Last week, we spent considerable time talking about end-of-year planning – both in portfolios and for clients’ personal financial plans. This led to several good questions coming from clients about their personal goals, and some additional ideas for this week’s memo. So, we are going to hit on a few more planning topics this week while also taking a dive into some items in the market that are moving portfolios.

This also brings up another important point: please reach out! We do our very best to communicate with our clients frequently throughout the year, but we also do not know every issue that is impacting you. As we get close to 2021, if there are year-end issues about which you have questions or concerns, please give us a call. That’s why we are here!

Last Week’s Market Movers

We have talked for some time now about our three main drivers for the market: fundamentals, the Election, and the Virus. While all three have been positive drivers to the portfolio in recent weeks – and all three remain constructive – there are still excuses for a bit of volatility in both the election and our nation’s response to COVID-19.

Finishing Up the Election

While we are now more than a month past the election, vestiges of its results are still lingering. The most public is President Trump’s continued push to find fault in the election results and prove that he was victorious. Insight is certainly not the group to opine about whether an election was fair, or the results legitimate. We would venture to guess the response from our clients on this would be mixed.

We can, however, lay out for you when this argument is going to end: tomorrow! That is because, by U.S. Code, states are required to resolve all election-related disputes six days before their electors cast their votes. Since electors vote on December 14th, that means all states must complete recounts, resolve legal challenges, and certify results no later than December 8th.

Typically, Governors also prepare Certificates of Ascertainment by this date which include the names of electors, certified election results, and the state’s seal. These are not technically due, however, until December 14th – the day the electors vote. So, while there is some wiggle room for states over the next few days, by this time next week the process will be completed.

At this point, the market has essentially built into its expectations that Joe Biden is the next President of the United States, so we would not expect any significant additional volatility based upon the outcome next Monday. However, watching how President Trump reacts to the result is something to which we will be paying attention.

Georgia on My Mind

We have talked extensively since the election about the benefits of a divided government, both for the economy and the markets. Inevitably, the question we are asked is “What about Georgia?”. While the results of the Georgia Senate runoffs are important (we would suggest the GOP will likely keep at least one seat – but could certainly be wrong), we would argue the question of divided government has already been decided.

We wrote a few weeks ago about Senator Joe Manchin (D-WV) and his declaration that he would not vote to upend the Senate filibuster. That is one of the most important political developments since Election Day. He reiterated it this week in the New York times in what we think is a very important article. You can read it here.

Without Manchin’s vote to end the filibuster, we get divided government no matter what the outcome of the Georgia election on January 5th. There will be no large tax increases, no Green New Deal, no single-payer healthcare. Congress will instead be forced to take a centrist approach to solving this nation’s problems and that will be beneficial to portfolios.

