“It has been said that politics is the second-oldest profession. I have learned that it bears a striking resemblance to the first.” –President Ronald Reagan

Thirty-two weeks ago, we wrote our first in what became a weekly series of “COVID Memos”. Those initial weekly updates focused almost entirely on the spread of the virus, its impact on the market and the damage caused to the economy. To be frank, when we began that exercise, it seemed like we would be done with it in a few weeks or months.

As time passed, COVID memos transitioned into “The Weekly Insight” and has been a vehicle to show our readers what we’re paying attention to and how we’re making decisions in our clients’ portfolios. We hope you have found it to be – if anything – a transparent look at our decision-making process.

These last 32 weeks have certainly not been devoid of topics to discuss. We have had a pandemic, civil unrest, natural disasters, and much more. But there is one we have just barely skimmed over: Politics.

We know the country is sick of it. We know you do not come to us for political insight. But the hard truth is politics and policy impact the market and economy. And no matter your party or persuasion, it is impossible to dispute this will be one of the most contentious and consequential elections in our lifetimes.

So today we are going to dive headlong into the muck. We are going to discuss the impact of the race on the market, the decisions we are making as we get closer to election day, and what the outcome might mean for portfolios. No matter your political persuasion, we would guess you will find something in here to give you hope – and something to cause concern. Our job is to look at this with an unbiased worldview and focus on how to protect your wealth.

43 Days Out…

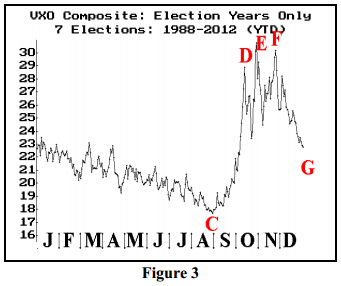

That’s it. 43 days left and Election Day will be here. You have heard us say this in these pages before – but it bears repeating: the last two months before a Presidential election are the most volatile two months in the stock market every four years. We included this chart in the memo a few months ago which demonstrates the spike in volatility.

