The Weekly Insight Podcast – A Yul Brynner Record

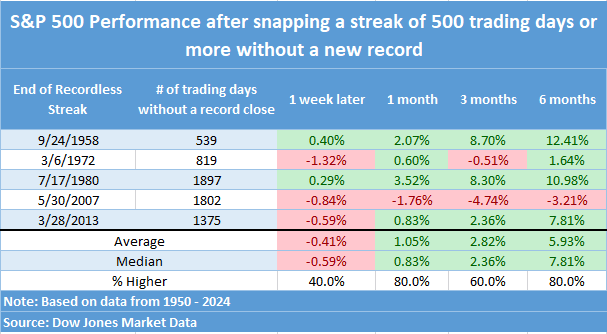

Anytime the market hits an all-time high we need to take a pause to recognize it. Well done, market! On Friday, the S&P 500 closed at a record high for the first time in more than two years. To put that in perspective, the 512 trading days it took to get from our last high to this one was the longest streak since the 1,375 trading days it took to get back to the October 2007 highs.

So, what does that mean for the market going forward? If history is any guide, it’s not bad news. The average six-month market return after breaking a 500-trading day streak without a new record high is 5.93% (or nearly 12% annualized). We’d take it.

It’s interesting, though, what drove us to the record close on Friday. Much like we’ve seen over the last year, it was the tech stocks. More importantly, the “Magnificent Seven” tech stocks. (We must give the Wall Street press corps credit for this one. Normally they produce really stupid names for groupings of stocks – i.e., FANMAG – but we like this one…)

The Magnificent Seven have been on a tear in the last year. In fact, their market capitalization is currently more than the economies of Canada, the United Kingdom, and Japan…combined.

Source: Apollo

Past performance is not indicative of future results.

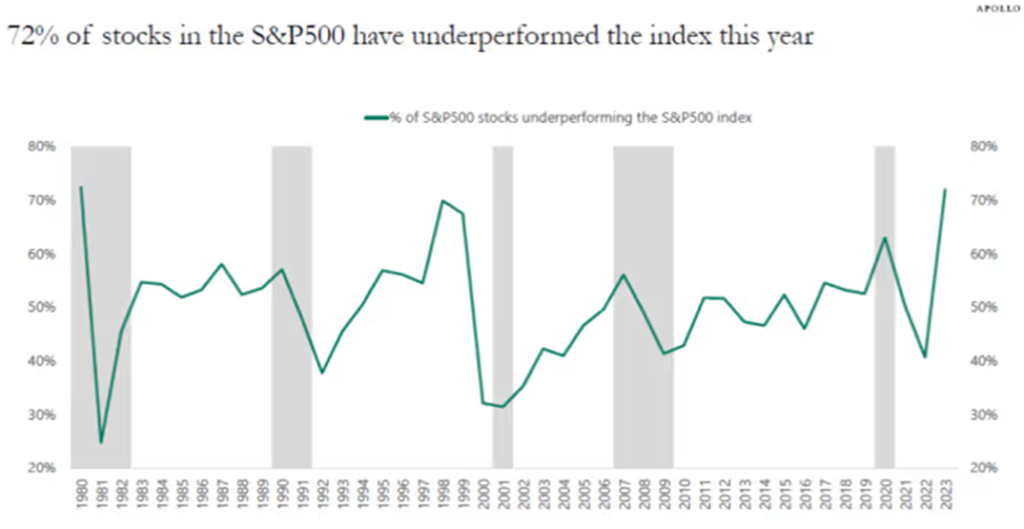

Their performance last year was remarkable when looking at the impact it had on the broader market. Or, more importantly, what it meant for the rest of the market. Fully 72% of stocks last year underperformed the index. That was the largest number we’ve seen since 1981.

Source: Apollo

Past performance is not indicative of future results.

The other side of the chart above, however, is really important. Look at what happens very quickly after you see a spike in the number of companies underperforming the market. You see a very quick reversal as that number drops precipitously. That is indicative of a broadening of the market – and hopefully a broadening of the rally as time marches forward.

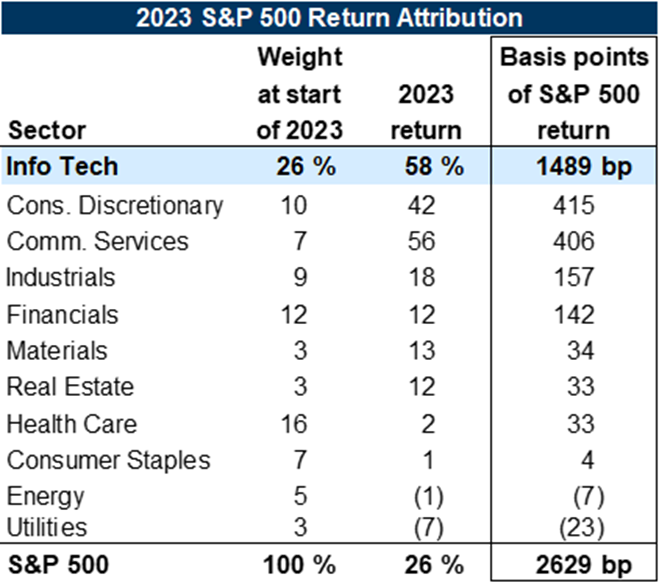

And a broadening is needed. Over half of the market’s return last year came from just one sector: information technology. The other sectors catching up a bit in 2024 will be good for portfolios.