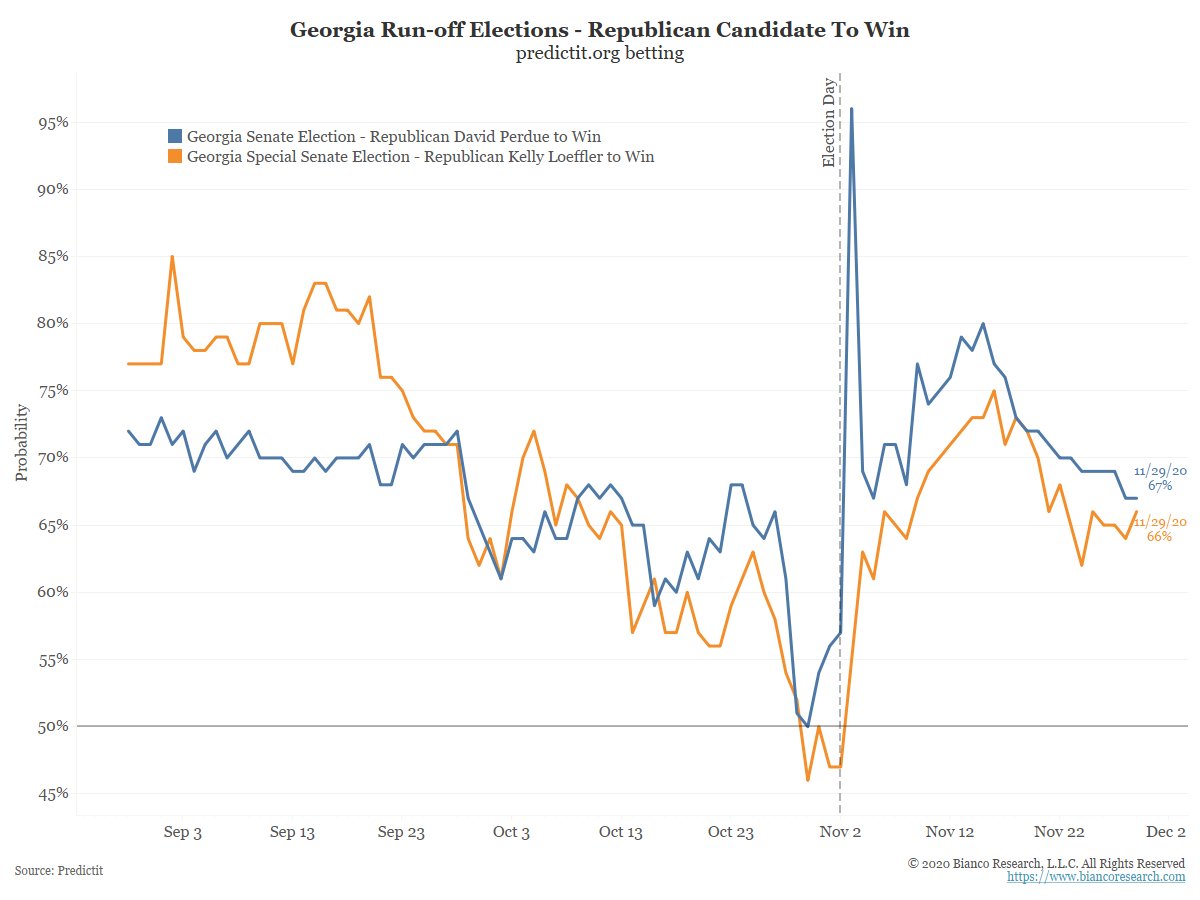

Additionally, it is worth noting that – at least today – the favorites to win the Georgia races are the two Republicans. As you can see from chart below, bettors on the PredictIt.org website are strongly favoring Perdue and Loeffler.

Source: Bianco Research

Vaccine Update

The market had a good week last week, with the S&P up just over 2 percent for the week. Whatever volatility we did have, however, was very focused on the virus and, more specifically, the vaccine.

While we have been flooded with good vaccine news over the last few weeks, we are now getting into the messy “operational” phase of the vaccine rollout. This period will see both excitement about the good news and panic about the bad. The end result – the vast majority of American’s receiving the vaccine – is just months away, but we cannot ignore the fact the path there will have roadblocks.

For example, just last week Pfizer’s stock was hit hard on the announcement that they now anticipate producing 50 million doses of the vaccine between now and year-end, down from previous guidance of 100 million doses. While it does not impact their 2021 goal of 1.3 billion doses, it gave Wall Street a fright and the stock was down nearly 4% on Tuesday. It still ended the week up nearly 6.25% because, in the end, what matters is the vaccine should be approved for distribution later this week. But it is an excellent reminder that the news of the day will undoubtedly play a role in this market and it will not always be positive.

Fannie Mae & Freddie Mac Update

A number of our clients are shareholders of Fannie Mae and Freddie Mac, particularly the holders of the preferred shares FNMAS and FMCKJ. While our partner Brian Boyle has put out some valuable updates on this in the last few weeks, we thought it important to highlight some recent information he provided.

