The Weekly Insight Podcast – The Powell Effect vs. The Trump Effect

There’s an old line in our industry that says, “activity breeds success”. The sentiment is, basically, if you sit on your duff and wait for things to happen to you, they won’t. If you go out and push – if you create activity – results will follow.

We’re sure President Trump must have heard that line at some point – because boy was the first week of the Trump Administration 2.0 “active”. Here’s what we’ve seen so far:

- Nearly 60 Executive Orders signed. Some have been meaningful, some merely symbolic. But it is clear he’s working towards proving to his supporters he’s going to do what he promised. These included:

- Getting all Federal workers back into the office

- Implementing a Federal regulatory and hiring freeze

- Reopening federal areas for energy exploration

- Sending military units to enforce the border

- Officially implementing “DOGE”

- Significant commitments for investments in the United States, including a $500 billion commitment to a private sector AI project led by Oracle, OpenAI and Softbank, a declaration from Saudi Arabia that it “wants to invest $600 billion in the United States”, and an announcement from Stellantis that it will reopen a Dodge assembly plan in Illinois.

- In a quite different approach than Trump 1.0, the new Trump Administration had a significant lineup of key executive positions – both Cabinet-level and sub-Cabinet-level – lined up for appointment on day one of the Administration.

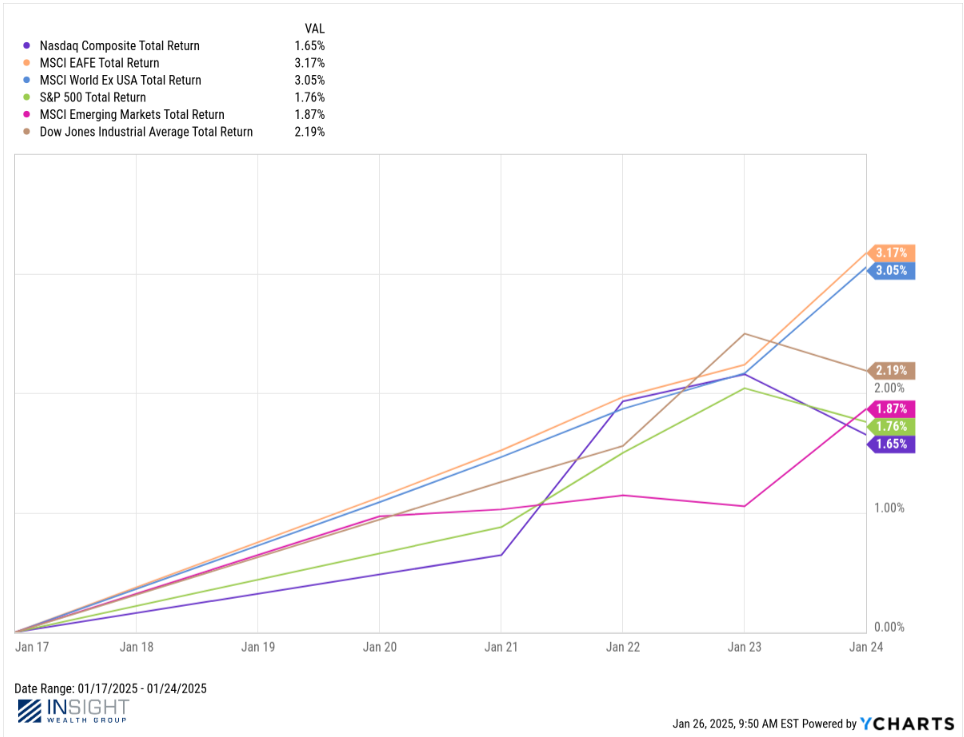

The stock market appreciated this approach. Domestic and international markets are up strongly, including the best first week under a new Administration in the S&P 500 since January 1985.

Past performance is not indicative of future results.

But, in large part, this is the sugar rush of a new Administration. Promises are made. Optimism abounds. If we’re being honest, however, nothing President Trump and his team have done has yet had time to seep into the economy. And it’s likely that what he hasn’t done had the biggest impact on markets thus far: no new tariffs have been implemented.

There is no doubt the Administration will continue to push forward in the coming weeks and months. But this week, we’re going to get a little dose of reality as the market must turn its focus back to the things that impact pricing. And we have a few big-ticket items happening that are worth our attention.

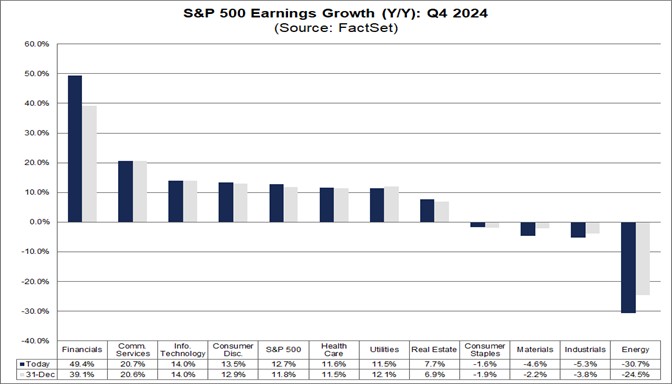

Tech Earnings

Amid all the political changes, earnings season has now hit full swing. And we’re off to a strong start. Per FactSet, “both the percentage of S&P 500 companies reporting positive earnings surprises and the magnitude of earnings surprises are above their 10-year averages”. That’s good news. Already the expectation for the complete S&P 500 earnings growth for Q4 has kicked up to 12.7%. That’s a significant move from where it sat at the end of the year when the expectation was 11.8%.

