The Weekly Insight Podcast – Some vs. Several

It was another positive week for the markets last week. The S&P 500 recorded its fourth positive week out of the last five and the Barclays Global Aggregate Bond Index has followed a similar track. The things that linked equities and bonds together last year for a rough run are having the opposite impact as we enter the second quarter this year.

But much like 2022, the news was dominated last week by discussion of the Fed, interest rates, and inflation. While the topics are the same – the narrative is changing. And this shift in messaging is one that may portend the end of the rate hike cycle. Let’s take a dive into what we learned last week.

FOMC Meeting Minutes

Before we dive into the “new news” that came out last week, we wanted to go through the “old news” that also came out. The Fed released their minutes from their March FOMC meeting. (We’ve never understood why they wait nearly a month to do so…).

As expected, most of the FOMC’s discussion last month centered around the concerns we were experiencing in the banking sector and what those concerns meant for interest rate policy. There were a few things to note:

- As discussed in Powell’s press conference in March, the Committee believes that, while the banking sector remains “strong and resilient”, the issues raised by the collapse of Silicon Valley Bank and others “were likely to result in tighter credit conditions for households and businesses and…weigh on economic activity, hiring, and inflation”.

- The Fed now believes a recession is coming. Per the minutes “the staff’s projection at the time of the March meeting included a mild recession starting later this year…Likewise, the unemployment rate was projected to rise above the staff’s estimate of its natural rate early next year”.

- Inflation is falling, but not as fast as the Committee would like (at the time of the meeting).

All of this led to two interesting passages later in the minutes:

“Several participants noted that, in their policy deliberations, they considered whether it would be appropriate to hold the target range steady at this meeting”.

“Some participants noted that given persistently high inflation and the strength of the recent economic data, they would have considered a 50-basis point increase in the target range to have been appropriate at this meeting”.

In the end, the FOMC unanimously agreed to meeting in the middle, raising rates by 0.25%. But cracks are starting to show amongst the members on the path forward. And we’d remind you that “words matter” when looking at the minutes. It’s notable that “several participants” wanted to stop rate hikes while “some participants” wanted to push a more rapid hiking path. “Several” is more than “some”.

