The Weekly Insight Podcast – A Messy Presidential Election

As we prepare to celebrate Independence Day, it’s an important time to remember just how messy our political system has been for the last 248 years. There was the 1924 Democratic National Convention that took 103 ballots to finally select a nominee that barely anyone had heard of (anyone remember John W. Davis?). Or the 1964 GOP Convention that even President Eisenhower called “unpardonable…I was deeply ashamed”.

The messiness began not in the 20th Century, but instead all the way back to the day we celebrate this week. Thomas Jefferson wrote in 1821 that he had to make changes in the Declaration of Independence – specifically removing the condemnation of slavery – to even be able to get it approved by the Continental Congress. That debate continued for 85 more years before culminating in a civil war.

Democracy is messy. It’s turbulent. It can be violent and off-putting. And our experiment with it has led to more freedom and prosperity throughout the world than any governing system in the history of the world. It’s important we remember that this week. But it’s also important we remember just how fragile it is as we strive to always protect it.

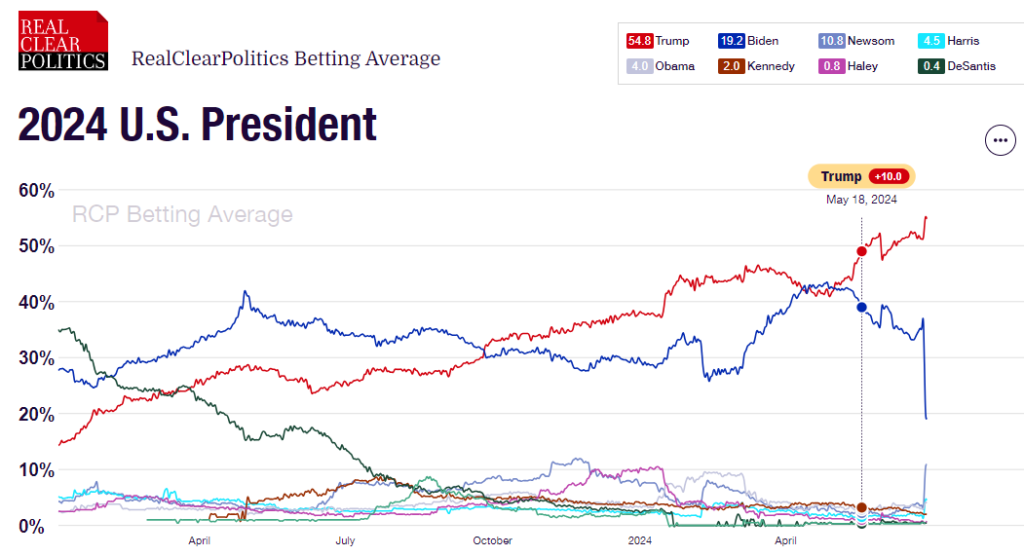

Which brings us to Thursday night’s entertainment on CNN. It was the first time we’ve ever seen a debate between a sitting President and a former President. I don’t think we’ll surprise readers from either side when I say it was significant disappointment for President Biden’s team as he struggled to look strong and Presidential. The political gambling markets took a swift turn to Trump immediately after it concluded.

Source: www.realclearpolling.com/betting-odds/2024/president

The political world was sent into chaos Thursday night and Friday as pundits began to proclaim that President Biden needed to be replaced on the ticket in November’s election. That is a very sticky wicket. First, there is nothing to indicate President Biden intends to step away from the race. That could certainly change – but for now he’s in. According to the DNC’s rules, delegates won by Biden are bound to vote for him. They can’t change their mind when they get to Chicago in August.

If Biden were to step aside prior to August 19th, all bets are off. There would undoubtedly be numerous potential candidates who would vie for the support of the delegates. California Governor Gavin Newsom, Michigan Governor Gretchen Whitmore and Vice President Kamala Harris all come to mind. No one knows how a contested convention would play out. The last time we had a convention go past the first ballot was 1952. Biden and Trump were 9 and 6 years old at the time.

But what does that mean for your portfolio? That’s why we’re here after all. It comes down to one of the simplest and most important market insights: markets hate uncertainty.

And strangely enough, like it or not, the market got less uncertainty last week. The likelihood that – all things being equal – we know who the next President will be, has increased dramatically since last Thursday. Some of you will love that, some of you will hate it. Our clients represent the split in the American political landscape. But at least the market has an idea of who will be running the world’s largest economy and can now begin to position itself for his policies.