Past performance is not indicative of future results

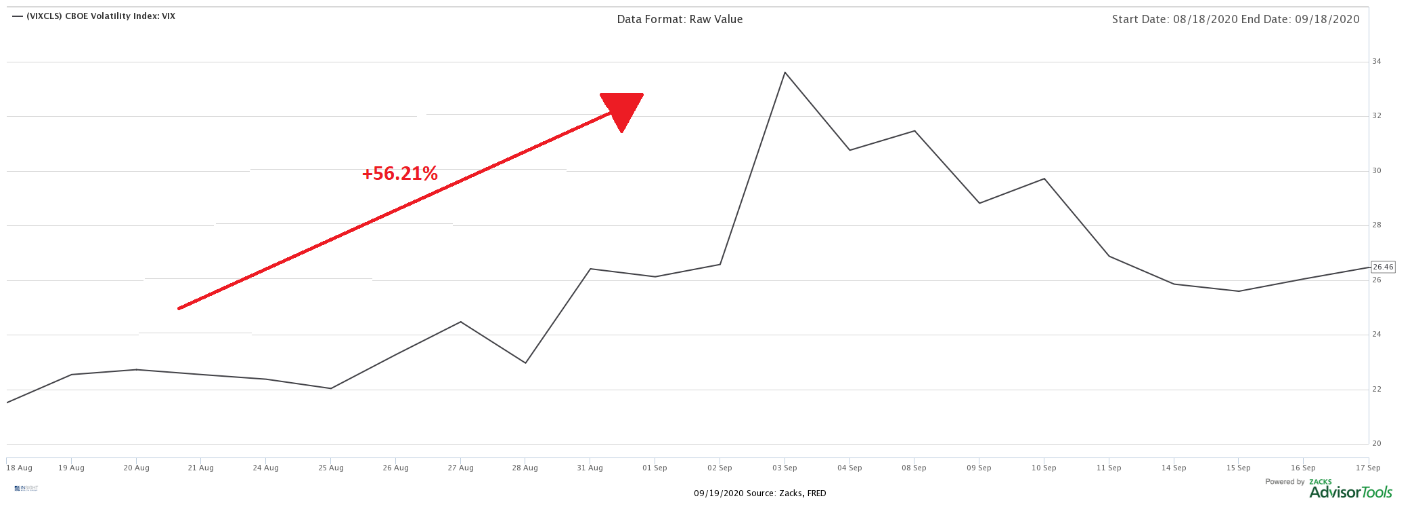

It should be no surprise then that the volatility chart for the last 30 days looks very similar to the historical chart.

Past performance is not indicative of future results

If there is one thing the market craves in these scenarios it is certainty. Frankly, it does not care if it is certainty of disaster or certainty of great success. Simply knowing the outcome of an election brings calm to the market. It would not matter if it were Biden or Trump. Just knowing that the outcome was assured would reduce the volatility in the market. The opposite is also true: more uncertainty will assuredly mean more volatility.

If the last four years has taught us anything it is this: polling is not as reliable as it once was. The first obvious sign was the Brexit vote in June 2016 and the Trump/Clinton election provided more confirmation. Something has changed. It may be the way people respond to the polls (i.e. more private about their views), it may be as simple as an increased level of motivation on the side expected to lose. In the end, however, it leads us to one very simple conclusion: we cannot possibly tell you who is going to win or lose. Especially with more than a month to go.

