The Weekly Insight Podcast – Ringing the Alarm on Social Security

Last week was a “get away” week for the market. Stock and bond markets were closed on Friday in celebration of the Easter weekend. And the results in the market were muted. The S&P ended the week down 0.34% – and remains up for the year. Not much to write home about considering the volatility we have gotten used to over the last three years!

The big economic news of the week was the JOLTs report (job openings) and the March unemployment data. The results? Mixed. The JOLTs report showed a significant drop in the number of job openings – dropping from 10.563MM in the last month to 9.931MM on Tuesday. That is the first time we have been under 10MM jobs available since July of 2021.

The unemployment data had some encouraging signs as well. We still created more new jobs in March, but less than expected and less than in February, dropping from 266,000 to 189,000. But the unemployment rate is sticky and dropped from 3.6% to 3.5%.

The Fed wants the labor market to cool down. The data is mixed. That is why we saw wild fluctuations last week in expectations of the next Fed meeting. Will they raise rates – or are they done – is going to be the big debate between now and the meeting on May 3rd. We will know a lot more this week when the CPI data comes out. It will be the last CPI report before the meeting and the results will reverberate for the next few weeks.

Social Security Insolvency

We have been chasing a lot of “immediate problems” over the last few years. It sometimes takes our eye off the bigger concerns that are slowly sneaking up on us. We wanted to spend some time today working through one of those concerns with you: Social Security.

We are not going to solve it in these pages, but it is something every one of our clients must understand. Because changes to the system are coming – and someone is going to get hurt.

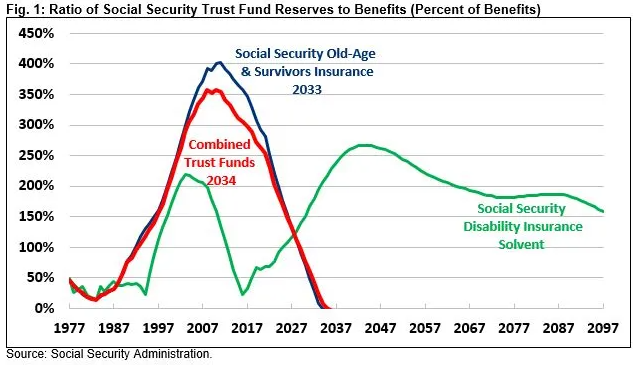

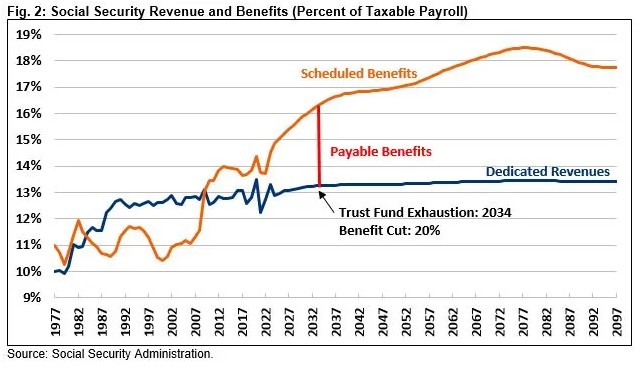

On March 31st, the trustees of the Social Security Trust Fund released their annual report. It was not pretty. According to the report, we are just 11 years away from Social Security being insolvent. That is a year earlier than they anticipated in 2022 (thanks inflation!) and lines up with expectations from the Congressional Budget Office as well.

Past performance is not indicative of future results.

We have been hearing about this forever, right? No sincere effort to fix Social Security has been undertaken by our elected leaders since 2005, when recently re-elected President Bush decided to use his “political capital” to reform the system. It did not go well. Both sides of the aisle attacked and largely ended his success on Capitol Hill.

It was easy, at the time, to argue there was no point. The Trust Fund reserves were growing. But the intervening 18 years have not been good. A rising number of people drawing benefits – combined with no action – means the hole we are in gets deeper and deeper. At our current pace, there is no way to plug the hole.

Past performance is not indicative of future results.

There are ways to avoid insolvency. But to do so, we must understand we only have three levers:

- Increasing Tax Revenue

- Decreasing Benefits

- Time

The math is simple: we will have to either increase taxes or decrease benefits. But time is the most important of these. The quicker we act – the less pain for everyone.

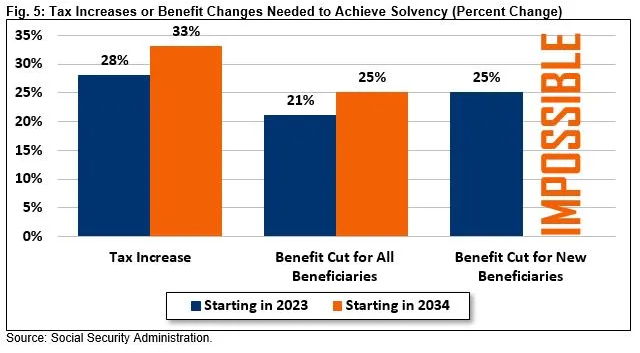

As the chart below shows, if we act now, we can avoid insolvency. A 28% increase in the Social Security payroll tax would solve the problem. The current payroll tax is 12.4% (6.2% paid by the employer and 6.2% paid by the employee). A 28% increase would bump this tax to 15.87% meaning the tax rate would rise by 1.74% for both employers and employees.

But if we wait until insolvency? That number jumps to 33%.

The same goes for benefit cuts. If we cut all benefits today by 21%, we would save the system. Wait until 2034? The cut goes to 25%.

Past performance is not indicative of future results.

The kicker here, though, is the data on the far right of the chart. We know politicians never want to be seen as taking money from “the elderly”. It has long been considered political suicide. So, the argument that is commonly made is we should adjust the benefits for those not yet in the system.

That is doable – today. If we acted immediately by cutting all new beneficiaries’ benefits by 25%, we could save the system. But if we wait? If we wait, we could cut their benefits to ZERO and the system would still be bankrupt.

So, what do we do? The honest answer is we should do some combination of both: raise payroll taxes, cut benefits. But there is reason to doubt Washington is brave enough to act. And we know why: the American voter is not willing to fix it.

We are seeing it today in France. President Macron just raised the retirement age from 62 to 64 in France (an even more unrealistic approach than our age 67!). The result? 10,000 tons of trash on the streets of Paris as sanitation workers went on strike. Unrelenting protests. Rage on the streets.

So, what can we do as financial advisors and investors? Make a plan. Much like the Social Security Trust Fund, you have some levers you can pull as well: savings and time. It is time – NOW – to look at your financial plan and begin to model the impacts of benefit cuts (or elimination) on your retirement. We are here and ready to help.

Change is coming. Due to cowardice, it may not come for another 11 years. But it’s coming. And we can act today to make sure you are able to withstand it.

Sincerely,