The Weekly Insight Podcast – Crowd Struck

There’s a lot to talk about this week – from the start of tech earnings to the latest inflation figures to the seeming beginning of a rotation from tech to the rest of the market. But before we dive into that, we must address the seismic impact of Friday’s Crowdstrike driven IT failures. Oh, and the fact that a sitting U.S. President just announced his abandoning his campaign for the White House. Lots to go through.

Friday’s event can’t be understated. Your author spent the day in airports trying to get back to Des Moines from Washington, DC. It was an unmitigated disaster. Travelers scheduled to fly on Friday are still in the process of getting to their destination on Monday.

But it wasn’t just travel that was impacted. Banks, hospitals, businesses, and schools were all impacted. It was the single largest IT meltdown since our world has become reliant upon computers. And it is a stark reminder of just how vulnerable we are to unintentional failures (like Friday) or intentional actors who attack our networks.

Earnings Season Is Here

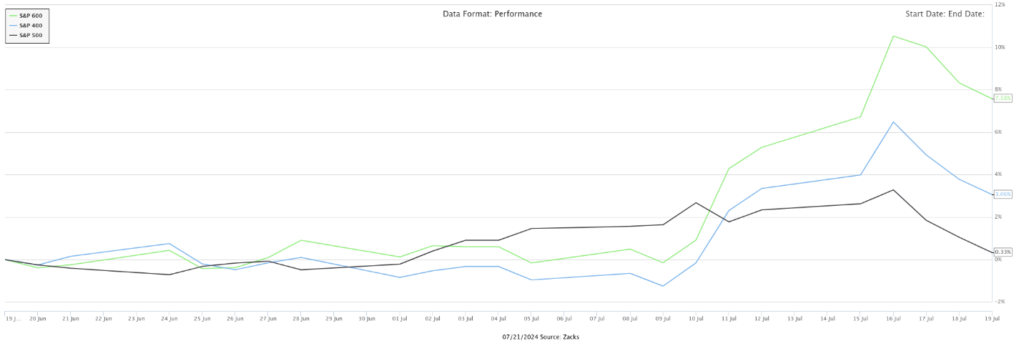

The timing of the incident was interesting in the sense that the market was already amid the start of a rotation away from big tech stocks and toward other areas of the economy that have been left behind by the latest rally. Everything was down last week (not dramatically), but it’s been the activity over the last ten days which has been fascinating. Mid-cap (S&P 400) and Small-Cap (S&P 600) stocks have been dramatically outpacing their large cap brethren.

Source: Zack’s Investment Research

Past performance is not indicative of future results.

That may quickly change this week as tech earnings come out. But we’d caution this may be part of a broader trend. Why? There is no question that big tech has led the way when it comes to earnings in recent quarters. But that is about to change. While earnings growth has lagged in the non-Magnificent 7 stocks, later this year, the rest of the S&P 500 is expected to catch up to the Nvidia’s of the world.

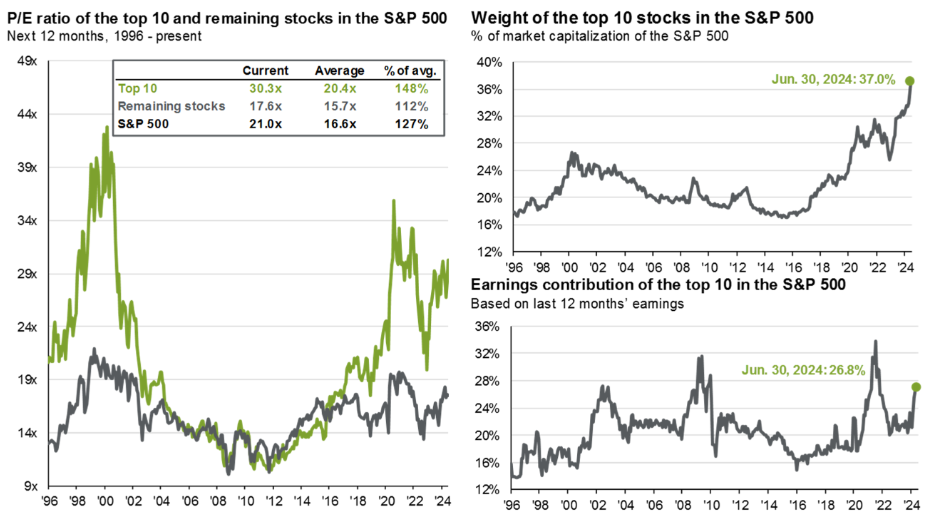

Source: JP Morgan Guide to the Markets

Past performance is not indicative of future results.

