The Weekly Insight Podcast – Jelly of the Month Club

Many of us at Insight are the parents to young kids, which makes this a wonderful time of year. The excitement and anticipation of Christmas combined with the tradition and time spent together is irreplaceable.

But the once great philosopher Chevy Chase gave us the Christmas classic “Christmas Vacation” to remind us that sometimes our expectations for the holidays can get a little above and beyond what can reasonably be expected. And last week we had our own little National Lampoon’s version of the stock market that was reminiscent of the movie.

There are too many in the movie to go through them all here: the tree that was too big, Cousin Eddie’s unexpected visit, Clark’s failed attempts at the greatest Christmas light display (ever). But there is one theme running through the movie: Clark waiting anxiously for his Christmas bonus so he can cover the deposit he put down on a new swimming pool which is meant to be his family’s present for the holiday.

You all likely know what happens: instead of getting a bonus he gets a year’s subscription to the Jelly of the Month Club. Rage ensues. Cousin Eddie kidnaps Clark’s boss. The police raid their home. It is a nightmare. But it should not have been a surprise to Clark. There was nothing his boss had said or done during the movie which would show he was a generous man intent on making Clark’s holiday.

Which brings us to the market last week. It was a rough week, and it was all precipitated by Clark’s boss (Chairman Powell) not giving out Christmas bonuses (dovish talk on interest rates). The temper tantrum that ensued was a near perfect reflection of the temper tantrum Clark threw in the movie.

But should the market have really been surprised? Or did Powell do exactly what he has been saying he would do? Let’s take a look.

The Terminal Rate

You may recall us saying in these pages that it was not what the Fed did – but instead what they said – that mattered in this meeting. Nothing could have been truer. In fact, in the Fed’s official statement of action coming out of the meeting (their normal 2-page press release) there were only two phrases that changed from last month. In their sentence about then inflationary impact of the Russian war, they changed the phrase from “creating upward pressure on inflation” to “contributing to upward pressure on inflation”. And they changed the target rate itself. That’s it.

So, what came out in the Summary of Economic Projections (SEP) was what really mattered. And what mattered most from that document was the discussion of a “terminal rate” – or how high interest rates will go before they begin to drop.

Now, before we dive too deep into this, we would once again point out that the Fed’s ability to predict what the Fed is going to do is…historically awful! One need only look at last December’s SEP when they announced they expected rates in 2022 to go to… 0.75%. Yeah, they missed that one…

But the SEP does have a bit more relevance when we are nearing the top of the cycle. The debate right now is not whether we go to 5% or go to 10% with interest rates. It is a much more fine-tuned conversation.

So, what did they predict? Roughly 5.25%. Ironically, the number the market had been predicting prior to the meeting.

That means we have 1.00% to 1.25% to go in the rate hike process. Which means another 0.50% hike in the next meeting and a couple 0.25% hikes to close it out and we are wrapped up with this process by May. We are getting closer.

The Path Forward for Inflation

Chairman Powell has been saying it since his Jackson Hole speech in August. And he said it again this week: the battle against inflation is a long one and is not going away just because we wish it were so.

But there is “long” and there is “1970s long”. This is not that, and the Fed’s SEP made clear the Fed Governors agree with that statement.

Source: FOMC Summary of Economic Projections, December 2022

Past performance is not indicative of future results

We all know inflation is falling at this point. By the Fed’s estimate, it will be down to 3.1% by the end of next year, 2.5% in 2024, and 2.1% in 2025. Is it perfect? No – perfect would be 2% flatline. But 3.1% next year is a heck of a lot better than the numbers we saw earlier this year.

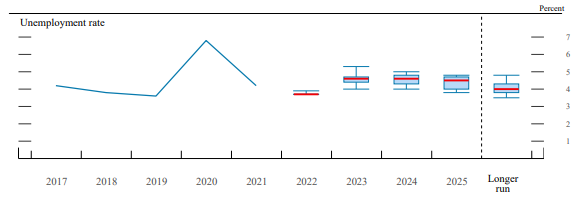

Unemployment

Unemployment is where we get into the muck a bit. We all know the battle by now: too many jobs being sought by too few people. It is hard to slow an economy down when employers are having to compete so aggressively for workers. Wages go up, driving up other costs in the economy.

Inevitably, part of slowing down the economy becomes increasing unemployment. It is a necessary evil. But how fast – and how high – will unemployment go? And can the Fed really control the rise?

What we know is the Fed is now predicting unemployment to hit 4.6% next year and stay at that level through 2025.

Source: FOMC Summary of Economic Projections, December 2022

Past performance is not indicative of future results

4.6% is not a particularly bad number. In fact, it is fully 1.14% below the average for the United States from 1948 – 2022 which sits at 5.74%. But it is not the rate itself – but the speed with which it gets there that matters. We’ve never grown unemployment by a full 1 percent in 12 months without causing a recession.

And therein lies the rub from the whole speech this week. The market really, really wanted Chairman Powell to reassure them of a “Christmas Miracle”: inflation goes away, and no pain is felt. He could not promise that. Instead, we got the Jelly of the Month Club.

It is, however, that very disappointment where the opportunity lies. The market has already been pricing in this pain for some time. Why? Because Powell keeps saying it – over and over again. It’s just that every now and then we hope it might be over and the market rallies a little bit before being put back in the box by Powell. But even with all the pessimism from last week, we are nowhere near testing the lows we saw in Q3. Patience will win out in this battle.

Happy Holidays!

As we close out the last memo prior the holiday, we want to wish each of you a very Merry Christmas! We will be taking a break from the Weekly Insight Memo and Podcast next week as we look to celebrate the holiday with our families. We hope you are able to do the same.

As a quick housekeeping item, our offices will be closed on Monday, December 26th and Monday, January 2nd to allow our staff some extra time with their families. The stock market is also closed on both of those days.

We will see you in 2023!

Sincerely,