Eight days. That is all that’s left in the latest test of our 2020 resiliency. Eight days from today we are going to know the results of the 2020 Election…hopefully.

We are not going to spend time today discussing who we think will prevail on Election Night. We will leave that to the professionals tomorrow night when we hope you can join us for the Insight 2020 Election Briefing. You will get to hear two highly regarded political professionals – Sara Fagen & Doug Sosnik – give their thoughts from both sides of the aisle. We had a chance to review their presentation earlier today and think you will find it quite interesting. If you have not already RSVP’d, please take a minute to do so HERE.

Instead we are going to focus our discussion this week – as we did last week – on some of the core things moving the market today. It is one last time to talk fundamentals before we start looking at the impacts of the Election on the market.

Do Not Overthink It

As we’ve discussed with you in our last several memos, the market is primarily pre-occupied over three issues right now: 1) the election; 2) COVID stimulus coming from Congress; 3) the progress toward a vaccine.

If we have learned anything in our careers in finance, it’s this simple adage: we do not have the power to predict the future. We can understand economic and market fundamentals (which look fairly strong, by the way), but we cannot predict the outcome of the election, nor when Congress will act, nor how soon we will have a vaccine.

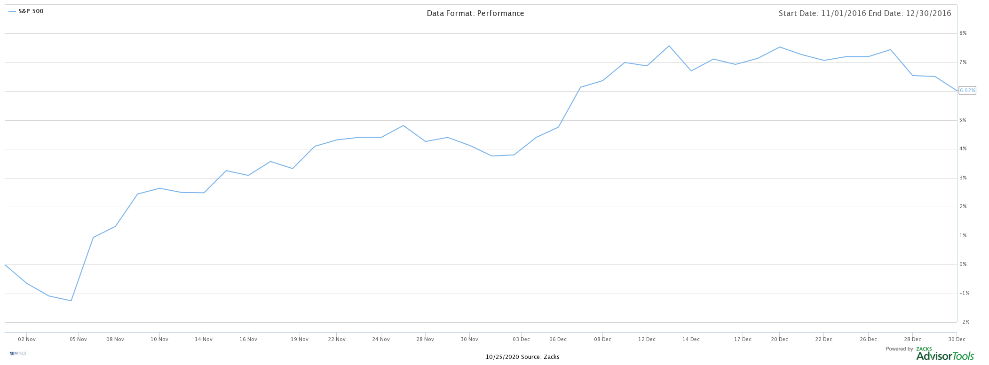

Financial advisors and money managers get into a very dicey situation when – faced with these type of near-term issues – try to guess the outcome. We remember a financial advisor who – in 2016 – was apoplectic about the impact Hillary Clinton becoming President would have on the market. So, he made the decision, weeks before the election, to pull his clients out of the market and put them into cash. That decision may have looked smart at the beginning of November 2016 – but as you can see it did not work out well for the rest of the year.

Past performance is not indicative of future results

What we know – no matter who is elected – is the fundamentals still lean toward equities and sticking close to our benchmarks is justified. Why? Two key points. First, there is no viable alternative to equities today. Fixed income is a very thin trade today with central banks around the world keeping rates at or near zero (or below in the case of German treasuries).

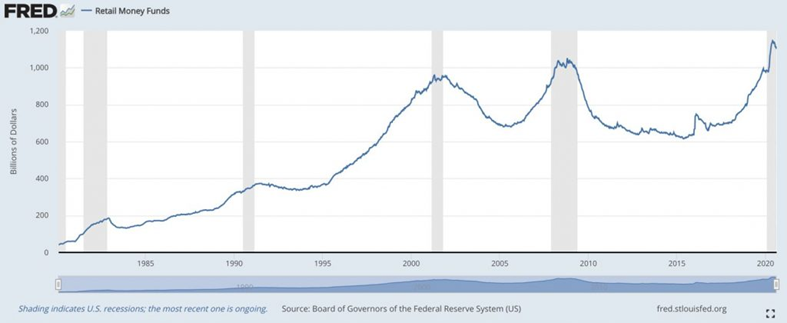

Second, there is still an amazing amount of capital on the sidelines. Dry powder matters and can be a defense against a contraction in the market.