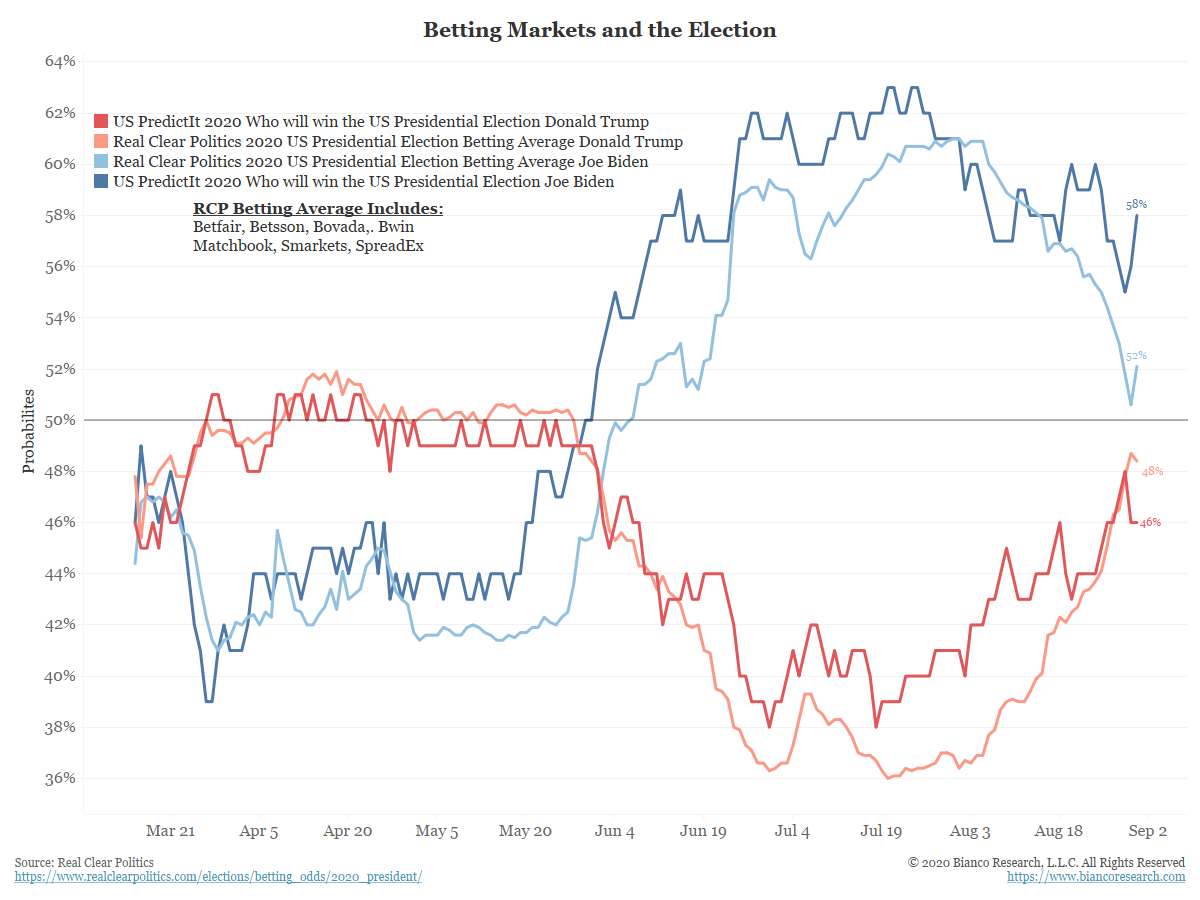

We can, however, see the same data the rest of the market is seeing. And – while it is clear the advantage today goes to Biden and the Democrats – the race is substantially closer than it was 60 days ago. The closer it gets, the more uncertainty there is and the more volatility we would expect in the market.

