the future of this system. But we shouldn’t count on this system being fully functional in 2033 and beyond. We need to watch this closely as it relates to your plan in the coming years.

In the meantime, hold your elected officials accountable to this issue. We need to have an honest conversation about it instead of just sticking our collective heads in the sand. The math doesn’t lie.

Sincerely,