Past performance is not indicative of future results.

Wednesday is going to be a huge test of how far earnings can grow this quarter. Apple (AAPL), Microsoft (MSFT), Meta (META) and Tesla (TSLA) all report earnings on Wednesday. They are the #2, # 3, 5, and #7 largest companies in the S&P 500 index. Combined they make up 17.83% of the entire index. And just for good measure, we also get Exxon Mobile (XOM), Chevron (CVX), and Starbucks (SBUX) reporting on Wednesday as well. It’s going to be a huge day for earnings.

This was all made more interesting over the weekend by the announcement of a new Chinese AI tool – DeepSeek – that can substantially reduce the cost of coming to market with AI tools. Tech stocks are down dramatically Monday morning and that will compound the importance of these earnings reports on Wednesday.

First Fed Meeting of 2025

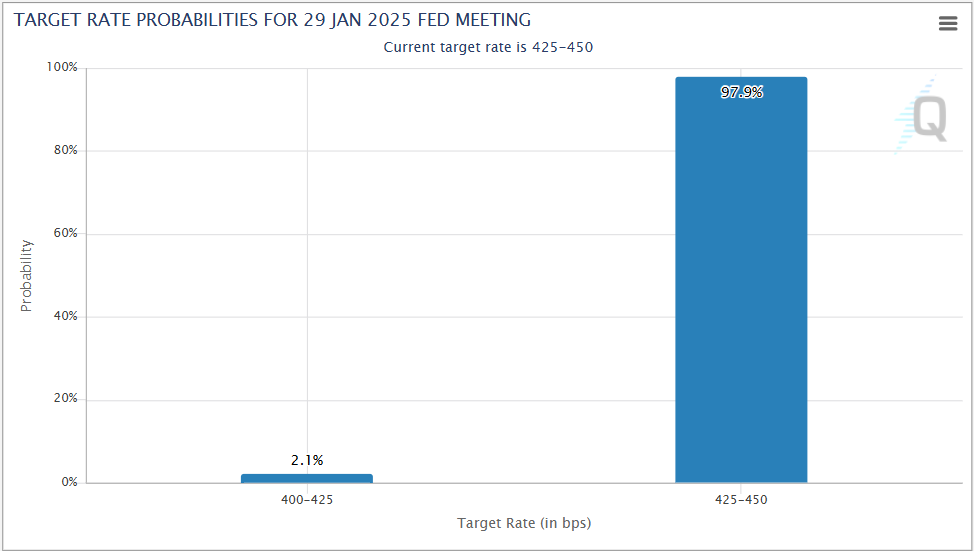

As if Wednesday wasn’t a big enough day for the market, we also have our first FOMC meeting of 2025. If anyone reading this is a day trader, you might want to take Wednesday off!

There’s no missing what the Fed is going to do with interest rates this month: a big, fat NADA. The consensus is nearly universal that rates will remain at 4.25% – 4.50%.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

As is often the case, it isn’t what the Fed does, but instead what Chairman Powell says, that will impact markets.

As you know, the market was surprised by better-than-expected CPI numbers for December. But the Fed’s “preferred gauge of inflation”, PCE data, won’t be available until after the meeting this week.

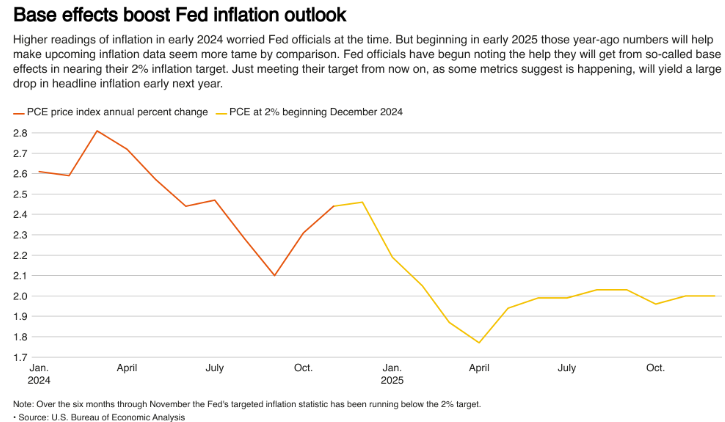

The truth is, inflation should improve dramatically in the coming months if, simply, nothing else happens. We must remember that inflation is measured as a comparison to the same time one year prior. One year ago, in early 2024, we saw a significant spike in inflation. That means, even if the month-over-month rate of inflation remains unchanged, we’ll see a drop in the year-over-year figures.

Source: www.reuters.com

Past performance is not indicative of future results.

And right now, the economy is chugging along. The job market – the Fed’s other top priority – remains strong. Wage growth, while still strong, is slowing. Energy prices have stabilized. Right now, we’re not in an inflationary environment.

But the Fed is worried about something else right now: the Trump Effect. And we’d anticipate there to be veiled references to this in their meeting minutes and Powell’s remarks on Wednesday.

We talked last week about the three major Trump policy positions (Trade, Taxes, and Immigration) and their potential to be inflationary. There was nothing this week that should have caused that risk to spike, but you can be certain the Fed is worried that these policies could undo their work on inflation. And it will likely cause them to be particularly cautious (maybe too cautious) in the weeks and months ahead.

As such, don’t be surprised if Chairman Powell once again talks down the stock market on Wednesday. A little volatility should not shock us. We’ve had a great start to the year and can afford to be patient in the coming weeks.

Sincerely,