Past performance is not indicative of future results

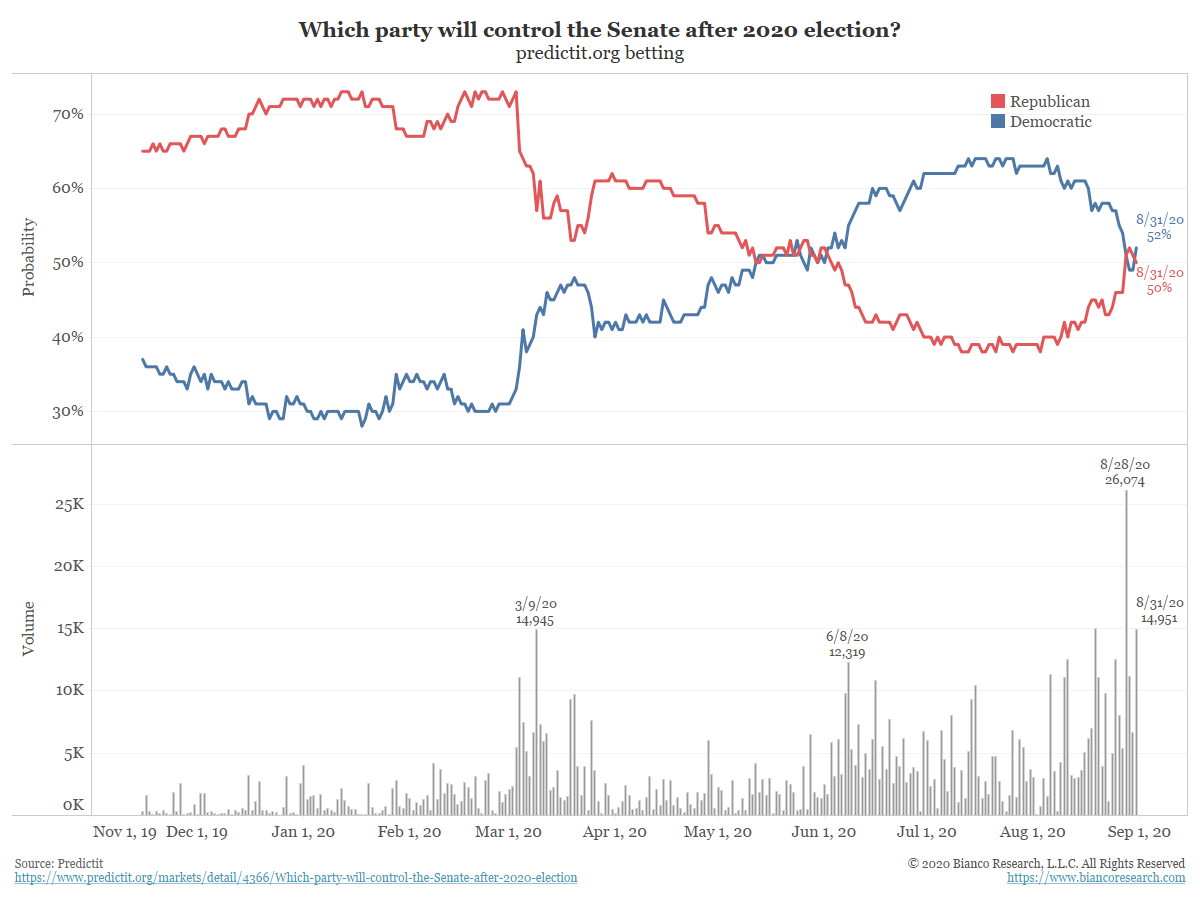

Where the Presidential race has gotten closer, the odds of Senate control (important later in this memo!) are basically 50/50 at this point.

Past performance is not indicative of future results

Given this rising uncertainty and rising volatility, we have decided in our core portfolios (Growth, Conservative Growth and Balanced models) to reduce our exposure to equities. We have replaced a portion of our S&P500 Index holdings with a short-term Vanguard fixed income ETF (VCSH). As the next month progresses, we will be watching this dynamic closely and may take additional risk off the table if necessary.

Election Day…or Election Month?

The real work in portfolios will begin on Election Day – but that may not be due to the election being decided. On the contrary, it may be the lack of clarity around the result which would throw the market for a loop. While we certainly hope this is not the case, we must be prepared.

We have been through an extended recount before (Bush v. Gore). In fact, one of our partners was on the ground in Florida working for one of the candidates during the recount. While it was a time of great uncertainty for the country – one thing was clear: no matter the eventual victor, the two sides would congratulate each other, unite for the country (for a day or two anyway) and move their focus to the 2004 election.

While we do not doubt a peaceful transition of power (or maintained control of power) will eventually happen, the rhetoric is certainly turned up this year. What happens when that rhetoric meets an unclear result, or an election that cannot be decided until several days (or weeks) later when absentee ballots have been counted? We will undoubtedly see more protests as we saw earlier this year. Will there be additional violence?

The longer this process is drawn out – the worse it is for the country, the economy, and the stock market. While we cannot with assume this will be the outcome – we must be prepared.

Weighing the Outcomes

Back before the 2016 election we talked about having our “Clinton Wins” and “Trump Wins” plans. There were more than a few folks out there who wondered why we were wasting our time on the Trump plan when it was clear he would not prevail. The lesson: it always pays to be prepared.

This year we need to be prepared for four scenarios. The first is what we raised above – that the election is not clearly decided. After that question is resolved there are three additional options:

- Trump Wins – Congress Holds

- Biden Wins – Congress Holds

- Biden Wins – Democrats control the Senate

You will note we do not include a “Trump wins and the Republicans control the House”. While we can certainly add that plan if necessary, there is no indication at this point it is a possibility. Additionally, while it is possible that Trump could win and the Republicans could lose control of the Senate, we believe the result is similar to the “Trump Wins – Congress Holds” scenario.

