The Weekly Insight Podcast – Cuts Are Coming… Now What?

Another Fed meeting is coming this week. Another press conference from Chairman Powell. Another round of speculation and drama from the financial media. And yet another Weekly Insight where we must address it. If you’re like us, you’re a bit…spent…on the whole Fed drama.

And for good reason. We’ve been playing this game now for four years. The first round was “when will they hike?”. Now we’re over a year into “when will they cut?”. It was January 2023 – fully 18 months ago – when we wrote a memo outlining the market’s expectation that rate cuts would begin in May of 2023. Yet 14 months later, nothing has changed.

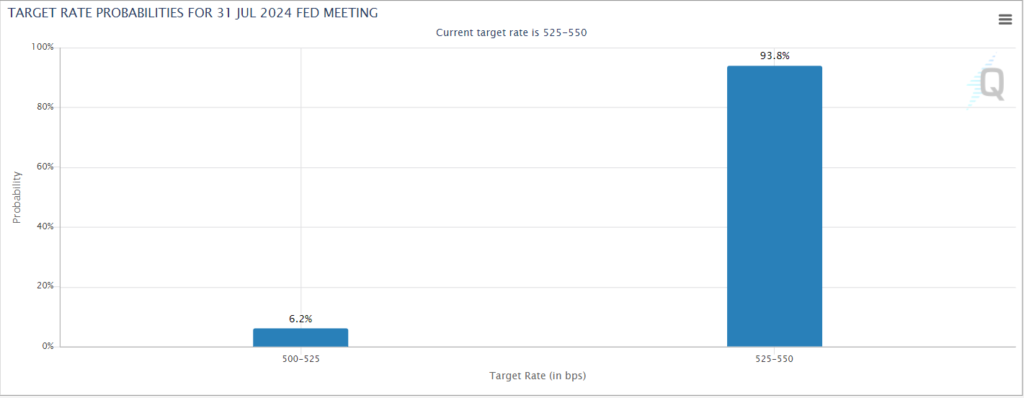

And, if probability markets are to be believed, nothing is going to change this week either. The current projection is 94% odds the Fed keeps rates where they are today.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

We had a call with some market analysts last week and asked the question “What happens if the Fed surprises everyone with a rate cut next week?”. The answer was telling: the Fed has never made a move in rates when the market had not priced it in with at least 90% probability. The only exception to that rule has been moments like the immediate COVID crisis when they cut rates to zero in emergency meetings. The Fed doesn’t like surprising the market.

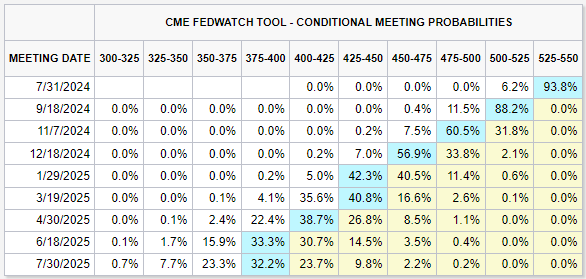

But the market is also certain about something else. It is 100% certain that rate cuts are going to start in September. The only dispute is will it be a 25-basis point cut (88%), a 50-basis point cut (11%) or a 75-basis point cut (<1%). The Fed has made its path clear, and the market is reporting it was heard loud and clear.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

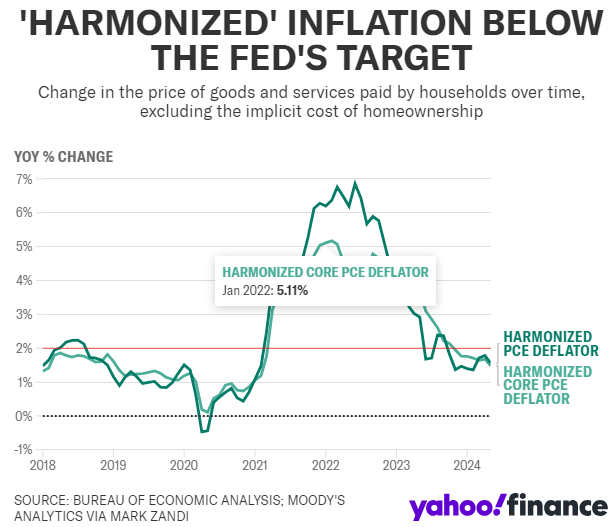

That means the only potential source for drama at this week’s Fed meeting would be if Chairman Powell were to put the brakes on the idea of a September rate cut. That’s unlikely considering the latest inflation data we received on Friday. PCE – the Fed’s “preferred gauge” of inflation – dropped from 2.6% to 2.5%. And “Harmonized PCE” – inflation removing the cost of homeownership – has now fallen below the Fed’s 2% target. (Remember that housing inflation has been stubborn and, we would argue, inflated by bad data.)