Latest Inflation Data

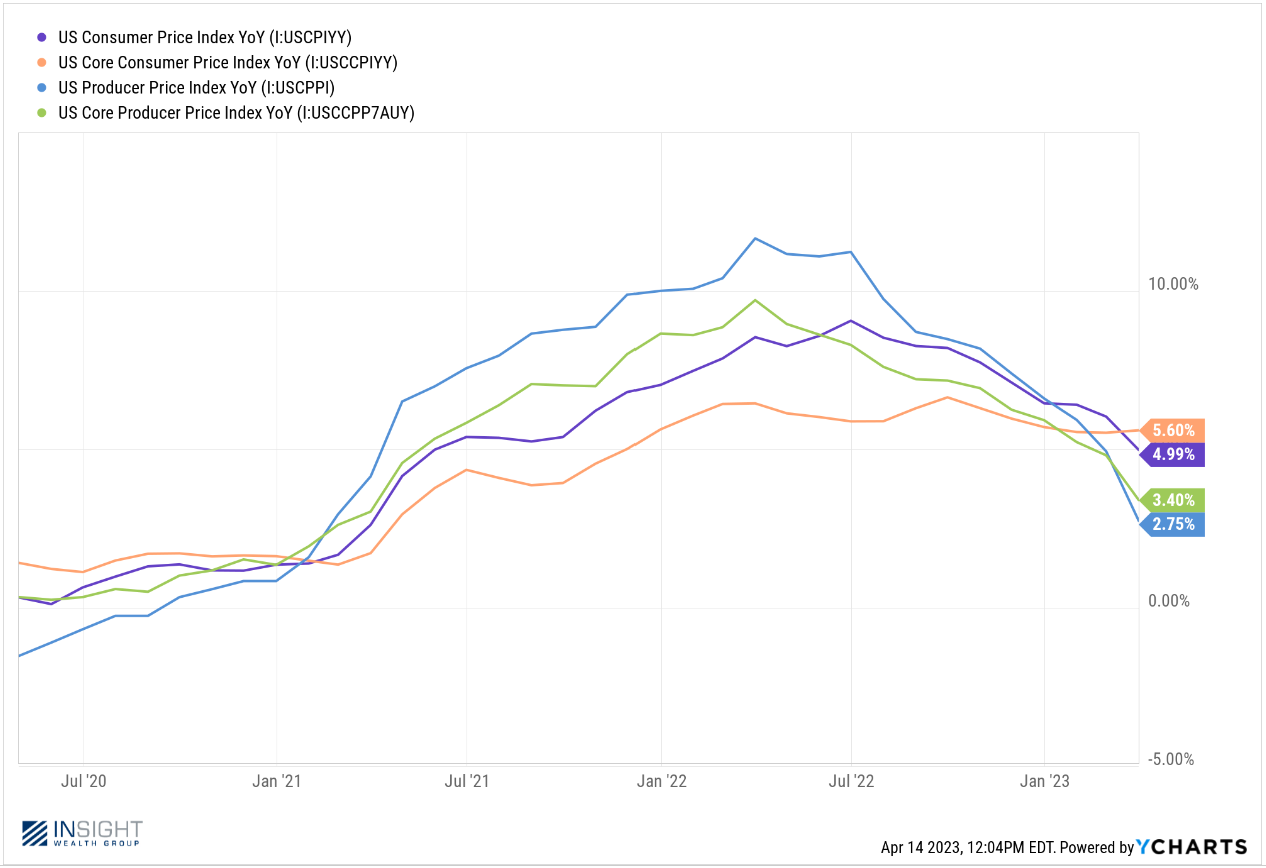

At the same time the minutes were coming out, we were also receiving the latest inflation data. We were blessed with both CPI (Consumer Price Index) and PPI (Producer Price Index) data last week.

We saw a massive (and better than expectations) shift in the overall CPI data. The month-over-month calculation grew at just 0.1% (vs. 0.2% expected) and the year-over-year number dropped from 6.0% to 5.0% (vs. 5.2% expected).

Core CPI, on the other hand, came in right as expected with month-over-month coming in at 0.4% (down from 0.5% last month) and year-over-year coming in at 5.6%.

The PPI numbers were equally good. PPI tends to lead CPI and the data is starting to reflect the Fed’s hopes: 3.4% for Core PPI and 2.75% for all-items.

What’s notable is that overall CPI came in lower than Core CPI (we saw this cross in February for PPI). That’s the first time we’ve seen this inversion since January 2021.

Past performance is not indicative of future results.

Why? The first reason is energy prices. We’ve now hit the one-year mark for measuring the impact of energy costs from the Ukraine war. You may recall that energy prices spiked aggressively last February and March due to fear of the impact of the war on oil and natural gas production. It turns out the U.S. can provide for our own energy needs pretty well (and more as we’re once again a net exporter) and prices have fallen and stabilized.

The second reason is one you’ve heard us talk about a lot: shelter inflation. Shelter now makes up 43.7% of the calculation for Core CPI. And according to the Bureau of Labor Statistics (BLS), the cost of shelter rose another 0.60% in March. That’s after increases of 0.8% in February and 0.7% in January.

The politest way we can say this is “Bollocks!”. It’s just a bad, bad data set. These numbers have been growing well outside the bounds of what the world is actually seeing right now – especially the “owners equivalent rent” data set. According to the BLS rents have been rising, and rising, and rising. But the actual data – from Zillow – shows us rents peaked in September. And while we’re getting our typical spring rise in rents, they still haven’t cleared the number we saw on September 30th.

And even more important are the Zillow estimates for the future: 1.7% growth in home prices between now and March 31st of next year. Shelter price inflation has ground to a halt. But the BLS’s archaic calculation has not kept pace. When it finally catches up, core inflation is going to head south quickly.

That’s in keeping with the FOMC minutes this week where they said, “In 2024 and 2025, both total and core inflation were expected to be near 2 percent”.

Some vs. Several

So, inflation is improving, and the Fed is now getting to the point of acquiescence on interest rates. That’s great news. But we need to expect some pain and volatility as this process concludes. As we saw in the Fed’s minutes from last month, there is dissension amongst the members about where to go next. That diversity of opinion is good. But it also is going to lead to uncertainty in the coming weeks.

Just take last Friday as an example. There were two competing headlines on Yahoo Finance:

- Fed’s Waller Says Inflation ‘Still Much Too High’

- Fed Can ‘Hit the Mark and Hold’ with One More Rate Hike, Bostic Says

That’s two FOMC members – Board of Governors member Christopher Waller and Atlanta Fed Governor Raphael Bostic – who have completely different views on where to go next.

Waller sounded pessimistic on Friday, saying “Whether you measure inflation by CPI or the Fed’s preferred measure of PCE, it is still much too high and so my job is not done…Financial conditions have not significantly tightened, the labor market continues to be strong and quite tight, and inflation is far above target, so monetary policy needs to be tightened further”.

We’d guess he was one of the “some” that wanted to raise rates by 0.50% last month.

Bostic had a much different take. He stated that he believed the rapid rate increase of last year were just now starting to “bite” and that “we’ve got a lot of momentum suggesting that we’re on the path to 2%”. In fact, he even mentioned he believes the inflation battle can be won without a recession or a significant rise in unemployment.

Bostic was probably one of the “several” that was considering halting rate hikes at the last meeting.

Are the “some” right? Or is it the “several”? We’ll see. But we shouldn’t be surprised by the increasing conflict at the FOMC about this issue. The decision to stop rate hikes is a big one. We’d be more concerned if there weren’t conflicting opinions. But the next Fed meeting – just less than three weeks from now – is going to be one of the most important since the pandemic.

Sincerely,