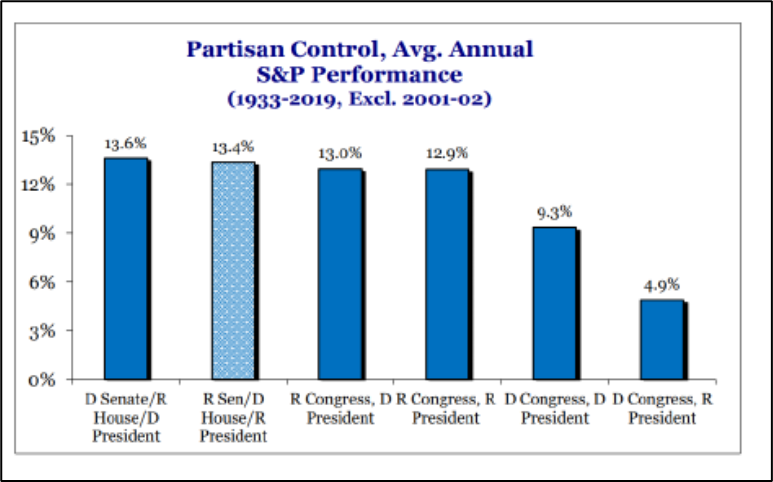

History is clear when looking at the three options above: the first two are significantly more advantageous to the market than the third. Divided control of power is beneficial to the market and the economy. Why? Frankly because very little gets accomplished. The status quo reigns supreme and – as discussed above – there is a great deal of certainty about what will happen.

Past performance is not indicative of future results

It is the third option – that Biden wins and the Democrats take total control of the Congress – that would scare the market the most. Please understand us on this point: it is not because Republicans are better than Democrats or vice versa. It is because there are significant areas of progressive policy that will lead to a great deal of uncertainty (there’s that word again!) in the market.

We are not yet able to say what areas will be top priorities in this scenario and which will fall down the list. The Green New Deal – if passed in its original form – would, for instance, be devastating to energy stocks. But we doubt the original form would be the end product.

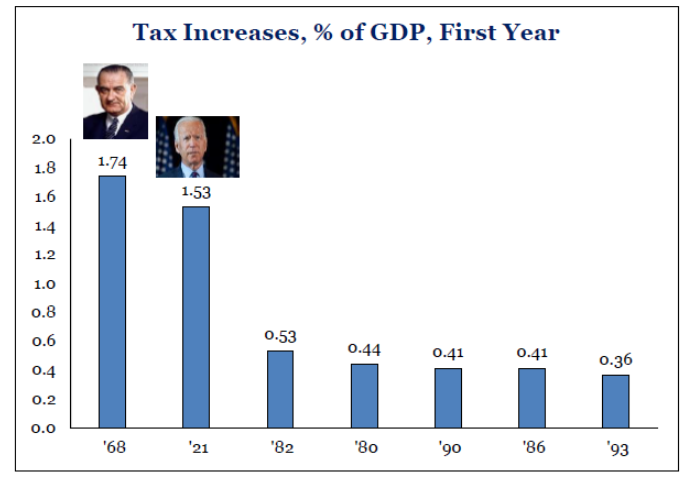

It is tax policy, however, that has us concerned. As you can see from the chart below, if Biden were to pass his entire tax policy next year, it would be the largest tax increase as a percent of GDP since Johnson’s tax hike to pay for the Great Society Programs.

Past performance is not indicative of future results

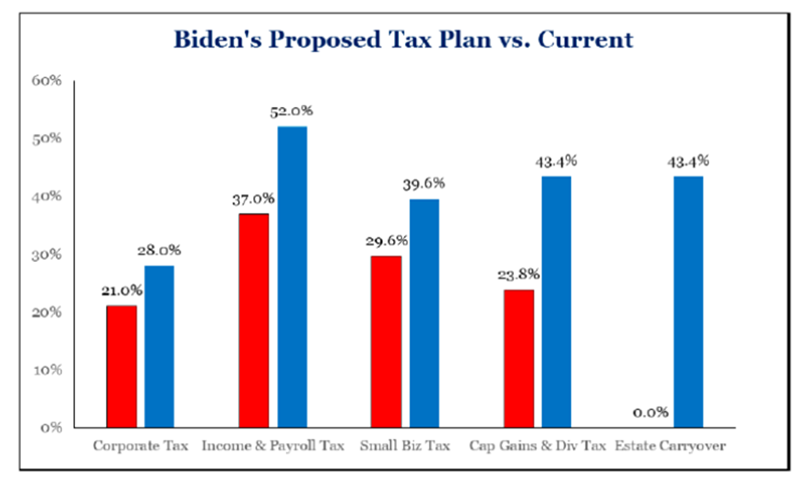

The proposal is extensive. It would essentially raise the tax on every type of income imaginable.