Past performance is not indicative of future results.

So, the question of when rate cuts begin seems to be answered. But it brings up a much more important question: what will rate cuts mean for investors and the economy? Let’s look at what history can tell us.

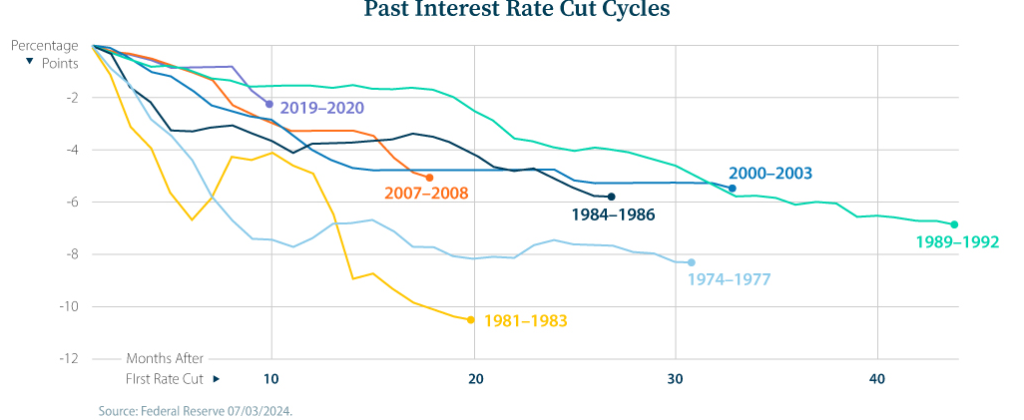

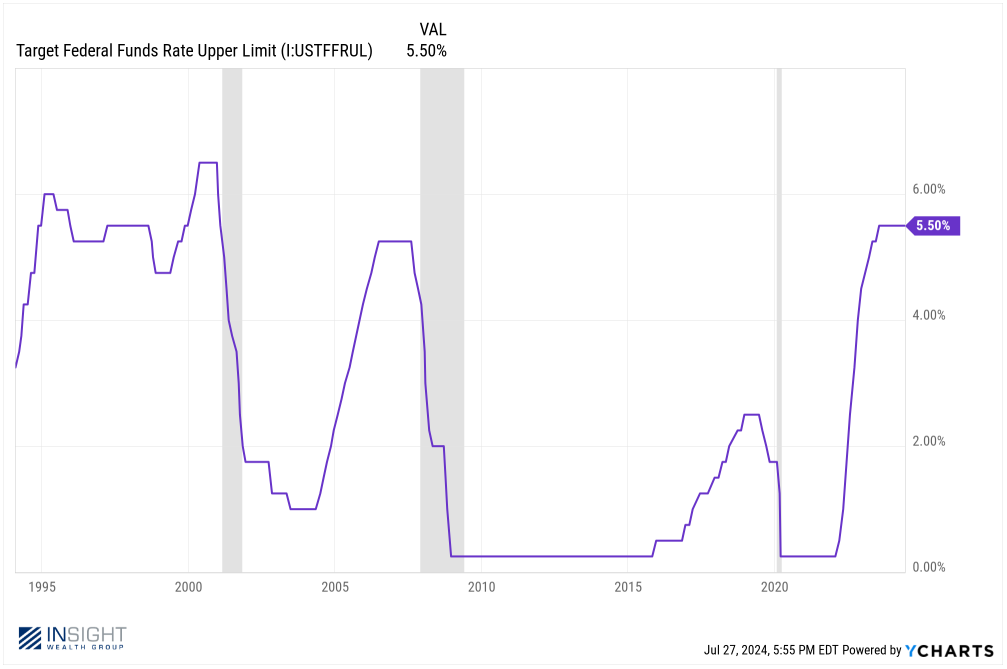

The U.S. has had seven rate cut cycles since the 1970s. The first thing we see when looking at them is, while there are some similarities, they’ve all been different for various reasons. Some have lasted longer than others, some have been more volatile (rates down, then up, then down). And the magnitude of the cycles has varied widely – from just over 2% to over 10%.

