The Weekly Insight Podcast – Strikes and Shutdowns, Oh My!

Two steps forward, one step back. Or is it one step forward and two steps back? Either way, that’s what it seems has been happening for the last 3+ years in this market. Pandemic. Drama filled elections. War in Ukraine. Inflation. Interest Rates. It just seems like there is always something out there to interrupt the momentum of the markets.

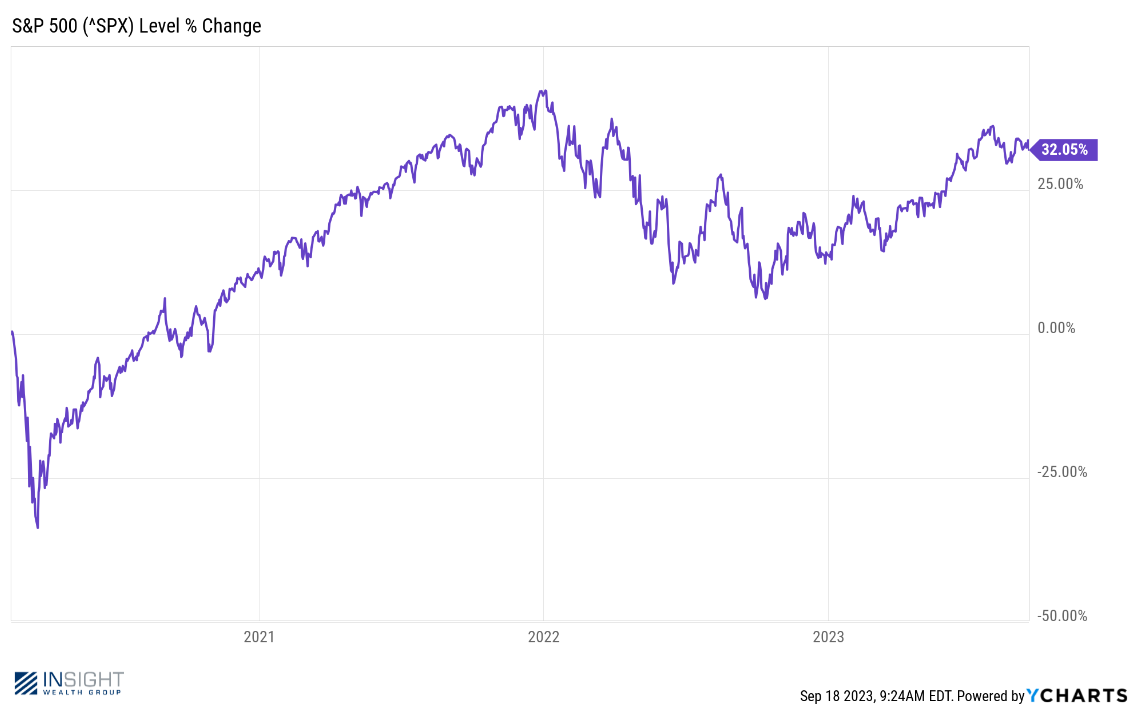

But here’s the dirty little secret the news does not talk about: we have survived all these things pretty well! If you go back to the pre-pandemic high on February 18, 2020, the result has been much better than most people feel like it has been.

Past performance is not indicative of future results.

Does it feel like the market has averaged 8.95% per year since before the pandemic? Because it has. We’ve weathered the storm remarkably well.

Now we have the latest storm clouds rolling in. It’s a two-fer this time: a UAW strike and the potential for a federal government shutdown. Both sound scary. Now when you put two the two of them together it sounds downright panic inducing. But are they really that big of a deal in the grand scheme of things? Should we be panicking and running for the hills? Or is this one of those moments to steel yourself and soldier through?

Let’s take a look at both to see what they mean for the U.S. economy in the coming months.

The Shutdown

Let’s be blunt. There is only a small group of legislators that want a government shutdown. We all know them as the House Freedom Caucus, and they are the most conservative of the bunch in the U.S. House.

Setting aside the policy issues for a moment (I think we can all agree the Federal Government spends too much money!), it is important to understand the politics here and the potential market impacts.

As with all things in Washington, we have two tracks working on the budget planning process – the Senate Plan and the House Plan. And right now, a fascinating thing is happening in the Senate that no one is talking about: bipartisan legislation.

For the last several months, Senators Patty Murray (D-Wash) and Susan Collins (R-Maine) have been working together to put together spending bills in the so-called “regular order”. What is “regular order”, you ask? It is the way legislation is supposed to be crafted. The demanding work of Committee hearings and budget planning takes place, so bi-partisan legislation is presented to the whole floor.