As holders of this position know, we are watching closely for an amendment to the Preferred Stock Purchase Agreement (PSPA). While we are hopeful the PSPA will be amended before year-end, anytime politics plays a role in a security there is reason to be cautious.

There were some important hearings this week that provided some additional clarity on the situation. We will quote directly from Boyle:

“At yesterday’s (December 1st) Senate Banking Committee hearing, Chairman Mike Crapo (R-ID) used his opening remarks to encourage Secretary Mnuchin and FHFA Director Calabria to take administrative action to end the conservatorships of Fannie Mae and Freddie Mac.During their testimony at the same hearing, both Secretary Mnuchin and Fed Chairman Powell endorsed the recently finalized capital rule and reiterated the need for private capital, something that can only be accomplished by amending the PSPA and crystallizing Treasury’s investment.

“In today’s (December 2nd) hearing before the House Committee on Financial Services, Secretary Mnuchin confirmed reports that he is discussing changes to the PSPA with the FHFA.While Mnuchin stated they haven’t made any decision yet, we expect an amendment to the PSPA to occur prior to year-end…”

There is still a lot to play out here – and the window between now and Biden’s inauguration is closing quickly. But it seems as though we will have some answers soon.

More Financial Planning Topics

As discussed, a few more items came up in our year-end financial planning conversations this week that we thought might be relevant. Let’s take a quick run through them:

Charitable Giving and the CARES Act

As you will remember, the CARES Act was the key piece of COVID-19 stimulus legislation passed by Congress and signed by the President earlier this year. There is a myriad of opportunities in the legislation which are worth addressing. One item we have not addressed yet with clients is the impact of the CARES Act on charitable giving. Here are a few key points:

- Typically, if you itemize your deductions, cash charitable gifts are limited to 60 percent of your Adjusted Gross Income (AGI). The CARES Act raised that to 100 percent of AGI for this tax year only.

- Similarly, for corporate contributions, this level was raised from 10 percent to 25 percent of taxable income.

- If you are not itemizing your deductions in 2020, the CARES Act allows for an additional “above-the-line” deduction for charitable gifts made in cash of up to $300.

- We addressed the issue of Qualified Charitable Gifts for those who typically have required minimum distributions (RMDs). We would just remind you that while RMDs have been suspended for this year, you can make charitable contributions out of your IRA accounts if you are older than 70 ½.

CARES Act and Net Operating Losses

Business owners may recall that the 2018 Tax Cuts and Jobs Act disallowed the carryback of losses and limited loss carryforwards so they can only be applied to 80% of a business’s future income. While that continues to be the law going forward, the CARES Act provided a short-term reprieve. The CARES Act now allows net operating losses in 2018, 2019 and 2020 to be carried back five years to offset taxable income during those years. It also allows carryforwards to offset 100% of taxable income in 2019 and 2020. In 2021, the 80% carry forward limitation is restored, so make sure you are addressing this with your tax advisor now. Businesses that are breaking even right now might want to consider increasing their spending between now and year-end to take advantage of this change.

Donor Advised Funds

We have written about Donor Advised Funds in the past, but a reminder might be worthwhile. To refresh, a Donor Advised Fund is an account into which you can make a charitable contribution right now, control the investments of over time, and make charitable contributions at your discretion. Simply put, you get the tax advantage of the charitable contribution today without being required to pay it all out immediately. It works kind of like a “poor man’s foundation”, without all the tax and reporting pains creating a foundation requires.

While this can be an excellent tool at the end of the year to reduce taxable income, we would also note there are some programs which may be worth taking advantage of after the calendar rolls into 2021. For example, for Iowa residents, the state provides a limited tax credit program which can reduce your taxes due to the state dollar-for-dollar. However, since it is a limited pool, once it’s gone it’s gone. That pool usually expires sometime in the first half of the year. If you anticipate 2021 might be a good year, looking at a program like this in January may be beneficial.

We hope, as always, this memo finds you and yours well. If you need anything, please do not hesitate to let us know. We look forward to working with you to wrap up 2020 in a positive light!

Sincerely,