Source: Goldman Sachs

Past performance is not indicative of future results.

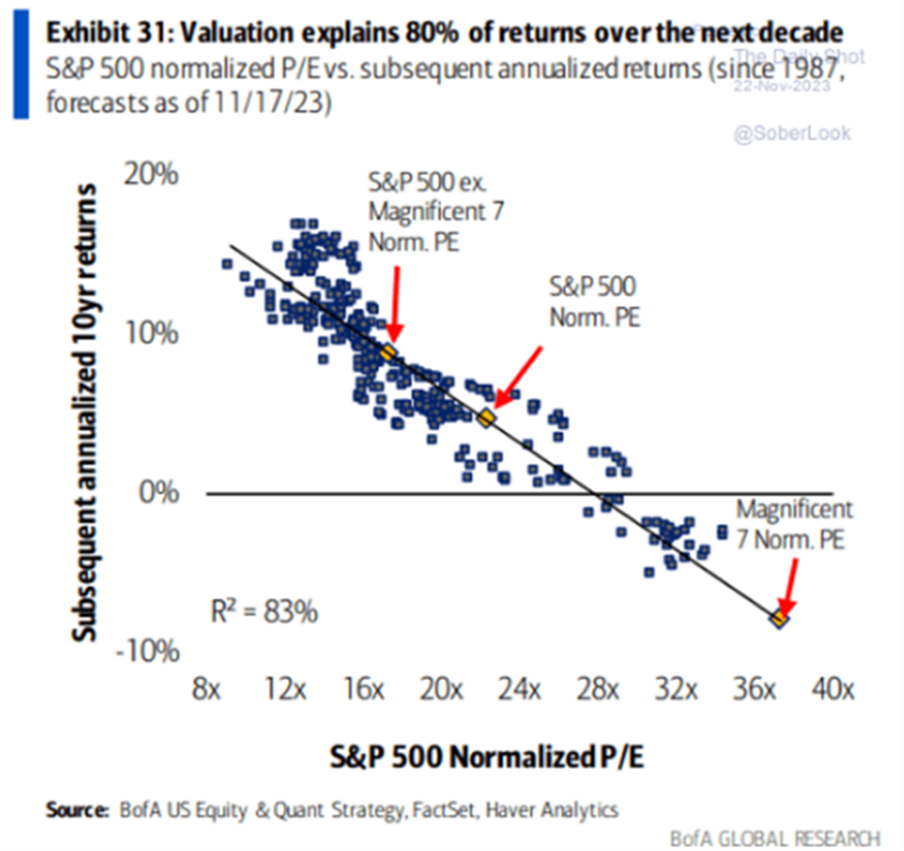

We’ll admit that we continue to be underweight the Magnificent 7. Smartest move ever? Probably not. We have some exposure, but certainly not the exposure we would have if we were just generically holding the S&P 500. But there’s a reason for that, and it lies in valuations.

Valuations matter as they can be significantly predictive of future returns. And if you look at where the S&P 500 is if you exclude the Magnificent 7, the numbers are pretty good. History would tell us the next decade for the “S&P 493” would line up in the high single digits per year. But the Magnificent 7 are at the completely opposite end of the curve. Their valuations, at more than thirty-five times earnings, are not indicative of a productive next decade.

Past performance is not indicative of future results.

Let’s run a math problem. We know the Magnificent Seven make up 28.6% of the S&P 500 today. If they return -8% per year over the next decade and the other 493 names return +8% per year over the same period, we get this return profile for the market:

That’s a big drag on portfolios. And the problem is, most people don’t know just how exposed they are to the Magnificent Seven. Over the last fifteen years, we’ve seen a significant move from “active” investing to “passive” investing. That’s been largely due to the advent of cheap ETFs which give people access to the market they never had before. But it also means much more indexing than ever before. Fifteen years ago, only 20% of U.S. assets were “passive”. Today that number is more than 50%. And those people don’t know just how much of their portfolio is in a significantly overvalued asset.

Past performance is not indicative of future results.

Is this all bad news? No. In fact, there’s a lot of good news embedded here. Smart investors will have plenty of opportunities to capitalize on the expansion of the other 493 names in the coming weeks, months, and years. But it tells us that asset allocation is really going to matter. That’s vastly different than the “rising tides lift all boats” market many of us have gotten so used to since the Great Financial Crisis ended in 2009. And it means firms like Insight are going to have to earn our keep in the coming years!

Sincerely,