As their parties’ leaders of the Appropriations Committee, they have had remarkable success. The first of three spending packages was voted on last week. It passed 91-7. The plan is to put the other two to a vote in the coming days. We find it hard to believe this, but the Senate is doing its job. That feels weird, right?

The House is a whole other issue. The forty-five members of the House Freedom Caucus understand the influence they have in a House as divided as we have today. With only a 10-vote margin between Republicans and Democrats in the House, they have a distinct ability to impact legislation. And they are not feeling very bipartisan. They are demanding an additional $120 billion in spending cuts beyond what was agreed to with the Democrats in the June debt-ceiling agreement.

Things came to a head in last week’s House Republican Caucus luncheon. House Speaker Kevin McCarthy basically told his members to get in line or to vote him out. (His language was much more colorful than that…). According to Rep. Don Bacon (R-Neb), McCarthy’s message was clear: “We (Republicans) will be losers if we get a shutdown”.

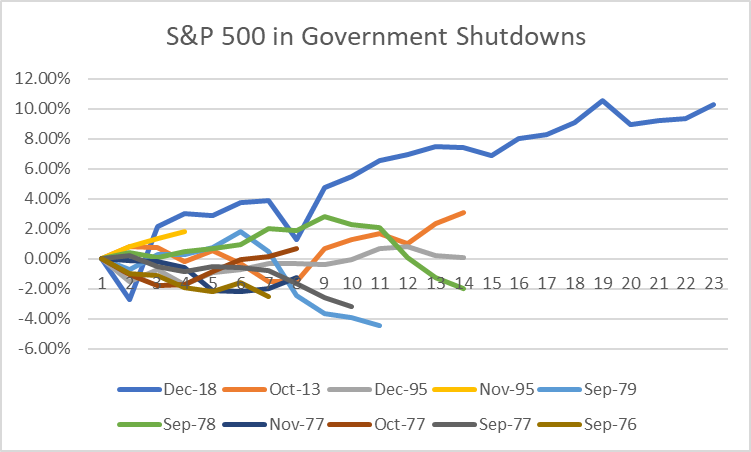

No offense to Representative Bacon, but Team Insight is not that concerned about the political ramifications for the U.S. House. We are much more concerned about what it means for the market and the economy. So, this weekend we did a little digging on past government shutdowns and their impact on the market. The results were surprisingly…tame.

Source: YCharts.com

Past performance is not indicative of future results.

The Federal Government has had ten shutdowns in the modern era that lasted more than three days (and twenty-one shutdowns total). The average market performance during each shutdown was +0.25%. Even if you exclude the obvious outlier when the market was up over 10% in 2018, the average return comes down to -0.86%. Simply put, the impact of a shutdown has, historically, been negligible.

But there is another thing to consider here as well: we forget our history. We bet if you asked most people to identify the times we have had government shutdowns lasting longer than 3 days, we would hear about the Clinton, Obama, and Trump shutdowns. But they only make of 40% of the history. We had six shutdowns in three years from 1976 – 1979! Maybe, just maybe, politicians have always been bad at this…

Strike, Strike, Strike!

Amid all this, the United Auto Workers (UAW) initiated a strike against Ford, GM, and Stellantis (Dodge/Chrysler/Jeep) on Friday. It is the first time the UAW has gone after all three automakers at once and is intended to force a better contract across the industry.

The demands of the union are massive. Initially it was a 46% pay increase over the next five years (20% immediately) and the return of pensions and cost of living escalators. They have also asked for a thirty-two-hour work week which would force manufacturers to hire more employees and grow the UAWs ranks.

The big three have countered with a 20% pay hike, including a year one bump of 10%. Ford has estimated that the UAW’s demands would increase per-hour labor costs from $65/hour to $150/hour. Ford CEO Jim Farley bluntly explained it would bankrupt the company.

In the end, much of this is a negotiating tactic to push for the best deal possible. A deal will certainly be reached at some point. The question is how long this will drag on and what impact the strike will have on the broader economy.

Right now, the answer is not much of an impact at all. Instead of going with a full strike across the industry, the UAW chose to limit the strike to three plants (one from each company) which impacts roughly 13,000 employees (less than 10% of the Big Three UAW workforce). The rest of the Big Three plants are open and operating.

Much like government shutdowns, we have been through this before. Do you remember, for example, the 2019 strike that lasted 40 days and impacted nearly 50,000 GM employees? Didn’t think so!

Moody’s Chief Economist Mark Zandi stated on NPR this week that, even if all 150,000 members were to strike for six weeks, the impact to GDP would be negligible. He estimated it would take 0.2% off Q4 GDP. It would be felt, but it is not going to cause an economic catastrophe.

This too will pass and will be forgotten to history. But right now, it causes stress on the markets and stress to our psyche. Which is why it is important to remember just how strong the economy continues to be today. We will get through this just fine.

Sincerely,