There is something important to remember here, though. Right now, the top 10 stocks in the S&P 500 make up more than 37% of the market cap of the index (and 27% of the earnings). If they begin to stumble as investors rotate to more attractive earnings elsewhere, they have the potential to pull the market down with them. If you’re a straight owner of an S&P 500 index fund, that may cause pain.

Source: JP Morgan Guide to the Markets

Past performance is not indicative of future results.

The market is – and always will be – a forward pricing tool. The movement we’ve seen in recent weeks toward smaller cap stocks has reflected that. But it’s also a tool that is highly susceptible to intervening, short-term information. Earnings season may just provide that boost to the mega cap tech stocks in the coming weeks. Google and Tesla report earnings this week, with Amazon and Meta coming next week. That could drive mega cap prices higher. As FactSet points out this week, four companies (AMZN, GOOG, META, & NVDA) are expected to show huge earnings growth this quarter. The other 496 companies in the S&P…not so much.

Past performance is not indicative of future results.

So don’t count out tech yet. But the back half of the year may include an interesting shift away from the AI driven conversation that has so dominated markets. If so, we’re excited for what that may mean for portfolios.

More Inflation Data and the Fed Around the Corner

On Friday of this week, we will be getting the latest PCE inflation data. As you’ll recall, this is the Fed’s “preferred” gauge of inflation. The expectation today is the numbers should be quite good, with Core PCE falling from 2.6% to 2.5% for the month of June and all-items PCE growing at just 0.1% month-over-month.

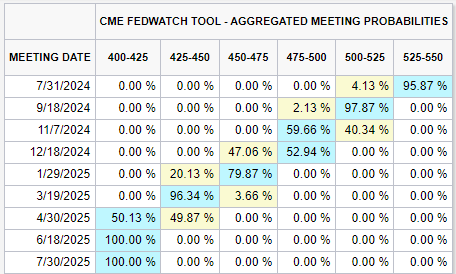

This continues the new trend we’ve seen in both the CPI and PCE reports in recent months. And if the report comes in as expected, it should cement the market’s belief that there is a 100% chance of a rate cut in September.

Source: www.CMEGroup.com

More interesting from the chart above, however, is the absolute certainty the market has that rates will drop 1.25% over the next year. That indicates five rate cuts in the next seven Fed meetings, which would be an aggressive pace.

We’ll know a lot more about that next week when the Fed meets and gives us yet another press conference to digest. But we shouldn’t expect too much from next week’s meeting. Barring some sort of very surprising news (i.e., an early rate cut — very unlikely), no news will be good news from the Fed.

Biden’s Out

Just in case you didn’t have enough political drama in your life, President Biden gifted us yet another “unprecedented” situation when he announced on social media that he would no longer be running for re-election. Ignoring for a second that a United States President chose to make that decision via Twitter, this shakes up the political situation in ways none of us have experienced.

The closest parallel to this was LBJ’s decision not to run for re-election in 1968. But he dropped out with eight months left before Election Day and Democrats were able to run a full primary calendar to determine a nominee. Biden’s decision – much influenced by his party – just 29 days before the DNC Convention is much, much different.

It’s clear – especially after Biden’s endorsement – that Vice President Harris is the leader out of the gate to be the nominee. Political gambling markets show just how far ahead she is from any other potential candidate.

Source: www.RealClearPolling.com

Past performance is not indicative of future results.

But if we’ve learned anything from the last few weeks, much can change in a brief period of time. We’ll be watching this closely and report back with any insights.

But we’d also leave you with this reminder: the market doesn’t care who wins the election. It just wants certainty. Any uncertainty can create volatility. Biden just opened a whole new bag of uncertainty. Don’t be surprised if it takes markets a few days to digest this and some negative returns persist in the meantime.

Sincerely,