Past performance is not indicative of future results

While we doubt the proposal would be passed in its entirety immediately out of the gate – there is one area that concerns us: Capital Gains & Dividend Taxes.

First, it is important to understand that raising the Capital Gains tax is probably one of the easiest things to do without angering the populace. Bluntly, while it impacts most people reading this memo, it only affects a small portion of U.S. taxpayers. To the average American, it is a “tax on the wealthy”, who are easy to hate these days.

Second, if it is easy to pass without political fallout, the market can easily come to the assumption it will be accomplished in 2021. If that is the case, investors will do all they can to avoid that payment by realizing capital gains after the election but before the end of the year. We have seen in years past how investors taking losses has accelerated market declines at the end of the year (see 2018). This could theoretically be the exact opposite: investors running for the exit to realize their capital gains before the rate doubles. This would create volatility that has nothing to do with market fundamentals. In theory, it would be an excellent time to dive headlong into the market – but it may make for a scary time at the end of the year.

The Passing of Ruth Bader Ginsburg

As if 2020 had not given us enough, the news came out Friday evening that Supreme Court Justice Ruth Bader Ginsburg passed away after a long struggle with pancreatic cancer. First, we must say this: whether you agreed or disagreed with her decisions, Ginsburg was an incredibly gifted woman who gave everything she had to the law. She is an example which will be held up for years to come.

Her death, however, makes this election season even more tumultuous. We will not get into the debate over whether the Republicans should push through a nominee before the election or predict whether they have the votes to succeed. That will all come to light soon.

There is one issue in portfolios, however, which is significantly impacted by her passing: the Supreme Court hearing on Collins v. Mnuchin which is scheduled for December. Collins v. Mnuchin (and its sister case Mnuchin v. Collins) is the landmark case the Court agreed to hear regarding the Treasury Department’s net worth sweep of Fannie Mae and Freddie Mac.

While we can’t possibly know how Justice Ginsburg may have voted on these cases – we now know this: whomever fills the seat – be it a Biden nominee or a Trump nominee – will not be seated in time to hear the case. Thus, tradition would mean they would not vote on the case.

While there is ever little certainty in these matters, what we have seen in recent years is an evenly divided court with Chief Justice Roberts often breaking the tie. However, in the current 8-judge court, there are now five “conservative” judges and just three “liberal” judges. The general consensus in these cases is the more conservative judges were more likely to rule in the shareholders’ favor. If it ends up being a tie, the ruling of the lower court stands. Either way, the current court should benefit our case.

Bring in the Pros

Part of our job is to collect information from the best possible sources we can find and deploy that intelligence into your portfolios. While traditionally that focuses on economic and market issues, we have seen fit to include political experts in our stable as well. This year we believe that will prove to be a wise decision.

As we have done with our economic and market experts, it is our hope to make our political experts available to you as well prior to the election. While we are still working out the details, we would ask you pencil in the evening of Tuesday, October 27th for a pre-election webinar. It is our hope to include the former White House Political Directors from both the George W. Bush and Bill Clinton administrations. As soon as the details are finalized, you will be receiving an invitation from us. We hope you can participate!

There is no doubt the time between now and the New Year is going to be a moving target. We will continue to do our best to provide you with the most current information available to us as we navigate these choppy waters. We would ask, however, if you have any concerns or changes in your risk profile you communicate directly with your advisor so we can make appropriate adjustments in your personal strategies.

If you have any questions, please do not hesitate to let us know!

Sincerely,