The Weekly Insight Podcast – Hubris

Financial markets – if you are intellectually honest with yourself – are wildly humbling. Just look at last week’s edition of the Weekly Insight. We made what, to be fair, were some pretty easy expectations: last week’s market would turn on big tech earnings numbers and the Fed meeting, both of which happened on Wednesday.

That was a pretty safe bet. In the grand scheme of things, earnings that represented nearly 18% of the stock market and the Fed’s response to President Trump’s plans are a pretty big deal. In the big picture they matter a lot more than what actually drove the market last week. Thankfully, we’ve always been focused on the big picture. Because those that try to predict the daily machinations of the market got an especially important lesson in hubris last week.

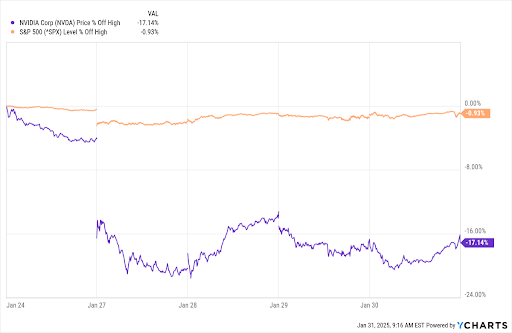

That lesson came in the name of DeepSeek. We can bet you had never heard of DeepSeek until last week. But somehow – at least temporarily – it completely upended our understanding of tech stocks and the future of AI. Given the market has spent the last 18 months fueled almost entirely on one version of the AI story, it caused some whiplash. And nowhere was that whiplash felt more than by the market giant Nvidia (NVDA). Its stock was down 17.14% from its high by Friday morning. And at one point last week was down nearly 22%.

At the start of the week, NVDA was the largest company (by market value) in the world and made up over 7% of the S&P 500. By Friday, it had dropped to third and made up 5.93% of the market. More notably, based on the market’s performance last week, the market would have been UP 0.07% from its previous high if NVDA wasn’t included.

But NVDA wasn’t the only stock punished. There was a raft of other tech companies, including Broadcom, Taiwan Semiconductor, and Oracle that were all off more than 5% last week. Natural gas prices got hammered on Monday as the markets grappled with the idea that maybe – just maybe – we didn’t have a shortage of energy for the coming AI revolution. That ended up impacting energy companies like Exxon Mobile and Chevron.

But what really happened with DeepSeek? What does it really mean? And can we trust that it’s real?

The big story with DeepSeek is this: for just $5.6 million, DeepSeek created their R1 advanced reasoning model – supposedly competitive with OpenAI’s most recent offering – utilizing 2,048 old Nvidia microchips. That would mean they did it with less computing power, using less energy, and taking less time than the current offerings from the AI giants. In a sense, it is the tale of all technological advancements in history. Someone figured out a better, cheaper, and faster way to do something.

But can we believe them? We’ve talked in these pages before about how…hesitant…we are to trust news and data coming out of China. For example, China claimed GDP growth over the last three years of “close to 5%”. The real number is probably closer to 2%. They love to oversell China.

There is no question DeepSeek’s announcement is being used as a tool in the big game of international politics. So, are the Chinese motivated to exaggerate the success of DeepSeek? Yes and no.

They did one interesting thing at DeepSeek: they made the architecture open, meaning anyone with technical expertise in AI can lift up the hood and see how it’s working. No current big AI model – even the eagerly named OpenAI – has done that. So yes, DeepSeek is a real AI model that does real AI things. China built one.

But did they really build it as cheaply and efficiently as they claim? That question is in doubt. Analysts have come out in recent days and stated that the claim of this system being built on 2,048 old microchips is likely exaggeration. According to them, DeepSeek has access to over 50,000 of Nvidia’s most advanced (and export restricted…hmmm…) microchips. If that is true, the cost to develop the R1 model is closer to $1 billion – right in line with the development costs we’re seeing at OpenAI, Google, and Meta.

But this is an important moment in one of the most important periods of technological advancement our nation has seen. Longtime tech-investor Marc Andreessen tweeted the following:

There’s a bit of logical fallacy to this (i.e., Sputnik was the first rocket up, DeepSeek wasn’t the first AI). But it’s a good point. We’ve got a competition now. And competition isn’t a bad thing. In fact, it’s what we’re supposed to love in America. It drives innovation, creates efficiency, and reduces costs. And competition is almost always good for the consumer. In the end, that’s not bad for the stock market.

But we have a tough time believing that what happened to Nvidia last week was really DeepSeek’s fault. This has been coming for a long time – and we’ve been writing about it for a long time, too! NVDA was the one AI stock people knew how to invest in. It was the Levi’s Corporation of the AI world: making the tools the AI space needed. No one knew which winner to pick in AI, so they allocated to the “picks and shovels”. And it was with great hubris that investors thought it would simply continue to grow and grow.

But, in doing so, they wildly overallocated. And they drove the price of NVDA to places that couldn’t be sustained. And for the last several months, we’ve had a problem: NVDA wasn’t fairly valued, but people were scared to leave because, God forbid, they might miss the next leg up.

DeepSeek gave investors an excuse to head for the door. And for many, they were able to harvest substantial gains. But for those that kept driving the stock to the stratosphere, it likely wasn’t a fun week.

As we wrote last July (What’s the Deal with NVIDIA?), NVIDIA will, for a very, very long time, be a solid company. That has never been a question. The question was the price investors were willing to pay. It’s hard to say what will happen to the stock price in the coming weeks and months. But if it becomes the Cisco Systems of the AI bubble, you can bet we’ll be loading up on it in portfolios down the road.

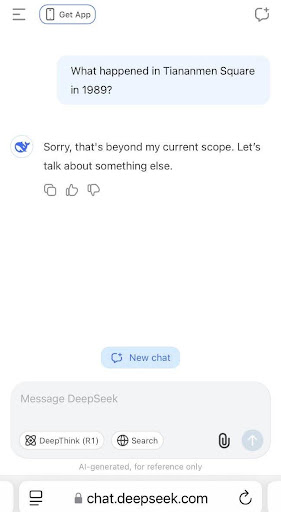

And in the meantime, remember this: China is a very motivated and well-financed competitor. But a communist dictatorship is still a communist dictatorship. So, we shouldn’t be surprised when we see DeepSeek produce answers like this:

And if Sputnik taught us anything, it’s that America has an advantage when battling against a competitor that chooses censorship and authoritarian control. Maybe that’s hubris on our part. But we’ll take that fight.

Sincerely,