Past performance is not indicative of future results

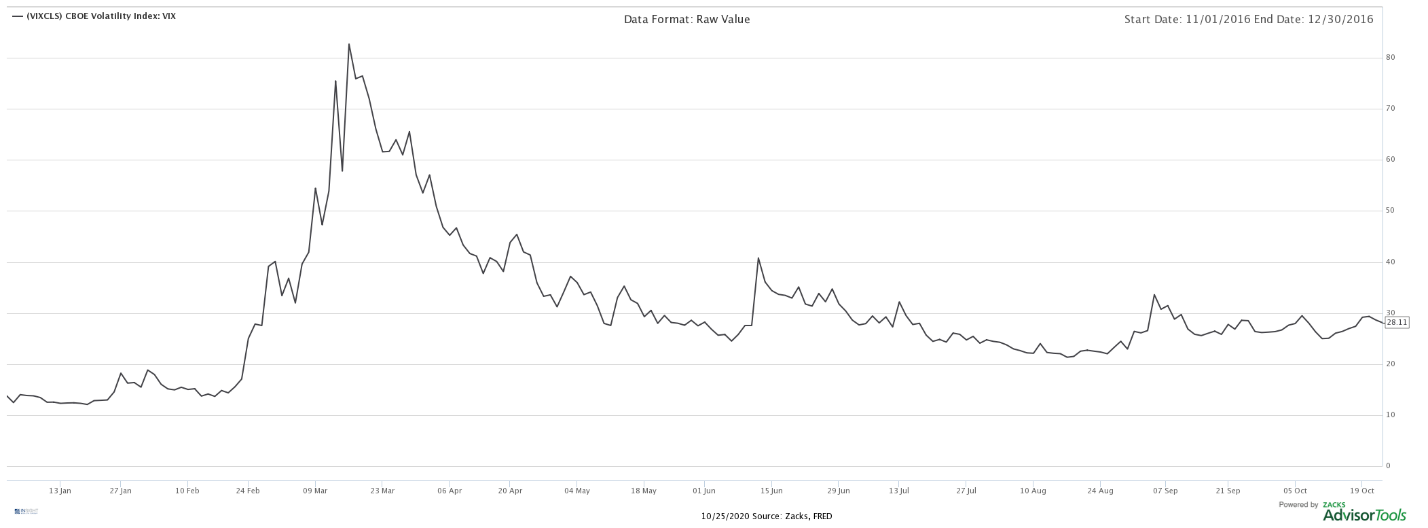

Finally, defense in this environment is very expensive today. The market has already priced in volatility to the next few months as you can see by the VIX chart below. As a refresher, the VIX is a measure of volatility. If you expect increased volatility, you should see the VIX go up. In a more stable environment, it should go down.

Past performance is not indicative of future results

While the VIX has certainly retreated from its March Coronaggedon highs, it still remains significantly elevated. At its current reading it is sitting 47.1% above its long-term historical average of 18.80.

Elections Are not Everything

It is important to remember that the course of this economy over the next 12 – 24 months is not going to be set exclusively on Election Night (or the weeks that follow). We have often beaten back the common misconception that “Republicans are good for the market; Democrats are bad for the market”. It is simply not true historically. As we have pointed out many times, it is split government – when the politicians cannot get in the way – that is actually best for the economy.

But no matter what happens on Election Night, there is a strong argument that – no matter who is elected – there is upside. Yes, a GOP victory will mean a continued low tax environment, less regulation, etc. all of which is good for the market. But we found this quote from Goldman Sachs this week interesting regarding a Democrat sweep:

“All else equal, such a blue wave would likely prompt us to upgrade our forecasts.The reason is that it would sharply raise the probability of a fiscal stimulus package of at least $2 trillion shortly after the presidential inauguration on January 20, followed by longer-term spending increased on infrastructure, climate, health care, and education that would at least match the likely longer-term tax increases on corporations and upper-income earners.” –Jan Hatzius, Head of Global Investment Research

Simply put, what Goldman is saying here is this:

- Yes, the Democrats are going to increase taxes.