Source: www.VisualCapitalist.com

Past performance is not indicative of future results.

There are some similarities and/or conditions that are worth noting, however. The first is that nearly every rate cut cycle has seen rates go down by 2% or more in the first 10 months. Only the slow and steady cuts of 1989 – 1992 saw less magnitude. The current market projections for this cycle are much more conservative. There is only an 8.4% probability we’ll get to 200 basis points in cuts in the first 10 months. The broad expectation is it will be closer to 1.50%. That would be much more indicative of a “soft landing” instead of a Fed making quick cuts to combat a recession.

Source: www.CMEGroup.com

Past performance is not indicative of future results.

The second thing to note about the previous cycles is the average magnitude of the cuts is 6.4%. Even if you exclude the 1981 -1983 outlier of 10.5%, the average is still 5.7%. This cycle will not be even close to 5.7%. Rates are currently at 5.5% and the final rate level is likely to be close to 3%. That would mean a total magnitude of cuts of 2.5%.

Unsurprisingly, rate cuts have historically been quite good for consumers. Lower rates mean people buying more things and buying more things on credit. Car ownership and home ownership get cheaper. Lines of credit get cheaper. Mortgages get refinanced and consumers monthly spend on debt goes down. As you know, Americans don’t usually see more money in their pocket as something to save. It gets spent. And that’s good for the economy.

The only two outliers we’ve seen to this were the reaction to rate cuts leading into the Great Financial Crisis and the COVID pandemic. Consumer spending shrunk in both of those moments – understandably so. But if you remove those outliers, consumer spending from the start of the rate cut cycle to the end was up 3.3% on average.

Source: www.VisualCapitalist.com

Past performance is not indicative of future results.

But the big question – and the one you’re most concerned about – is what have rate cuts done for the market. Historically there is a substantial difference between market performance during a rate cut and market performance after a rate cut. During a cut, bonds have outperformed significantly, while equities and real estate have struggled. But after a cut has concluded, the flood gates have opened for all three asset classes.

Source: www.VisualCapitalist.com

Past performance is not indicative of future results.

This is where we think this cycle may show “past performance is not indicative of future results”. Every time we’ve cut rates in the past it has been in response to a recession. What do equity and real estate valuations do in a recession? They struggle. There is a difference between correlation and causation. Rate cuts are not causing equity prices to stumble. They’re stumbling because of a recession, and it is the recession that is causing the rate cuts.

Shaded areas represent periods of recession.

Past performance is not indicative of future results… we mean it this time!

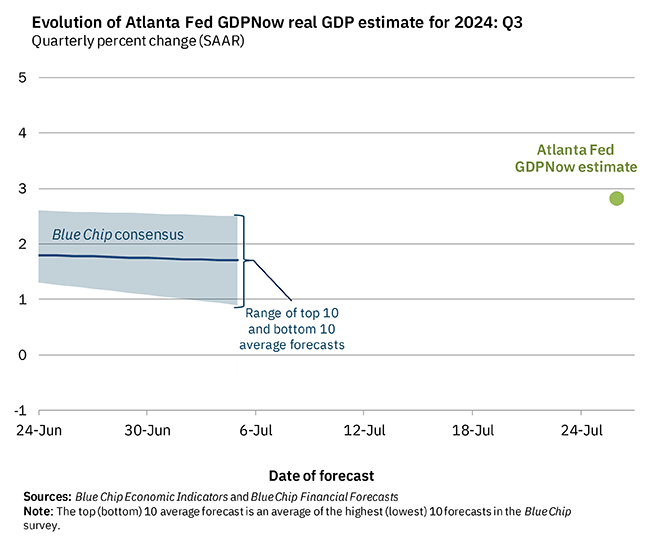

We’re not headed for a recession…yet. Q2 GDP came out on Thursday and showed the economy grew at 2.8%, well above the 2.0% economists were projecting. Yet again, the only projection that was close was the Atlanta Fed’s GDPNow calculation which was estimating 2.6%. They just came out with their first projection for Q3, and it shows the economy growing at a robust 2.8% again this quarter.

Source: www.AtlantaFed.org

Past performance is not indicative of future results.

We’re going to be in a brave new world if the Fed can orchestrate this soft landing. Rate cuts without a recession will be something market prognosticators haven’t experienced before. We know bonds will go higher as rates fall. But will equities as well? We’d argue they will. But there isn’t a historical precedent to rely upon. And anytime the words “this time its different” leave our lips, we shudder a bit.

Sincerely,