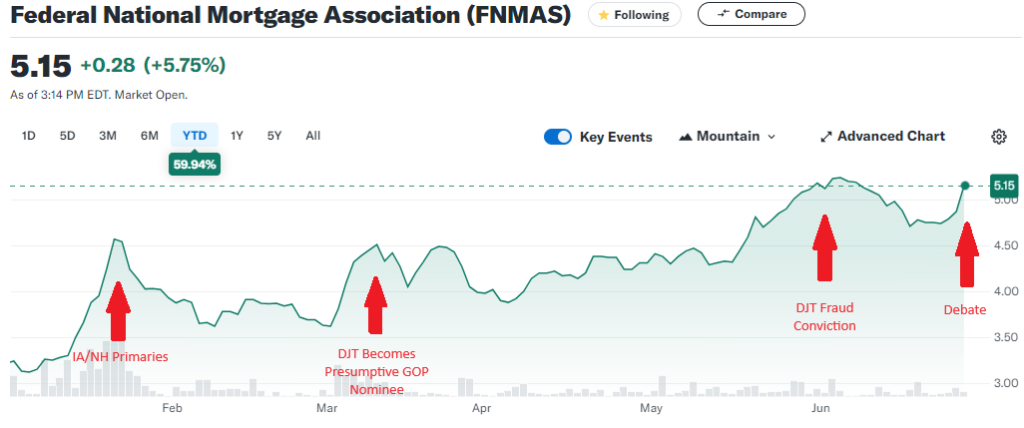

An excellent example of this is a stock many of our clients are familiar with: the preferred shares of Fannie Mae (FNMAS). This is a stock that is extremely sensitive to political outcomes. Donald Trump has been clear that, if elected again, he would institute policies that would be highly beneficial for the owners of these shares. Let’s look at how the stock has behaved since the start of the year.

Source: www.YahooFinance.com

The more likely Trump will win, the better the stock has done (and vice versa). Confidence in the FNMAS position is the best it’s been since shortly after Biden took office. Right or wrong, the market has more certainty about the potential outcome.

There’s always a “but” though, right? Donald Trump may be the leader in this two-person race. But it’s important to remember it is a race between two tremendously unpopular candidates. If Biden were to drop out, the game will reset. And any reset would mean a significant amount of new uncertainty injected into the market. The kind of uncertainty we have not seen caused by an election in generations.

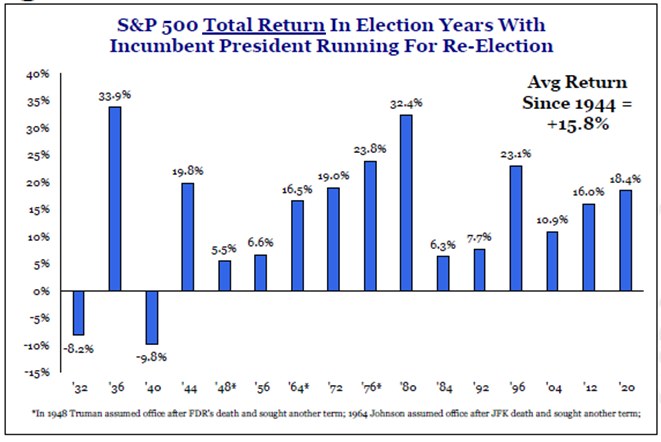

And that brings us back to the data we’ve shown you before. We know that presidential election years are consistently positive for the market. The average return since 1944 is 15.8%.

Past performance is not indicative of future results.

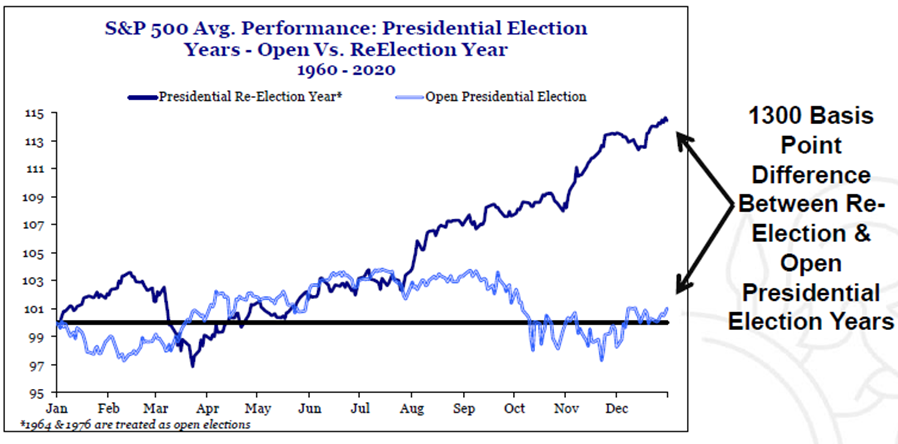

But that performance is specifically tied to certainty. Once we know who the President is going to be, the market does quite well. But when there is some question about who will be elected? Choppiness ensues.

Past performance is not indicative of future results.

So, prepare yourself. The next 55 days are going to decide the path of this market from now until November. If the race continues as is, we’ll get increased certainty about the outcome and the market will be happy. But if we get a new entrant, don’t be surprised if volatility kicks up as leadership of the free world comes into doubt once again.

Until then, just remember that our Great Experiment has suffered much more difficult circumstances. And there is still much to celebrate on Independence Day. We may not be perfect, but our “more perfect union” has a lot left to offer the world.

Sincerely,