- But their spending increases over the next 12 months will have an economic impact large enough to more than offset the impact of those tax increases.

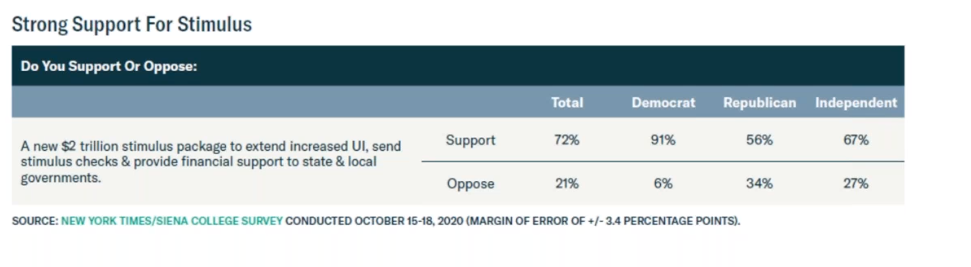

As you know, we are not huge fans of spending money that does not exist. Still, there is little question lower wage earners in our economy need additional support and the chart below shows voters of all stripes continue to support another round of fiscal stimulus. That stimulus would undoubtedly boost the economy…in the short-term. In the long-term, someone is going to have to pay the piper.

Post-Election Positioning

This is where we do not want to get too far ahead of ourselves as no one yet knows the outcome. But we can start seeing some of the writing on the wall.

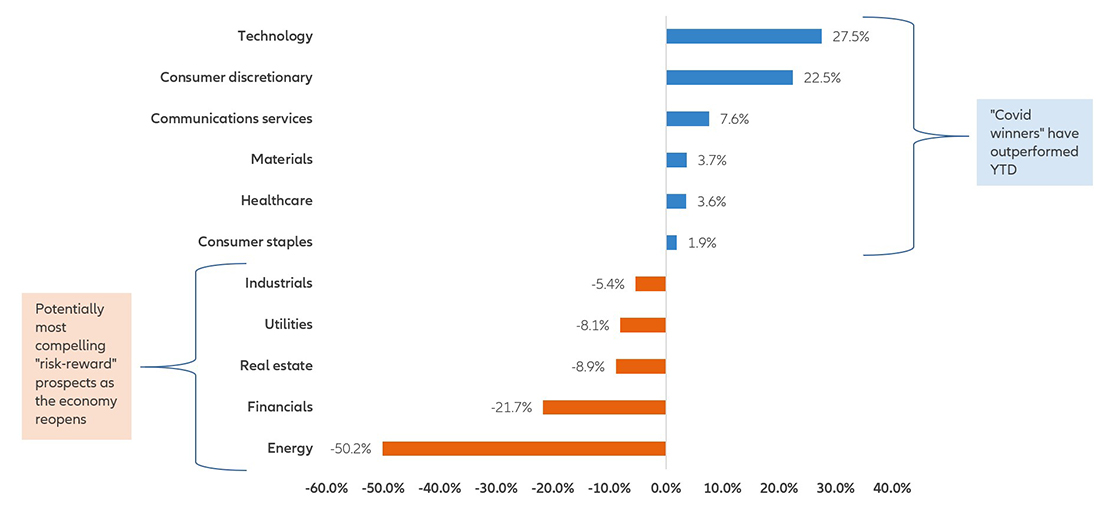

First, we know we want to take advantage of those areas which have not yet been “COVID Winners”. We have talked extensively about energy – which we continue to believe has significant runway into next year. As you can see below, we would also want to include financials, real estate, and utilities in that discussion as well.

Past performance is not indicative of future results

The victor will help provide some guidance on what priorities will be post-election. For example, if there is a D-sweep, expect us to look much more closely at areas of the market that could benefit from increased infrastructure and environmental spending as those will be priorities.

We certainly hope we are only 8 days away from taking one of the big question marks off the board in what has been a difficult year. Once November 3rd is done, we can better understand how these solid fundamentals will drive us into the future.

Sincerely,